Official Promissory Note Template for Texas State

The Texas Promissory Note form serves as a crucial document in lending and borrowing transactions, providing a clear outline of the terms agreed upon by both parties. This legally binding instrument details the amount borrowed, the interest rate, and the repayment schedule, ensuring that all aspects of the loan are transparent. Additionally, it specifies the rights and obligations of both the lender and the borrower, including any penalties for late payments or default. By utilizing this form, individuals and businesses can protect their interests while fostering trust in financial agreements. Understanding the key components of the Texas Promissory Note is essential for anyone looking to engage in a loan transaction, as it not only formalizes the agreement but also provides a framework for resolving disputes should they arise.

Misconceptions

Understanding the Texas Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

-

The Texas Promissory Note is the same as a loan agreement.

This is not true. A promissory note is a simpler document that outlines the borrower's promise to repay a specific amount. A loan agreement often includes additional terms and conditions.

-

All promissory notes must be notarized.

While notarization can add a layer of authenticity, it is not always required for a promissory note to be legally binding in Texas.

-

A promissory note must be in writing to be enforceable.

This is a common belief, but oral agreements can also be enforceable. However, having a written note is highly recommended for clarity and proof.

-

Interest rates on promissory notes are always fixed.

Interest rates can be fixed or variable, depending on what the parties agree upon. It is essential to specify the terms clearly in the note.

-

The Texas Promissory Note is only for personal loans.

This misconception overlooks the fact that promissory notes can be used for business loans, real estate transactions, and more.

-

Once signed, a promissory note cannot be changed.

In reality, parties can modify the terms of a promissory note, but both parties must agree to the changes and document them properly.

-

A promissory note guarantees repayment.

While it is a legal promise to repay, it does not guarantee that the borrower will fulfill that promise. If the borrower defaults, the lender may need to take further legal action.

Being aware of these misconceptions can help both lenders and borrowers navigate their financial agreements more effectively. Always consider consulting a legal expert when drafting or signing a promissory note to ensure all terms are clear and enforceable.

Texas Promissory Note: Usage Instruction

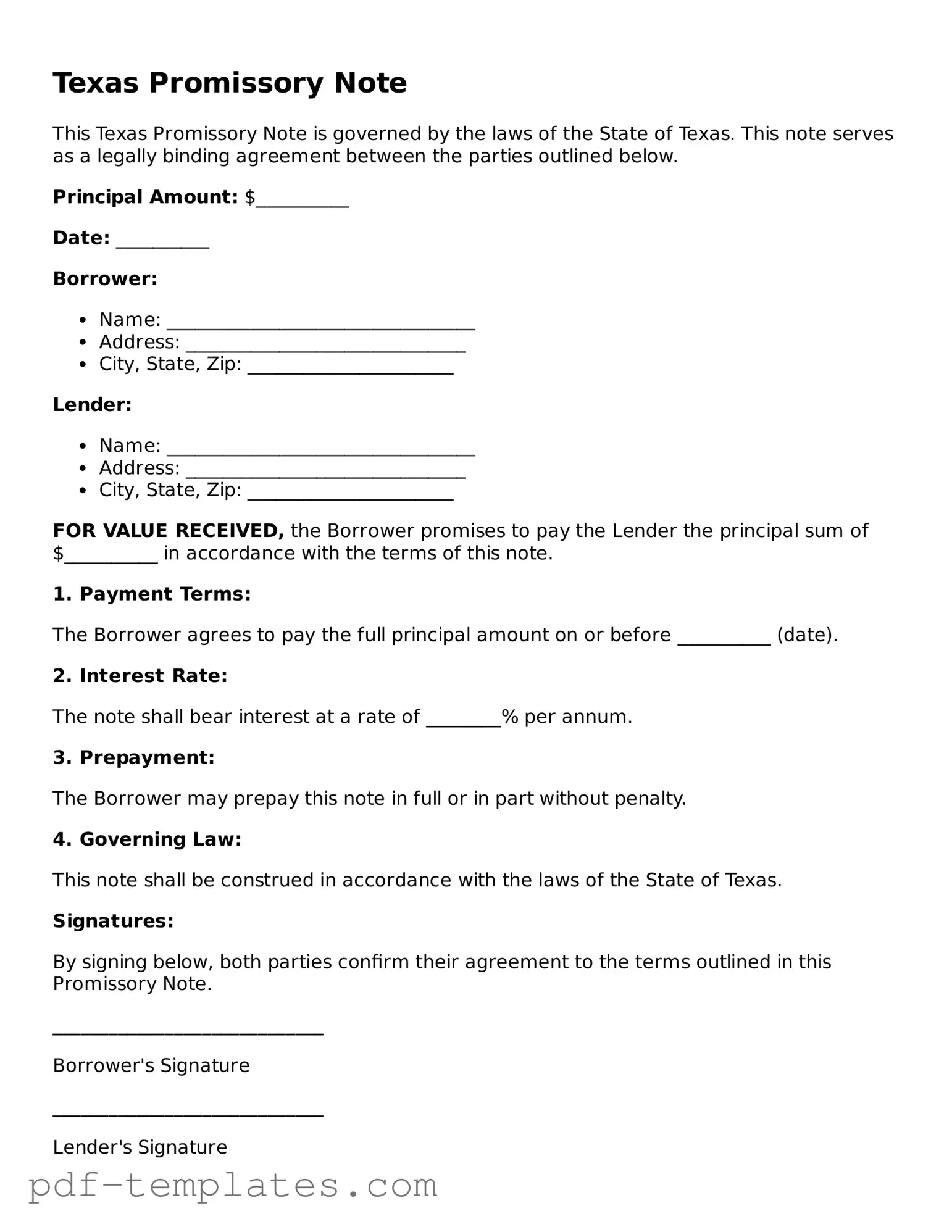

Once you have your Texas Promissory Note form ready, it's time to fill it out accurately. This document serves as a written promise to repay a loan under specified terms. Follow these steps carefully to ensure that all necessary information is included and correct.

- Begin by entering the date at the top of the form. This is the date when the note is being created.

- Next, write the name and address of the borrower. This identifies the individual or entity responsible for repaying the loan.

- Then, fill in the name and address of the lender. This is the person or organization providing the loan.

- In the next section, specify the principal amount of the loan. This is the total amount borrowed, not including interest.

- Indicate the interest rate. Make sure to specify whether it is a fixed or variable rate.

- Detail the repayment schedule. Include how often payments will be made (e.g., monthly, quarterly) and the duration of the loan.

- Provide information on any late fees or penalties for missed payments. This helps clarify the consequences of not adhering to the repayment schedule.

- Sign and date the form at the bottom. The borrower must sign to acknowledge the terms outlined in the note.

- If applicable, have a witness or notary public sign the document to add an extra layer of validity.

After completing the form, ensure that both the borrower and lender keep copies for their records. This will help in tracking the loan and maintaining clear communication throughout the repayment period.

Common mistakes

-

Incorrect Borrower Information: Many individuals fail to provide accurate details about the borrower. This includes the full name, address, and contact information. Omitting or misspelling any of these can lead to confusion later.

-

Missing Lender Information: Just as with the borrower, it is crucial to include complete information about the lender. Ensure that the lender's name and address are clearly stated.

-

Unclear Loan Amount: Some people write the loan amount in words but neglect to include it in numbers, or vice versa. Both formats should be provided to avoid any misinterpretation.

-

Failure to Specify Interest Rate: Not indicating the interest rate can lead to disputes later on. Clearly state whether the loan is interest-free or specify the applicable rate.

-

Omitting Repayment Terms: Individuals often forget to outline how and when the loan will be repaid. Include details about the payment schedule, due dates, and any grace periods.

-

Ignoring Default Conditions: Many do not specify what constitutes a default. It’s important to outline the consequences if the borrower fails to make payments on time.

-

Not Including Signatures: A common mistake is to leave out the necessary signatures. Both the borrower and lender must sign the document for it to be legally binding.

-

Neglecting to Date the Document: Failing to include the date on which the note is signed can create issues regarding the timeline of the agreement. Always ensure the date is clearly marked.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a certain time or on demand. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, specifically Sections 3.104 to 3.119. |

| Essential Elements | To be valid, the note must include the principal amount, interest rate (if applicable), payment terms, and signatures of the parties involved. |

| Types of Notes | There are various types of promissory notes, including secured and unsecured notes, each with different implications for the lender and borrower. |

| Enforceability | A properly executed Texas Promissory Note can be legally enforced in court, provided it meets all necessary legal requirements. |

Dos and Don'ts

When filling out the Texas Promissory Note form, it is important to approach the process with care. Below is a list of things to consider, both what to do and what to avoid.

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information about both parties involved.

- Do clearly state the amount being borrowed and the interest rate, if applicable.

- Do specify the repayment terms, including due dates and payment methods.

- Do sign and date the form in the appropriate sections.

- Don't leave any sections blank unless specifically instructed to do so.

- Don't use vague language; be clear and precise in your wording.

- Don't forget to keep a copy of the signed note for your records.

- Don't rush through the process; take your time to ensure accuracy.

Similar forms

A loan agreement is a formal document that outlines the terms and conditions of a loan between a borrower and a lender. Like a Texas Promissory Note, it specifies the amount borrowed, the interest rate, repayment schedule, and consequences of default. However, a loan agreement can be more detailed, often including clauses that address collateral, warranties, and the rights of both parties, making it a comprehensive contract beyond just the promise to repay.

A mortgage is another document closely related to a promissory note. In a mortgage, the borrower agrees to repay a loan used to purchase property, while the property itself serves as collateral. The promissory note in this case represents the borrower's promise to repay the loan. The mortgage document secures that promise, allowing the lender to take possession of the property if the borrower fails to pay.

A personal guarantee is a document where an individual agrees to be responsible for the debt of a business or another individual. Similar to a promissory note, it signifies a commitment to repay a loan. However, a personal guarantee can extend beyond just the specific loan amount, potentially holding the guarantor liable for the entire debt if the primary borrower defaults.

An installment agreement is a payment plan that allows a borrower to pay back a loan in smaller, manageable amounts over time. Like a promissory note, it outlines the total amount owed and the payment schedule. The key difference lies in the flexibility of payments, as installment agreements may allow for adjustments based on the borrower’s financial situation.

A lease agreement, particularly in the context of leasing property or equipment, shares similarities with a promissory note in that it outlines payment obligations. Both documents detail the terms of payment, including the amount and due dates. However, a lease agreement typically includes additional terms related to the use of the property or equipment, such as maintenance responsibilities and duration of the lease.

A credit agreement is a broader document that outlines the terms under which credit is extended to a borrower. Similar to a promissory note, it includes details about the amount of credit, interest rates, and repayment terms. However, a credit agreement often encompasses various forms of credit, such as lines of credit or revolving credit, making it more complex than a simple promise to pay.

A security agreement is a document that grants a lender a security interest in specific assets of the borrower. Like a promissory note, it establishes the borrower’s obligation to repay a loan. However, a security agreement goes further by detailing the collateral that secures the loan, providing the lender with a claim to specific assets if the borrower defaults.

For those navigating the complexities of medical treatment following workplace injuries in California, understanding the necessary documentation is crucial. The All California Forms site provides resources and access to important forms, such as the Request for Authorization for Medical Treatment, which is essential for formalizing requests for medical services as mandated by the Division of Workers’ Compensation system.

A forbearance agreement is a temporary arrangement between a lender and borrower that allows the borrower to pause or reduce payments for a specified time. This document can resemble a promissory note in that it acknowledges the debt and outlines repayment terms. The key difference lies in its focus on providing relief to the borrower during financial hardship, rather than simply detailing the original loan terms.

A deed of trust is similar to a promissory note in that it involves a loan secured by real estate. In this document, the borrower conveys the property title to a trustee, who holds it as collateral for the loan. While the promissory note represents the borrower's promise to repay, the deed of trust provides a legal framework for the lender to reclaim the property if the borrower fails to meet their obligations.

A loan modification agreement is a document that changes the original terms of a loan, often to make repayment more manageable for the borrower. Like a promissory note, it details the obligations of the borrower. However, it focuses on adjusting existing terms, such as interest rates or payment amounts, rather than establishing a new loan or obligation.

Check out Popular Promissory Note Forms for Different States

New York Promissory Note - The agreement may allow for alternative payment methods, including cash, check, or electronic transfer.

Simple Promissory Note Template California - Lenders can use a promissory note to protect their rights and claim against the borrower if repayments are not made.

To obtain a blank version of the USCIS I-9 form, you can visit https://documentonline.org/blank-uscis-i-9, which provides an easily accessible resource for employers to ensure compliance with employment verification standards.

Virginia Promissory Note - This form can be customized to suit the needs of both the borrower and lender.