Official Articles of Incorporation Template for Virginia State

When embarking on the journey of starting a business in Virginia, one of the first and most crucial steps is to complete the Articles of Incorporation form. This document serves as the foundational blueprint for your corporation, outlining essential details that define your business's structure and purpose. It typically includes the corporation's name, which must be unique and comply with state regulations, as well as the principal office address, which establishes where your business will operate. Additionally, the form requires the identification of the registered agent—a person or entity designated to receive legal documents on behalf of the corporation. Importantly, the Articles of Incorporation also stipulate the number of shares the corporation is authorized to issue, providing insight into its financial framework. By addressing these key aspects, the form not only facilitates the legal formation of your business but also sets the stage for its future growth and governance. Understanding the significance of each component is vital for ensuring compliance with Virginia law and for laying a strong foundation for your entrepreneurial aspirations.

Misconceptions

When it comes to the Virginia Articles of Incorporation form, several misconceptions often arise. Understanding these can help streamline the incorporation process. Here are four common misunderstandings:

-

Incorporation is only for large businesses.

Many people think that only large companies need to incorporate. In reality, small businesses and even solo entrepreneurs can benefit from incorporation. It provides legal protection and can enhance credibility.

-

Filing Articles of Incorporation is the only step in starting a business.

While filing the Articles is a crucial step, it is not the only one. Businesses also need to obtain necessary licenses, set up tax accounts, and create bylaws. Each of these steps is essential for a successful launch.

-

Once incorporated, a business can operate indefinitely without any further action.

This is a common myth. Businesses must file annual reports and pay certain fees to maintain their corporate status. Failing to do so can lead to penalties or even dissolution.

-

The Articles of Incorporation are a public document that anyone can access.

While it is true that Articles of Incorporation are public records, access may vary by state. In Virginia, anyone can request copies, but there may be fees associated with obtaining them.

Virginia Articles of Incorporation: Usage Instruction

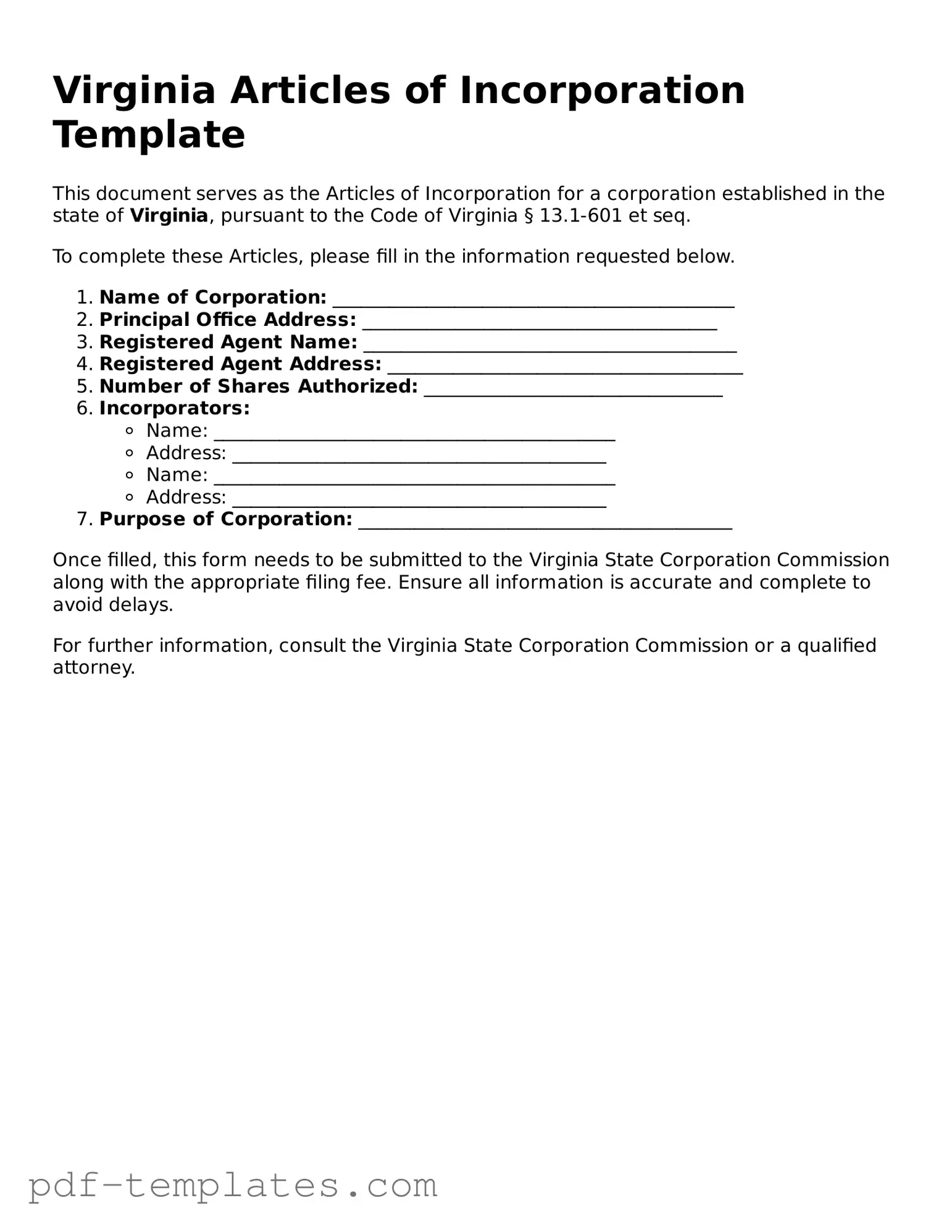

Once you have gathered all necessary information, you are ready to fill out the Virginia Articles of Incorporation form. This document is essential for establishing your business entity in the state. Follow these steps carefully to ensure everything is completed accurately.

- Start by downloading the Virginia Articles of Incorporation form from the official state website or obtain a physical copy.

- Fill in the name of your corporation. Ensure it complies with Virginia naming requirements.

- Provide the principal office address. This should be a physical location in Virginia.

- List the name and address of the registered agent. This person or entity will receive legal documents on behalf of your corporation.

- Indicate the purpose of your corporation. Be clear and concise about what your business will do.

- Specify the number of shares the corporation is authorized to issue. Include any classes of shares, if applicable.

- Include the names and addresses of the initial directors. At least one director is required.

- Sign and date the form. The incorporator must sign, and the date of signing should be included.

- Submit the completed form along with the required filing fee to the Virginia State Corporation Commission.

After submission, keep a copy of the filed Articles of Incorporation for your records. You will receive confirmation from the state once your corporation is officially registered.

Common mistakes

-

Incorrect Entity Name: Many individuals fail to ensure that the name of the corporation is unique and not already in use. This can lead to delays or outright rejection of the application.

-

Missing Registered Agent Information: The form requires the designation of a registered agent. Omitting this information or providing inaccurate details can complicate the incorporation process.

-

Inaccurate Business Purpose: Some applicants write vague or overly broad descriptions of their business purpose. A clear and specific purpose is essential to comply with state requirements.

-

Incorrect Number of Shares: Failing to specify the correct number of shares the corporation is authorized to issue can lead to issues down the line, particularly regarding ownership and control.

-

Improper Signatures: All required signatures must be present. Missing a signature or having an unauthorized person sign can invalidate the application.

-

Neglecting to Include Incorporators: The form must list the names and addresses of the incorporators. Forgetting to include this information can delay processing.

-

Not Following Formatting Guidelines: Some individuals overlook specific formatting requirements, such as font size and spacing. Adhering to these guidelines is crucial for acceptance.

-

Failure to Review for Errors: Rushing through the application often leads to typos or incorrect information. A careful review can prevent unnecessary complications.

-

Ignoring State Fees: Individuals sometimes forget to include the appropriate filing fee. This oversight can result in the rejection of the application or delays in processing.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The Virginia Articles of Incorporation form is used to legally create a corporation in Virginia. |

| Governing Law | This form is governed by the Virginia Nonstock Corporation Act, found in Title 13.1 of the Code of Virginia. |

| Filing Requirement | Filing the Articles of Incorporation with the Virginia State Corporation Commission is mandatory for incorporation. |

| Information Needed | The form requires the corporation's name, registered agent, and principal office address. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

| Initial Directors | The form may require the names and addresses of the initial directors of the corporation. |

| Approval Process | Once filed, the Virginia State Corporation Commission reviews the form for compliance before approval. |

| Amendments | Changes to the Articles of Incorporation can be made through an amendment process, which also requires filing. |

| Public Record | The Articles of Incorporation become part of the public record, accessible to anyone who wishes to view them. |

Dos and Don'ts

When filling out the Virginia Articles of Incorporation form, there are several important steps to keep in mind. Proper attention to detail can help ensure a smooth incorporation process. Here are five things you should do and five things you should avoid.

- Do: Provide accurate and complete information.

- Do: Clearly state the purpose of your corporation.

- Do: Include the name of your corporation, ensuring it complies with Virginia naming requirements.

- Do: Designate a registered agent with a physical address in Virginia.

- Do: Review the form for any errors before submission.

- Don't: Use a name that is too similar to an existing corporation.

- Don't: Forget to include the required filing fee.

- Don't: Leave any sections of the form blank unless instructed.

- Don't: Submit the form without verifying the accuracy of the information provided.

- Don't: Rely solely on online templates without understanding the requirements.

Similar forms

The Virginia Articles of Incorporation form shares similarities with the Certificate of Incorporation, commonly used in other states. Both documents serve as the foundational legal paperwork required to establish a corporation. They outline essential information such as the corporation's name, purpose, and registered agent. While the specific requirements may vary slightly from state to state, the overall function remains consistent: to formally create a corporation recognized by the state government.

Another document akin to the Articles of Incorporation is the Limited Liability Company (LLC) Articles of Organization. This form is used to establish an LLC, a popular business structure that provides liability protection to its owners. Like the Articles of Incorporation, the Articles of Organization require basic information about the business, including its name, address, and management structure. Both documents are crucial for gaining legal recognition and protection under state law.

The Partnership Agreement is another document that shares common ground with the Articles of Incorporation. While not a formal incorporation document, it outlines the terms and conditions under which partners will operate their business. This agreement addresses ownership stakes, profit distribution, and management responsibilities, similar to how the Articles of Incorporation define the structure and governance of a corporation. Both documents aim to provide clarity and legal protection for the parties involved.

The Bylaws of a corporation can also be compared to the Articles of Incorporation. While the Articles serve as the initial legal framework for establishing the corporation, the Bylaws provide detailed rules and procedures for its internal operations. They cover topics such as shareholder meetings, voting rights, and the roles of officers. Together, these documents ensure that the corporation runs smoothly and adheres to both state laws and the desires of its founders.

The Nonprofit Articles of Incorporation is another document similar to the Virginia Articles of Incorporation. This form is specifically designed for organizations that aim to operate without profit. Like its for-profit counterpart, it includes essential information about the organization, such as its mission, governance structure, and registered agent. Both documents serve to legally establish the organization and provide it with the benefits of incorporation, such as limited liability and tax-exempt status.

The Certificate of Formation for a Business Trust also shares similarities with the Articles of Incorporation. This document is used to create a business trust, which is a unique business entity that combines elements of partnerships and corporations. Like the Articles of Incorporation, it requires the disclosure of the trust's name, purpose, and management structure. Both documents aim to provide legal recognition and establish the framework for how the entity will operate.

The importance of understanding legal documents related to business formation cannot be overstated. For example, the California Loan Agreement form serves as a legally binding document between a borrower and a lender, outlining the terms and conditions of a loan in the state of California. This form covers the specifics of the loan, including the amount, interest rate, repayment schedule, and any security or collateral, ensuring both parties are protected. For comprehensive resources on similar agreements, you can refer to All California Forms, which offer various legal templates to support business needs.

Finally, the Foreign Corporation Registration is another document that relates to the Articles of Incorporation. When a corporation formed in one state wishes to operate in Virginia, it must file this registration. This document requires information about the original Articles of Incorporation and confirms that the corporation is in good standing in its home state. Both documents ensure compliance with state laws and allow businesses to expand their reach while maintaining legal protections.

Check out Popular Articles of Incorporation Forms for Different States

Articles of Organization Washington State - The Articles often clarify restrictions on the transfer of shares, if applicable.

To ensure a smooth transaction, consider utilizing the Texas Firearm Bill of Sale form template to document your agreement and protect your interests during the sale. For further assistance, you can access the form by visiting the detailed Firearm Bill of Sale resource.

How Much Is an Llc in Texas - Essential for establishing a clear business identity.