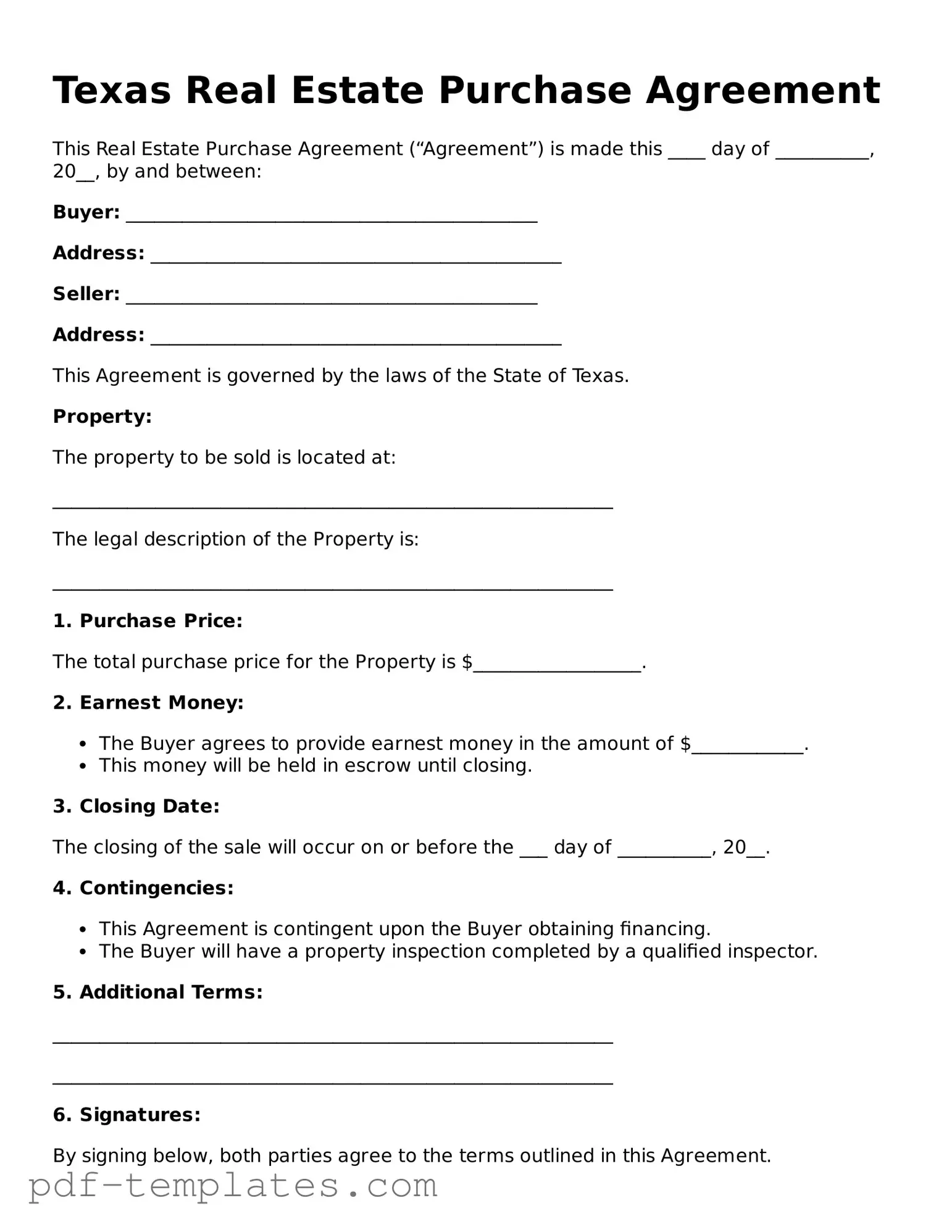

Official Real Estate Purchase Agreement Template for Texas State

The Texas Real Estate Purchase Agreement form serves as a crucial document in the real estate transaction process, outlining the terms and conditions under which a property is bought and sold. This form includes essential details such as the names of the buyer and seller, a description of the property, and the agreed-upon purchase price. It also addresses important contingencies, such as financing and inspection requirements, ensuring that both parties are protected throughout the transaction. The agreement specifies the closing date and any earnest money deposits, which demonstrate the buyer's commitment to the purchase. Additionally, it may outline the responsibilities for repairs, property taxes, and other obligations that arise before the sale is finalized. By clearly delineating the rights and responsibilities of each party, the Texas Real Estate Purchase Agreement helps to facilitate a smoother transaction while minimizing potential disputes. Understanding the components of this form is essential for anyone involved in real estate transactions in Texas, whether they are buyers, sellers, or real estate professionals.

Misconceptions

Understanding the Texas Real Estate Purchase Agreement form is crucial for anyone involved in a real estate transaction in Texas. However, several misconceptions can lead to confusion. Here are ten common misconceptions about this important document.

- The form is the same for every transaction. Each real estate transaction is unique, and the Texas Real Estate Purchase Agreement can be customized to fit specific terms and conditions.

- Only licensed real estate agents can use the form. While agents often handle these documents, buyers and sellers can also use the form independently, provided they understand its contents.

- Once signed, the agreement cannot be changed. Parties can negotiate changes to the agreement even after it has been signed, as long as all parties consent to the modifications.

- The agreement guarantees a sale. Signing the Texas Real Estate Purchase Agreement does not guarantee that the sale will go through. Contingencies and other factors can affect the outcome.

- It covers everything related to the property. The agreement addresses specific aspects of the transaction but may not include every detail, such as local zoning laws or homeowners' association rules.

- All contingencies must be waived for the agreement to be valid. Contingencies are often included to protect buyers and sellers. Waiving them is not a requirement for the agreement to be legally binding.

- The agreement is a legally binding contract from the start. While it can become legally binding once signed, certain conditions, such as contingencies, may need to be met first.

- There is no need for legal review. It is advisable for both parties to have the agreement reviewed by a legal professional to ensure their rights are protected.

- All terms are standard and cannot be negotiated. Many terms within the agreement can be negotiated, including price, closing date, and repairs.

- The form is only for residential properties. The Texas Real Estate Purchase Agreement can be used for various types of real estate transactions, including commercial properties.

Addressing these misconceptions can help ensure that all parties involved in a real estate transaction in Texas are better informed and prepared for the process ahead.

Texas Real Estate Purchase Agreement: Usage Instruction

Once the Texas Real Estate Purchase Agreement form is completed, it will be ready for submission to the relevant parties involved in the transaction. The following steps outline how to accurately fill out the form.

- Begin by entering the date of the agreement at the top of the form.

- Fill in the names of the buyer(s) and seller(s) in the designated sections.

- Provide the property address, including city, state, and zip code.

- Specify the purchase price in the appropriate field.

- Indicate the amount of earnest money to be deposited and the method of payment.

- List any financing details, including the type of loan if applicable.

- Fill out the closing date, specifying the expected date for the transaction to be finalized.

- Include any contingencies, such as inspections or financing conditions, as needed.

- Sign and date the agreement in the spaces provided for both the buyer(s) and seller(s).

- Ensure that all parties receive a copy of the signed agreement for their records.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a complete and accurate description of the property. This includes not specifying the correct address, legal description, or any relevant details that identify the property clearly.

-

Missing Buyer and Seller Information: Individuals often overlook the importance of including full names and contact information for both the buyer and seller. Omitting this information can lead to confusion and complications in the transaction process.

-

Incorrect Pricing and Terms: Another frequent error involves misrepresenting the purchase price or failing to include essential terms, such as the earnest money deposit or financing contingencies. Accurate financial details are crucial for a smooth transaction.

-

Neglecting to Address Contingencies: Buyers and sellers sometimes forget to specify contingencies, such as inspections or financing conditions. Without these clauses, either party may face unexpected challenges that could jeopardize the sale.

-

Failure to Sign and Date: Lastly, a simple yet significant mistake is neglecting to sign and date the agreement. An unsigned document is not legally binding, which can lead to disputes or misunderstandings later on.

PDF Features

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Real Estate Purchase Agreement is governed by the laws of the State of Texas. |

| Purpose | This form outlines the terms and conditions under which a buyer agrees to purchase real estate from a seller. |

| Parties Involved | The agreement includes the buyer, the seller, and may involve real estate agents representing both parties. |

| Essential Elements | Key components include the purchase price, property description, and closing date. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, which must be satisfied for the sale to proceed. |

| Signature Requirement | Both parties must sign the agreement for it to be legally binding. |

Dos and Don'ts

When filling out the Texas Real Estate Purchase Agreement form, it's essential to approach the process with care. Here’s a list of things you should and shouldn’t do to ensure everything goes smoothly.

- Do read the entire agreement carefully before filling it out.

- Do provide accurate information about the property and parties involved.

- Do include all necessary signatures and dates.

- Do review any contingencies you wish to include, like financing or inspections.

- Do consult with a real estate professional or attorney if you have questions.

- Don't leave any sections blank unless instructed to do so.

- Don't rush through the form; take your time to ensure accuracy.

- Don't use vague language; be specific in your terms and conditions.

- Don't forget to keep a copy of the signed agreement for your records.

Following these guidelines will help you navigate the form with confidence and clarity. Remember, attention to detail can make a significant difference in the outcome of your real estate transaction.

Similar forms

The Texas Real Estate Purchase Agreement is similar to the Residential Purchase Agreement commonly used in many states. Both documents outline the terms of a real estate transaction, including the purchase price, financing details, and contingencies. They provide a structured format for buyers and sellers to agree upon, ensuring that essential elements such as property description and closing date are clearly stated. This helps to prevent misunderstandings and provides a legal framework for the transaction.

Another document that shares similarities is the Commercial Purchase Agreement. Like its residential counterpart, this document details the terms of a sale but is tailored for commercial properties. It addresses unique considerations such as zoning laws, lease agreements, and business operations. Both agreements serve the same fundamental purpose: to formalize the sale and protect the interests of both parties involved.

The Offer to Purchase form is also comparable to the Texas Real Estate Purchase Agreement. This document is often used as a preliminary step in the buying process, where a buyer expresses interest in a property and outlines their proposed terms. While the Offer to Purchase may lead to a more formal agreement, it shares the same foundational elements, such as price and conditions, that will eventually be included in the final purchase agreement.

The Lease Purchase Agreement is another document that bears resemblance to the Texas Real Estate Purchase Agreement. This agreement allows a tenant to lease a property with the option to buy it later. It combines elements of both leasing and purchasing, outlining the terms of the lease while also detailing the conditions under which the tenant can purchase the property. Both documents require clarity on terms and conditions to protect the rights of both parties.

The Land Contract, or Contract for Deed, is similar in that it allows for the purchase of property over time. In this arrangement, the buyer makes payments directly to the seller, who retains legal title until the full purchase price is paid. This document outlines payment terms, interest rates, and what happens if the buyer defaults, paralleling the Texas Real Estate Purchase Agreement in its goal of establishing clear expectations between buyer and seller.

The Exclusive Right to Sell Agreement is another related document, particularly relevant for real estate agents. This agreement gives an agent the exclusive right to sell a property, detailing the commission structure and the duration of the agreement. While it serves a different purpose than a purchase agreement, both documents are critical in the real estate transaction process and emphasize the importance of clear communication and understanding between parties.

The Seller Financing Agreement is also comparable, as it outlines the terms under which a seller provides financing to the buyer. This document details payment schedules, interest rates, and consequences of default. Like the Texas Real Estate Purchase Agreement, it seeks to protect the interests of both parties and ensures that all terms are clearly articulated to avoid future disputes.

The Short Sale Agreement is another document that shares similarities with the Texas Real Estate Purchase Agreement. This type of agreement occurs when a property is sold for less than the amount owed on the mortgage. It requires the lender's approval and outlines the terms of the sale, including how the proceeds will be distributed. Both agreements aim to provide clarity and protect the rights of all parties involved in a complex transaction.

Lastly, the Quitclaim Deed, while primarily a transfer document, is similar in that it facilitates the transfer of property ownership. This document is often used in situations where the seller may not have clear title or when the parties have a close relationship, such as family members. While it does not detail the terms of a sale like the Texas Real Estate Purchase Agreement, it is still an essential document in the realm of real estate transactions, emphasizing the need for clear and documented agreements in property transfers.

Check out Popular Real Estate Purchase Agreement Forms for Different States

Generic Home Purchase Agreement - Buyers may specify desired appraisals in the agreement.

Property Purchase Agreement Format - The agreement offers legal protection by creating a binding commitment once signed.