Official Last Will and Testament Template for Washington State

In the state of Washington, a Last Will and Testament serves as a crucial legal document that allows individuals to articulate their wishes regarding the distribution of their assets after death. This form not only designates beneficiaries who will receive property and possessions, but it also provides an opportunity to appoint an executor, the person responsible for administering the estate. Additionally, the will can include provisions for guardianship of minor children, ensuring their care is entrusted to someone the testator deems appropriate. The Washington Last Will and Testament form must meet specific requirements to be considered valid, such as being signed by the testator in the presence of at least two witnesses. This ensures that the document reflects the true intentions of the individual and protects against potential disputes among heirs. Furthermore, the form can be modified or revoked at any time, offering flexibility as circumstances change throughout one’s life. Understanding these key elements is essential for anyone looking to create a comprehensive estate plan that honors their wishes and provides peace of mind for their loved ones.

Misconceptions

There are several misconceptions about the Washington Last Will and Testament form that can lead to confusion. Here are seven common misunderstandings:

- All wills must be notarized. Many people believe that a will must be notarized to be valid in Washington. In reality, notarization is not required. However, having a notary can help prove the authenticity of the will.

- Oral wills are valid. Some individuals think that they can create a valid will just by speaking their wishes. In Washington, oral wills, also known as nuncupative wills, are not recognized except in very limited circumstances.

- Handwritten wills are automatically valid. While Washington does allow handwritten wills, known as holographic wills, they must meet specific criteria to be considered valid. The entire will must be in the handwriting of the testator.

- Once a will is created, it cannot be changed. There is a belief that a will is set in stone once it is signed. In fact, a will can be amended or revoked at any time, as long as the testator is of sound mind.

- All assets must be listed in the will. Some people think that every single asset must be included in the will. While it is a good practice to list significant assets, not all assets need to be mentioned, especially those that pass outside of probate.

- Only lawyers can create a will. There is a common misconception that only attorneys can draft a will. In Washington, individuals can create their own wills, but they should ensure that they follow the legal requirements to make it valid.

- Wills are only for the wealthy. Many believe that only wealthy individuals need a will. In reality, anyone with assets, regardless of their value, can benefit from having a will to ensure their wishes are followed after their death.

Washington Last Will and Testament: Usage Instruction

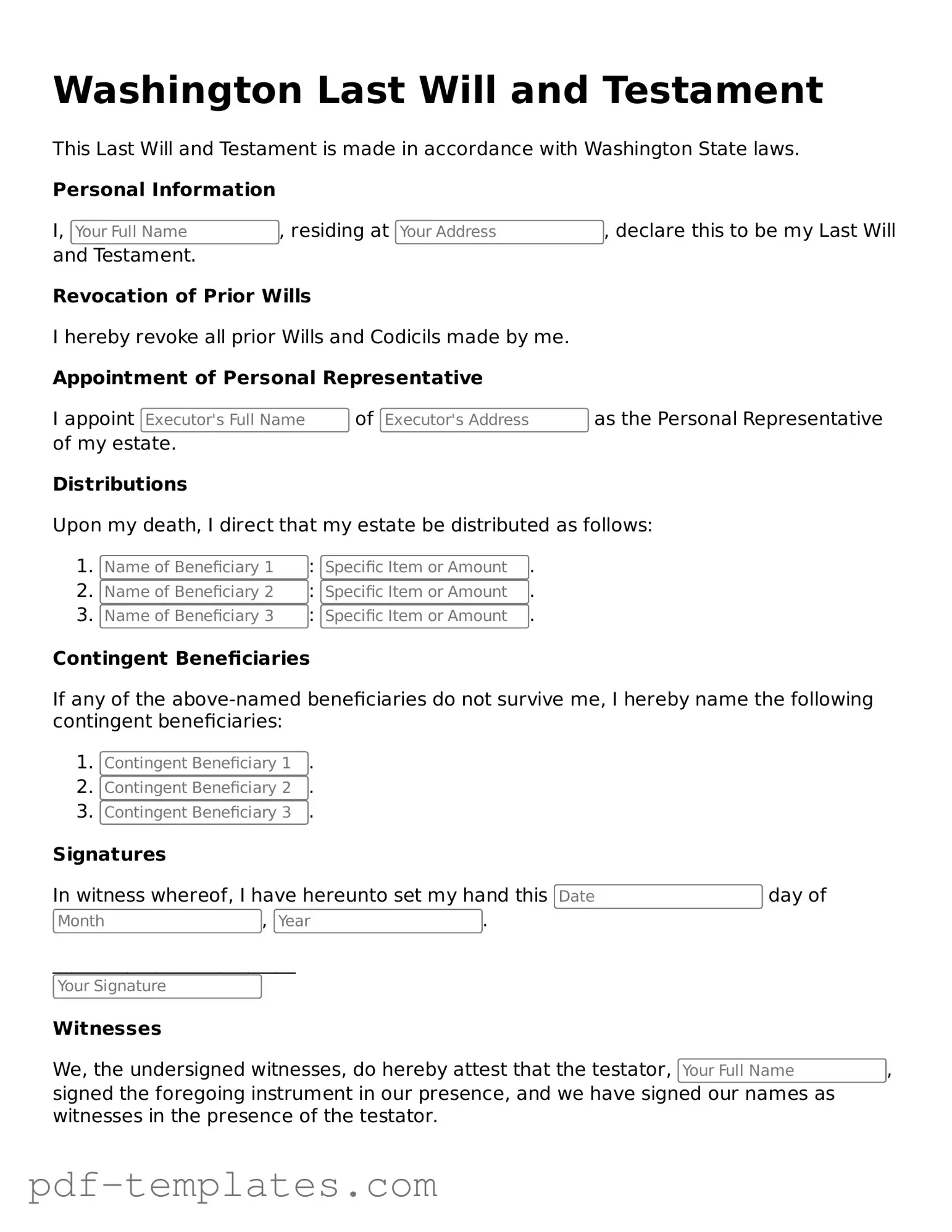

After you have gathered the necessary information and materials, you are ready to fill out the Washington Last Will and Testament form. This document is essential for outlining your wishes regarding the distribution of your assets and the care of any dependents after your passing. Follow the steps below to ensure that you complete the form accurately.

- Begin by entering your full name at the top of the form. Make sure to use your legal name as it appears on official documents.

- Next, provide your current address. Include the street address, city, state, and zip code.

- Indicate the date on which you are completing the will. This helps establish the validity of the document.

- Designate an executor. This is the person you trust to carry out your wishes as stated in the will. Write their full name and address.

- List your beneficiaries. These are the individuals or organizations who will receive your assets. Clearly state their names and relationships to you.

- Detail your assets. Include information about real estate, bank accounts, investments, and personal belongings. Be specific to avoid confusion later.

- Address any specific bequests. If you wish to leave particular items to certain individuals, clearly outline these requests.

- Consider guardianship for any minor children. If applicable, name the person you would like to care for your children in the event of your passing.

- Review the completed form for accuracy. Ensure that all information is correct and clearly stated.

- Sign the document in the presence of at least two witnesses. They should also sign the form, acknowledging that they witnessed your signature.

Once you have completed these steps, your will will be ready for storage. Keep it in a safe place and inform your executor and loved ones where it can be found. Regularly review and update the document as needed to reflect any changes in your life circumstances.

Common mistakes

-

Not Clearly Identifying the Testator: Individuals often forget to include their full name and address at the beginning of the will. This omission can lead to confusion about the document's validity.

-

Failing to Sign the Document: A common mistake is neglecting to sign the will. Without a signature, the will may not be recognized as a legal document.

-

Improper Witnessing: In Washington, a will must be witnessed by at least two individuals. Failing to have the correct number of witnesses can invalidate the will.

-

Not Including a Residual Clause: Some people forget to specify what happens to any remaining assets after specific bequests. This can lead to disputes among heirs.

-

Using Ambiguous Language: Vague terms can create confusion about the testator's intentions. Clear and precise language is essential to avoid misinterpretation.

-

Neglecting to Update the Will: Life circumstances change, and individuals often fail to revise their wills accordingly. This oversight can lead to unintended distributions of assets.

-

Not Considering Tax Implications: Some individuals overlook the potential tax consequences of their estate plans. Understanding these implications is crucial for effective planning.

-

Failing to Store the Will Safely: After completing the will, individuals sometimes do not store it in a secure location. This can result in the document being lost or destroyed.

PDF Features

| Fact Name | Details |

|---|---|

| Legal Basis | The Washington Last Will and Testament is governed by the Revised Code of Washington (RCW) Chapter 11.12. |

| Age Requirement | In Washington, individuals must be at least 18 years old to create a valid will. |

| Witness Requirement | Two witnesses are required to sign the will, ensuring that the testator's intentions are verified. |

| Revocation | A will can be revoked at any time by the testator, either by creating a new will or by destroying the old one. |

| Self-Proving Wills | Washington allows for self-proving wills, which can streamline the probate process by eliminating the need for witness testimony. |

Dos and Don'ts

When filling out the Washington Last Will and Testament form, it's important to follow certain guidelines to ensure your wishes are clearly stated and legally valid. Here’s a list of things to do and avoid:

- Do clearly identify yourself at the beginning of the document.

- Do include the date when you are signing the will.

- Do name an executor who will carry out your wishes.

- Do be specific about how you want your assets distributed.

- Don't use vague language that could lead to confusion.

- Don't forget to sign the will in the presence of witnesses.

- Don't use a will that was not created according to Washington state laws.

- Don't assume that a verbal agreement will suffice; always put your wishes in writing.

Similar forms

The Washington Living Will is similar to the Last Will and Testament in that both documents express an individual's wishes regarding their life and property. While a Last Will and Testament details how assets should be distributed after death, a Living Will focuses on medical decisions and end-of-life care. Both documents require clear language and the signature of the individual to be legally binding, ensuring that their intentions are respected in both health and financial matters.

The Washington Durable Power of Attorney is another document that shares similarities with a Last Will and Testament. Both documents allow individuals to designate someone to make decisions on their behalf. However, a Durable Power of Attorney is effective during the individual’s lifetime and can cover financial and healthcare decisions, whereas a Last Will and Testament only takes effect after death. Each document serves to protect the individual's interests and ensure that their wishes are carried out.

A Revocable Living Trust is comparable to a Last Will and Testament in its purpose of asset distribution. Both documents are used to manage and transfer property upon death. However, a Revocable Living Trust can avoid probate, allowing for a more private and often quicker transfer of assets. Unlike a Last Will, which becomes public record, a trust remains confidential, offering additional privacy for the individual's estate plan.

The Washington Advance Directive combines elements of both a Living Will and a Durable Power of Attorney for healthcare. Similar to a Last Will and Testament, it allows individuals to express their healthcare preferences and appoint someone to make medical decisions if they become incapacitated. This document ensures that an individual’s healthcare wishes are honored, paralleling the intent of a Last Will to ensure that one's wishes regarding property and dependents are respected after death.

The Washington Declaration of Guardian is another document that is similar to a Last Will and Testament, particularly in its focus on personal care. This document allows individuals to designate a guardian for their minor children or dependents in the event of their death or incapacitation. While a Last Will primarily addresses asset distribution, both documents reflect an individual’s desire to provide for their loved ones and ensure their well-being.

The Washington Beneficiary Designation form is related to a Last Will and Testament in that both documents determine how assets are distributed. Beneficiary designations are often used for specific accounts, such as life insurance or retirement accounts, and take precedence over a Last Will. This means that individuals can directly name beneficiaries, ensuring that certain assets bypass the probate process, similar to how a Last Will directs the distribution of an estate.

The Washington Codicil serves as an amendment to an existing Last Will and Testament. It allows individuals to make changes or updates to their will without drafting an entirely new document. This is similar to a Last Will in that it must be signed and witnessed to be valid. A Codicil is a useful tool for adapting an estate plan as circumstances change, while still maintaining the original intent of the Last Will.

The Washington Affidavit of Heirship is another document that can complement a Last Will and Testament. It is used to establish the rightful heirs of a deceased person when there is no will. While a Last Will clearly outlines the distribution of assets, an Affidavit of Heirship can help clarify the legal heirs and their respective shares, thus assisting in the proper administration of the estate.

The Washington Estate Inventory is similar to a Last Will and Testament in that it provides a detailed account of an individual's assets. This document is often created as part of the probate process to help ensure that all assets are accounted for and distributed according to the wishes expressed in the Last Will. Both documents work together to provide clarity and transparency regarding an individual's estate.

In California, the rental application process is a crucial step for landlords seeking responsible tenants. Utilizing a thorough application form is essential for gathering key details about applicants, including their financial background and rental history, ensuring landlords make informed decisions. For those interested in accessing various necessary documents, including the California Rental Application, resources can be found at All California Forms, which provides guidance and templates tailored to the state's regulations.

Lastly, the Washington Trust Certification is akin to a Last Will and Testament in its function of confirming the existence and terms of a trust. This document can be used to show that a trust is valid and to outline its provisions. While a Last Will distributes assets upon death, a Trust Certification can facilitate the management and distribution of assets during the individual's lifetime and beyond, ensuring that their wishes are upheld.

Check out Popular Last Will and Testament Forms for Different States

Making a Will in California - Is a personal reflection that can bring closure to family members after the individual's death.

The ADP Pay Stub form is a document that employees receive, detailing their earnings and deductions for each pay period. It serves as a crucial tool for understanding compensation, withholding taxes, and other financial information. For those who are looking for a convenient way to access this document, you can visit pdftemplates.info/adp-pay-stub-form for assistance.

Will Legal - Can help ensure that a person's legacy is carried out as intended.

Sample Will Form - A clear outline of how you want your belongings allocated among heirs.