Official Operating Agreement Template for Virginia State

When starting a business in Virginia, particularly a Limited Liability Company (LLC), an Operating Agreement is a crucial document to have. This form outlines the management structure and operational guidelines for the LLC, ensuring that all members are on the same page. It addresses key aspects such as the distribution of profits and losses, the roles and responsibilities of each member, and the procedures for making important decisions. Additionally, the Operating Agreement can specify how new members can join the LLC and how existing members can exit. Having this agreement in place helps prevent misunderstandings and provides a clear framework for how the business will function. Furthermore, while Virginia does not legally require an Operating Agreement, having one can significantly enhance the credibility and professionalism of your LLC. It serves as a vital reference point for members, guiding them through various scenarios that may arise during the life of the business.

Misconceptions

Understanding the Virginia Operating Agreement form is essential for those forming a limited liability company (LLC) in Virginia. However, several misconceptions often arise regarding this important document. Below are nine common misconceptions, along with clarifications to help dispel any confusion.

- It is not necessary to have an Operating Agreement. Many believe that an Operating Agreement is optional. However, having one is highly recommended, as it outlines the management structure and operating procedures of the LLC, helping to prevent disputes among members.

- The Operating Agreement must be filed with the state. Some individuals think they need to submit the Operating Agreement to the Virginia Secretary of State. In reality, this document is kept internally and does not need to be filed.

- All members must sign the Operating Agreement. While it is best practice for all members to sign, it is not a legal requirement. The agreement can still be valid if it is adopted by a majority of members.

- The Operating Agreement can only be amended with unanimous consent. This is a common belief, but amendments can often be made with a majority vote, unless the agreement specifies otherwise.

- It is a one-size-fits-all document. Many assume that a standard template will suffice for every LLC. Each business has unique needs, and the Operating Agreement should be tailored to reflect those specific circumstances.

- The Operating Agreement only covers financial matters. While financial provisions are important, the agreement also addresses management roles, decision-making processes, and procedures for adding or removing members.

- Once created, the Operating Agreement is set in stone. This misconception overlooks the fact that the Operating Agreement can be revised as the business evolves. Regular reviews and updates are advisable to ensure it remains relevant.

- All LLCs in Virginia must use the same format for their Operating Agreements. This is not true. LLCs can adopt various formats and structures for their Operating Agreements, as long as they comply with state laws.

- Legal assistance is unnecessary when drafting an Operating Agreement. While some may feel confident drafting their own agreement, consulting with a legal professional can provide valuable insights and ensure compliance with Virginia laws.

By clarifying these misconceptions, individuals can better understand the importance of the Virginia Operating Agreement and its role in the successful operation of an LLC.

Virginia Operating Agreement: Usage Instruction

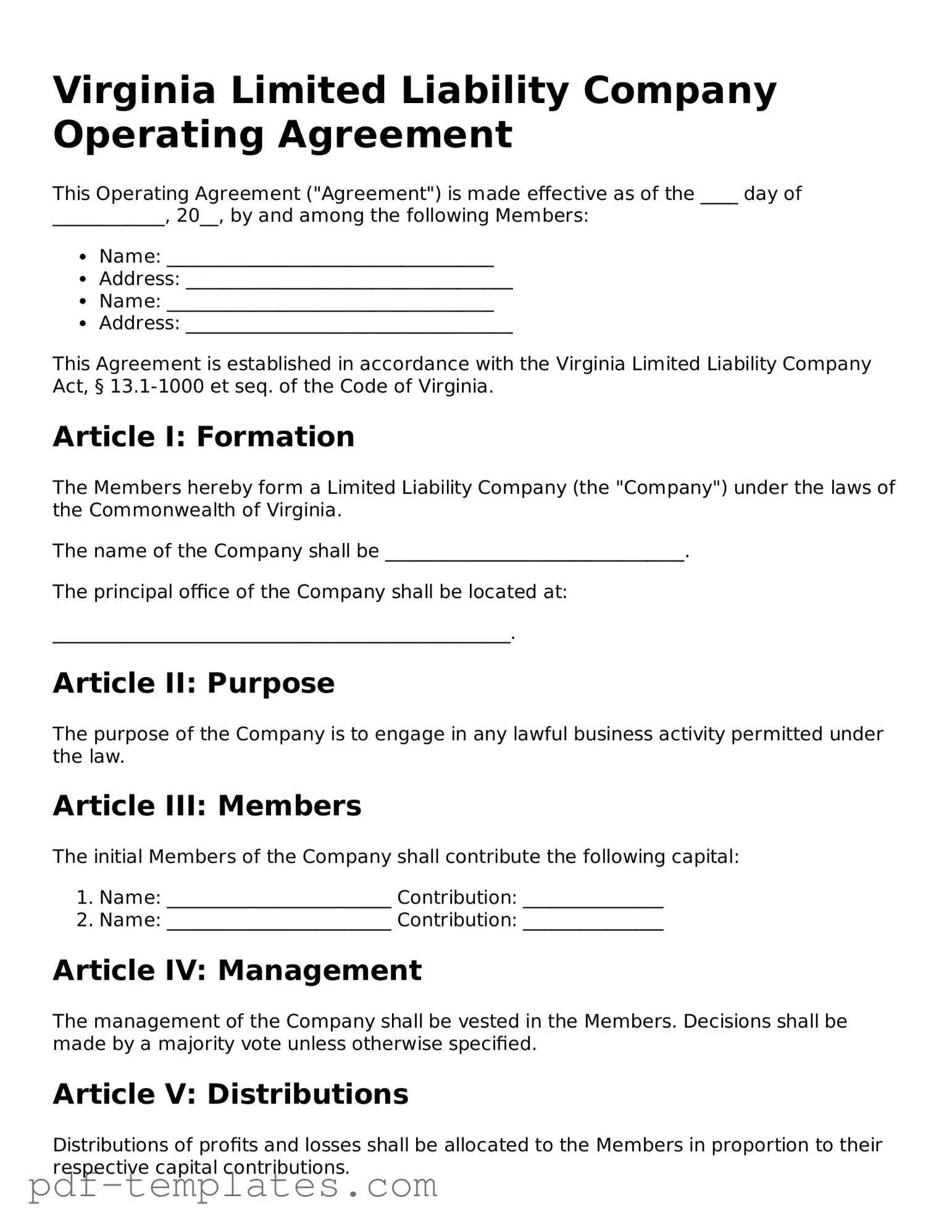

After completing the Virginia Operating Agreement form, you will be ready to finalize your business structure and ensure that all members are on the same page regarding the operation of the business. This document will outline the management structure, member responsibilities, and other essential elements of your business. Follow these steps to fill out the form accurately.

- Begin with the title of the document. Clearly label it as "Operating Agreement" at the top of the form.

- Enter the name of your business. This should match the name registered with the state of Virginia.

- Provide the principal office address. Include the street address, city, state, and zip code.

- List the names and addresses of all members involved in the business. Include each member's full name and residential address.

- Detail the purpose of the business. Describe the primary activities and objectives of your company.

- Outline the management structure. Specify whether the business will be member-managed or manager-managed and provide details as necessary.

- Define the ownership percentages for each member. Clearly state how ownership is divided among the members.

- Include provisions for profit and loss distribution. Explain how profits and losses will be allocated among members.

- Address the process for adding new members. Outline the steps and requirements for bringing in additional members.

- Specify the procedures for member withdrawal or termination. Include any necessary notice periods and conditions for leaving the business.

- Sign and date the document. Ensure that all members sign the agreement to indicate their consent and understanding.

Common mistakes

-

Neglecting to Include All Members: One common mistake is failing to list all members of the LLC. Every member's name and address should be clearly documented to avoid future disputes.

-

Inaccurate Ownership Percentages: When specifying ownership percentages, individuals sometimes miscalculate or misrepresent their shares. Ensure that the total ownership adds up to 100% to maintain clarity.

-

Omitting Management Structure: Some people forget to outline how the LLC will be managed. It's essential to specify whether it will be member-managed or manager-managed to set clear expectations.

-

Failing to Define Roles and Responsibilities: Without clearly defined roles, confusion can arise. Each member's duties should be explicitly stated to prevent overlaps and misunderstandings.

-

Not Including Voting Procedures: Voting rights and procedures are often overlooked. Establishing how decisions will be made and the voting process is crucial for effective governance.

-

Ignoring Profit Distribution Methods: Members sometimes skip detailing how profits and losses will be distributed. Clearly outline the method to ensure everyone understands how financial matters will be handled.

-

Neglecting to Address Dispute Resolution: Disputes may arise, and it's vital to have a plan in place. Including a dispute resolution process can save time and money in the event of a disagreement.

-

Not Updating the Agreement: After the agreement is completed, many individuals forget to revisit it. Regularly updating the Operating Agreement to reflect changes in membership or management is essential for ongoing compliance.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The Virginia Operating Agreement outlines the management structure and operational guidelines for a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Virginia Limited Liability Company Act, specifically Title 13.1, Chapter 12 of the Code of Virginia. |

| Members' Rights | The agreement defines the rights and responsibilities of the members, including profit distribution and decision-making processes. |

| Flexibility | Virginia law allows LLCs to customize their Operating Agreement, providing flexibility in management and operational procedures. |

| Required for LLCs | While not mandatory, having an Operating Agreement is highly recommended for LLCs in Virginia to prevent disputes and clarify operations. |

| Amendments | The Operating Agreement can be amended as needed, but changes must be agreed upon by the members according to the terms set forth in the agreement. |

Dos and Don'ts

When filling out the Virginia Operating Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are five key things to do and avoid:

- Do read the instructions carefully before starting.

- Do provide accurate information about all members and their roles.

- Do include a clear description of the business purpose.

- Do review the completed form for any errors before submission.

- Do keep a copy of the signed agreement for your records.

- Don't leave any sections blank unless specified.

- Don't use vague language; be specific in your descriptions.

- Don't ignore state requirements or deadlines.

- Don't forget to have all members sign the agreement.

- Don't submit the form without checking for compliance with Virginia laws.

Similar forms

The Virginia Operating Agreement is similar to the LLC Membership Agreement. Both documents outline the rights and responsibilities of members in a limited liability company. They serve to clarify the management structure and the distribution of profits and losses among members. While the Operating Agreement is specific to Virginia, the Membership Agreement can be used in various states, but both aim to protect the interests of the members and ensure smooth operations within the company.

When navigating the complexities of immigration documentation, it is crucial to understand various forms, including the USCIS I-864, which can be referenced for detailed guidance at documentonline.org/blank-uscis-i-864/. This form plays an essential role in the support structure required for immigrants, ensuring that sponsors are committed to providing necessary financial aid, thus facilitating a smoother process towards permanent residency in the United States.

Another comparable document is the Partnership Agreement. This agreement is used by partnerships to define the roles of partners, how profits are shared, and the procedures for resolving disputes. Like the Operating Agreement, it establishes clear guidelines for the operation of the business. However, while the Operating Agreement is specific to LLCs, the Partnership Agreement is tailored for partnerships, making it essential for different business structures.

The Corporate Bylaws also share similarities with the Virginia Operating Agreement. Bylaws govern the internal management of a corporation, detailing the roles of directors and officers, meeting protocols, and voting procedures. Both documents are crucial for establishing the framework within which a business operates. However, while Operating Agreements are for LLCs, Bylaws are specific to corporations, reflecting the differences in business structure.

Lastly, the Shareholders Agreement is akin to the Virginia Operating Agreement. This document is used in corporations to outline the rights and obligations of shareholders. It covers aspects such as share transfer restrictions and decision-making processes. Both agreements aim to protect the interests of their respective parties and ensure that all members or shareholders understand their rights and responsibilities within the business entity.

Check out Popular Operating Agreement Forms for Different States

Is an Operating Agreement Required for an Llc in California - It can specify how disputes will be resolved, such as mediation or arbitration.

Operating Agreement Llc Pa - It assists in aligning the interests of all members toward common goals.

In addition to understanding the importance of the CA DMV SR1 form, it is essential for drivers to familiarize themselves with other necessary documentation related to vehicle incidents. For comprehensive resources, you can refer to All California Forms, which provides access to various forms needed for different situations encountered on the road.

Create an Operating Agreement - An Operating Agreement is useful for setting expectations and avoiding legal issues.

Operating Agreement Template Pdf - This document can help ensure continuity of the LLC’s operations.