Official Durable Power of Attorney Template for Washington State

When it comes to planning for the future and ensuring that your financial and legal affairs are managed according to your wishes, the Washington Durable Power of Attorney form is an essential tool. This form empowers a trusted individual, known as your agent, to make decisions on your behalf when you are unable to do so yourself. It covers a wide range of responsibilities, from managing bank accounts and real estate transactions to handling healthcare decisions, ensuring that your interests are safeguarded even in challenging times. One of the standout features of this document is its durability; it remains effective even if you become incapacitated, providing peace of mind that your affairs will be handled seamlessly. Additionally, you have the flexibility to specify the powers granted to your agent, tailoring the authority to fit your unique needs. Understanding how to properly execute and utilize this form is crucial, as it not only protects your interests but also helps avoid potential conflicts among family members during difficult situations. As you navigate this important aspect of estate planning, knowing the ins and outs of the Washington Durable Power of Attorney can make a significant difference in securing your future and maintaining control over your life’s decisions.

Misconceptions

Understanding the Washington Durable Power of Attorney (DPOA) form is crucial for anyone considering its use. However, several misconceptions can lead to confusion and misinformed decisions. Below are five common misconceptions about the DPOA in Washington.

- Misconception 1: A Durable Power of Attorney is only for financial matters.

- Misconception 2: The DPOA is only effective when the principal is incapacitated.

- Misconception 3: Once a DPOA is signed, the principal loses all control over their affairs.

- Misconception 4: A DPOA is a one-size-fits-all document.

- Misconception 5: A DPOA does not require witnesses or notarization.

While many people associate the DPOA primarily with financial decisions, it can also grant authority for healthcare decisions. This means that a person can designate someone to make medical choices on their behalf if they become incapacitated.

This is not entirely true. A Durable Power of Attorney becomes effective immediately upon signing, unless stated otherwise in the document. This allows the designated agent to act on behalf of the principal right away, regardless of their mental state.

In reality, the principal retains the right to manage their own affairs as long as they are capable of doing so. The agent's authority only comes into play when the principal is unable to make decisions due to incapacity.

This is misleading. A Durable Power of Attorney can be customized to fit the specific needs of the principal. The document can specify the powers granted to the agent, allowing for a tailored approach to decision-making.

In Washington, a Durable Power of Attorney must be signed in the presence of a notary public or two witnesses to be valid. This requirement helps ensure that the document is executed properly and can stand up to scrutiny if challenged.

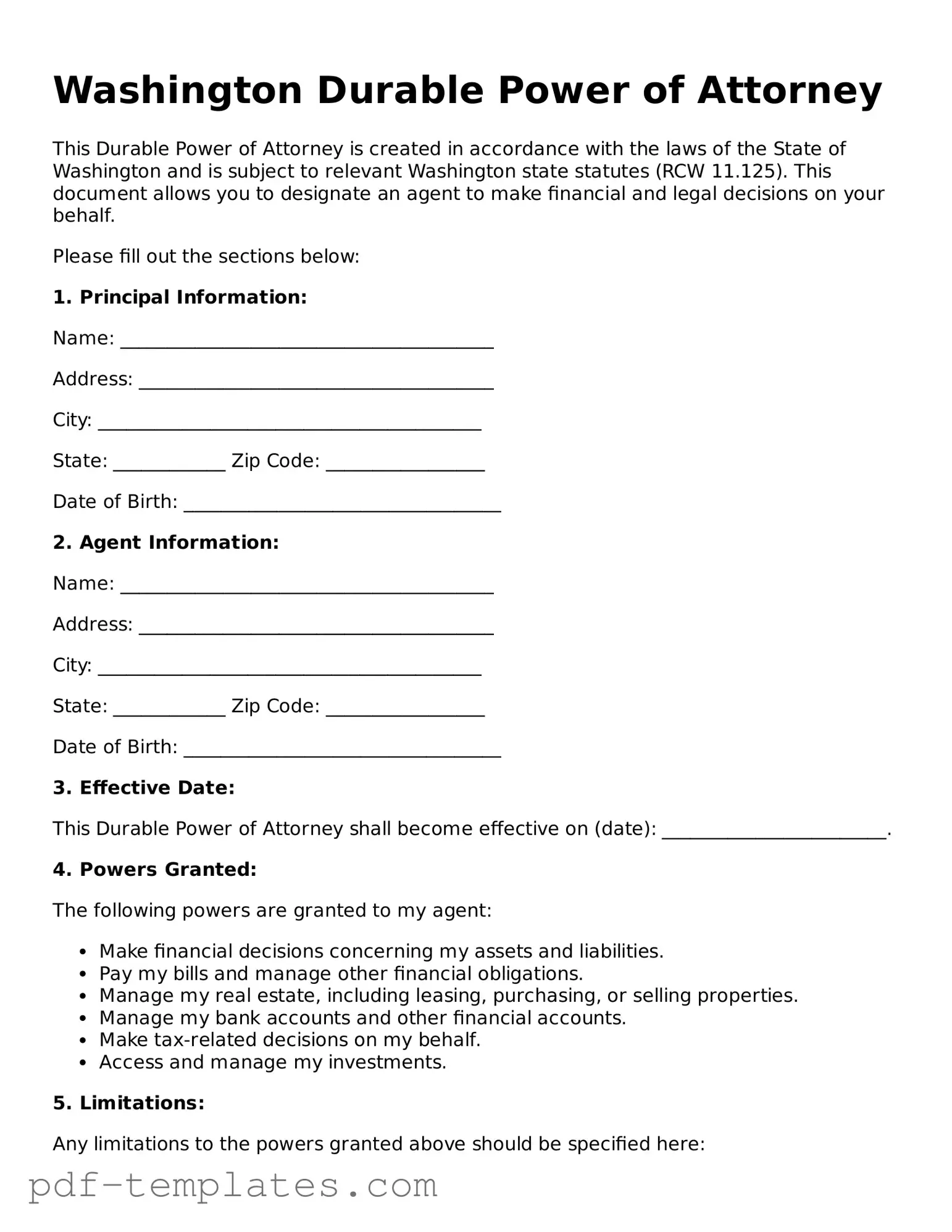

Washington Durable Power of Attorney: Usage Instruction

Completing the Washington Durable Power of Attorney form is an important step in designating someone to make decisions on your behalf. Follow these steps carefully to ensure the form is filled out correctly.

- Obtain the Washington Durable Power of Attorney form. You can find it online or at legal supply stores.

- Read through the entire form before filling it out. Familiarize yourself with the sections and requirements.

- In the first section, enter your name and address. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your attorney-in-fact. This person will act on your behalf.

- Specify the powers you want to grant. You can choose general powers or limit them to specific areas, such as financial or healthcare decisions.

- Include any additional instructions or limitations you wish to impose on the powers granted.

- Sign and date the form in the designated area. Your signature must match your legal name.

- Have the form notarized. This step is essential for the document to be legally valid in Washington.

- Provide copies of the completed and notarized form to your attorney-in-fact and any relevant institutions.

After filling out the form, keep the original in a safe place. Ensure that your attorney-in-fact knows where to find it. Regularly review the document to confirm it still reflects your wishes.

Common mistakes

-

Failing to specify the powers granted. It is crucial to clearly outline what authority the agent will have. Without this, the document may not serve its intended purpose.

-

Not signing the form in front of a notary. Washington law requires that the Durable Power of Attorney be notarized to be valid. Omitting this step can invalidate the document.

-

Neglecting to date the document. A date is important for determining the validity of the powers granted. Without a date, questions about the timing of authority may arise.

-

Choosing an unsuitable agent. Selecting someone who may not act in your best interest can lead to complications. It is essential to choose a trustworthy and capable individual.

-

Forgetting to revoke previous powers of attorney. If there are existing documents, they should be formally revoked to avoid confusion about which document is in effect.

-

Ignoring state-specific requirements. Each state has its own rules regarding Durable Power of Attorney forms. Ensure compliance with Washington's specific regulations to avoid issues.

-

Not discussing the document with the agent. Open communication about the powers granted and your wishes is vital. This helps ensure that the agent understands their responsibilities.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone to make financial decisions on their behalf, even if they become incapacitated. |

| Governing Law | The Washington Durable Power of Attorney is governed by the Revised Code of Washington (RCW) 11.125. |

| Durability | This document remains effective even after the principal is incapacitated, distinguishing it from a standard power of attorney. |

| Principal and Agent | The person granting authority is called the principal, while the individual receiving the authority is known as the agent or attorney-in-fact. |

| Scope of Authority | The principal can specify the powers granted to the agent, which may include managing finances, property, and legal matters. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Witness Requirements | In Washington, the form must be signed in the presence of either a notary public or two witnesses to be valid. |

Dos and Don'ts

When filling out the Washington Durable Power of Attorney form, it's important to know what to do and what to avoid. Here’s a simple list to guide you:

- Do clearly identify the person you are appointing as your agent.

- Do specify the powers you want to grant to your agent.

- Do sign the form in front of a notary public.

- Do keep a copy of the signed document for your records.

- Do discuss your decisions with your agent beforehand.

- Don't leave any sections blank unless instructed.

- Don't use vague language that could lead to confusion.

- Don't forget to date the document when you sign it.

- Don't assume your agent knows your wishes without clear communication.

Similar forms

The Washington Durable Power of Attorney form shares similarities with a General Power of Attorney. Both documents allow an individual, known as the principal, to appoint someone else, referred to as the agent, to make decisions on their behalf. However, a General Power of Attorney typically becomes invalid if the principal becomes incapacitated, while a Durable Power of Attorney remains effective in such situations. This distinction is crucial for individuals seeking to ensure their financial and legal matters are managed even when they are unable to do so themselves.

Another document comparable to the Durable Power of Attorney is the Medical Power of Attorney. This form specifically focuses on healthcare decisions, granting an agent the authority to make medical choices for the principal if they are unable to communicate their wishes. While the Durable Power of Attorney can cover financial and legal matters, the Medical Power of Attorney addresses health-related issues. Both forms empower individuals to select trusted representatives to act in their best interests during times of incapacity.

Understanding the nuances of various legal documents is essential, especially when navigating personal and financial responsibilities. For those dealing with rental agreements, the California Agreement Room form is vital as it outlines the landlord-tenant relationship and ensures all parties are clear on their obligations. To explore additional resources related to such documents, you can refer to All California Forms, which provides comprehensive access to essential forms and information.

A Living Will is another document that shares a purpose with the Durable Power of Attorney, particularly in healthcare matters. A Living Will outlines an individual's preferences regarding medical treatment and end-of-life care. While the Durable Power of Attorney allows an agent to make decisions based on the principal's wishes, the Living Will provides specific instructions that the agent must follow. Together, these documents create a comprehensive plan for both health and financial decisions when an individual cannot advocate for themselves.

The Revocable Trust is also similar in function to the Durable Power of Attorney, as both can help manage assets during a person's lifetime and after their death. A Revocable Trust allows individuals to place their assets into a trust, which can be managed by a trustee. This arrangement can help avoid probate and provide clear instructions on asset distribution. While the Durable Power of Attorney grants authority to an agent to manage affairs, a Revocable Trust provides a structured way to handle assets and ensures that the principal's wishes are honored.

Finally, the Guardianship document is related to the Durable Power of Attorney in that both involve the management of an individual's affairs when they are unable to do so. A Guardianship is a legal arrangement where a court appoints someone to make decisions for a person deemed incapacitated. Unlike the Durable Power of Attorney, which is created voluntarily by the principal, Guardianship requires court intervention. Both documents serve to protect individuals who cannot make decisions for themselves, but they do so through different legal processes.

Check out Popular Durable Power of Attorney Forms for Different States

How to Get Power of Attorney in Ny - This form enables your agent to deal with creditors and pay bills on your behalf.

The Asurion F-017-08 MEN form is a crucial document used for processing specific insurance claims related to electronic devices. This form serves as a formal request for assistance, ensuring that customers receive the support they need for their devices in a timely manner. To learn more about this form, visit pdftemplates.info/asurion-f-017-08-men-form and get started by filling out the form by clicking the button below.

Texas Durable Power of Attorney Free Pdf - This power of attorney can cover a wide range of financial activities.