Official Motor Vehicle Bill of Sale Template for Texas State

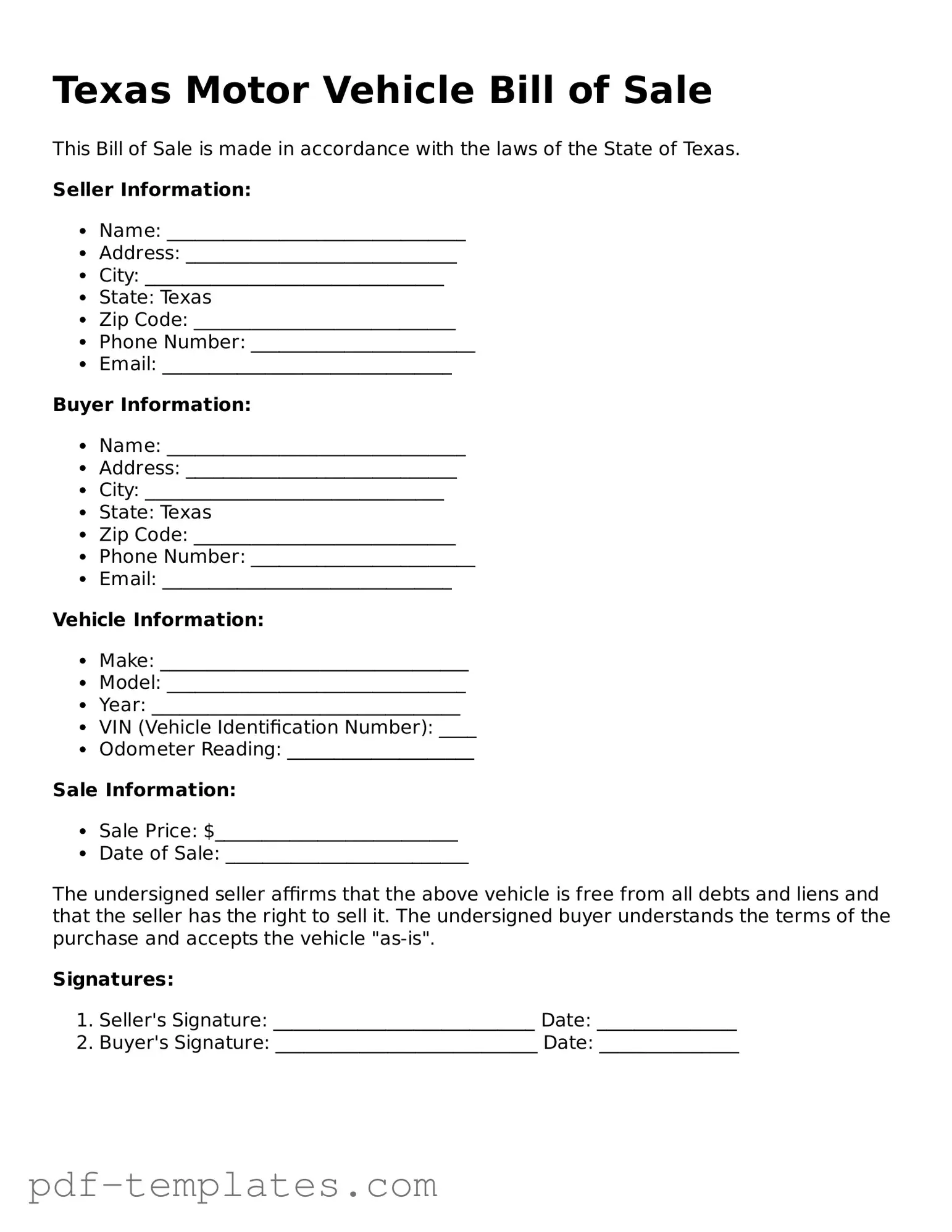

The Texas Motor Vehicle Bill of Sale form serves as a crucial document for anyone involved in the buying or selling of a vehicle in the state. This form captures essential information, such as the vehicle's make, model, year, and Vehicle Identification Number (VIN), ensuring that both parties have a clear record of the transaction. Additionally, it outlines the sale price and the date of the transaction, providing legal protection for both the buyer and seller. Signatures from both parties are required, confirming their agreement to the sale and the accuracy of the details provided. Furthermore, the form may also include information about any liens on the vehicle, which is vital for the buyer to know. By utilizing this form, individuals can facilitate a smooth transfer of ownership while adhering to Texas state laws, making it an indispensable tool in the vehicle sales process.

Misconceptions

When dealing with the Texas Motor Vehicle Bill of Sale form, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- It’s not a legally binding document. Many people think that a bill of sale is just a formality. In Texas, a properly completed bill of sale is a legal document that can help prove ownership and protect both the buyer and seller.

- Only the seller needs to sign it. Some believe that only the seller's signature is required. In fact, both the buyer and the seller should sign the bill of sale for it to be valid.

- A bill of sale is not needed for a gift. Some individuals think that if they are gifting a vehicle, a bill of sale is unnecessary. However, having a bill of sale can still provide proof of the transfer of ownership.

- It can be handwritten. While it’s true that a bill of sale can be handwritten, it’s often better to use a printed form. A typed or printed document is clearer and reduces the chances of errors.

- The form is only for private sales. Many assume that the bill of sale is only necessary for private transactions. However, it can also be used in dealer transactions or when trading vehicles.

- It’s not required for registration. Some people think that if they have the title, they don’t need a bill of sale for registration. In Texas, a bill of sale can be helpful for registration purposes, especially if the title is not available.

- All information is optional. There’s a misconception that all fields on the form are optional. Certain details, such as the vehicle identification number (VIN), are crucial for the document to be complete.

- It doesn’t need to be notarized. While notarization is not always required for a bill of sale in Texas, having it notarized can provide an extra layer of security and authenticity.

- It’s only for cars. Some believe that the bill of sale is only applicable to cars. In reality, it can be used for any motor vehicle, including trucks, motorcycles, and trailers.

Understanding these misconceptions can help ensure a smoother transaction when buying or selling a vehicle in Texas.

Texas Motor Vehicle Bill of Sale: Usage Instruction

After you have gathered the necessary information, you are ready to fill out the Texas Motor Vehicle Bill of Sale form. This document will serve as a record of the transaction between the buyer and seller. Accurate completion of the form is essential for both parties to ensure a smooth transfer of ownership.

- Start by entering the date of the sale at the top of the form.

- Provide the name and address of the seller. Make sure to include the full name and a complete address.

- Next, fill in the buyer's name and address, following the same format as the seller's information.

- Indicate the vehicle's details, including the make, model, year, and Vehicle Identification Number (VIN).

- Specify the sale price of the vehicle clearly. This should be the agreed amount between the buyer and seller.

- If applicable, include any trade-in information or notes about the condition of the vehicle.

- Both the seller and buyer should sign and date the form at the designated areas. This indicates agreement to the terms outlined in the document.

- Finally, make copies of the completed form for both parties' records.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details. This includes not only the vehicle identification number (VIN) but also the make, model, year, and odometer reading. Omitting any of this information can lead to complications in future ownership transfers.

-

Incorrect Signatures: It is essential for both the buyer and seller to sign the document. Some people mistakenly believe that only one signature is required. Both parties must sign to validate the transaction legally.

-

Failure to Date the Form: Neglecting to include the date of the transaction can cause confusion regarding when the sale occurred. This date is crucial for establishing the timeline of ownership and may affect tax obligations.

-

Not Notarizing the Document: While notarization is not always mandatory in Texas, many people overlook this step. Notarizing can provide an extra layer of security and authenticity, especially in disputes.

-

Misunderstanding the Sales Price: Some individuals either understate or overstate the sale price. This can lead to issues with tax assessments and may raise red flags during vehicle registration.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The Texas Motor Vehicle Bill of Sale is used to document the sale of a vehicle between a buyer and a seller. |

| Governing Law | This form is governed by Texas Transportation Code, Chapter 501. |

| Required Information | Both parties must provide their names, addresses, and signatures on the form. |

| Vehicle Details | The form requires specific details about the vehicle, including the make, model, year, and VIN (Vehicle Identification Number). |

| Sale Price | The sale price of the vehicle must be clearly stated on the bill of sale. |

| Notarization | Notarization is not required for the bill of sale in Texas, but it is recommended for added security. |

| Transfer of Ownership | The bill of sale serves as proof of ownership transfer and is necessary for the buyer to register the vehicle. |

| Tax Implications | Sales tax may be applicable based on the sale price, and the buyer is responsible for paying this tax when registering the vehicle. |

| Record Keeping | Both the buyer and seller should keep a copy of the bill of sale for their records. |

| Form Availability | The Texas Motor Vehicle Bill of Sale form can be obtained online or at local county tax offices. |

Dos and Don'ts

When filling out the Texas Motor Vehicle Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do provide accurate vehicle information, including the make, model, year, and VIN.

- Do include the full names and addresses of both the buyer and the seller.

- Do specify the sale price clearly, including any applicable taxes or fees.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed Bill of Sale for your records.

- Don't leave any sections blank; fill out all required fields.

- Don't use white-out or erase any information on the form.

- Don't falsify any information, as this can lead to legal issues.

- Don't forget to check for any additional requirements specific to your county.

Similar forms

The Texas Motor Vehicle Bill of Sale form is similar to a general Bill of Sale, which serves as a legal document that transfers ownership of personal property from one party to another. This document typically includes the names of the buyer and seller, a description of the item being sold, and the sale price. Like the Texas Motor Vehicle Bill of Sale, it provides proof of the transaction and protects both parties by clearly outlining the terms of the sale.

Another document that resembles the Texas Motor Vehicle Bill of Sale is the Vehicle Title. The title is an official document issued by the state that indicates ownership of a vehicle. When a vehicle is sold, the title must be transferred from the seller to the buyer. Both documents serve to establish ownership and include important details about the vehicle, such as its identification number and make.

The Purchase Agreement is also similar in nature. This document outlines the terms of the sale, including the price, payment methods, and any conditions that must be met before the sale is finalized. Like the Texas Motor Vehicle Bill of Sale, a Purchase Agreement protects both parties by ensuring that all terms are clearly stated and agreed upon before the transaction occurs.

A Lease Agreement shares similarities as well, particularly in situations where a vehicle is leased instead of sold. This document details the terms of the lease, including payment amounts, duration, and responsibilities of both the lessor and lessee. While it serves a different purpose than a bill of sale, it still establishes a legal relationship regarding the use of the vehicle.

The Odometer Disclosure Statement is another important document related to vehicle transactions. This form is required in many states, including Texas, to document the mileage on a vehicle at the time of sale. It helps prevent odometer fraud and is often included as part of the Motor Vehicle Bill of Sale, ensuring that the buyer is aware of the vehicle’s history.

Lastly, the Application for Title is closely related to the Texas Motor Vehicle Bill of Sale. After purchasing a vehicle, the buyer must apply for a new title in their name. This application typically requires the Bill of Sale as proof of purchase. Both documents work together to facilitate the transfer of ownership and ensure that the vehicle is properly registered with the state.

Check out Popular Motor Vehicle Bill of Sale Forms for Different States

Do You Need a Bill of Sale to Register a Car in Florida - May need to be notarized, depending on state laws, to bolster its legitimacy.

Vehicle Bill of Sale Template - This document is vital for proving ownership if the buyer wants to sell the vehicle later.

How to Sell a Car in Washington - This form captures essential details about the vehicle, including its make, model, and VIN.

Ca Dmv Statement of Facts - The Motor Vehicle Bill of Sale can support claims for lost or stolen vehicles.