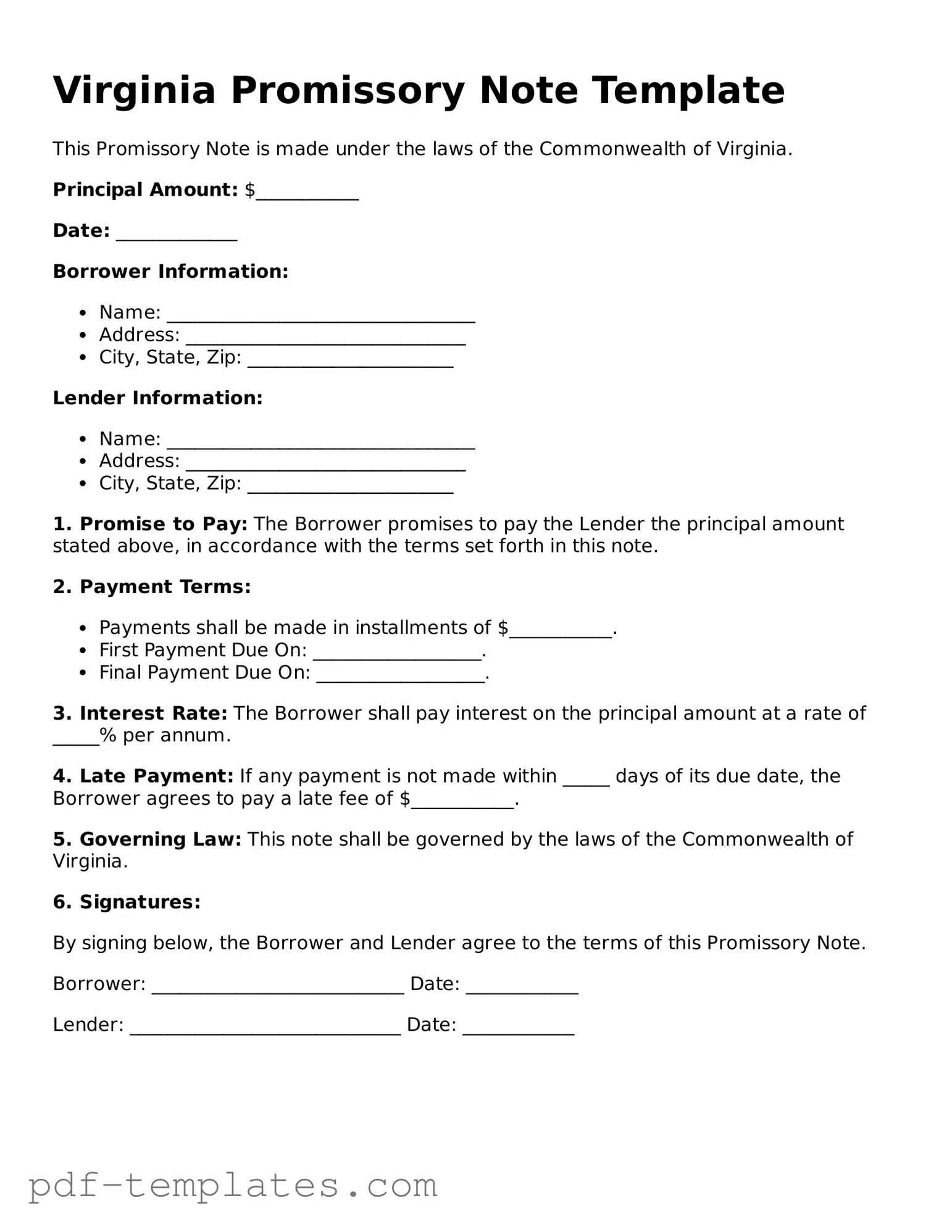

Official Promissory Note Template for Virginia State

When engaging in a loan agreement, a Virginia Promissory Note serves as a vital document that outlines the terms of the loan between the borrower and the lender. This form typically includes essential details such as the principal amount, interest rate, repayment schedule, and any applicable late fees. It's important to note that the borrower promises to repay the borrowed amount, making the note a legally binding commitment. In addition to these financial specifics, the document may also address what happens in the event of default, including any rights the lender has to pursue collection. Understanding the nuances of this form can help both parties navigate their responsibilities and protect their interests throughout the loan period. By clearly defining the terms and conditions, the Virginia Promissory Note fosters transparency and trust, ensuring that both the borrower and lender have a shared understanding of their agreement.

Misconceptions

Understanding the Virginia Promissory Note form is essential for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are nine common misconceptions:

- All promissory notes are the same. Many believe that promissory notes are uniform across states. In reality, each state has its own regulations and requirements that can significantly affect the terms and enforceability of the note.

- Only banks can issue promissory notes. This is not true. Individuals and businesses can also create promissory notes. As long as the note meets legal requirements, it can be used by anyone.

- A verbal agreement is sufficient. Some think that a verbal promise to pay is enough. However, having a written promissory note is crucial for legal protection and clarity regarding the terms of the loan.

- Promissory notes do not need to be notarized. While notarization is not always required, it can enhance the document's credibility and make it easier to enforce in court.

- Interest rates are not regulated. Many assume that lenders can charge any interest rate they wish. However, Virginia law does impose limits on interest rates to protect borrowers.

- All promissory notes are enforceable. Not all notes are automatically enforceable. Factors such as missing signatures or unclear terms can render a note invalid.

- Once signed, a promissory note cannot be changed. While it is true that changes can complicate matters, promissory notes can be amended if both parties agree to the modifications in writing.

- Only the lender can initiate legal action. Borrowers also have the right to take legal action if the lender fails to comply with the terms of the note.

- Promissory notes are only for large loans. Many think that promissory notes are only necessary for significant amounts of money. In fact, they can be used for any loan amount, regardless of size.

By addressing these misconceptions, both lenders and borrowers can better navigate the complexities of the Virginia Promissory Note form.

Virginia Promissory Note: Usage Instruction

After obtaining the Virginia Promissory Note form, you will need to complete it accurately to ensure it reflects the agreement between the parties involved. Carefully follow the steps outlined below to fill out the form correctly.

- Begin by entering the date at the top of the form. Use the format Month, Day, Year.

- Identify the borrower. Write the full legal name and address of the individual or entity borrowing the money.

- Next, specify the lender. Include the full legal name and address of the individual or entity lending the money.

- Clearly state the principal amount. This is the total sum of money being borrowed, written in both numerical and written form.

- Outline the interest rate. Indicate the annual interest rate applicable to the loan, if any.

- Describe the repayment terms. Specify when payments are due, how often they will be made, and the duration of the loan.

- Include any late fees or penalties. If applicable, state the fees that will be charged for late payments.

- Sign and date the form. Both the borrower and lender must sign and date the document to make it legally binding.

Once you have completed the form, ensure that both parties retain a copy for their records. This document serves as a formal agreement and should be kept in a safe place.

Common mistakes

-

Incorrect Names: One common mistake is failing to use the full legal names of both the borrower and the lender. Nicknames or abbreviations can lead to confusion.

-

Missing Dates: Not including the date when the note is signed can create issues. Always ensure you have the correct date to avoid future disputes.

-

Ambiguous Terms: Using vague language when describing the loan terms can lead to misunderstandings. Be clear about the amount borrowed, interest rates, and repayment schedule.

-

Omitting Signatures: Forgetting to sign the document is a frequent oversight. Both parties must sign the note for it to be legally binding.

-

Ignoring Witnesses or Notarization: Some may overlook the need for witnesses or notarization, depending on the amount of the loan. Check local requirements to ensure compliance.

-

Incorrect Interest Rate: Entering an incorrect interest rate can lead to legal issues. Double-check that the rate is accurate and complies with state laws.

-

Failure to Specify Payment Method: Not indicating how payments should be made (e.g., check, electronic transfer) can create confusion later on.

-

Not Including a Default Clause: Omitting a clause that explains what happens if the borrower defaults can leave both parties unprotected.

-

Neglecting to Review the Entire Document: Skimming through the document without careful review can lead to missed errors. Take the time to read everything thoroughly.

-

Failing to Keep Copies: Not keeping copies of the signed promissory note can be a mistake. Both parties should retain a copy for their records.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time. |

| Governing Law | The Virginia Promissory Note is governed by the Virginia Uniform Commercial Code (UCC), specifically Article 3. |

| Parties Involved | Typically, there are two main parties: the maker (borrower) and the payee (lender). |

| Key Components | A valid promissory note includes the principal amount, interest rate, payment terms, and signatures of the parties involved. |

| Types of Notes | Promissory notes can be secured or unsecured, depending on whether collateral backs the loan. |

| Enforceability | For a promissory note to be enforceable, it must be in writing and signed by the maker. |

| Default Consequences | If the maker defaults on the note, the payee may pursue legal action to recover the owed amount. |

Dos and Don'ts

When filling out the Virginia Promissory Note form, it is important to follow specific guidelines to ensure the document is valid and enforceable. Below are some key dos and don'ts to keep in mind.

- Do provide accurate and complete information about the borrower and lender.

- Do clearly state the loan amount and the interest rate, if applicable.

- Do specify the repayment terms, including the due date and payment schedule.

- Do sign and date the document in the presence of a witness or notary, if required.

- Don't leave any sections of the form blank; this can lead to ambiguity.

- Don't use vague language; clarity is crucial in legal documents.

- Don't forget to keep a copy of the signed note for your records.

- Don't ignore state-specific requirements that may affect the note's validity.

Similar forms

The Virginia Promissory Note form is similar to a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rates, and repayment schedules. However, a Loan Agreement may also include additional clauses regarding collateral, default conditions, and other obligations of the borrower, making it more comprehensive than a simple promissory note.

A Mortgage Note shares similarities with the Virginia Promissory Note, as it serves as a written promise to repay borrowed money. The key difference lies in the fact that a Mortgage Note is secured by real property. This means that if the borrower defaults, the lender has the right to foreclose on the property, whereas a standard promissory note is typically unsecured.

An IOU is another document that resembles a promissory note. Both serve as informal acknowledgments of a debt. However, an IOU is generally less formal and may lack specific terms regarding repayment, such as interest rates or due dates, making it less enforceable in a legal context.

The California Medical Power of Attorney form is a vital legal document that allows individuals to designate someone they trust to make healthcare decisions on their behalf when they are unable to do so. This form is essential for ensuring that a person's healthcare preferences are honored, even if they are unable to communicate their wishes directly. By establishing this power of attorney, individuals gain peace of mind knowing their health care choices are made by someone they trust. For those looking to learn more, All California Forms provide comprehensive insights and resources.

A Secured Promissory Note is closely related to the Virginia Promissory Note but includes a security interest in specific collateral. This means that if the borrower fails to repay, the lender can claim the collateral to recover the debt. The added layer of security differentiates it from a standard promissory note, which does not involve collateral.

A Demand Note is similar in that it represents a promise to pay a specific amount. However, the key distinction is that a Demand Note requires repayment upon the lender's request, rather than on a set schedule. This flexibility can be beneficial for lenders who may need immediate repayment.

A Commercial Promissory Note is tailored for business transactions and shares many features with the Virginia Promissory Note. It outlines the terms of a loan for business purposes, including repayment terms and interest rates. The main difference is that it is specifically designed for commercial use, which may involve larger sums and different regulatory considerations.

A Student Loan Note is similar in its function as a promise to repay borrowed funds for educational purposes. Like the Virginia Promissory Note, it specifies the amount borrowed and repayment terms. However, student loans often come with unique features, such as deferment options and income-driven repayment plans, which are not typically found in standard promissory notes.

A Personal Loan Agreement is akin to a promissory note, as it details the terms of a personal loan between individuals. It includes the amount borrowed, interest rate, and repayment schedule. However, a Personal Loan Agreement may also encompass additional terms, such as late fees and the consequences of default, providing a more detailed framework for the loan.

Finally, a Balloon Note is similar to a promissory note but includes a large final payment, or "balloon," due at the end of the loan term. While it outlines the regular payment schedule like a standard promissory note, the balloon payment structure can create a significant financial obligation at maturity, distinguishing it from other types of notes.

Check out Popular Promissory Note Forms for Different States

New York Promissory Note - A Promissory Note can be used for personal loans, business loans, or informal transactions between friends.

Promissory Note Florida - A promissory note should clearly state how and when payments will be made.

The Trader Joe's application form is a vital document for job seekers wishing to join this beloved grocery chain. It outlines necessary information about potential employees and provides an opportunity to showcase their unique skills and experience. For those interested, you can find the application at documentonline.org/blank-trader-joe-s-application/. Completing the form accurately can significantly increase the chances of landing a position at one of their stores.

Promissory Note Washington State - The note should specify whether it is interest-bearing or interest-free.

Simple Promissory Note Template California - The inclusion of specific terms in a promissory note can help avoid disputes regarding repayment.