Vehicle Repayment Agreement Document

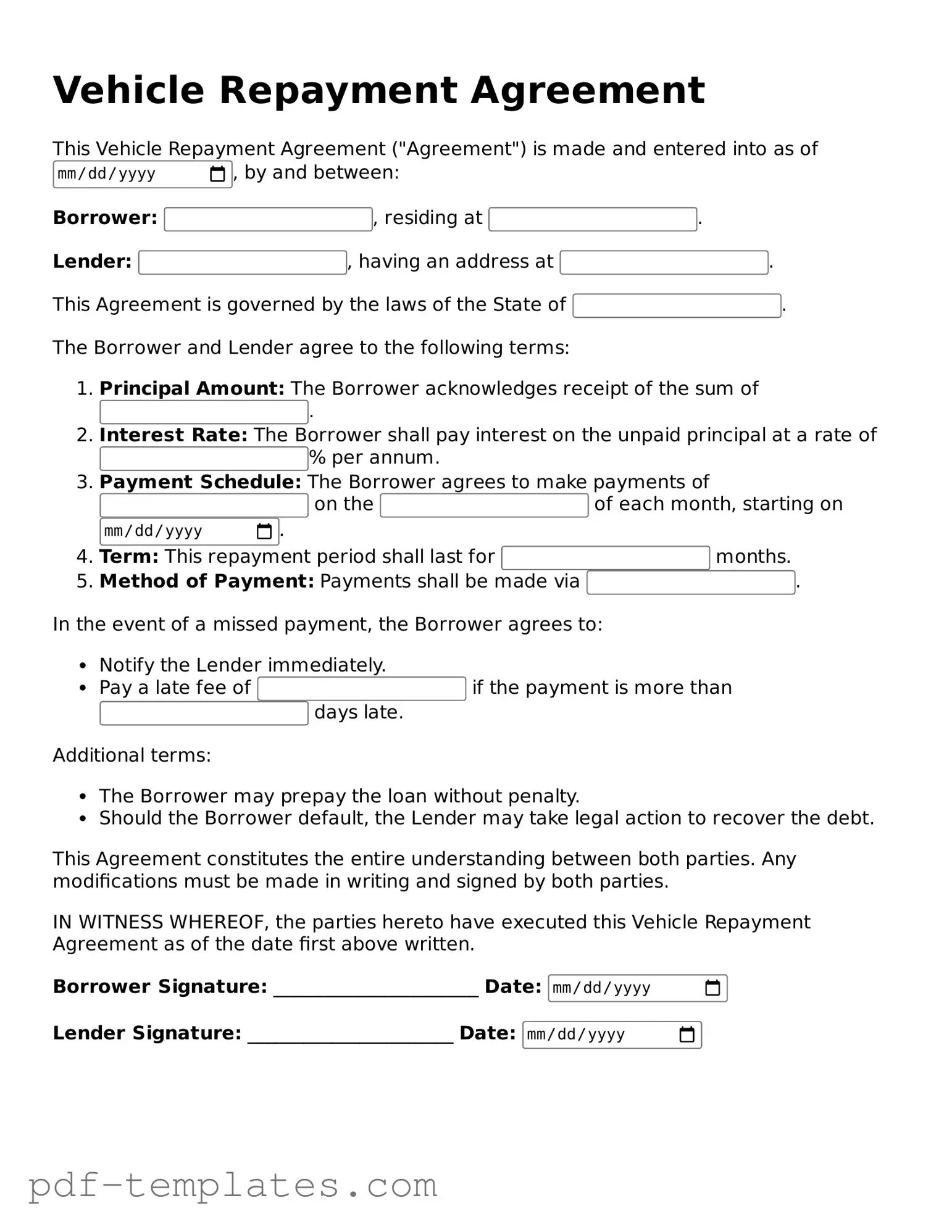

The Vehicle Repayment Agreement form serves as a crucial document for individuals and businesses involved in the financing of vehicles. This form outlines the terms and conditions under which a borrower agrees to repay a loan or financing amount for a vehicle purchase. It typically includes essential details such as the loan amount, interest rate, repayment schedule, and any applicable fees. Additionally, the form may specify the consequences of defaulting on the loan, ensuring that both parties understand their rights and obligations. By clearly defining these elements, the Vehicle Repayment Agreement helps to protect the interests of both the lender and the borrower, fostering transparency and accountability throughout the repayment process. Understanding this form is vital for anyone considering financing a vehicle, as it sets the foundation for a successful financial arrangement.

Misconceptions

Understanding the Vehicle Repayment Agreement form can be challenging, and misconceptions often arise. Here are eight common misunderstandings and clarifications to help clear the air.

-

It is the same as a loan agreement.

The Vehicle Repayment Agreement is not a loan agreement. Instead, it outlines the terms for repaying a vehicle purchase or lease, focusing on payment schedules and responsibilities.

-

Only the buyer needs to sign.

Both the buyer and the seller (or lender) must sign the agreement. This ensures that all parties acknowledge and accept the terms laid out in the document.

-

It guarantees vehicle ownership.

Signing this agreement does not automatically transfer ownership of the vehicle. Ownership is typically transferred through a separate title transfer process.

-

It is a one-time document.

The Vehicle Repayment Agreement may need updates or modifications. Changes in payment terms or circumstances can necessitate a new agreement or amendments to the existing one.

-

There are no consequences for missed payments.

Failing to adhere to the payment schedule can lead to serious consequences, including repossession of the vehicle or damage to credit ratings.

-

It can be ignored if the vehicle is returned.

Returning the vehicle does not absolve the buyer of their obligations under the agreement. Any outstanding payments or penalties may still apply.

-

It is only for new vehicles.

The agreement applies to both new and used vehicles. Whether purchasing or leasing, the terms can be relevant regardless of the vehicle's age.

-

All terms are negotiable.

While some terms can be negotiated, others are often set by the lender or dealership and may not be flexible. It’s essential to understand which aspects can be discussed.

Being informed about these misconceptions can help individuals navigate the Vehicle Repayment Agreement process with greater confidence and clarity.

Vehicle Repayment Agreement: Usage Instruction

Once you have the Vehicle Repayment Agreement form in front of you, it’s time to start filling it out. Follow these steps carefully to ensure that all necessary information is provided accurately. This will help facilitate the process moving forward.

- Begin by entering your full name in the designated space at the top of the form.

- Next, provide your current address, including city, state, and zip code.

- In the next section, write down your phone number and email address for contact purposes.

- Fill in the vehicle information, including the make, model, year, and Vehicle Identification Number (VIN).

- Specify the amount you owe on the vehicle and any other relevant financial details.

- Indicate your preferred repayment schedule, including the frequency of payments (weekly, bi-weekly, or monthly).

- Review the terms and conditions provided on the form, ensuring you understand your obligations.

- Sign and date the form at the bottom to confirm your agreement.

After completing the form, double-check all entries for accuracy. Once you are satisfied, submit it as instructed, and await further communication regarding your repayment plan.

Common mistakes

-

Inaccurate Personal Information: One of the most common mistakes is providing incorrect personal details. This includes your name, address, and contact information. Double-checking this information is essential, as any discrepancies can delay the processing of your agreement.

-

Missing Signatures: Another frequent error is neglecting to sign the form. A signature is not just a formality; it indicates your agreement to the terms. Without it, the document may be considered invalid.

-

Failure to Read Terms Carefully: Many individuals rush through the terms and conditions. This can lead to misunderstandings about payment amounts, due dates, and penalties for late payments. Taking the time to read and understand these terms can prevent future complications.

-

Omitting Necessary Documentation: Often, people forget to attach required documents, such as proof of income or identification. Failing to include these can result in delays or rejection of the agreement. Always ensure you have all necessary documents ready before submission.

PDF Features

| Fact Name | Details |

|---|---|

| Purpose | The Vehicle Repayment Agreement form outlines the terms for repayment of a loan or debt related to a vehicle. |

| Parties Involved | This agreement typically involves the borrower (the person taking the loan) and the lender (the financial institution or individual providing the loan). |

| Governing Law | In the United States, the governing laws may vary by state, often referencing state-specific vehicle finance regulations. |

| Repayment Terms | The form specifies the repayment schedule, including the amount and frequency of payments. |

| Interest Rates | It includes details about any applicable interest rates on the loan amount. |

| Default Conditions | The agreement outlines what constitutes a default, such as missed payments or failure to maintain insurance. |

| Signatures Required | Both parties must sign the agreement to make it legally binding. |

| Modification Clause | The form may include a clause regarding how changes to the agreement can be made, typically requiring written consent from both parties. |

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are ten things to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate personal information, including your name and address.

- Do include the correct vehicle identification number (VIN).

- Do review the repayment terms and conditions thoroughly.

- Do sign and date the form where indicated.

- Don't leave any required fields blank.

- Don't use abbreviations or shorthand in your responses.

- Don't provide false information, as this can lead to legal issues.

- Don't forget to keep a copy of the completed form for your records.

- Don't rush through the process; take your time to ensure everything is correct.

Similar forms

The Vehicle Repayment Agreement form is similar to a Loan Agreement. Both documents outline the terms and conditions under which a borrower agrees to repay a loan. They typically include details such as the loan amount, interest rate, repayment schedule, and consequences for defaulting on the agreement. The Loan Agreement provides a comprehensive framework for both parties, ensuring clarity and mutual understanding of the financial obligations involved.

Another document that shares similarities with the Vehicle Repayment Agreement is the Promissory Note. A Promissory Note serves as a written promise to pay a specific sum of money to another party. Like the Vehicle Repayment Agreement, it includes key details such as the amount owed, payment terms, and interest rates. Both documents are legally binding and serve to protect the rights of the lender while outlining the responsibilities of the borrower.

The Retail Installment Sales Contract is also akin to the Vehicle Repayment Agreement. This contract is commonly used in the sale of vehicles, detailing the terms of the sale and financing. It includes information about the purchase price, down payment, interest rates, and payment schedule. Both documents aim to formalize the financial relationship between the buyer and seller, ensuring that all parties are aware of their obligations.

When considering membership in a sorority, it's crucial to provide a comprehensive and compelling overview of the applicant, which can be effectively achieved through a Sorority Recommendation Letter. This document not only highlights the individual’s accomplishments and character but also serves to strengthen her application. For those requiring guidance on how to compose such a letter, resources like OnlineLawDocs.com can be immensely helpful.

A Lease Agreement can be compared to the Vehicle Repayment Agreement in that both involve a financial commitment for the use of an asset. While a Lease Agreement typically pertains to renting property or equipment, it shares similar components, such as payment terms, duration, and responsibilities for maintenance. Both agreements serve to protect the interests of the parties involved and clarify the expectations of use and payment.

The Security Agreement is another document that bears resemblance to the Vehicle Repayment Agreement. This document is often used when a borrower pledges collateral to secure a loan. It outlines the rights of the lender in case of default, including the ability to repossess the collateral. Like the Vehicle Repayment Agreement, it establishes clear terms regarding the repayment of the loan and the consequences of failing to meet those terms.

The Installment Payment Agreement is similar in nature to the Vehicle Repayment Agreement as it lays out the terms under which a borrower agrees to make payments over time. This document specifies the amount of each installment, payment frequency, and total loan amount. Both agreements aim to provide a structured repayment plan, ensuring that borrowers understand their obligations and lenders can anticipate cash flow.

Lastly, the Loan Modification Agreement shares characteristics with the Vehicle Repayment Agreement. This document is used when the original terms of a loan need to be altered, often due to the borrower's financial circumstances. It outlines the new payment terms and any changes to interest rates or repayment schedules. Both agreements are designed to ensure that the borrower can continue to meet their obligations while providing the lender with a clear understanding of the modified terms.

More Documents

Texas Hub Certification - This form helps track the issuance and transfer of membership interests within a company.

This Investment Letter of Intent form is crucial for investors hoping to understand the initial terms of engagement with potential companies, paving the way for a more formal agreement. For those interested in exploring this document further, we recommend reviewing the essential insights found in our guide to the Investment Letter of Intent process.

Mobile Home Bill of Sale - A document for transferring ownership of a mobile home.