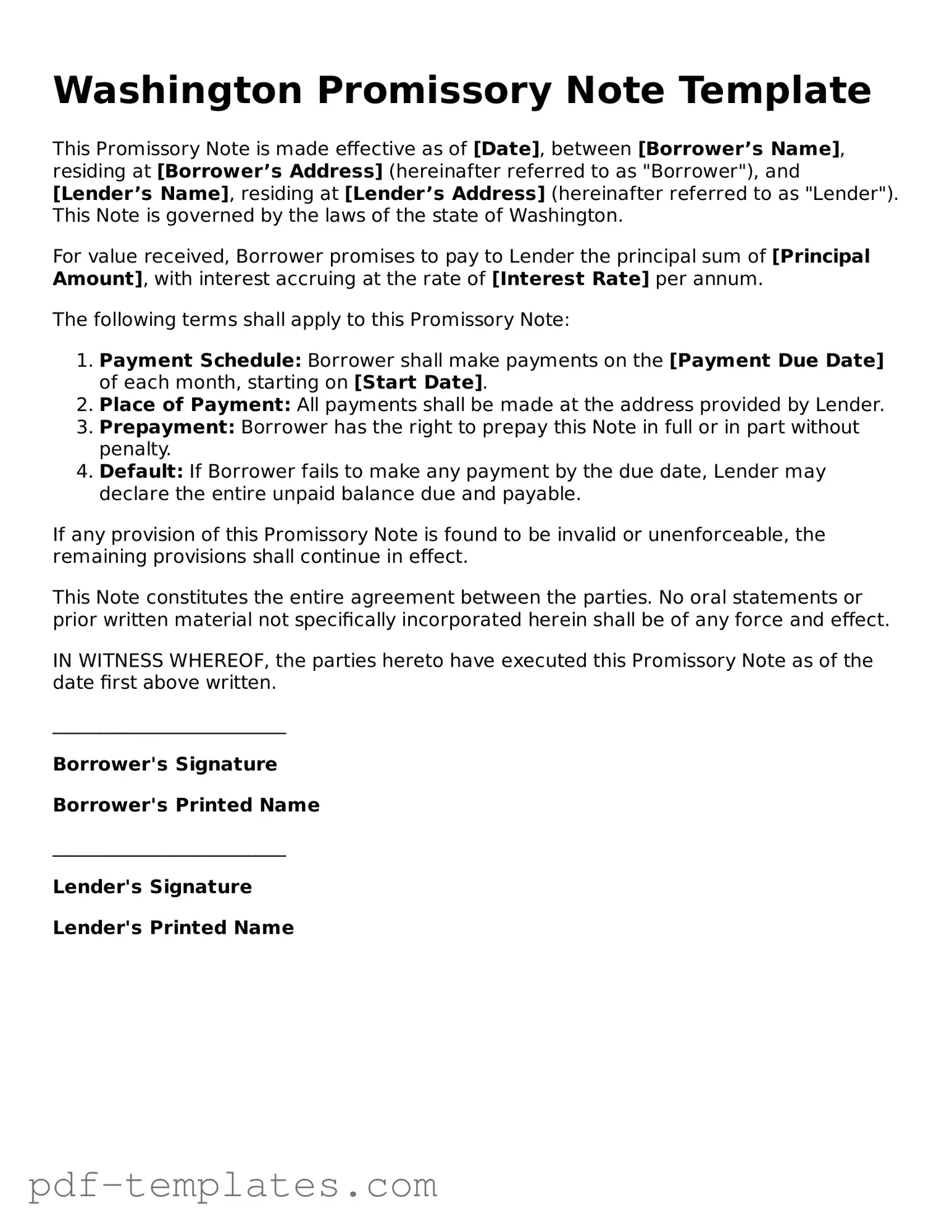

Official Promissory Note Template for Washington State

The Washington Promissory Note form serves as a crucial document in financial transactions, outlining the terms under which one party agrees to repay a sum of money to another. This legally binding agreement details essential aspects such as the principal amount borrowed, the interest rate applicable, and the repayment schedule. Additionally, it specifies the consequences of default, providing clarity on what happens if the borrower fails to meet their obligations. In Washington, this form is designed to protect both lenders and borrowers, ensuring that all parties understand their rights and responsibilities. By including provisions for late fees, prepayment options, and governing law, the Washington Promissory Note form offers a comprehensive framework for personal loans, business financing, and other monetary agreements. Understanding this form is vital for anyone involved in lending or borrowing money in the state, as it lays the groundwork for a transparent and enforceable financial relationship.

Misconceptions

Understanding the Washington Promissory Note form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- All Promissory Notes are the Same: Many believe that all promissory notes follow the same structure and terms. In reality, the Washington Promissory Note has specific legal requirements and formats that differ from those in other states.

- A Promissory Note is a Loan Agreement: Some people think that a promissory note is synonymous with a loan agreement. While both documents relate to borrowing money, a promissory note is primarily a promise to pay, whereas a loan agreement outlines the terms of the loan.

- Promissory Notes Do Not Require Signatures: It is a common misconception that a promissory note can be valid without signatures. In Washington, both the borrower and the lender must sign the note for it to be enforceable.

- Interest Rates Are Not Important: Some borrowers may think that the interest rate specified in the promissory note does not matter. However, the interest rate can significantly affect the total amount owed and should be clearly defined in the document.

- Verbal Agreements Are Sufficient: Many individuals believe that a verbal agreement is enough to create a binding obligation. In Washington, written documentation, such as a promissory note, is essential for legal enforcement.

- Promissory Notes Are Only for Large Loans: There is a misconception that promissory notes are only necessary for substantial loans. In fact, they can be used for any amount of borrowing, providing clarity and protection for both parties.

- Once Signed, a Promissory Note Cannot Be Changed: Some people think that a signed promissory note is set in stone. However, modifications can be made if both parties agree to the changes, and these should be documented in writing.

By addressing these misconceptions, individuals can better navigate the complexities of promissory notes in Washington and ensure that their financial agreements are clear and enforceable.

Washington Promissory Note: Usage Instruction

After you have gathered all necessary information, you are ready to fill out the Washington Promissory Note form. This document requires specific details about the loan and the parties involved. Carefully follow the steps below to ensure that you complete the form accurately.

- Begin by entering the date at the top of the form. This date should reflect when the note is being executed.

- Next, provide the name and address of the borrower. This information is essential to identify who is responsible for repaying the loan.

- Then, enter the name and address of the lender. This identifies who is providing the loan.

- Specify the principal amount of the loan. This is the total sum being borrowed.

- Indicate the interest rate, if applicable. Be clear about whether this is a fixed or variable rate.

- State the repayment terms. Include details such as the payment schedule and the duration of the loan.

- Include any late fees or penalties that may apply if payments are not made on time.

- Sign and date the form. Both the borrower and lender should sign to acknowledge their agreement to the terms.

- Finally, make copies of the completed form for both parties. Keeping a record is important for future reference.

Common mistakes

-

Inaccurate Borrower Information: One common mistake is providing incorrect details about the borrower. This includes misspellings of names, wrong addresses, or incorrect Social Security numbers. Always double-check this information to ensure accuracy.

-

Missing Loan Amount: Another frequent error is failing to clearly state the loan amount. It’s essential to write the amount both in numbers and words to avoid any confusion or disputes later.

-

Omitting Interest Rate: Some people forget to include the interest rate or leave it blank. Clearly specifying the interest rate is crucial, as it affects the total amount to be repaid.

-

Incorrect Payment Terms: Misunderstanding or miswriting the payment terms can lead to significant issues. Ensure that the repayment schedule, including due dates and frequency of payments, is clearly outlined.

-

Neglecting Signatures: Finally, failing to sign the document is a critical mistake. Both the borrower and lender must sign the promissory note for it to be legally binding. Without signatures, the note may not hold up in court.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Washington Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a defined time. |

| Governing Law | The Washington Promissory Note is governed by the Revised Code of Washington (RCW) Title 62A, which is based on the Uniform Commercial Code. |

| Parties Involved | Typically, there are two parties: the borrower (maker) who promises to pay and the lender (payee) who receives the payment. |

| Interest Rate | The note may specify an interest rate. If not stated, Washington law allows for a maximum interest rate of 12% per annum unless otherwise agreed. |

| Payment Terms | Payment terms can vary; they may include a lump sum payment or installments over a specified period. |

| Default Provisions | The note may include provisions outlining what constitutes a default, such as failure to make timely payments. |

| Transferability | Promissory notes in Washington can be transferred or sold to another party unless restricted by the terms of the note. |

| Notarization | While notarization is not required, having the note notarized can provide additional legal protection and credibility. |

| Enforcement | If the borrower defaults, the lender has the right to pursue legal action to enforce the note and recover the owed amount. |

Dos and Don'ts

When filling out the Washington Promissory Note form, attention to detail is essential. Here are five things you should and shouldn't do to ensure the document is completed correctly.

- Do read the instructions carefully before starting. Understanding the requirements will help you avoid mistakes.

- Do provide accurate information. Ensure that names, dates, and amounts are correct to prevent future disputes.

- Do sign the document in the appropriate section. Your signature is necessary for the note to be legally binding.

- Don't leave any required fields blank. Missing information can render the note invalid.

- Don't use white-out or erase any mistakes. Instead, draw a line through the error and initial it to maintain a clear record of changes.

Similar forms

The Washington Promissory Note form shares similarities with a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. While a promissory note is a straightforward promise to repay, a loan agreement may include additional clauses regarding default, collateral, and other legal protections for the lender. Essentially, both serve to formalize the borrowing process, but a loan agreement provides a more comprehensive legal framework.

Another document that resembles the Washington Promissory Note is the Secured Promissory Note. This type of note includes a security interest in an asset, which acts as collateral for the loan. If the borrower defaults, the lender has the right to seize the specified asset. Like the Washington Promissory Note, it contains essential information about the loan terms, but it adds an extra layer of security for the lender.

The Washington Promissory Note is also similar to a Personal Loan Agreement. This document is used when an individual borrows money from another individual or financial institution. It details the loan amount, repayment terms, and interest rates, much like the promissory note. However, a personal loan agreement may also include terms related to the borrower's creditworthiness and specific conditions for repayment, providing a more tailored approach to personal lending.

Additionally, the Washington Promissory Note can be compared to a Business Loan Agreement. This document is used when a business borrows funds for operational needs or expansion. While both documents outline loan terms, a business loan agreement often includes clauses related to business performance, use of funds, and potential consequences for default. This makes it more complex than a standard promissory note, which typically focuses solely on repayment.

For those involved in lending agreements, it's essential to utilize proper documentation that safeguards all parties' interests. The https://formcalifornia.com offers valuable resources for creating legally sound loan agreements, ensuring that every aspect, from repayment terms to collateral requirements, is clearly defined and agreed upon.

The Washington Promissory Note is also akin to a Mortgage Note. A mortgage note is a specific type of promissory note that secures a loan with real estate as collateral. Both documents detail the borrower's promise to repay the loan, but a mortgage note includes specific terms regarding the property and the lender's rights in case of default. This added layer of security is crucial in real estate transactions.

Finally, the Washington Promissory Note bears resemblance to an Installment Loan Agreement. This document outlines a loan that is repaid in regular installments over a specified period. Like the promissory note, it specifies the loan amount and interest rate. However, the installment loan agreement may provide more detailed information about payment schedules and late fees, making it a more structured document for borrowers who prefer predictable payment plans.

Check out Popular Promissory Note Forms for Different States

Virginia Promissory Note - Additional clauses can be included based on the individual needs of both parties.

The Trader Joe's application form is a vital document for job seekers wishing to join this beloved grocery chain. It outlines necessary information about potential employees and provides an opportunity to showcase their unique skills and experience. For those interested, the application can be accessed at https://documentonline.org/blank-trader-joe-s-application, and completing the form accurately can significantly increase the chances of landing a position at one of their stores.

Blank Promissory Note - This form provides a transparent loan structure for both parties.

Simple Promissory Note Template California - This document can act as a protective tool for both borrowers and lenders in financial dealings.