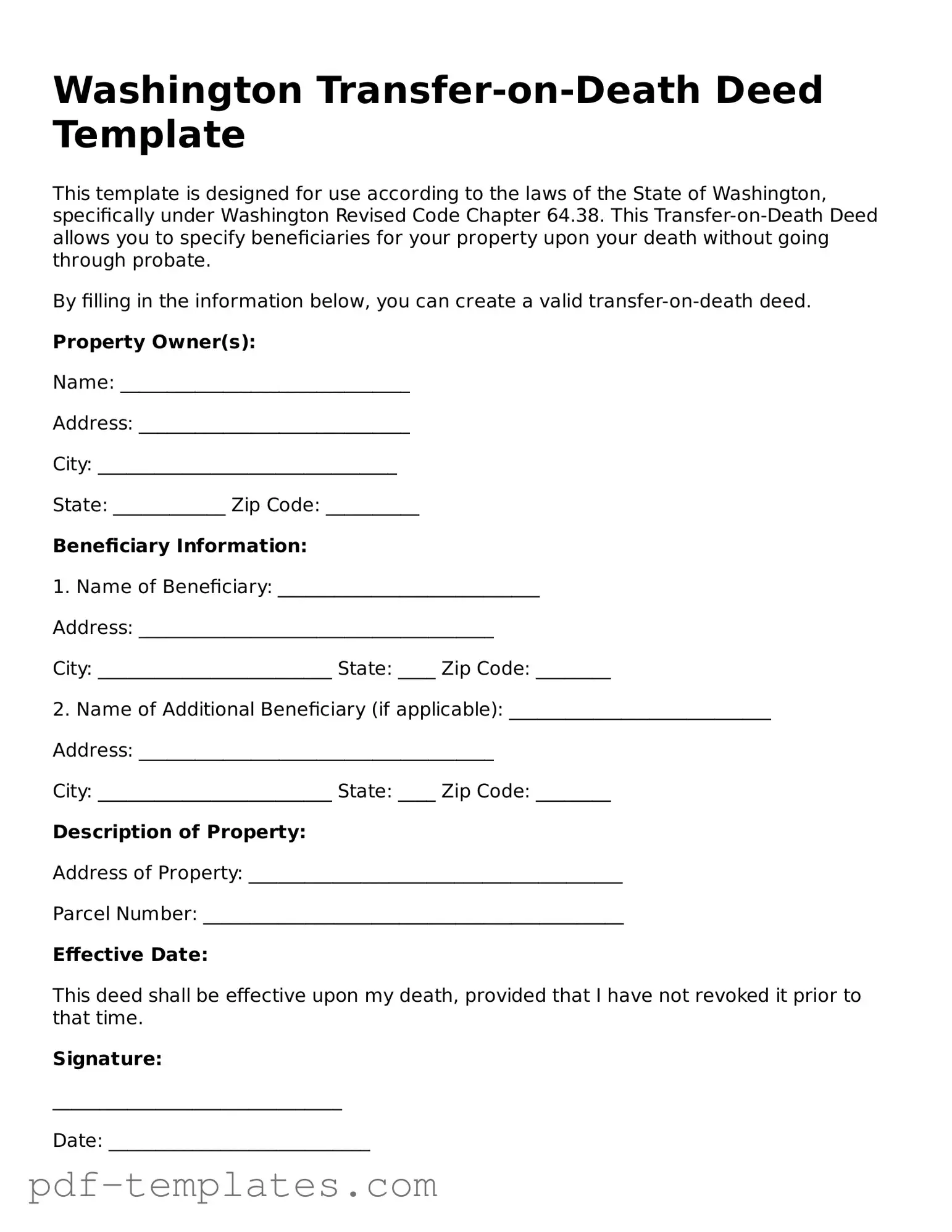

Official Transfer-on-Death Deed Template for Washington State

The Washington Transfer-on-Death Deed form is a valuable tool for property owners looking to simplify the transfer of real estate upon their passing. This legal document allows individuals to designate a beneficiary who will automatically receive ownership of the property without the need for probate. By utilizing this form, property owners can maintain control over their assets during their lifetime while ensuring a seamless transition to their chosen heir. It's important to note that the deed must be properly executed and recorded to be valid. Additionally, the form provides flexibility, allowing for changes in beneficiaries or even revocation of the deed if circumstances change. Understanding the nuances of this form can help individuals make informed decisions about their estate planning and ensure their wishes are honored after they are gone.

Misconceptions

Understanding the Washington Transfer-on-Death Deed form is essential for effective estate planning. Here are seven common misconceptions surrounding this form:

- It only applies to real estate. Many believe that the Transfer-on-Death Deed can only be used for real estate. In reality, it is specifically designed for transferring real property upon death, but it does not cover personal property or financial accounts.

- It is the same as a will. Some people think that a Transfer-on-Death Deed functions like a will. However, a will takes effect only after death and goes through probate, while a Transfer-on-Death Deed transfers property directly to the beneficiary without the need for probate.

- It can be revoked at any time. While it is true that a Transfer-on-Death Deed can be revoked, it must be done properly. A written revocation must be executed and recorded to ensure it is legally effective.

- All beneficiaries must be present to sign. Many believe that all beneficiaries must sign the deed for it to be valid. In fact, only the owner of the property needs to sign the deed; beneficiaries do not need to be present at the time of signing.

- It is automatically valid once signed. Some individuals think that signing the Transfer-on-Death Deed makes it automatically effective. The deed must be recorded with the county auditor’s office to be legally enforceable.

- It eliminates all estate taxes. A common misconception is that using a Transfer-on-Death Deed means no estate taxes will apply. However, estate taxes may still be applicable based on the total value of the estate, including the property transferred via the deed.

- It is only for married couples. Some people assume that only married couples can use this deed. In fact, any individual owner of real property can utilize a Transfer-on-Death Deed to designate beneficiaries, regardless of marital status.

By clarifying these misconceptions, individuals can make informed decisions about their estate planning needs.

Washington Transfer-on-Death Deed: Usage Instruction

Once you have the Washington Transfer-on-Death Deed form ready, it's time to fill it out accurately. This deed allows you to designate a beneficiary who will receive your property upon your passing, without the need for probate. Careful attention to detail is essential to ensure that the document is valid and enforceable.

- Begin by entering your name as the current owner of the property at the top of the form.

- Provide your address, including city, state, and zip code, directly below your name.

- Next, describe the property you wish to transfer. Include the full address and any relevant legal descriptions, such as parcel numbers.

- Identify the beneficiary or beneficiaries. Include their full names and addresses. If there are multiple beneficiaries, make sure to specify how the property will be divided among them.

- Sign and date the form in the designated area. This signature confirms your intent to transfer the property upon your death.

- Have the deed notarized. A notary public must witness your signature to validate the document.

- Finally, file the completed deed with the appropriate county office where the property is located. This step is crucial to ensure the transfer takes effect.

Common mistakes

-

Not using the correct form. Make sure to use the Washington Transfer-on-Death Deed form specifically designed for this purpose.

-

Failing to include the legal description of the property. The deed must clearly identify the property being transferred.

-

Omitting the names of the beneficiaries. All individuals who will receive the property should be listed.

-

Not signing the deed in the presence of a notary. A notary public must witness the signature for the deed to be valid.

-

Forgetting to record the deed with the county auditor. The deed must be filed to ensure it takes effect upon the owner's death.

-

Using outdated information. Ensure that all names, addresses, and details are current and accurate.

-

Not specifying how to handle multiple beneficiaries. Clear instructions should be provided if there are multiple people receiving the property.

-

Failing to consider tax implications. Understand how the transfer may affect property taxes for the beneficiaries.

-

Neglecting to update the deed after changes in circumstances. Life events such as marriage or divorce may necessitate updates.

-

Not consulting with a professional. Seek advice from a legal expert to avoid common pitfalls.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners in Washington to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The Washington Transfer-on-Death Deed is governed by Washington Revised Code (RCW) 64.38. |

| Eligibility | Any individual who owns real property in Washington can create a TOD Deed, regardless of age or residency status. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed. This designation can be changed or revoked at any time before the owner's death. |

| Filing Requirements | The completed TOD Deed must be recorded with the county auditor in the county where the property is located to be effective. |

| Revocation | To revoke a TOD Deed, the property owner must file a revocation document with the county auditor, or create a new TOD Deed that supersedes the previous one. |

| Impact on Taxes | The transfer of property via a TOD Deed does not trigger immediate tax consequences, but beneficiaries may be responsible for property taxes after the owner's death. |

| Exclusions | Transfer-on-Death Deeds cannot be used for certain types of property, such as property held in a trust or property subject to a mortgage without specific provisions. |

| Legal Advice | While creating a TOD Deed is straightforward, consulting with a legal professional is recommended to ensure it aligns with overall estate planning goals. |

Dos and Don'ts

When filling out the Washington Transfer-on-Death Deed form, it is essential to approach the task with care and attention. Here are some important dos and don'ts to consider:

- Do ensure that you have the correct legal description of the property.

- Do include the full names of all beneficiaries clearly.

- Do sign the deed in the presence of a notary public.

- Do file the deed with the appropriate county office after completion.

- Do keep a copy of the filed deed for your records.

- Don't leave out any required information on the form.

- Don't forget to check for any local requirements that may apply.

- Don't sign the deed without having it notarized.

- Don't assume that verbal agreements regarding the deed are sufficient.

- Don't neglect to inform beneficiaries about the deed and its implications.

Similar forms

The Washington Transfer-on-Death Deed (TODD) is similar to a traditional will in that both documents allow individuals to dictate how their property will be distributed after their death. A will requires the probate process, which can be time-consuming and costly. In contrast, a TODD allows property to transfer directly to the designated beneficiary without going through probate, simplifying the process and reducing expenses for the heirs. This direct transfer can be especially beneficial for those who want to avoid the complexities of probate court.

For those interested in establishing a comprehensive plan for managing their assets, the California General Power of Attorney form is essential. This legal document enables the principal to appoint an agent to handle financial decisions on their behalf, which can be crucial in various situations, including incapacity. To explore additional forms that might cater to unique needs, you can access All California Forms.

Check out Popular Transfer-on-Death Deed Forms for Different States

Transfer on Death Deed Texas Form Free - This deed has become a popular option for estate planning in many states across the U.S.

The Trader Joe's application form is a vital document for job seekers wishing to join this beloved grocery chain. It outlines necessary information about potential employees and provides an opportunity to showcase their unique skills and experience. For those interested in the application process, more details can be found at documentonline.org/blank-trader-joe-s-application, and completing the form accurately can significantly increase the chances of landing a position at one of their stores.

Pennsylvania Transfer on Death Deed Form - State laws may dictate how disputes among beneficiaries are resolved if the deed is not clear.