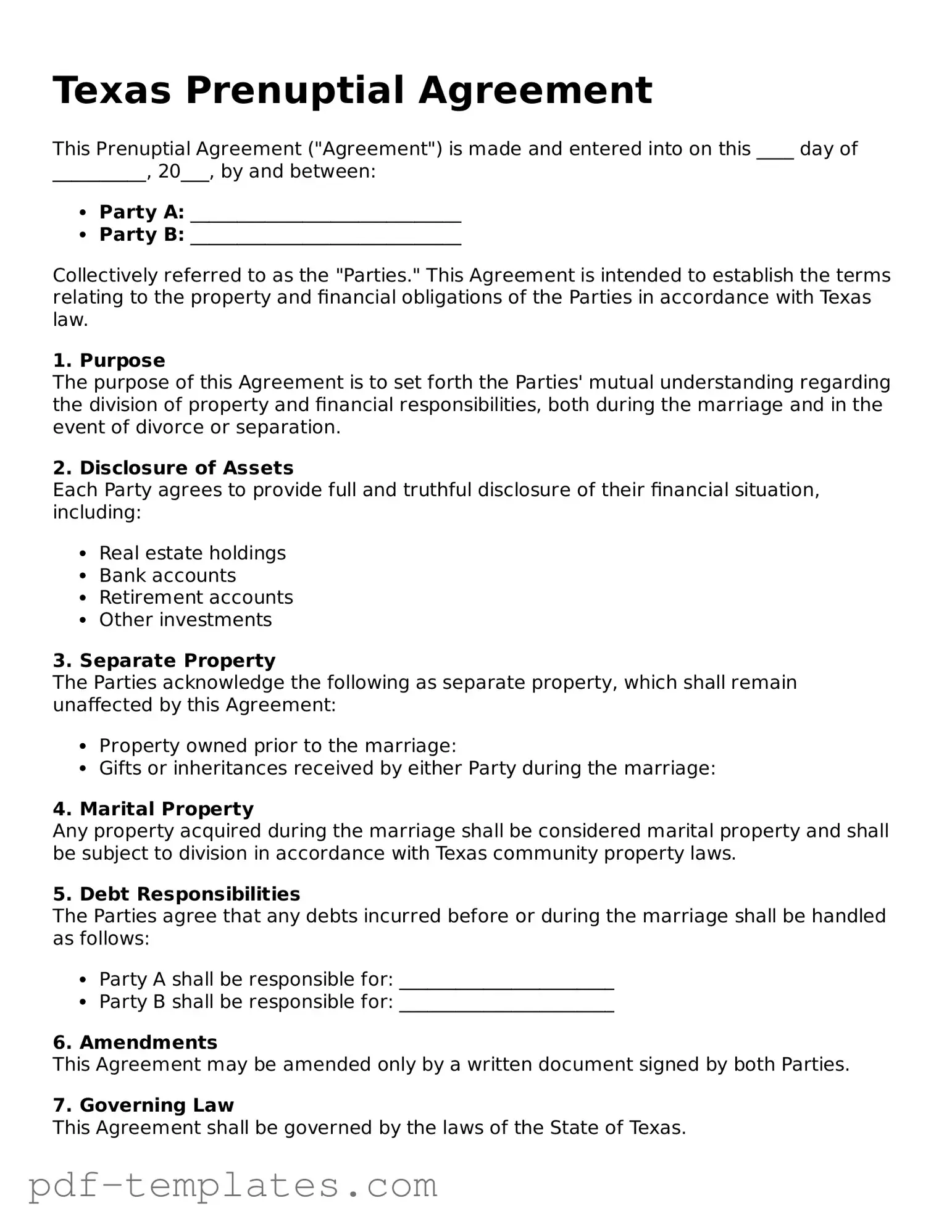

Official Prenuptial Agreement Template for Texas State

When couples in Texas consider tying the knot, discussions about financial matters and asset protection often arise. A Texas Prenuptial Agreement can serve as a vital tool in these conversations, allowing both parties to outline their rights and responsibilities in the event of a divorce or separation. This legal document provides clarity on how assets will be divided, addresses potential spousal support, and can even specify how debts will be managed. It is essential for both partners to fully disclose their financial situations, ensuring that the agreement is fair and enforceable. Additionally, the form must be signed voluntarily and ideally well in advance of the wedding date to avoid any claims of coercion. By taking the time to draft a comprehensive prenuptial agreement, couples can foster open communication about finances and lay a strong foundation for their marriage, all while safeguarding their individual interests.

Misconceptions

-

Misconception 1: Prenuptial agreements are only for wealthy individuals.

This is a common belief, but prenuptial agreements can benefit anyone entering a marriage. They help clarify financial expectations and protect both parties' interests, regardless of income level.

-

Misconception 2: Prenuptial agreements are only enforceable if signed before the wedding.

While it is ideal to finalize a prenuptial agreement before the wedding, some courts may still enforce agreements signed shortly after the ceremony, provided both parties consented and there was no coercion involved.

-

Misconception 3: A prenuptial agreement can cover any topic.

Not all topics are appropriate for a prenuptial agreement. Courts typically enforce agreements that address property division and financial responsibilities, but they do not uphold clauses related to child custody or support.

-

Misconception 4: Prenuptial agreements are unromantic and suggest distrust.

Many view prenuptial agreements as a practical tool rather than a sign of distrust. They can foster open communication about finances and expectations, which can strengthen a relationship.

Texas Prenuptial Agreement: Usage Instruction

Filling out the Texas Prenuptial Agreement form is an important step for couples planning to marry. This process ensures that both parties clearly understand their rights and responsibilities regarding their assets and debts. Follow these steps carefully to complete the form accurately.

- Begin by gathering personal information. Collect full names, addresses, and dates of birth for both parties.

- Identify the date of the marriage. This is essential for the agreement to be valid.

- List all assets and liabilities. Clearly outline what each party owns and owes before the marriage.

- Discuss and agree on the division of property. Decide how assets will be handled in case of divorce or separation.

- Include any provisions for spousal support. Determine if either party will receive support and under what conditions.

- Review the completed form together. Ensure both parties understand and agree to all terms.

- Sign the document in front of a notary public. This step is crucial for the agreement to be legally binding.

After completing the form, each party should keep a signed copy for their records. It’s wise to consult with a legal professional to ensure everything is in order and complies with Texas law.

Common mistakes

-

Inadequate Disclosure of Assets: Failing to fully disclose all assets and liabilities can lead to disputes later. Transparency is crucial for a valid agreement.

-

Not Seeking Legal Advice: Many individuals skip consulting with a legal professional. Understanding the implications of a prenuptial agreement is essential.

-

Using Vague Language: Ambiguities in the language can create confusion. Clear and specific terms help prevent misunderstandings.

-

Not Considering Future Changes: Failing to account for potential changes in circumstances, such as children or career shifts, can make the agreement less effective.

-

Ignoring State Laws: Each state has different requirements. Not adhering to Texas laws regarding prenuptial agreements can render the document unenforceable.

-

Signing Under Pressure: Coercion or signing without adequate time to review the document can lead to claims of duress. Both parties should feel comfortable with the agreement.

-

Failing to Update the Agreement: Life changes, such as marriage or divorce, may necessitate updates. Regularly reviewing the agreement ensures it remains relevant.

-

Not Including a Dispute Resolution Clause: Omitting a method for resolving disputes can lead to complications. Including mediation or arbitration can simplify future disagreements.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement in Texas is a legal document that outlines the division of assets and financial responsibilities between spouses in the event of divorce or separation. |

| Governing Law | Texas prenuptial agreements are governed by the Texas Family Code, specifically Chapter 4. |

| Requirements | For a prenuptial agreement to be valid in Texas, it must be in writing and signed by both parties before marriage. |

| Enforceability | The agreement is enforceable unless it is proven to be unconscionable or if one party did not voluntarily sign it. |

| Disclosure | Full disclosure of assets and liabilities is not strictly required, but it is highly recommended to ensure fairness and transparency. |

Dos and Don'ts

When filling out the Texas Prenuptial Agreement form, it is essential to approach the process with care. The following list outlines ten important dos and don’ts to consider.

- Do communicate openly with your partner about your financial expectations.

- Do fully disclose all assets and debts to ensure transparency.

- Do consult with a legal professional to understand the implications of the agreement.

- Do ensure both parties sign the document voluntarily and without pressure.

- Do keep a copy of the signed agreement for your records.

- Don't rush through the process; take the time needed to discuss all terms.

- Don't omit any significant assets or liabilities from the disclosure.

- Don't use vague language; be clear and specific in all terms outlined.

- Don't ignore state laws that may affect the validity of the agreement.

- Don't forget to review and update the agreement if circumstances change.

Similar forms

A Cohabitation Agreement is similar to a prenuptial agreement in that it outlines the rights and responsibilities of two individuals living together. While a prenuptial agreement is typically used before marriage, a cohabitation agreement is designed for couples who choose to live together without formalizing their relationship through marriage. Both documents can address issues such as property division, financial responsibilities, and support obligations, helping to clarify expectations and protect both parties in the event of a separation.

A Postnuptial Agreement serves a similar purpose to a prenuptial agreement but is created after a couple is already married. Like a prenuptial agreement, a postnuptial agreement can detail how assets will be divided in case of divorce or separation. It may also address financial responsibilities and support arrangements. Couples often use this document to clarify financial matters that may have arisen during their marriage, providing peace of mind and reducing potential conflicts.

A Marriage Settlement Agreement is closely related to a prenuptial agreement, as it is often used to finalize the terms of a divorce. This document outlines how assets and debts will be divided, as well as any arrangements for child custody and support. While a prenuptial agreement is created before marriage, a marriage settlement agreement is negotiated after a couple has decided to end their marriage. Both documents aim to protect the interests of each party and provide clarity regarding financial matters.

A Trust Agreement can also be compared to a prenuptial agreement, especially when it comes to protecting assets. A trust agreement allows individuals to place their assets into a trust, which can then be managed for their benefit or the benefit of their heirs. Similar to a prenuptial agreement, a trust agreement can help ensure that specific assets are safeguarded from division during a divorce, providing a level of security for the individuals involved.

A Will is another important document that can be likened to a prenuptial agreement. While a prenuptial agreement focuses on financial matters during a marriage or partnership, a will addresses how an individual's assets will be distributed upon their death. Both documents serve to protect the interests of the individual and their loved ones, ensuring that their wishes are respected regarding asset distribution and minimizing potential disputes among heirs.

A Business Partnership Agreement shares similarities with a prenuptial agreement in the sense that it outlines the terms of a partnership between two or more individuals. This document can specify how profits and losses will be shared, the roles of each partner, and what happens if one partner decides to leave the business. Just as a prenuptial agreement protects personal assets, a business partnership agreement protects the interests of the partners involved in the business venture.

The Request for Authorization for Medical Treatment (DWC Form RFA) serves as an essential tool in navigating the complexities of workers' compensation, ensuring that employees receive the necessary medical support after an occupational injury or illness. By requiring the submission of relevant medical documentation, the form helps streamline the approval process for treatment, facilitating timely assistance for those affected. To explore more resources related to this form, including various guidelines and templates, please visit All California Forms.

A Child Custody Agreement is another document that can be compared to a prenuptial agreement. While the latter focuses on financial matters, a child custody agreement addresses the care and custody of children in the event of a separation or divorce. Both documents aim to provide clarity and structure, helping to minimize disputes and ensure that the rights and responsibilities of each party are clearly defined.

A Living Trust can be seen as a counterpart to a prenuptial agreement, particularly regarding asset protection. A living trust allows individuals to manage their assets during their lifetime and dictate how those assets will be distributed after their death. Like a prenuptial agreement, a living trust can help safeguard assets from potential claims during a divorce, ensuring that specific assets remain protected and are passed on according to the individual’s wishes.

Finally, a Non-Disclosure Agreement (NDA) can be related to a prenuptial agreement in terms of confidentiality. An NDA is often used to protect sensitive information shared between parties. In the context of a prenuptial agreement, confidentiality clauses may be included to protect the financial information and personal details of each party. Both documents emphasize the importance of privacy and trust in relationships, whether personal or professional.

Check out Popular Prenuptial Agreement Forms for Different States

Washington Prenuptial Contract - This form can clarify how joint ventures, such as home purchases, will be managed.

To ensure your educational plans are on track, consider utilizing the comprehensive Homeschool Letter of Intent that outlines your commitment to homeschooling. This vital form can be accessed by visiting Texas Homeschool Letter of Intent form, which serves as the official notice to the state and initiates your journey into homeschooling.

Virginia Prenuptial Contract - A prenuptial agreement can help establish trust between partners regarding finances.