Transfer-on-Death Deed Document

The Transfer-on-Death Deed (TOD) form serves as a valuable estate planning tool that allows individuals to designate beneficiaries who will receive their real property upon their death. This form enables property owners to transfer ownership without the need for probate, streamlining the process for heirs. By completing and recording a TOD deed, the property owner retains full control of the property during their lifetime, including the right to sell or mortgage it. The form requires specific information, such as the property owner's details, a legal description of the property, and the names of the designated beneficiaries. Importantly, the TOD deed must be executed in accordance with state laws to ensure its validity. This form can be a straightforward solution for those looking to simplify the transfer of their property and minimize the administrative burden on their loved ones after their passing.

Misconceptions

Understanding the Transfer-on-Death (TOD) Deed can be challenging. Here are ten common misconceptions about this legal document:

- It avoids probate entirely. While a TOD deed allows property to pass outside of probate, it does not eliminate the need for probate for other assets.

- It is only for real estate. The TOD deed specifically applies to real property, but other forms of transfer can be used for personal property.

- It is irrevocable once signed. A TOD deed can be revoked or changed by the owner at any time before their death.

- It automatically transfers ownership upon signing. The transfer only occurs upon the death of the property owner, not at the time of signing.

- All states recognize TOD deeds. Not all states have enacted laws allowing for TOD deeds; check local regulations for availability.

- It eliminates tax implications. Beneficiaries may still face tax obligations, such as property taxes or capital gains taxes, upon transfer.

- It can be used for joint ownership. A TOD deed is designed for single ownership; joint owners must consider other options for transfer.

- Beneficiaries have immediate access to the property. Beneficiaries cannot access the property until the owner passes away and the deed is executed.

- It is a substitute for a will. A TOD deed should complement a will, as it only covers specific property and does not address other assets.

- It requires a lawyer to create. While legal assistance can be helpful, many states provide templates that allow individuals to create a TOD deed on their own.

Understanding these misconceptions can help individuals make informed decisions about estate planning and property transfer.

Transfer-on-Death Deed - Customized for State

Transfer-on-Death Deed: Usage Instruction

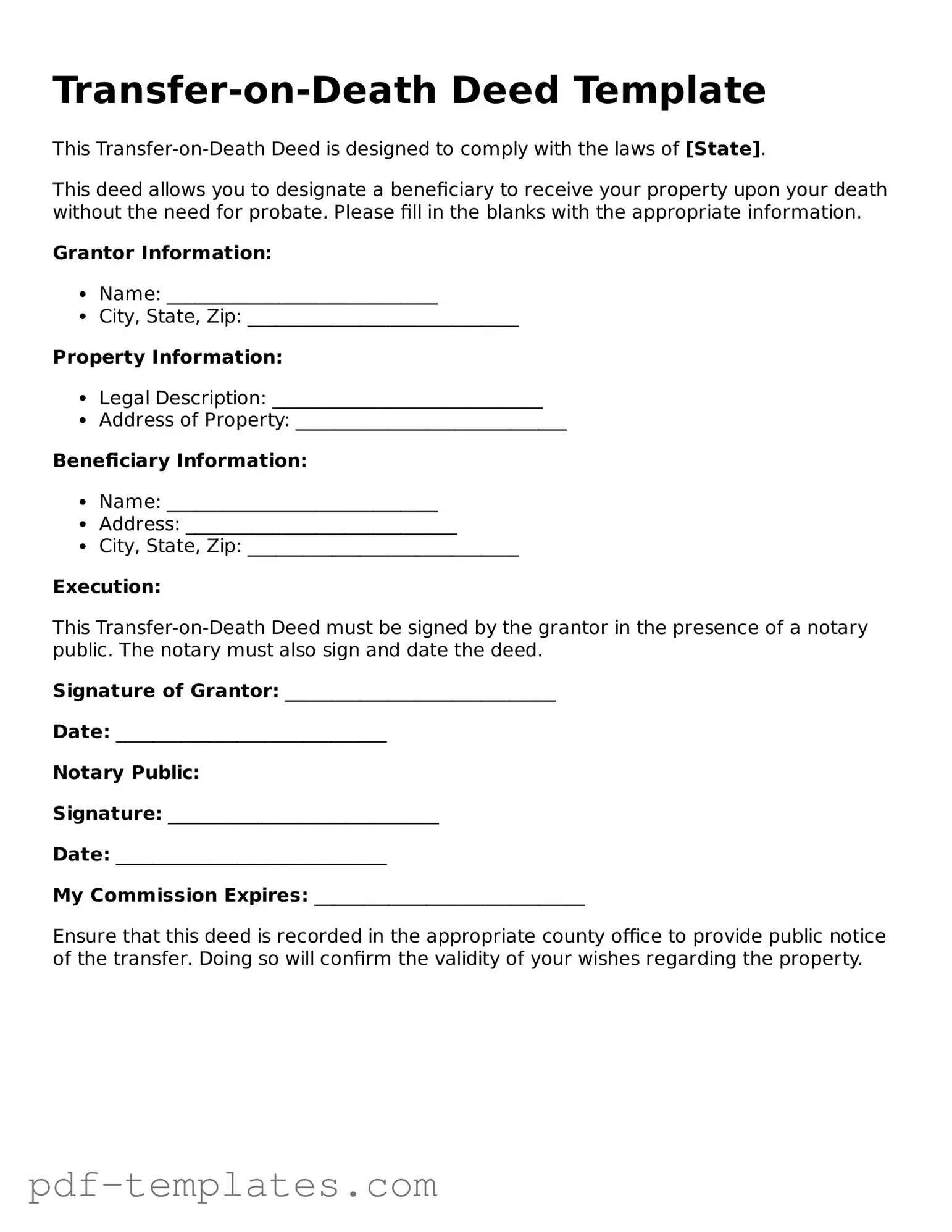

Filling out a Transfer-on-Death Deed form is a straightforward process that allows you to designate a beneficiary for your property. After completing the form, you will need to ensure it is properly signed and recorded to be effective. Below are the steps to guide you through filling out the form.

- Obtain the Form: Start by acquiring the Transfer-on-Death Deed form. You can usually find this form on your state’s official website or at a local courthouse.

- Provide Your Information: Fill in your name and address at the top of the form. This identifies you as the property owner.

- Describe the Property: Clearly describe the property you are transferring. Include details such as the address and any legal descriptions required.

- List the Beneficiary: Enter the full name and address of the person you wish to inherit the property. Ensure the beneficiary is clearly identified.

- Include Alternative Beneficiaries (if desired): If you want to designate an alternative beneficiary in case the primary one cannot inherit, include their information as well.

- Sign the Form: You must sign the form in front of a notary public. This step is crucial for the validity of the deed.

- Record the Deed: After signing, take the completed deed to your local county recorder’s office to officially record it. This step ensures that the deed is legally recognized.

Common mistakes

-

Not including all required information. Many people forget to fill out all sections of the form, which can lead to delays or even rejection of the deed.

-

Failing to sign the deed. A common mistake is neglecting to sign the document. Without a signature, the deed is not valid.

-

Not having witnesses or notarization. Depending on state laws, some deeds require witnesses or notarization. Skipping this step can invalidate the deed.

-

Incorrectly identifying the beneficiaries. Listing beneficiaries with incorrect names or insufficient details can create confusion and potential legal issues.

-

Omitting property details. Failing to provide a complete legal description of the property can lead to disputes or challenges later on.

-

Not understanding state laws. Each state has its own rules regarding Transfer-on-Death Deeds. Ignoring these can result in non-compliance and complications.

-

Using outdated forms. Laws change, and using an outdated form may lead to issues with validity. Always ensure you have the most current version.

-

Not recording the deed. After filling out the form, failing to record it with the appropriate local office can mean the deed is not legally recognized.

-

Assuming it’s a one-time task. Many people think that once the deed is signed, it’s done. However, it’s important to review and update it as circumstances change.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real property to a beneficiary upon their death, avoiding probate. |

| Governing Law | In many states, the Transfer-on-Death Deed is governed by the Uniform Real Property Transfer on Death Act (URPTDA), though specific laws may vary by state. |

| Revocation | The deed can be revoked at any time before the death of the property owner, allowing for flexibility in estate planning. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries, providing options for how the property will be distributed. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift tax or income tax upon the transfer of property, as the transfer occurs at death. |

| State Variations | Some states may have specific requirements for executing the deed, such as notarization or witness signatures, so it is important to check local laws. |

Dos and Don'ts

When filling out a Transfer-on-Death Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are six things to keep in mind:

- Do: Clearly identify the property you are transferring.

- Do: Include the full legal names of all parties involved.

- Do: Sign the deed in front of a notary public.

- Do: File the completed deed with the appropriate county office.

- Don’t: Leave out any required information; this can delay the process.

- Don’t: Forget to inform the beneficiaries about the deed.

Following these steps can help ensure that your Transfer-on-Death Deed is valid and effective. It’s a straightforward process, but attention to detail is crucial.

Similar forms

The Transfer-on-Death Deed (TODD) form shares similarities with a Last Will and Testament. Both documents serve to dictate the distribution of an individual's assets after their passing. A Last Will allows a person to specify who will inherit their property and may also appoint guardians for minor children. In contrast, the TODD allows for the direct transfer of real estate to beneficiaries without the need for probate, which can simplify the process and reduce costs for the heirs. While a will takes effect only after death, the TODD operates during the owner’s lifetime, allowing them to retain control over the property until they pass away.

An additional document that resembles the Transfer-on-Death Deed is the Revocable Living Trust. Like the TODD, a Revocable Living Trust allows for the seamless transfer of assets upon the owner's death. The trust holds the property during the owner's lifetime, and upon their passing, the assets can be distributed according to the terms set forth in the trust document. This method can also help avoid probate, providing a level of privacy and efficiency in asset distribution. Both documents aim to simplify the transfer process, but a living trust can cover a broader range of assets, not just real estate.

In navigating the various estate planning tools available, it is essential to recognize the potential benefits of documents such as the California Notary Acknowledgement form, which plays a pivotal role in authenticating these essential legal instruments. For those interested in understanding and obtaining relevant forms, All California Forms can provide comprehensive resources to ensure that all legal processes are properly documented and executed.

Lastly, the Life Estate Deed shares characteristics with the Transfer-on-Death Deed. A Life Estate Deed allows an individual to retain the right to live in or use a property during their lifetime, while designating a beneficiary who will receive full ownership after their death. This arrangement provides the current owner with control and use of the property, similar to how the TODD allows the owner to maintain control until death. Both documents serve to streamline the transfer of property and can help avoid the lengthy probate process, though they differ in the rights retained by the original owner during their lifetime.

Additional Types of Transfer-on-Death Deed Templates:

Sample Deed in Lieu of Foreclosure - The initiative shows a willingness to settle debts by the borrower.

A Trailer Bill of Sale form is a legal document that facilitates the transfer of ownership of a trailer from one person to another. This form is essential for ensuring that both the seller and buyer have a clear record of the transaction. For those looking to create or obtain this important document, you can visit documentonline.org/blank-trailer-bill-of-sale. Filling out this document correctly can help prevent disputes and facilitate future transactions involving the trailer.