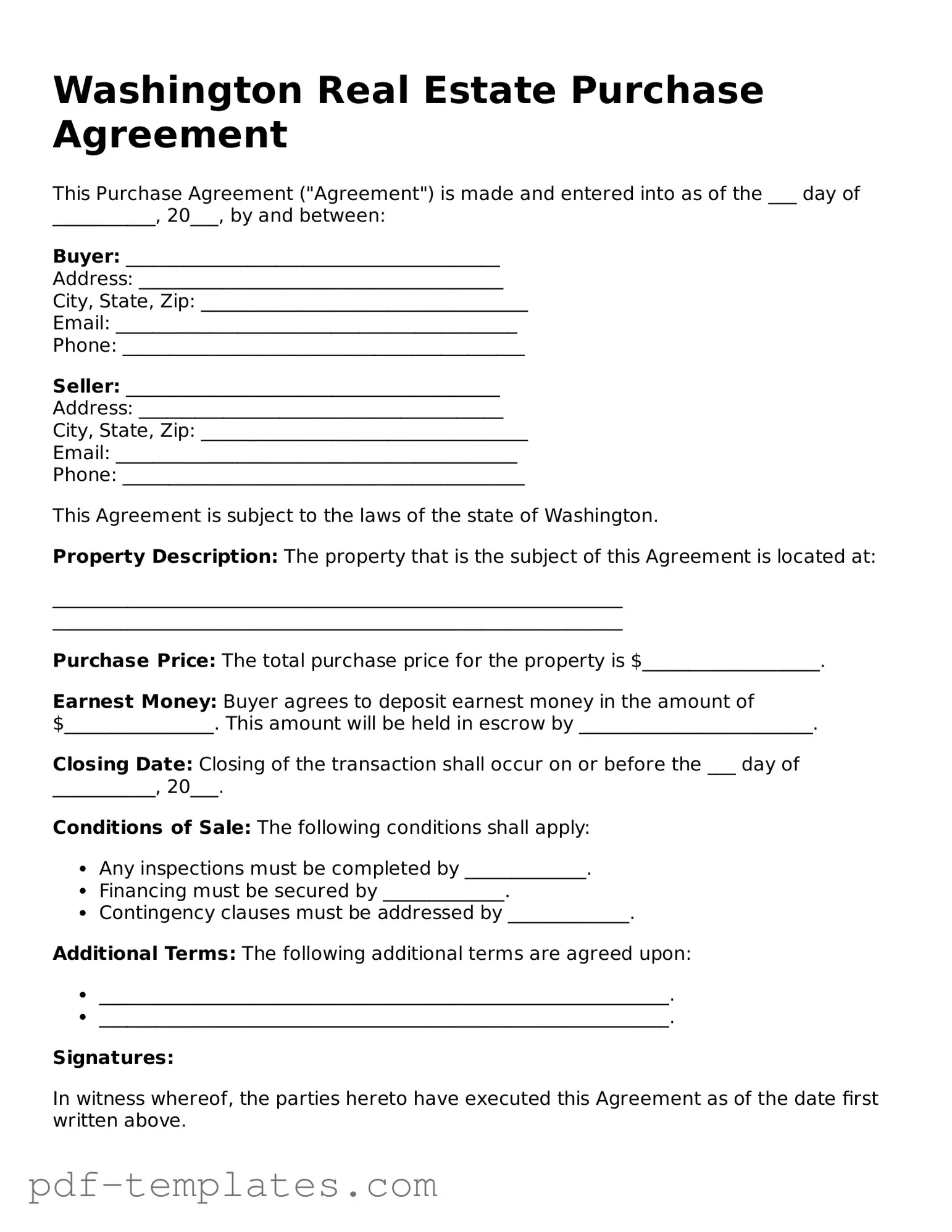

Official Real Estate Purchase Agreement Template for Washington State

The Washington Real Estate Purchase Agreement form serves as a crucial document in the process of buying and selling property within the state. This form outlines the terms and conditions agreed upon by the buyer and seller, ensuring that both parties have a clear understanding of their rights and responsibilities. It typically includes essential details such as the purchase price, the closing date, and any contingencies that may affect the transaction. Additionally, it addresses important aspects like earnest money deposits, property disclosures, and the responsibilities for repairs or inspections. By clearly delineating these elements, the agreement helps to minimize misunderstandings and potential disputes. Furthermore, the form often incorporates provisions for resolving conflicts, thereby providing a framework for both parties to follow should issues arise. Understanding this agreement is vital for anyone involved in a real estate transaction in Washington, as it lays the groundwork for a successful transfer of property ownership.

Misconceptions

Many individuals encounter misconceptions about the Washington Real Estate Purchase Agreement (REPA) form. Understanding these misconceptions can lead to better decision-making in real estate transactions. Here are seven common misunderstandings:

- The REPA is a legally binding contract from the moment it is signed. While the REPA becomes binding once both parties sign it, there are often contingencies that must be satisfied before the agreement is fully enforceable.

- All terms are negotiable. While many terms in the REPA can be negotiated, certain legal and regulatory requirements may limit the extent of these negotiations.

- The seller must disclose all property defects. Sellers are required to disclose known defects, but they are not obligated to disclose issues they are unaware of. Buyers should conduct their own inspections.

- Using a standard form guarantees a smooth transaction. A standard form provides a framework, but the specifics of each transaction can introduce complexities that require careful attention.

- Once submitted, the REPA cannot be changed. Amendments to the REPA can be made if both parties agree. Flexibility exists as long as both sides consent to the changes.

- The REPA is the only document needed for a real estate transaction. In addition to the REPA, other documents such as disclosures, title reports, and financing agreements may be necessary to complete the transaction.

- Real estate agents can provide legal advice regarding the REPA. Real estate agents can offer guidance and interpretation, but they are not licensed to provide legal advice. It is advisable to consult an attorney for legal questions.

By dispelling these misconceptions, buyers and sellers can approach their real estate transactions with greater clarity and confidence.

Washington Real Estate Purchase Agreement: Usage Instruction

After gathering the necessary information, you can proceed to fill out the Washington Real Estate Purchase Agreement form. This document is essential for formalizing the agreement between the buyer and seller regarding the sale of a property. Follow these steps to ensure the form is completed correctly.

- Identify the Parties: Write the full names of the buyer(s) and seller(s) at the top of the form. Make sure to include any middle names or initials.

- Property Description: Provide a detailed description of the property being sold. Include the address, parcel number, and any relevant legal descriptions.

- Purchase Price: Clearly state the total purchase price of the property. Specify the amount in both numbers and words to avoid confusion.

- Earnest Money: Indicate the amount of earnest money the buyer will provide. Mention how and when this money will be delivered.

- Financing Terms: Describe how the buyer plans to finance the purchase. Include details about any loans, down payments, or other financing arrangements.

- Closing Date: Specify the proposed closing date for the transaction. This is when the ownership will officially transfer.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as inspections or financing approvals.

- Signatures: Ensure that all parties sign and date the agreement. Each party should keep a copy for their records.

Common mistakes

-

Not Reading the Entire Document: Many people jump straight to filling out the form without fully understanding the terms and conditions. This can lead to misunderstandings later on.

-

Incorrectly Filling in Buyer and Seller Information: It’s crucial to provide accurate names and contact details. Typos or missing information can create legal complications.

-

Overlooking the Property Description: A precise description of the property, including address and parcel number, must be included. Vague descriptions can lead to disputes.

-

Ignoring Contingencies: Failing to include important contingencies, like financing or inspection, can jeopardize the buyer's position and lead to unexpected issues.

-

Not Specifying the Purchase Price: Clearly stating the purchase price is essential. Leaving it blank or vague can create confusion and potential legal problems.

-

Missing Signatures: Both parties must sign the agreement. Forgetting to sign can render the document invalid, leaving everyone in a lurch.

-

Failing to Include Dates: Dates for offer, acceptance, and closing are important. Omitting these can lead to misunderstandings about timelines.

-

Not Understanding Earnest Money Requirements: The amount and terms regarding earnest money should be clear. Confusion here can lead to disputes over funds.

-

Ignoring Local Laws and Regulations: Each area may have specific requirements. Not being aware of these can lead to non-compliance and issues down the line.

-

Neglecting to Seek Professional Help: Many individuals attempt to fill out the form without guidance. Consulting a real estate professional can help avoid costly mistakes.

PDF Features

| Fact Name | Details |

|---|---|

| Governing Law | The Washington Real Estate Purchase Agreement is governed by the laws of the State of Washington. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction between a buyer and a seller. |

| Offer and Acceptance | The agreement serves as an offer from the buyer, which the seller can accept, reject, or counter. |

| Contingencies | Common contingencies include financing, inspection, and appraisal, which protect the buyer's interests. |

| Earnest Money | The form typically requires the buyer to submit earnest money as a show of good faith. |

| Closing Date | The agreement specifies a closing date, marking the transfer of ownership from the seller to the buyer. |

| Disclosure Requirements | Sellers must provide disclosures regarding the property's condition, ensuring transparency in the transaction. |

Dos and Don'ts

When filling out the Washington Real Estate Purchase Agreement form, consider the following guidelines:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed agreement for your records.

- Don't leave any required fields blank; this may invalidate the agreement.

- Don't use abbreviations or shorthand that may cause confusion.

- Don't make changes to the form without proper authorization.

- Don't forget to consult with a real estate professional if you have questions.

Similar forms

The Washington Real Estate Purchase Agreement form is similar to the Residential Purchase Agreement used in many states. Both documents outline the terms and conditions under which a buyer agrees to purchase a property from a seller. Key elements like the purchase price, closing date, and contingencies for inspections or financing are typically included in both agreements. They serve to protect both parties by clearly defining their rights and obligations throughout the transaction process.

For a thorough understanding of real estate transactions, many turn to relevant legal documents, including the Hold Harmless Agreement form. A crucial aspect of safeguarding interests, this form delineates the responsibilities and liabilities between parties involved. To learn more about this important legal resource, you can visit this page for a comprehensive overview.

Another comparable document is the Commercial Purchase Agreement. While it is specifically designed for commercial properties, it shares many features with the residential version. Both agreements detail the terms of sale, including the purchase price and any conditions that must be met before the sale is finalized. However, the commercial version may include additional clauses related to zoning laws, tenant leases, and property use, reflecting the complexities of commercial real estate transactions.

The Listing Agreement is another document that bears similarities to the Real Estate Purchase Agreement. This document is used by sellers to authorize a real estate agent to market their property. Like the purchase agreement, it outlines terms, including commission fees and the duration of the listing. While the purchase agreement focuses on the sale itself, the listing agreement sets the stage for that sale by establishing the seller’s intent to sell and the agent’s role in facilitating the transaction.

The Option to Purchase Agreement is also related. This document allows a buyer the right, but not the obligation, to purchase a property at a later date for a specified price. Similar to the Real Estate Purchase Agreement, it includes terms such as the option fee and the duration of the option. This agreement provides flexibility for buyers who may need more time to secure financing or make decisions while still locking in a purchase price.

The Lease Purchase Agreement is another relevant document. It combines elements of both a lease and a purchase agreement, allowing a tenant to rent a property with the option to buy it later. Like the Real Estate Purchase Agreement, it specifies the purchase price and terms of sale. This arrangement can be beneficial for buyers who may not be ready to purchase immediately but want to secure a property for future ownership.

Lastly, the Seller Financing Agreement is similar in that it outlines the terms under which a seller agrees to finance the buyer's purchase of the property. This document includes details such as the interest rate, repayment schedule, and any contingencies. While it serves a specific purpose within the broader context of a real estate transaction, it shares the fundamental goal of clearly defining the terms of a property sale, much like the Real Estate Purchase Agreement.

Check out Popular Real Estate Purchase Agreement Forms for Different States

Realestate Purchase Agreement - May specify the method of financing for the purchase.

Generic Home Purchase Agreement - It may contain information on how to handle closing costs.

Trec License - Specific payment methods and schedules for the purchase price can also be included.

In addition to defining the terms of service, utilizing a reliable source for drafting the California Independent Contractor Agreement form is essential for compliance. For those seeking a comprehensive template, formcalifornia.com offers an editable format that can help ensure all necessary details are covered, promoting clarity in the relationship between the contractor and the hiring entity.

New York Real Estate Contract - Both the buyer and seller must sign the agreement for it to be legally binding.