Official Quitclaim Deed Template for Texas State

The Texas Quitclaim Deed form serves as a vital legal instrument for transferring property ownership in the state of Texas. This form allows an individual, known as the grantor, to relinquish any claim they may have to a property, thereby enabling another party, the grantee, to assume ownership without guaranteeing the title's validity. It is important to note that a quitclaim deed does not provide the same level of protection as a warranty deed, as it makes no promises regarding the property’s title status. The form typically includes essential details such as the names of both the grantor and grantee, a description of the property being transferred, and the date of the transfer. Additionally, it must be signed in front of a notary public to ensure its legality. Understanding the nuances of the Texas Quitclaim Deed is crucial for anyone involved in property transactions, whether for personal or business purposes, as it can significantly impact future ownership rights and responsibilities.

Misconceptions

When it comes to the Texas Quitclaim Deed, several misconceptions can lead to confusion for those looking to transfer property. Here are four common misunderstandings:

- A Quitclaim Deed Transfers Ownership Completely. Many people believe that a quitclaim deed transfers full ownership of a property. In reality, it only conveys whatever interest the grantor has in the property. If the grantor has no legal claim, the recipient receives nothing.

- A Quitclaim Deed Provides a Guarantee of Title. Another misconception is that a quitclaim deed guarantees a clear title. This is not the case. Unlike a warranty deed, a quitclaim deed does not come with any warranties or guarantees about the property’s title. It’s essential to conduct a title search to ensure there are no liens or claims against the property.

- Quitclaim Deeds Are Only for Family Transfers. While it’s true that many people use quitclaim deeds for transferring property among family members, they can also be used in various situations. This includes transferring property during a divorce, clearing up title issues, or even for business purposes.

- Quitclaim Deeds Are Irreversible. Some individuals think that once a quitclaim deed is executed, it cannot be undone. Although it can be challenging to reverse a property transfer, it is possible to create a new deed to transfer the property back. However, this process can involve legal complexities, so consulting with a professional is advisable.

Understanding these misconceptions can help individuals make informed decisions when dealing with property transfers in Texas.

Texas Quitclaim Deed: Usage Instruction

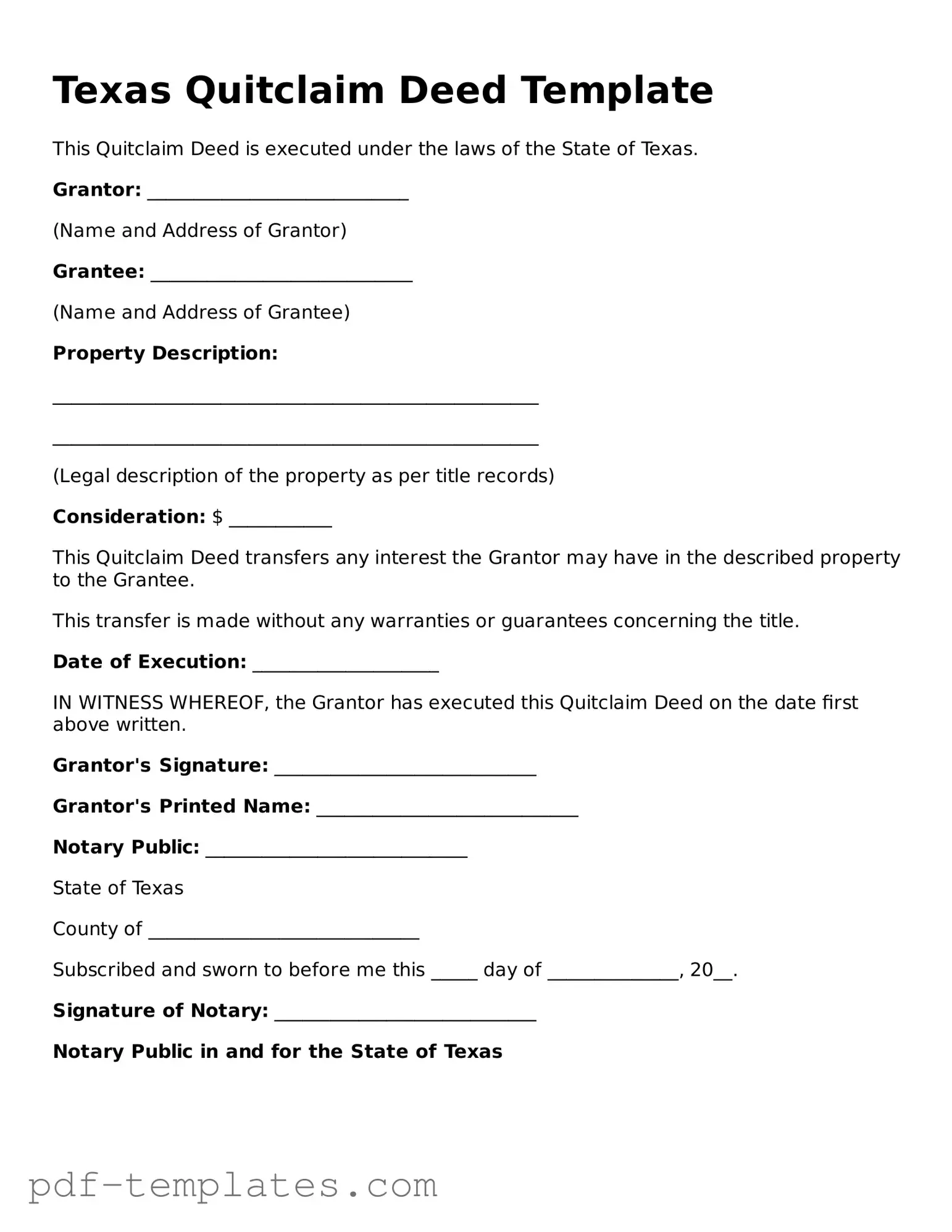

Once you have your Texas Quitclaim Deed form ready, it’s important to fill it out accurately to ensure a smooth transfer of property. Take your time with each section, and don’t hesitate to ask for help if you need it. After completing the form, you will need to sign it in front of a notary public before filing it with the appropriate county office.

- Obtain the Form: Download the Texas Quitclaim Deed form from a reliable source or obtain a physical copy from your local county clerk's office.

- Fill in Grantor Information: Write the full name and address of the person transferring the property (the grantor).

- Fill in Grantee Information: Write the full name and address of the person receiving the property (the grantee).

- Describe the Property: Provide a detailed description of the property being transferred, including the address and any legal descriptions if available.

- Include Consideration: State the amount of money or value exchanged for the property, or note "for love and affection" if no money is involved.

- Sign the Form: The grantor must sign the form in front of a notary public to validate the document.

- Notarization: Ensure that the notary public signs and stamps the form, confirming that the signature is legitimate.

- File the Deed: Take the completed and notarized Quitclaim Deed to the county clerk’s office where the property is located to file it officially.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to accurately describe the property. Ensure that the legal description matches what is recorded in the county records.

-

Missing Signatures: All parties involved must sign the deed. Omitting a signature can render the document invalid.

-

Not Notarizing the Document: A quitclaim deed typically requires notarization. Without a notary's acknowledgment, the deed may not be legally binding.

-

Incorrect Grantee Information: Mistakes in the name or address of the grantee can lead to complications. Double-check this information for accuracy.

-

Using the Wrong Form: Ensure that you are using the correct version of the quitclaim deed for Texas. Different states may have varying requirements.

-

Failing to Record the Deed: After filling out the form, it is crucial to record it with the appropriate county office. Neglecting this step can lead to disputes over ownership.

-

Not Including Consideration: While a quitclaim deed may not always require a monetary amount, it’s important to specify any consideration exchanged, even if it is nominal.

-

Ignoring Local Laws: Each county may have specific regulations regarding quitclaim deeds. Familiarize yourself with local requirements to avoid issues.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Texas Quitclaim Deed is a legal document used to transfer ownership of real estate without guaranteeing the title's validity. |

| Governing Law | The Texas Quitclaim Deed is governed by the Texas Property Code, specifically Title 1, Chapter 5. |

| Use Cases | This form is often used in situations like divorce settlements, transferring property between family members, or clearing up title issues. |

| Consideration | While a quitclaim deed can be executed for a nominal fee, no monetary consideration is required for the transfer to be valid. |

| Notarization | The signature of the grantor must be notarized for the quitclaim deed to be legally effective. |

| Recording | To protect the interests of the new owner, the deed should be recorded with the county clerk's office where the property is located. |

| Limitations | A quitclaim deed does not provide any warranties or guarantees regarding the property title, which means the buyer assumes all risks. |

Dos and Don'ts

When filling out the Texas Quitclaim Deed form, there are important practices to follow. Here are six things you should and shouldn't do:

- Do ensure all names are spelled correctly and match the names on the property title.

- Do provide a complete legal description of the property being transferred.

- Do sign the form in front of a notary public to validate the deed.

- Do check for any local requirements that may affect the filing process.

- Don't leave any sections of the form blank; complete all required fields.

- Don't forget to file the completed deed with the county clerk's office after signing.

Similar forms

A warranty deed is a document that provides a guarantee from the seller to the buyer that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, which transfers whatever interest the seller may have without any guarantees, a warranty deed offers protection against future claims. This means that if any issues arise regarding the property’s title, the seller is legally responsible for resolving them. Buyers often prefer warranty deeds because of this added layer of security.

A special warranty deed is similar to a warranty deed but with a key difference. It guarantees that the seller has not encumbered the title during their ownership of the property. However, it does not protect against claims that may have arisen before the seller acquired the property. This type of deed is often used in commercial real estate transactions where the seller wants to limit their liability for past issues while still providing some assurance to the buyer.

A bargain and sale deed transfers ownership of property but does not provide any warranties against encumbrances. It implies that the seller has the right to sell the property but does not guarantee that the title is free from defects. This type of deed is often used in foreclosure sales or tax sales, where the seller may not have a complete history of the property’s title.

A grant deed is another document that conveys property ownership, offering some assurances to the buyer. It guarantees that the seller has not sold the property to anyone else and that the property is free from undisclosed encumbrances. While it does not provide as much protection as a warranty deed, it still offers more assurance than a quitclaim deed, making it a popular choice for residential transactions.

A deed of trust, while primarily a security instrument, shares similarities with a quitclaim deed in that it transfers an interest in property. In a deed of trust, the borrower conveys the property to a trustee to secure a loan. If the borrower defaults, the trustee can sell the property to satisfy the debt. Unlike a quitclaim deed, a deed of trust involves a lender and is used to protect their interest in the property.

An easement deed grants a specific right to use a portion of someone else's property for a particular purpose, such as access to a road or utility installation. While it does not transfer ownership, it shares the quitclaim deed's characteristic of transferring interests in property without guaranteeing ownership. Easement deeds can be temporary or permanent, depending on the agreement between the parties involved.

A lease agreement is a contract that allows one party to use another party's property for a specified period in exchange for payment. While not a deed, it shares the concept of transferring rights related to property. Unlike a quitclaim deed, which transfers ownership, a lease maintains the original owner's title while granting specific usage rights to the tenant.

A life estate deed allows an individual to retain ownership of a property for their lifetime, after which the property passes to another party. This type of deed is similar to a quitclaim deed in that it transfers an interest in property, but it also includes the stipulation of the life tenant's rights. The life estate deed is often used in estate planning to avoid probate.

A mineral rights deed conveys ownership of the minerals beneath a property. This deed is similar to a quitclaim deed in that it can transfer whatever interest the seller has without warranties. Mineral rights can be sold or leased separately from the surface rights, and this type of deed is commonly used in the oil and gas industry.

A tax deed is issued when a property is sold at a tax foreclosure auction due to unpaid taxes. Like a quitclaim deed, a tax deed transfers ownership without guarantees about the title. Buyers of tax deeds should be aware that they may inherit existing liens or other issues, making this type of deed riskier than a traditional sale.

Check out Popular Quitclaim Deed Forms for Different States

Florida Quit Claim Deed Rules - Unlike a warranty deed, a quitclaim deed does not provide the buyer with legal protections regarding the title.

How to File a Quitclaim Deed in Virginia - Can resolve issues related to inherited property among heirs.

Quitclaim Deed Form Pennsylvania - The form can also be used to add or remove names from a property title, simplifying ownership changes.