Official Operating Agreement Template for Washington State

The Washington Operating Agreement form is a crucial document for any limited liability company (LLC) operating in the state of Washington. It serves as the foundational framework that outlines the management structure, operational procedures, and financial arrangements of the LLC. This form addresses key elements such as member roles and responsibilities, voting rights, profit distribution, and procedures for adding or removing members. Additionally, it can specify how decisions are made and how disputes are resolved, ensuring clarity and stability within the business. By establishing these guidelines, the Operating Agreement not only helps to prevent misunderstandings among members but also provides a roadmap for the company’s future growth and success. Understanding the significance of this document is essential for anyone looking to form or manage an LLC in Washington, as it lays the groundwork for a well-organized and legally compliant business operation.

Misconceptions

When it comes to the Washington Operating Agreement, many individuals and business owners hold misconceptions that can lead to confusion or missteps. Here are eight common misunderstandings, clarified for better understanding:

- Operating Agreements are optional. Many people believe that having an Operating Agreement is not necessary. However, in Washington, while it’s not legally required for all businesses, having one is highly recommended. It helps define the roles and responsibilities of members and can prevent disputes.

- All Operating Agreements are the same. Some think that there’s a one-size-fits-all Operating Agreement. In reality, each agreement should be tailored to the specific needs and goals of the business. Different businesses have different structures, and the agreement should reflect that.

- Only LLCs need an Operating Agreement. While it’s true that Limited Liability Companies (LLCs) often use Operating Agreements, other business structures can benefit from them too. Corporations and partnerships can also use these agreements to outline governance and operational procedures.

- Once created, the Operating Agreement cannot be changed. Some believe that an Operating Agreement is set in stone once it’s drafted. In fact, it can and should be updated as the business evolves or as members’ roles change. Regular reviews can ensure it remains relevant.

- Operating Agreements are only for large businesses. This misconception suggests that only larger companies need to worry about having an Operating Agreement. In truth, even small businesses and startups can greatly benefit from having a clear outline of operations and member roles.

- All members must sign the Operating Agreement. While it’s advisable for all members to sign, it’s not always legally required for every single member to do so. However, having all members sign can strengthen the agreement’s enforceability.

- The Operating Agreement is the same as the Articles of Organization. Some confuse these two documents. The Articles of Organization are filed with the state to officially form the business, while the Operating Agreement is an internal document that governs the business’s operations.

- Legal help is not needed to draft an Operating Agreement. Many think they can create an Operating Agreement on their own without any legal assistance. While templates are available, having a legal professional review or draft the agreement can ensure it meets all necessary legal requirements and addresses specific business needs.

Understanding these misconceptions can help business owners make informed decisions about their Operating Agreements, ultimately leading to smoother operations and fewer conflicts down the line.

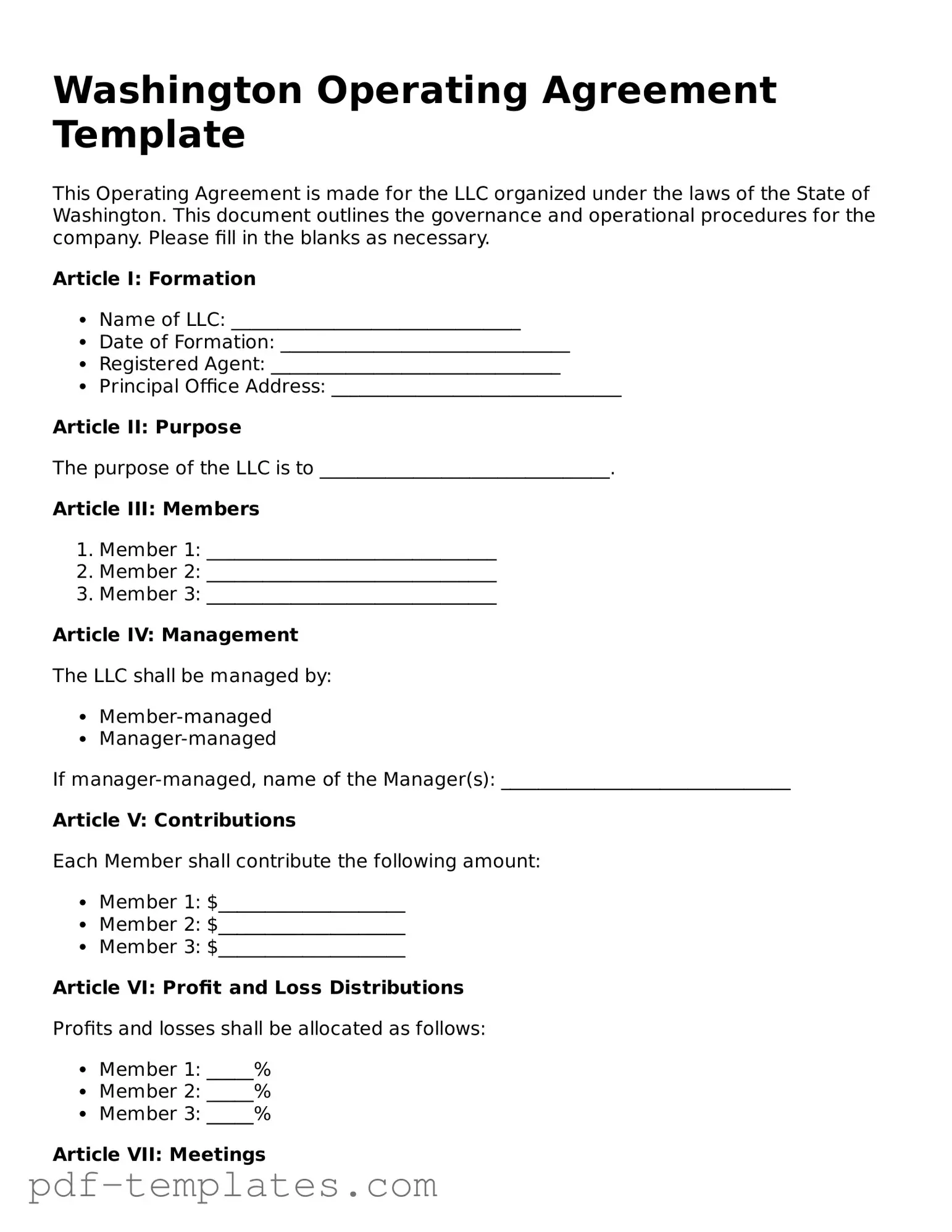

Washington Operating Agreement: Usage Instruction

Once you have the Washington Operating Agreement form, it is important to fill it out accurately. This document will guide the internal operations of your business and clarify the roles of each member. Follow the steps below to ensure you complete the form correctly.

- Begin by entering the name of your business at the top of the form.

- Provide the principal address of the business. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the business. Ensure that each member's information is accurate.

- Specify the purpose of the business. This should be a brief description of what your business will do.

- Outline the management structure. Indicate whether the business will be managed by members or by appointed managers.

- Detail the voting rights of each member. Specify how decisions will be made and the percentage of votes needed for approval.

- Include information about profit and loss distribution among members. Clearly state how profits will be divided.

- Set forth the rules for adding new members. Describe the process for admitting new individuals into the business.

- Establish procedures for resolving disputes. Outline how conflicts will be handled within the organization.

- Finally, have all members sign and date the agreement. Ensure that each signature is dated to confirm agreement.

Common mistakes

When filling out the Washington Operating Agreement form, it’s important to avoid common mistakes. Here are ten mistakes that people often make:

-

Incomplete Information: Failing to provide all required details can lead to delays or rejections. Ensure every section is filled out completely.

-

Incorrect Member Names: Spelling errors or incorrect names can cause confusion. Double-check the names of all members involved.

-

Missing Signatures: Not signing the document can render it invalid. Make sure all required parties sign the agreement.

-

Incorrect Dates: Using the wrong date can create legal issues. Verify that all dates are accurate and consistent throughout the document.

-

Failure to Specify Roles: Not clearly defining each member's role can lead to misunderstandings. Outline responsibilities clearly.

-

Ignoring State Requirements: Each state has specific rules. Ensure the agreement complies with Washington state laws.

-

Inadequate Operating Procedures: Not detailing how the business will operate can lead to disputes. Include clear procedures for decision-making.

-

Not Addressing Profit Distribution: Failing to outline how profits will be shared can cause conflicts. Clearly state the distribution method.

-

Neglecting to Update the Agreement: Not revising the agreement after changes can create problems. Review and update it regularly as needed.

-

Overlooking Dispute Resolution: Not including a plan for resolving disputes can lead to lengthy conflicts. Establish a clear process for handling disagreements.

By avoiding these mistakes, you can help ensure that the Washington Operating Agreement is completed correctly and serves its intended purpose effectively.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The Washington Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC) in Washington State. |

| Governing Law | This agreement is governed by the Revised Code of Washington (RCW) Title 25.15, which covers LLCs. |

| Member Roles | It defines the roles and responsibilities of members and managers, ensuring clarity in decision-making processes. |

| Flexibility | The agreement allows for flexibility in structuring the LLC, enabling members to customize terms to fit their needs. |

| Legal Protection | A well-drafted Operating Agreement provides legal protection for members, helping to prevent disputes and misunderstandings. |

Dos and Don'ts

When completing the Washington Operating Agreement form, it’s essential to approach the task with care. Here’s a list of ten important do's and don'ts to guide you through the process.

- Do read the entire form carefully before you begin filling it out.

- Don't rush through the sections; take your time to ensure accuracy.

- Do provide clear and concise information about your business and its members.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Do double-check the names and addresses of all members for correctness.

- Don't use abbreviations or nicknames; always use full legal names.

- Do include the date the agreement is being signed.

- Don't forget to have all members sign the agreement where indicated.

- Do keep a copy of the completed agreement for your records.

- Don't assume that verbal agreements are sufficient; everything should be documented.

By following these guidelines, you can ensure that your Washington Operating Agreement is completed correctly and effectively. This will help protect your business and its members.

Similar forms

The Washington Operating Agreement is akin to the Articles of Organization, which serve as the foundational document for a limited liability company (LLC). While the Operating Agreement outlines the internal workings and management structure of the LLC, the Articles of Organization are filed with the state to officially create the business entity. Both documents are essential for establishing an LLC, but they serve different purposes. The Articles provide basic information, such as the company name and registered agent, while the Operating Agreement details the rights and responsibilities of members and managers.

Another similar document is the Partnership Agreement, which governs the relationship between partners in a business partnership. Like the Operating Agreement, it outlines the roles, responsibilities, and profit-sharing arrangements among partners. Both documents are critical for avoiding disputes and ensuring that all parties understand their obligations. However, while the Operating Agreement is specific to LLCs, the Partnership Agreement applies to general and limited partnerships, reflecting the different legal structures involved.

The Bylaws of a corporation also share similarities with the Washington Operating Agreement. Bylaws establish the rules and procedures for a corporation's internal management, including the roles of directors and officers, meeting protocols, and voting procedures. Both documents serve to guide the governance of their respective entities, ensuring that operations run smoothly. However, while the Operating Agreement is focused on LLCs, Bylaws are specific to corporations and typically include more formalities due to the nature of corporate governance.

The Shareholders’ Agreement is another document that parallels the Operating Agreement. This agreement is used by corporations to outline the rights and obligations of shareholders. Like the Operating Agreement, it addresses issues such as share transfer restrictions, voting rights, and management roles. Both documents aim to protect the interests of the parties involved and provide clarity on how the business will operate, although the Shareholders’ Agreement is specifically tailored for corporate structures.

The LLC Membership Certificate can also be compared to the Operating Agreement. This document serves as proof of ownership in an LLC and may contain information about the member’s contributions and ownership percentage. While the Operating Agreement provides a comprehensive framework for management and operations, the Membership Certificate focuses on ownership rights. Both documents are essential for members to understand their stakes in the business.

To begin your homeschooling process, it's important to understand the significance of the Texas Homeschool Letter of Intent form. This form is a foundational requirement for families looking to educate their children at home. For more information about completing this essential document, refer to a detailed overview of the Homeschool Letter of Intent and its guidelines at a resourceful site.

Another related document is the Business Plan, which outlines the strategic direction and operational plans for a business. While the Operating Agreement focuses on governance and internal procedures, the Business Plan addresses market analysis, financial projections, and business goals. Both documents are crucial for guiding the business, but they serve different purposes in terms of management versus strategic planning.

The Non-Disclosure Agreement (NDA) can also be seen as similar in that it protects sensitive information within a business context. While the Operating Agreement governs the relationships among members, the NDA ensures that confidential information is not disclosed to outsiders. Both documents help maintain the integrity and security of the business, although they address different aspects of business operations.

Lastly, the Employment Agreement may bear some resemblance to the Operating Agreement, particularly in terms of outlining roles and responsibilities. Employment Agreements define the terms of employment for individual employees, including duties, compensation, and termination conditions. In contrast, the Operating Agreement focuses on the relationships and responsibilities among members of the LLC. Both documents are vital for establishing clear expectations and reducing the potential for disputes.

Check out Popular Operating Agreement Forms for Different States

Operating Agreement Llc Pa - The agreement may specify the authority of members in business dealings.

For those interested in understanding the significance of a Durable Power of Attorney in estate planning, it's important to recognize how this document empowers your designated agent to make crucial decisions during times when you may be incapable of doing so yourself.

How to Create an Operating Agreement - The Operating Agreement can establish guidelines for the distribution of intellectual property.