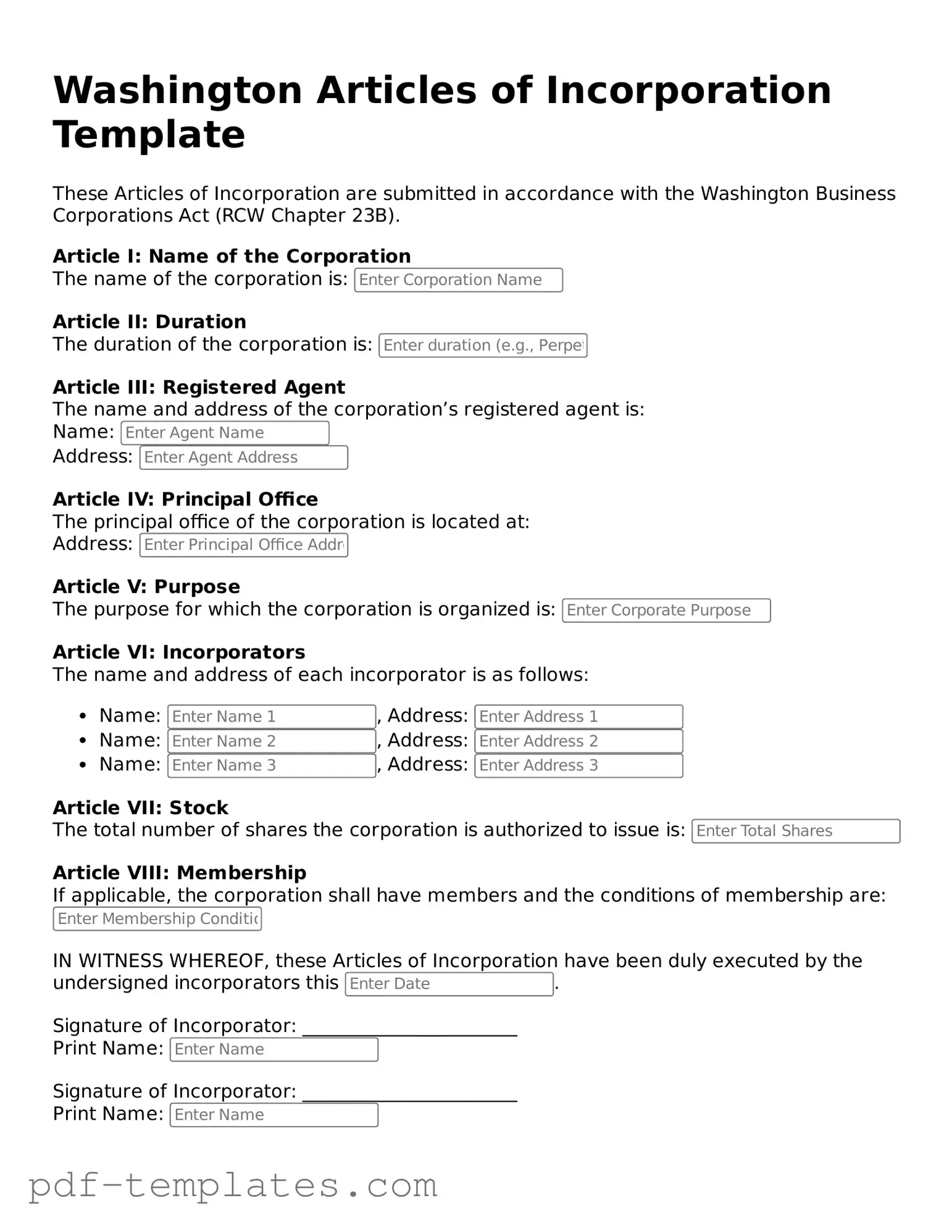

Official Articles of Incorporation Template for Washington State

The Washington Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in the state of Washington. This form serves as the official record of the corporation's creation and outlines essential details about the business. Key components include the corporation's name, which must be unique and compliant with state regulations, and the purpose of the corporation, which describes the nature of its business activities. Additionally, the form requires information about the registered agent, who will receive legal documents on behalf of the corporation, and the address of the corporation's principal office. It also includes provisions for the number of shares the corporation is authorized to issue, which is vital for determining ownership and investment opportunities. Furthermore, the Articles of Incorporation may contain details about the corporation's governance structure, including the names and addresses of the initial directors. Completing this form accurately is essential for ensuring legal compliance and facilitating the smooth operation of the business in Washington.

Misconceptions

When it comes to the Washington Articles of Incorporation form, several misconceptions can lead to confusion. Understanding these common myths is essential for anyone looking to incorporate in Washington state.

- Myth 1: The Articles of Incorporation are optional.

- Myth 2: You can file Articles of Incorporation without a business name.

- Myth 3: The process is the same for all types of businesses.

- Myth 4: You don’t need to include a registered agent.

- Myth 5: Articles of Incorporation are the only document needed to start a business.

- Myth 6: Once filed, Articles of Incorporation cannot be changed.

- Myth 7: You can file Articles of Incorporation at any time.

- Myth 8: Incorporation guarantees personal liability protection.

This is not true. Filing Articles of Incorporation is a necessary step to legally establish a corporation in Washington.

A unique business name is required. The name must not be similar to existing businesses and must comply with state regulations.

Different types of entities, such as nonprofits or for-profits, have distinct requirements. Be sure to choose the correct form for your business type.

A registered agent is mandatory. This person or entity will receive legal documents on behalf of the corporation.

While they are crucial, other documents may be necessary, including bylaws and business licenses, depending on your business structure.

Changes can be made, but they require filing an amendment. It’s essential to keep your information current.

There are deadlines and specific times that may be more advantageous for filing. Planning ahead can save you time and money.

While incorporation provides a level of protection, it does not shield you from all types of liability. Understanding the limits is crucial.

Washington Articles of Incorporation: Usage Instruction

After you have gathered all the necessary information, you can begin filling out the Washington Articles of Incorporation form. This document is essential for officially establishing your business as a corporation in Washington State. Once completed, you will submit it to the Washington Secretary of State's office, along with any required fees. Here’s how to fill out the form step by step:

- Choose Your Business Name: Start by selecting a unique name for your corporation. Ensure it meets state requirements and is not already in use.

- Provide the Duration: Indicate how long you expect your corporation to exist. Most corporations are set up to exist indefinitely.

- List Your Registered Agent: Enter the name and address of your registered agent. This person or entity will receive legal documents on behalf of your corporation.

- State the Purpose: Describe the primary purpose of your corporation. This can be broad, but it should reflect your business activities.

- Include Incorporator Information: Fill in the name and address of the incorporator. This is the person responsible for submitting the Articles of Incorporation.

- Provide Initial Directors: List the names and addresses of the initial directors of the corporation. Typically, you need at least one director.

- Sign and Date the Form: The incorporator must sign and date the form to validate it.

- Review for Accuracy: Double-check all entries for accuracy and completeness before submission.

- Submit the Form: Send the completed form to the Washington Secretary of State, along with the required filing fee.

Once you have submitted the form, you will receive confirmation of your corporation's formation. Keep this confirmation for your records, as it is an important document for your business operations.

Common mistakes

-

Incorrect Business Name: Many individuals fail to ensure that the name they choose for their corporation is unique and not already in use. Before submitting the form, it is essential to check the Washington Secretary of State's database to confirm availability.

-

Missing Registered Agent Information: A registered agent is crucial for receiving legal documents. Some applicants neglect to provide complete information about their registered agent, including the agent's address and consent to serve in this role.

-

Improper Purpose Statement: The purpose statement must clearly outline the business activities. Vague or overly broad descriptions can lead to confusion and may result in rejection of the application.

-

Incorrect Number of Shares: When specifying the number of shares, applicants sometimes make errors in calculations or fail to indicate the par value. This can affect the corporation's structure and financial obligations.

-

Omitting Incorporator Signatures: The form requires signatures from the incorporators. Some individuals forget to sign or fail to provide the names and addresses of all incorporators, which can delay the incorporation process.

PDF Features

| Fact Name | Details |

|---|---|

| Purpose | The Washington Articles of Incorporation form is used to officially create a corporation in the state of Washington. |

| Governing Law | This form is governed by the Washington Business Corporation Act, specifically Title 23B of the Revised Code of Washington (RCW). |

| Filing Requirement | To establish a corporation, the Articles of Incorporation must be filed with the Washington Secretary of State. |

| Information Needed | Key details required include the corporation's name, duration, registered agent, and the number of shares authorized. |

| Fee Structure | A filing fee is required, which varies based on the type of corporation and the method of submission (online or paper). |

| Amendments | Once filed, amendments to the Articles of Incorporation can be made by submitting a formal amendment form to the Secretary of State. |

Dos and Don'ts

When filling out the Washington Articles of Incorporation form, it's important to follow certain guidelines to ensure a smooth process. Here are five things you should and shouldn't do:

- Do provide accurate information about your business name and address.

- Do include the names and addresses of all initial directors.

- Do clearly state the purpose of your corporation.

- Don't leave any required fields blank; all sections must be completed.

- Don't forget to sign and date the form before submission.

Similar forms

The Articles of Incorporation is similar to the Certificate of Formation in several states. Both documents serve to officially create a corporation. The Certificate of Formation outlines basic information about the business, such as its name, purpose, and registered agent. This document is often required to be filed with the state’s Secretary of State, just like the Articles of Incorporation. Both documents establish the legal existence of a corporation and provide essential details that inform the public about the company’s structure.

The Bylaws of a corporation are also closely related to the Articles of Incorporation. While the Articles provide foundational information about the corporation, the Bylaws detail the internal rules and procedures for managing the company. They outline how meetings are conducted, how officers are elected, and how decisions are made. Together, these documents ensure that the corporation operates smoothly and in accordance with its stated purpose.

A Certificate of Good Standing can be compared to the Articles of Incorporation as well. This certificate verifies that a corporation is properly registered and compliant with state regulations. While the Articles of Incorporation are the initial filing that establishes a corporation, the Certificate of Good Standing is often required for business transactions, such as opening bank accounts or applying for loans. It confirms that the corporation is active and in good standing with the state.

The Operating Agreement is another document that shares similarities with the Articles of Incorporation, particularly for Limited Liability Companies (LLCs). While the Articles of Incorporation establish the LLC’s existence, the Operating Agreement outlines how the LLC will be managed and how profits and losses will be distributed. This agreement is crucial for clarifying the roles of members and ensuring that the LLC operates according to its members' wishes.

The Partnership Agreement is akin to the Articles of Incorporation in that it formalizes the structure of a business partnership. This document outlines the roles, responsibilities, and profit-sharing arrangements among partners. Like the Articles, the Partnership Agreement is essential for legal recognition and helps prevent disputes by clearly defining each partner’s contributions and obligations.

Similarly, the Business License is a document that, while different in purpose, is essential for legal operation. The Articles of Incorporation establish a corporation, while a Business License permits that corporation to operate legally within a specific jurisdiction. Both documents are necessary for compliance with local laws and regulations, ensuring that businesses are recognized by the state and local authorities.

The Shareholder Agreement is another document that complements the Articles of Incorporation. It outlines the rights and responsibilities of shareholders within a corporation. This agreement can address issues such as share transfers, voting rights, and dispute resolution. While the Articles of Incorporation provide the framework for the corporation, the Shareholder Agreement offers more detailed governance regarding the relationships among shareholders.

Finally, the Annual Report is similar to the Articles of Incorporation in that it is a required document for maintaining a corporation’s status. The Articles of Incorporation establish the corporation, while the Annual Report provides updates on its activities, financial status, and any changes in management. Filing the Annual Report keeps the corporation in good standing with the state and ensures that public records are accurate and up to date.

Check out Popular Articles of Incorporation Forms for Different States

Scc Documents - Ensure your corporate name complies with state guidelines.

Pa Corporation - Includes the corporation's name and purpose of formation.

How Much Is an Llc in Texas - Filing allows for the creation of a business entity separate from its owners.

Form California Llc - Identifies the incorporators who are filing the document.