Official Transfer-on-Death Deed Template for Virginia State

The Virginia Transfer-on-Death Deed form serves as a valuable estate planning tool, allowing property owners to transfer real estate to designated beneficiaries upon their death without the need for probate. This deed facilitates a straightforward and efficient transfer process, ensuring that the property passes directly to the chosen individuals, thus avoiding potential delays and expenses associated with traditional probate proceedings. The form requires specific information, including the names of the current property owners and the intended beneficiaries, as well as a legal description of the property being transferred. Additionally, it must be signed by the property owner and witnessed to ensure its validity. By utilizing this deed, individuals can maintain control over their property during their lifetime while providing a clear directive for its transfer after their passing. This approach not only simplifies the transfer process but also helps to minimize disputes among heirs, making it an appealing option for many Virginia residents looking to streamline their estate planning efforts.

Misconceptions

Understanding the Virginia Transfer-on-Death Deed form can help individuals make informed decisions about estate planning. However, several misconceptions can lead to confusion. Below is a list of common misconceptions regarding this legal document.

- It automatically transfers property upon signing. The deed does not transfer property until the owner passes away. Until that time, the property remains in the owner's name.

- It eliminates the need for a will. While a Transfer-on-Death Deed can be a useful tool, it does not replace the need for a will. A will addresses other aspects of estate planning that the deed does not cover.

- Only real estate can be transferred. The Transfer-on-Death Deed specifically applies to real property, not personal property or other assets.

- It is only for wealthy individuals. This form can benefit anyone who wishes to simplify the transfer of real estate, regardless of their financial status.

- It is irrevocable once filed. The deed can be revoked or changed at any time before the owner's death, as long as the owner follows the proper legal procedures.

- All heirs must agree to the deed. The owner can designate a beneficiary without needing consent from other heirs, although this may lead to family disputes later.

- It avoids probate completely. While the property transfers outside of probate, other aspects of the estate may still require probate proceedings.

- There are no tax implications. Beneficiaries may still face tax obligations upon inheriting the property, depending on local laws and the property's value.

- It is a complicated legal document. The form is straightforward and designed for ease of use, making it accessible for most individuals.

- It can be used for multiple properties in one deed. Each property must have its own Transfer-on-Death Deed; multiple properties cannot be combined into a single deed.

Being aware of these misconceptions can help individuals navigate their estate planning options more effectively.

Virginia Transfer-on-Death Deed: Usage Instruction

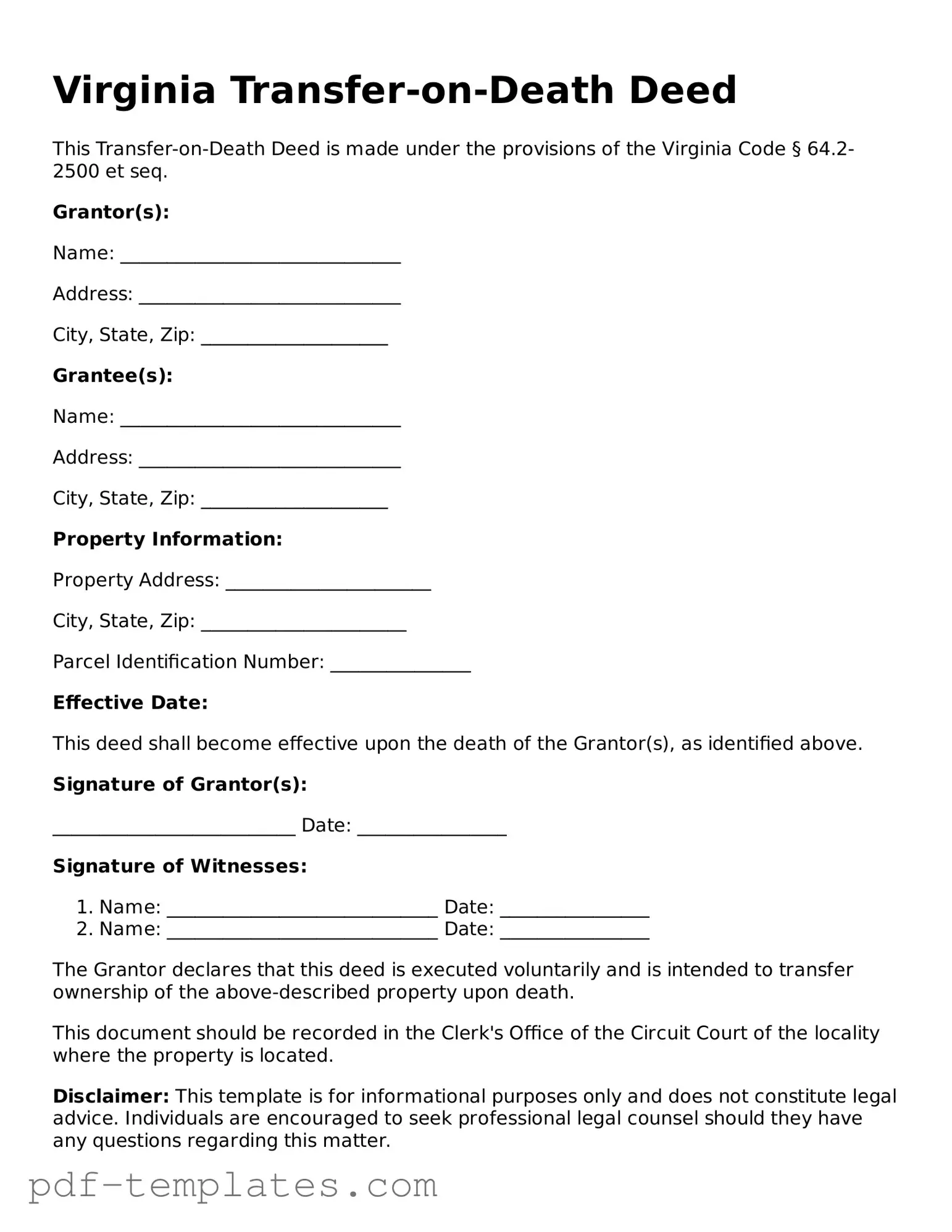

Completing the Virginia Transfer-on-Death Deed form is an important step in ensuring that your property is transferred according to your wishes after your passing. This process requires careful attention to detail, as accurate information is crucial for the deed to be valid. Below are the steps to fill out the form correctly.

- Begin by downloading the Virginia Transfer-on-Death Deed form from the appropriate state website or obtaining a physical copy.

- At the top of the form, fill in the name of the property owner(s). This should include the full legal names as they appear on the property title.

- Next, provide the address of the property being transferred. Ensure that the address is complete and accurate to avoid any confusion.

- In the designated section, list the name(s) of the beneficiary or beneficiaries who will receive the property. Again, use full legal names.

- Include the relationship of the beneficiary to the property owner, if applicable. This helps clarify the intent of the transfer.

- Sign and date the form in the appropriate spaces. The signature must be that of the property owner(s) who are transferring the property.

- Have the deed notarized. A notary public must witness the signing of the deed to make it legally binding.

- Finally, file the completed and notarized deed with the local land records office in the county where the property is located. This step is essential for the deed to take effect.

Common mistakes

-

Not understanding the purpose: Many people fill out the Transfer-on-Death Deed form without fully grasping what it does. This deed allows property to pass directly to beneficiaries upon the owner’s death, avoiding probate. It’s crucial to know this before proceeding.

-

Incorrect property description: A common mistake is failing to accurately describe the property. The deed must include a clear and precise description to avoid confusion later. Ambiguities can lead to legal disputes.

-

Not naming beneficiaries: Some individuals forget to list the beneficiaries entirely. Without named beneficiaries, the property may not transfer as intended, potentially leading to complications.

-

Omitting signatures: The deed requires signatures from the property owner. If this step is overlooked, the document is not valid. All necessary parties must sign for the deed to take effect.

-

Failing to notarize: In Virginia, the deed must be notarized to be legally binding. Neglecting this step can invalidate the deed, making it ineffective in transferring property.

-

Not recording the deed: After filling out the form, it must be recorded with the local land records office. If this is not done, the deed has no legal effect, and the property may still go through probate.

-

Using outdated forms: Laws and forms can change. Using an outdated version of the Transfer-on-Death Deed form may lead to issues. Always ensure you have the most current form available.

-

Not reviewing the deed: Failing to double-check the completed deed can lead to errors. It’s wise to review all information for accuracy before submission to prevent future complications.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed (TODD) allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Virginia Transfer-on-Death Deed is governed by Virginia Code § 64.2-621 through § 64.2-627. |

| Eligibility | Any individual who owns real property in Virginia can create a TODD for their property. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries on the deed, who will receive the property upon the owner's death. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, as long as the owner is alive and competent. |

| Filing Requirements | The deed must be recorded in the local land records office where the property is located to be effective. |

| No Immediate Transfer | Ownership of the property does not transfer to the beneficiary until the property owner's death. |

| Tax Implications | Property transferred via a TODD may be subject to estate taxes, depending on the total value of the estate. |

| Limitations | Transfer-on-Death Deeds cannot be used for all types of property; they are limited to real estate. |

| Legal Advice | Consulting with an attorney is recommended to ensure the deed is properly executed and to understand the implications. |

Dos and Don'ts

When filling out the Virginia Transfer-on-Death Deed form, it is crucial to follow certain guidelines to ensure the process is smooth and legally sound. Below is a list of things you should and shouldn't do.

- Do ensure that you are eligible to use the Transfer-on-Death Deed.

- Do clearly identify the property being transferred.

- Do provide accurate information about the beneficiaries.

- Do sign the deed in the presence of a notary public.

- Do record the deed with the appropriate local government office.

- Don't leave any sections of the form incomplete.

- Don't use vague language when describing the property.

- Don't forget to inform beneficiaries about the deed.

- Don't assume that verbal agreements are sufficient.

By adhering to these guidelines, you can help ensure that your intentions regarding property transfer are clearly understood and legally enforceable.

Similar forms

The Virginia Transfer-on-Death Deed (TOD) is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries without going through probate. This deed is similar to a Living Trust, which also facilitates the transfer of assets upon the owner’s death. A Living Trust holds property during the owner’s lifetime and designates beneficiaries to receive the property after death. Both documents aim to simplify the transfer process and avoid the lengthy probate procedure, but a Living Trust can encompass various types of assets beyond real estate.

Another document akin to the TOD is the Will. A Will outlines how a person wishes their assets to be distributed after death. While both documents serve the purpose of transferring property, a Will typically requires probate, which can be time-consuming and costly. In contrast, the TOD deed allows for a more streamlined transfer of property directly to the beneficiary, bypassing the probate process altogether.

The Durable Power of Attorney (DPOA) also shares similarities with the TOD deed. While a TOD deed specifies how property is transferred after death, a DPOA allows an individual to designate someone to manage their financial affairs while they are still alive but incapacitated. Both documents are essential for estate planning, ensuring that a person’s wishes are respected, whether they are alive or deceased.

A Joint Tenancy Agreement is another document that resembles the TOD deed. In a Joint Tenancy, two or more individuals hold title to a property together, and upon the death of one tenant, the property automatically transfers to the surviving tenant(s). Like the TOD deed, this arrangement avoids probate and facilitates a smooth transition of ownership. However, unlike the TOD deed, joint tenancy involves shared ownership during the owner’s lifetime.

The Life Estate Deed is similar in that it allows an individual to retain certain rights to a property while designating a beneficiary to receive the property upon their death. This arrangement provides the original owner with the ability to live in or use the property during their lifetime, while ensuring a clear transfer of ownership afterward. Both the Life Estate Deed and the TOD deed help avoid probate, but they differ in the rights retained by the original owner.

A Transfer-on-Death Registration (TODR) for securities is another comparable document. This registration allows individuals to name beneficiaries for their financial accounts, such as stocks or bonds. Similar to the TOD deed, the TODR facilitates the direct transfer of assets upon death without going through probate. Both documents reflect a growing trend toward simplifying the transfer of assets and providing clarity to beneficiaries.

The Beneficiary Designation form used for retirement accounts and insurance policies is another document that aligns with the TOD deed. This form allows individuals to name beneficiaries who will receive the proceeds of their accounts upon death. Like the TOD deed, this process bypasses probate, ensuring that beneficiaries receive their inheritance quickly and efficiently. Both documents emphasize the importance of clearly designating who will inherit assets.

The Quitclaim Deed can also be considered similar to the TOD deed. A Quitclaim Deed is used to transfer ownership of property without guaranteeing that the title is clear. While it is often used to transfer property between family members or in divorce situations, it does not provide the same automatic transfer upon death that the TOD deed offers. However, both documents facilitate property transfers, albeit in different contexts.

The Trader Joe's application form is a vital document for job seekers wishing to join this beloved grocery chain. It outlines necessary information about potential employees and provides an opportunity to showcase their unique skills and experience. Completing the form accurately can significantly increase the chances of landing a position at one of their stores. For more details, refer to the application here: https://documentonline.org/blank-trader-joe-s-application/.

Lastly, the Assignment of Interest document shares some characteristics with the TOD deed. This document allows an individual to assign their rights or interests in a property to another party. While an Assignment of Interest can be executed during a person’s lifetime, the TOD deed specifically designates a beneficiary to receive property upon the owner’s death. Both documents can simplify the transfer process, but they serve different purposes in estate planning.

Check out Popular Transfer-on-Death Deed Forms for Different States

Free Printable Transfer on Death Deed Form Florida - This deed enables the transfer of real estate without going through probate, simplifying the process for heirs.

In order to ensure all legal bases are covered when preparing for potential incapacity, individuals in California may want to consider filling out the California General Power of Attorney form. This essential document empowers a trusted agent to handle financial decision-making in cases where the principal cannot do so. For a comprehensive guide and access to necessary documentation, you can visit All California Forms, which offers a variety of relevant resources tailored for your needs.

Transfer on Death Deed Texas Form Free - A Transfer-on-Death Deed can be revoked or amended at any time before the owner's death.