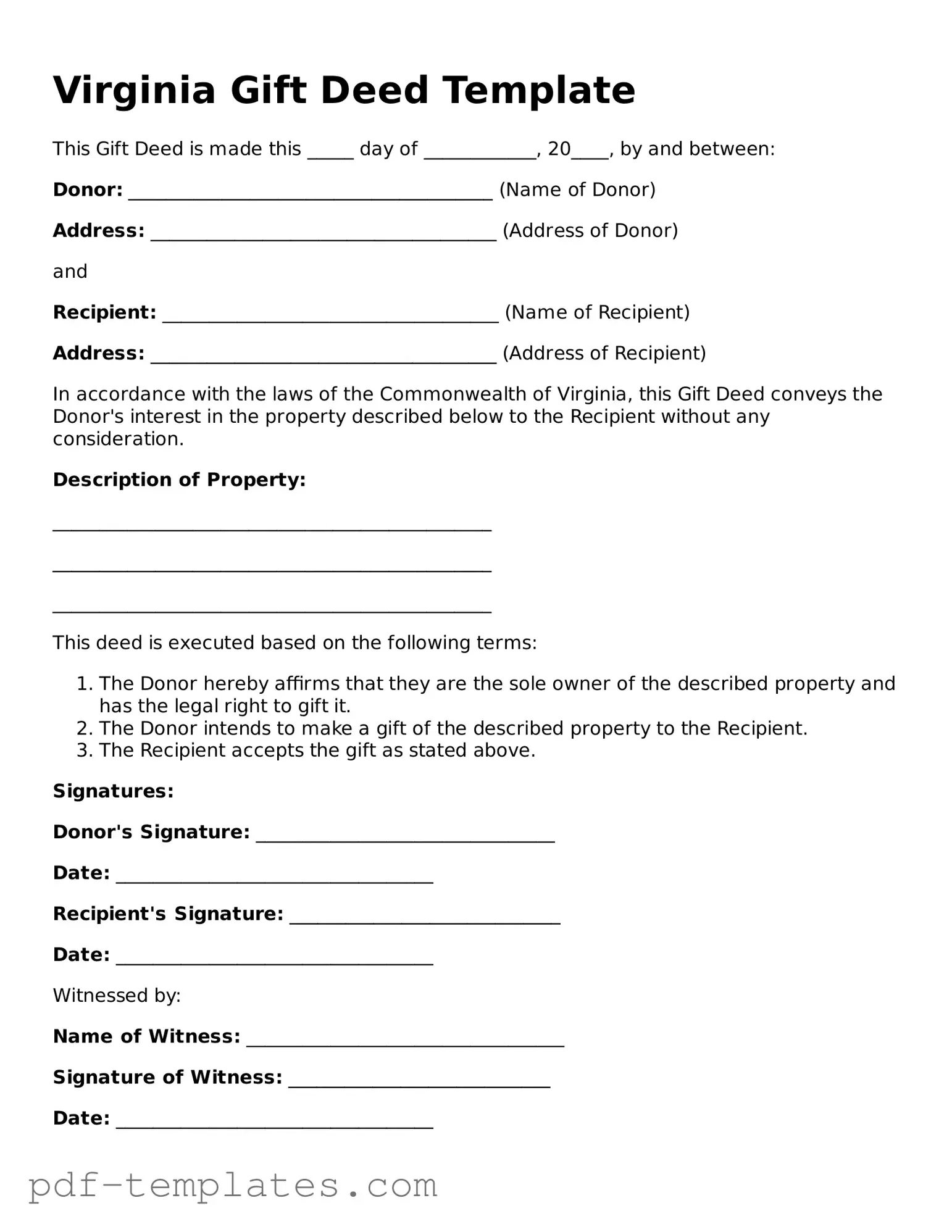

Official Gift Deed Template for Virginia State

The Virginia Gift Deed form serves as a vital tool for individuals wishing to transfer property as a gift without the expectation of payment. This form simplifies the process of conveying ownership, allowing the giver, often referred to as the grantor, to transfer property rights to the recipient, known as the grantee, with ease and clarity. It is essential to include specific details, such as the legal description of the property, the names of both parties, and any relevant terms or conditions that may apply to the gift. Additionally, the Gift Deed must be signed by the grantor in the presence of a notary public to ensure its legality and to protect all parties involved. Understanding the nuances of this form can help avoid potential disputes in the future, making it a crucial document for anyone considering the generous act of gifting real estate in Virginia.

Misconceptions

Understanding the Virginia Gift Deed form can be challenging, and several misconceptions often arise. Below are six common misunderstandings that people may have regarding this legal document.

- Gift Deeds are only for family members. Many believe that gift deeds can only be used to transfer property between family members. In reality, anyone can give a gift deed to anyone else, regardless of their relationship.

- A Gift Deed does not require any formalities. Some people think that a gift deed can be created informally, without any legal requirements. However, for a gift deed to be valid in Virginia, it must be in writing, signed by the donor, and delivered to the recipient.

- Gift Deeds are irreversible. There is a misconception that once a gift deed is executed, it cannot be revoked. While it is true that gift deeds are generally permanent, certain circumstances, such as fraud or lack of capacity, may allow for revocation.

- Gift Deeds incur no tax implications. Many individuals believe that transferring property through a gift deed is tax-free. However, gift taxes may apply depending on the value of the property and the donor’s overall gifting history.

- All properties can be transferred using a Gift Deed. Some assume that any type of property can be conveyed through a gift deed. While real estate and personal property can typically be transferred, there may be restrictions on certain types of assets, such as those subject to liens or mortgages.

- A Gift Deed does not need to be recorded. It is a common belief that gift deeds do not require recording with the local government. However, recording the deed can provide legal protection and help establish clear ownership in the event of disputes.

By addressing these misconceptions, individuals can better understand the implications and requirements of the Virginia Gift Deed form, ensuring a smoother transfer of property.

Virginia Gift Deed: Usage Instruction

Completing the Virginia Gift Deed form is a straightforward process that requires careful attention to detail. After filling out the form, it will need to be signed and notarized before it can be officially recorded. This ensures that the transfer of property is legally recognized and protected.

- Obtain the Virginia Gift Deed form. This can usually be found online or at your local courthouse.

- Begin by entering the date at the top of the form. Ensure the date is accurate, as it will be important for record-keeping.

- Identify the grantor, who is the person giving the gift. Provide their full legal name and address in the designated fields.

- Next, enter the name and address of the grantee, the person receiving the gift. Make sure to include their full legal name as well.

- Describe the property being gifted. Include the address and any relevant details that clearly identify the property. If applicable, reference the property’s tax identification number.

- Indicate the consideration, which is typically stated as “for love and affection.” This signifies that no monetary exchange is occurring.

- Both the grantor and grantee should sign the document in the appropriate sections. The signatures must be original and not electronic.

- Find a notary public to witness the signatures. The notary will verify the identities of the signers and then notarize the document.

- Make copies of the completed and notarized Gift Deed for your records.

- Finally, file the original Gift Deed with the local land records office in the county where the property is located. There may be a filing fee, so check in advance.

Common mistakes

-

Missing Signatures: One common mistake is forgetting to have all necessary parties sign the deed. Both the giver and the recipient must sign the document. If either party's signature is missing, the deed may not be valid.

-

Incorrect Property Description: It's crucial to provide a clear and accurate description of the property being gifted. Failing to include the correct address or legal description can lead to confusion or disputes later on.

-

Not Notarizing the Document: In Virginia, a Gift Deed must be notarized to be legally binding. Neglecting to have the deed notarized can render it unenforceable, meaning the gift may not be recognized by the law.

-

Omitting Tax Considerations: Some individuals overlook the potential tax implications of gifting property. It's wise to consult with a tax professional to understand any gift tax obligations that may arise from the transaction.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Virginia Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The Virginia Gift Deed is governed by the Virginia Code, specifically § 55.1-600 through § 55.1-617. |

| Requirements | The deed must be in writing, signed by the donor, and acknowledged before a notary public. |

| Consideration | Unlike a sale, no monetary consideration is required for a gift deed to be valid. |

| Tax Implications | Gifts may have tax implications, including potential gift tax liabilities for the donor. |

| Revocation | Once executed, a gift deed generally cannot be revoked unless specific conditions are met. |

| Recording | To protect the interests of the parties involved, it is advisable to record the deed with the local county clerk. |

| Beneficiary Designation | The deed should clearly identify the recipient, or beneficiary, of the property to avoid disputes. |

| Legal Advice | It is recommended to seek legal advice when drafting or executing a gift deed to ensure compliance with state laws. |

Dos and Don'ts

When filling out the Virginia Gift Deed form, it is essential to approach the process with care. Here are some important dos and don'ts to consider:

- Do ensure that all names are spelled correctly. Accurate names prevent future legal complications.

- Do include a clear description of the property being gifted. A detailed description helps avoid misunderstandings.

- Do sign the form in the presence of a notary. Notarization adds validity to the document.

- Do check local regulations regarding gift deeds. Different jurisdictions may have specific requirements.

- Do keep a copy of the completed deed for your records. This provides proof of the transaction.

- Don't leave any sections blank. Incomplete forms can lead to delays or rejection.

- Don't use vague language when describing the property. Clarity is crucial for legal purposes.

- Don't forget to include the date of the transaction. This establishes the timeline for the gift.

- Don't overlook the importance of understanding tax implications. Gifts may have tax consequences for both the giver and receiver.

Similar forms

The Virginia Gift Deed is similar to a Quitclaim Deed. Both documents are used to transfer property ownership. However, a Quitclaim Deed does not guarantee that the grantor has clear title to the property. Instead, it simply transfers whatever interest the grantor may have. This means that if there are any claims or liens against the property, the grantee may inherit those issues. In contrast, a Gift Deed is specifically intended to transfer property as a gift, often without any expectation of compensation.

The California Medical Power of Attorney form is a crucial legal document that empowers individuals to designate a trusted person for healthcare decisions should they become incapacitated. This form ensures that their medical preferences are honored, even without their direct communication. For more information on creating such a document, you can visit https://formcalifornia.com/, which provides essential resources to assist in the process of establishing a medical power of attorney, offering peace of mind during challenging times.

An Affidavit of Heirship shares similarities with the Gift Deed in that both documents can be used in the context of property transfer. An Affidavit of Heirship establishes the heirs of a deceased person and can help facilitate the transfer of property to those heirs. While a Gift Deed is used to transfer property while the owner is alive, an Affidavit of Heirship often comes into play after the owner's death, making it a posthumous document.

The Special Warranty Deed is another document that is similar to the Gift Deed. Like a Warranty Deed, it is used to transfer property. However, a Special Warranty Deed only guarantees that the grantor has not encumbered the property during their ownership. This means that any issues that existed prior to the grantor's ownership are not covered. A Gift Deed, on the other hand, does not provide any warranties regarding the property's title.

Check out Popular Gift Deed Forms for Different States

Gift Deed California - This document can be used for various types of property, including real estate and personal items.

A Texas Vehicle Purchase Agreement is a legal document that outlines the terms and conditions of a vehicle sale between a buyer and a seller. This form serves to protect both parties by detailing the specifics of the transaction, including the sale price, vehicle information, and any warranties or representations. For more information, you can refer to the detailed guidelines at documentonline.org/blank-texas-vehicle-purchase-agreement/. Understanding this agreement is essential for ensuring a smooth and legally compliant purchase process.

Texas Gift Deed Pdf - A Gift Deed must include specific details, such as the names of the giver and receiver and a description of the property being gifted.