Official Quitclaim Deed Template for Washington State

When it comes to transferring property in Washington State, the Quitclaim Deed form plays a crucial role. This legal document allows a property owner to transfer their interest in a property to another party without making any guarantees about the title's validity. Essentially, it is a straightforward way to convey ownership, often used among family members or in situations where the property title is not in dispute. The Quitclaim Deed does not provide the same level of protection as other types of deeds, such as Warranty Deeds, which assure the buyer of a clear title. It's important to understand that while the Quitclaim Deed can simplify the transfer process, it also carries risks, particularly for the recipient. The new owner may inherit any existing claims or liens against the property. Therefore, careful consideration and, if necessary, legal advice are recommended before proceeding with this type of deed. In Washington, the form must be properly completed and filed with the county auditor to ensure the transfer is legally recognized. Understanding these aspects can help individuals navigate the complexities of property transfers with greater confidence.

Misconceptions

When dealing with real estate transactions in Washington, many people hold misconceptions about the Quitclaim Deed form. Understanding these misconceptions can help clarify its purpose and implications.

-

A Quitclaim Deed transfers ownership without guarantees.

Many believe that a Quitclaim Deed offers the same level of protection as other types of deeds. In reality, it transfers whatever interest the grantor has in the property, if any, without making any guarantees about the title. This means the grantee may receive no ownership rights at all.

-

Quitclaim Deeds are only for transferring property between family members.

While Quitclaim Deeds are often used in family transactions, they are not limited to these situations. They can be utilized in various scenarios, including divorce settlements, business partnerships, or any situation where the transfer of property rights is necessary.

-

A Quitclaim Deed eliminates all potential claims on the property.

Some individuals mistakenly think that using a Quitclaim Deed removes all claims against the property. However, it does not protect against liens or other encumbrances. If the grantor has debts tied to the property, those may still exist even after the transfer.

-

Using a Quitclaim Deed is a complicated process.

Many believe that the process of executing a Quitclaim Deed is overly complex. In fact, it is relatively straightforward. The form requires basic information about the property and the parties involved, and it can typically be completed without the need for legal assistance.

-

A Quitclaim Deed is only valid if notarized.

While notarization is a common practice that adds credibility, it is not strictly required for a Quitclaim Deed to be valid in Washington. However, it is highly recommended to ensure the document is accepted by the county recorder’s office.

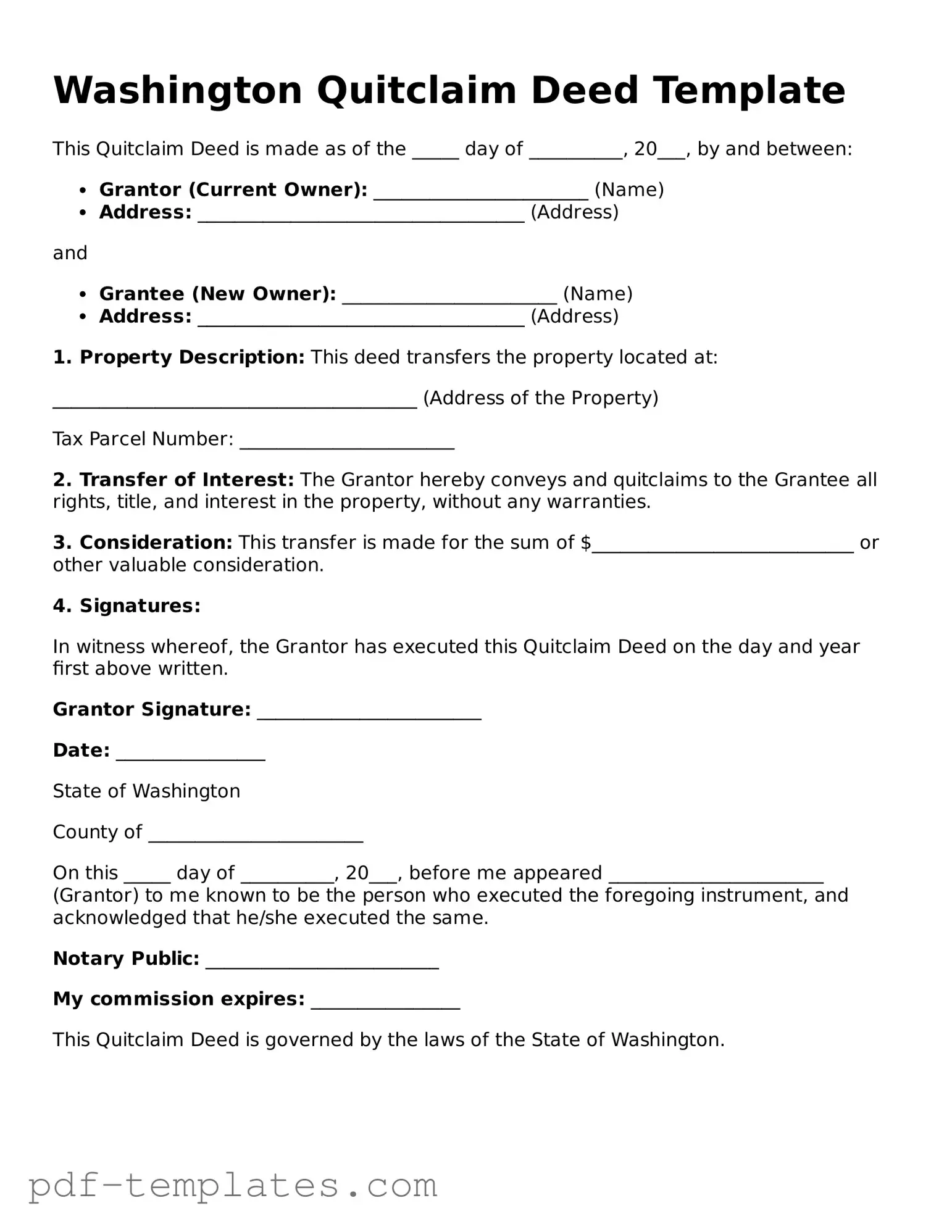

Washington Quitclaim Deed: Usage Instruction

Once you have the Washington Quitclaim Deed form in hand, you’ll want to ensure that it is filled out accurately. This document is crucial for transferring property rights, so take your time and follow the steps carefully.

- Obtain the Form: Download the Washington Quitclaim Deed form from a reliable source or acquire a physical copy from a local government office.

- Fill in the Grantor's Information: At the top of the form, write the name and address of the person transferring the property (the grantor).

- Fill in the Grantee's Information: Next, provide the name and address of the person receiving the property (the grantee).

- Describe the Property: Clearly describe the property being transferred. Include the address and any legal descriptions necessary to identify it uniquely.

- Consideration: State the amount of money or value exchanged for the property, if applicable. If it’s a gift, you can note that as well.

- Sign the Document: The grantor must sign the form in the presence of a notary public. Ensure the signature matches the name written on the form.

- Notarization: Have the notary public complete their section, verifying the identity of the grantor and witnessing the signature.

- Record the Deed: Take the completed and notarized Quitclaim Deed to the county recorder’s office where the property is located. Pay any required fees to have it officially recorded.

After completing these steps, the Quitclaim Deed will be filed with the county, making the transfer of property rights official. Keep a copy for your records, as it serves as proof of the transaction.

Common mistakes

-

Failing to include the legal description of the property. This is essential for identifying the specific parcel of land being transferred.

-

Not having the grantor and grantee names accurately spelled. Errors in names can lead to confusion and potential legal issues.

-

Omitting the date of the transfer. This information is crucial for establishing the timeline of ownership.

-

Neglecting to provide the consideration amount, even if it is nominal. This value reflects what the grantee is paying for the property.

-

Not signing the document in front of a notary public. A notarized signature is often required for the deed to be valid.

-

Forgetting to check the county requirements for recording the deed. Each county may have specific rules or additional forms needed.

-

Leaving out the property address. While the legal description is vital, the common address helps in identifying the property more easily.

-

Failing to keep a copy of the completed deed for personal records. This is important for future reference and proof of ownership.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Washington Quitclaim Deed is a legal document used to transfer ownership of real property without guaranteeing that the title is clear. |

| Governing Law | The use of Quitclaim Deeds in Washington is governed by the Revised Code of Washington (RCW) Chapter 64.04. |

| Consideration | While a Quitclaim Deed can be executed without monetary consideration, it is customary to include a nominal amount to validate the transaction. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property) and notarized for it to be legally effective. |

| Recording | To protect the interests of the new owner, the Quitclaim Deed should be recorded with the county auditor’s office where the property is located. |

Dos and Don'ts

When filling out the Washington Quitclaim Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things to do and things to avoid.

- Do ensure that all property information is accurate and complete.

- Do include the names of all parties involved in the transaction.

- Do provide a legal description of the property being transferred.

- Do sign the document in the presence of a notary public.

- Do check for any local requirements that may affect the deed.

- Don't leave any sections of the form blank unless specifically instructed.

- Don't use incorrect names or misspellings for the parties involved.

- Don't forget to date the document before submission.

- Don't assume that the form is valid without proper notarization.

Similar forms

A warranty deed is similar to a quitclaim deed in that both are used to transfer ownership of property. However, the key difference lies in the level of protection they offer to the buyer. A warranty deed guarantees that the seller holds clear title to the property and has the right to sell it. This means the buyer is protected against any claims or disputes regarding ownership. In contrast, a quitclaim deed offers no such guarantees, making it a riskier option for the buyer.

A special warranty deed also shares similarities with a quitclaim deed, but it includes some additional protections for the buyer. Like a quitclaim deed, a special warranty deed transfers ownership without guaranteeing a clear title. However, it does provide a limited warranty that the seller has not caused any issues with the title during their ownership. This means that while the buyer still faces risks, they have some assurance against problems that arose while the seller owned the property.

Understanding the benefits of a Durable Power of Attorney for effective estate planning is essential for ensuring that your wishes are respected and your financial affairs are managed appropriately during times of incapacity.

A deed of trust is another document that can be compared to a quitclaim deed, although it serves a different purpose. A deed of trust is used in real estate transactions to secure a loan. In this case, the property acts as collateral for the loan. While a quitclaim deed transfers ownership without any financial obligation, a deed of trust involves a lender and provides a legal claim to the property if the borrower defaults on the loan. Both documents involve property transfer, but they have distinct roles in financing.

Check out Popular Quitclaim Deed Forms for Different States

Quit Claim Deed Cost - A Quitclaim Deed transfers property without guaranteeing ownership.

Quitclaim Deed Form Pennsylvania - This form can be utilized to clear up title issues when a property is inherited or transferred through an estate.

This straightforward Mobile Home Bill of Sale document simplifies the sale process by providing a clear framework for the exchange of ownership between parties. Understanding its requirements will aid both buyers and sellers in completing transactions efficiently.

Free Quitclaim Deed Form California - A key characteristic is that it releases any interest the grantor has in the property.

How to File a Quitclaim Deed in Texas - A Quitclaim Deed can be used to clarify property boundaries.