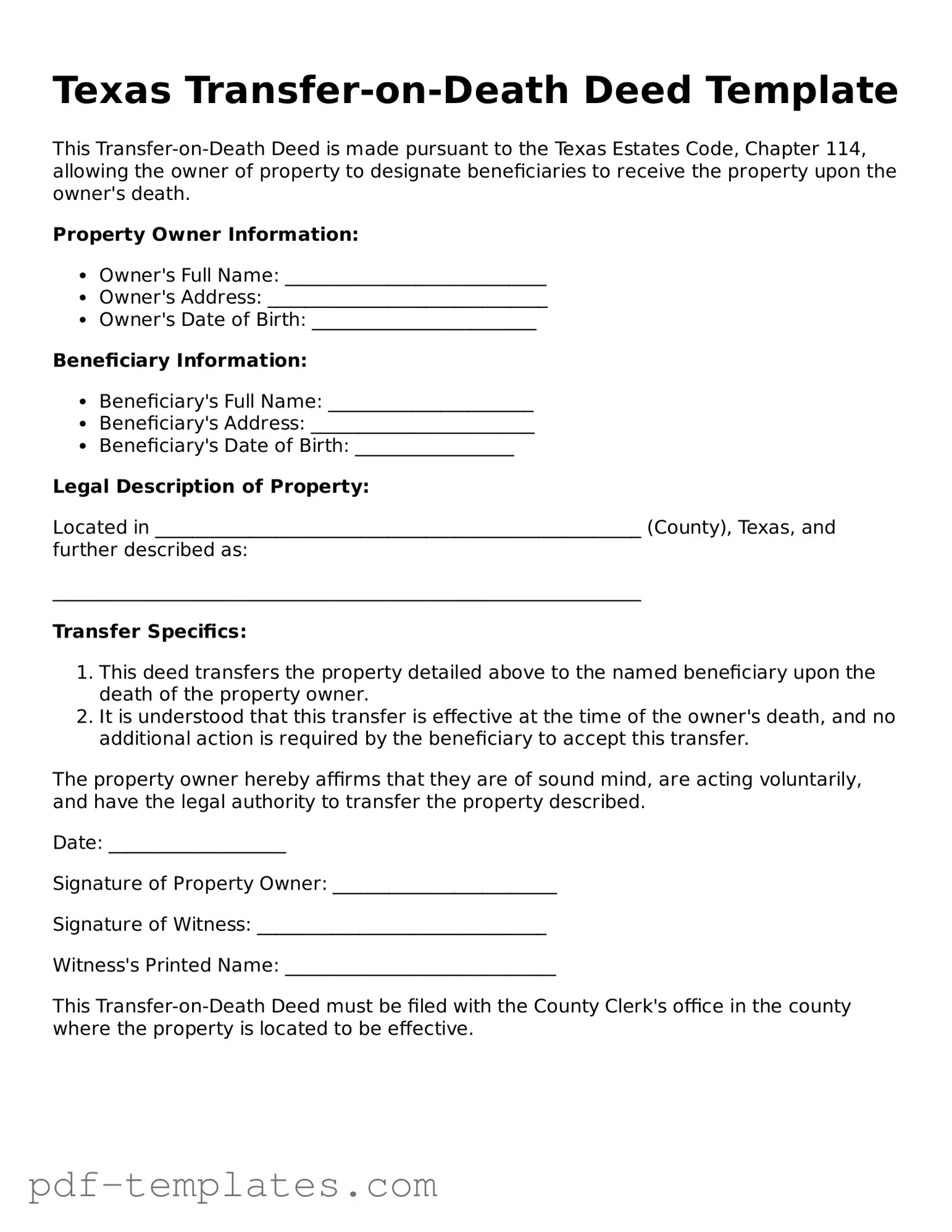

Official Transfer-on-Death Deed Template for Texas State

In Texas, planning for the future of your property can be simplified through the use of a Transfer-on-Death Deed (TODD). This legal document allows property owners to designate beneficiaries who will inherit real estate upon their passing, all without the need for probate. By using a TODD, individuals can maintain control of their property during their lifetime while ensuring a smooth transition for their heirs. The form requires specific information, such as the names of the beneficiaries and a clear description of the property, to avoid any confusion later on. Importantly, the deed must be properly executed and recorded with the county clerk to be effective. This straightforward approach to estate planning can alleviate potential disputes and streamline the transfer process, making it an attractive option for many Texas homeowners. Understanding the nuances of the Transfer-on-Death Deed form is essential for anyone looking to secure their property for future generations.

Misconceptions

Understanding the Texas Transfer-on-Death Deed can help avoid confusion and ensure that property transfers occur smoothly. Here are five common misconceptions about this legal tool:

-

Transfer-on-Death Deeds are only for wealthy individuals.

This is not true. Anyone can use a Transfer-on-Death Deed to designate beneficiaries for their property, regardless of their financial status. It is a useful tool for anyone who wants to simplify the transfer of real estate upon their death.

-

Once a Transfer-on-Death Deed is signed, it cannot be changed.

This misconception is incorrect. The owner can revoke or modify the deed at any time during their lifetime. It is important to follow the proper procedures to ensure any changes are legally binding.

-

A Transfer-on-Death Deed avoids all taxes.

This is misleading. While a Transfer-on-Death Deed can help avoid probate, it does not eliminate tax obligations. Beneficiaries may still be responsible for property taxes and potential capital gains taxes when they sell the property.

-

Beneficiaries automatically gain ownership of the property upon the owner's death.

This is not entirely accurate. Beneficiaries do gain the right to inherit the property, but the deed must be properly recorded after the owner's death to complete the transfer. Failing to do so can lead to complications.

-

Transfer-on-Death Deeds are only valid in Texas.

This is a misconception. While Texas has specific laws governing Transfer-on-Death Deeds, other states have similar provisions. However, the rules and requirements can vary significantly, so it’s essential to understand the laws in each state.

Texas Transfer-on-Death Deed: Usage Instruction

After you have gathered the necessary information, you are ready to fill out the Texas Transfer-on-Death Deed form. This deed allows you to designate a beneficiary who will receive your property upon your passing, without going through probate. Follow these steps carefully to complete the form correctly.

- Begin by writing your name and address in the designated section at the top of the form.

- Next, provide a description of the property you wish to transfer. This should include the address and any legal description required.

- Identify your beneficiary or beneficiaries. Include their full names and addresses. If there are multiple beneficiaries, clearly state how the property should be divided among them.

- Sign the form in the presence of a notary public. Your signature must be acknowledged by the notary for the deed to be valid.

- Have the notary public sign and seal the document, confirming their acknowledgment of your signature.

- Finally, file the completed deed with the county clerk's office in the county where the property is located. Make sure to keep a copy for your records.

Common mistakes

-

Incorrect Property Description: Failing to provide a clear and accurate description of the property can lead to significant issues. Ensure that the legal description matches the property records exactly.

-

Missing Signatures: Both the owner and the designated beneficiary must sign the deed. Omitting one of these signatures can invalidate the document.

-

Improper Notarization: The deed must be notarized to be valid. Neglecting to have the document properly notarized can result in complications during the transfer process.

-

Failure to Record the Deed: After completing the deed, it must be filed with the county clerk's office. Not recording the deed means the transfer will not be recognized.

-

Not Updating the Deed: If circumstances change, such as the death of a beneficiary, it’s crucial to update the deed. Failing to do so can lead to confusion and disputes among heirs.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Texas Transfer-on-Death Deed allows property owners to designate beneficiaries to receive real estate upon their death, avoiding probate. |

| Governing Law | The Texas Transfer-on-Death Deed is governed by Texas Property Code, Chapter 114. |

| Eligibility | Any owner of real property in Texas can create a Transfer-on-Death Deed, provided they are of sound mind and legal age. |

| Revocability | The deed can be revoked or amended at any time before the property owner's death, allowing for flexibility in estate planning. |

| Filing Requirements | The deed must be recorded in the county where the property is located to be effective. This ensures that the beneficiaries' rights are protected. |

| Beneficiary Designation | Property owners can name one or multiple beneficiaries, and they may specify the shares each beneficiary will receive. |

| Transfer Process | Upon the owner's death, the property automatically transfers to the named beneficiaries without the need for probate, streamlining the process. |

| Limitations | The Transfer-on-Death Deed cannot be used for certain types of property, such as a homestead or property held in a trust. |

Dos and Don'ts

When filling out the Texas Transfer-on-Death Deed form, it's important to follow certain guidelines to ensure everything goes smoothly. Here’s a list of what you should and shouldn’t do:

- Do ensure that you have the correct property description. This includes the address and legal description.

- Do include the names of all beneficiaries clearly. Make sure there are no spelling errors.

- Do sign the deed in front of a notary public. This step is crucial for the deed to be valid.

- Do file the deed with the county clerk's office. This makes the transfer official.

- Do keep a copy of the filed deed for your records. It’s good to have for future reference.

- Don’t forget to check for any local laws that may affect the deed. Regulations can vary by county.

- Don’t leave out any required information. Incomplete forms can lead to delays.

- Don’t use vague language when describing the property. Be as specific as possible.

- Don’t sign the deed without a notary. An unnotarized deed may not be enforceable.

- Don’t assume that filing the deed is the only step. Make sure to inform your beneficiaries about it.

Similar forms

The Texas Transfer-on-Death Deed (TODD) form is similar to a will in that both documents allow individuals to designate beneficiaries for their property after death. A will outlines how a person's assets should be distributed upon their passing, while a TODD specifically allows for the transfer of real estate directly to named beneficiaries, bypassing the probate process. This can simplify the transfer and reduce costs associated with estate administration, making it an appealing option for property owners in Texas.

In navigating the complexities of estate planning, it's essential to consider various legal instruments available, including the distinguished All California Forms which may assist in understanding the requirements for legal documentation in California. Each option, from the Transfer-on-Death Deed to the Lady Bird Deed, offers unique benefits that can significantly enhance the efficiency of property transfer, ensuring that one's wishes are honored without the burdens of probate.

Check out Popular Transfer-on-Death Deed Forms for Different States

Pennsylvania Transfer on Death Deed Form - The Transfer-on-Death Deed can provide peace of mind regarding future property ownership for heirs.

The Asurion F-017-08 MEN form is essential for facilitating insurance claims related to electronic devices, allowing customers to formally request assistance. To learn more about this important document, visit pdftemplates.info/asurion-f-017-08-men-form for detailed information and guidance on how to fill it out effectively.

Free Printable Transfer on Death Deed Form Florida - A properly executed Transfer-on-Death Deed can provide peace of mind to property owners aware of their wishes for the future.