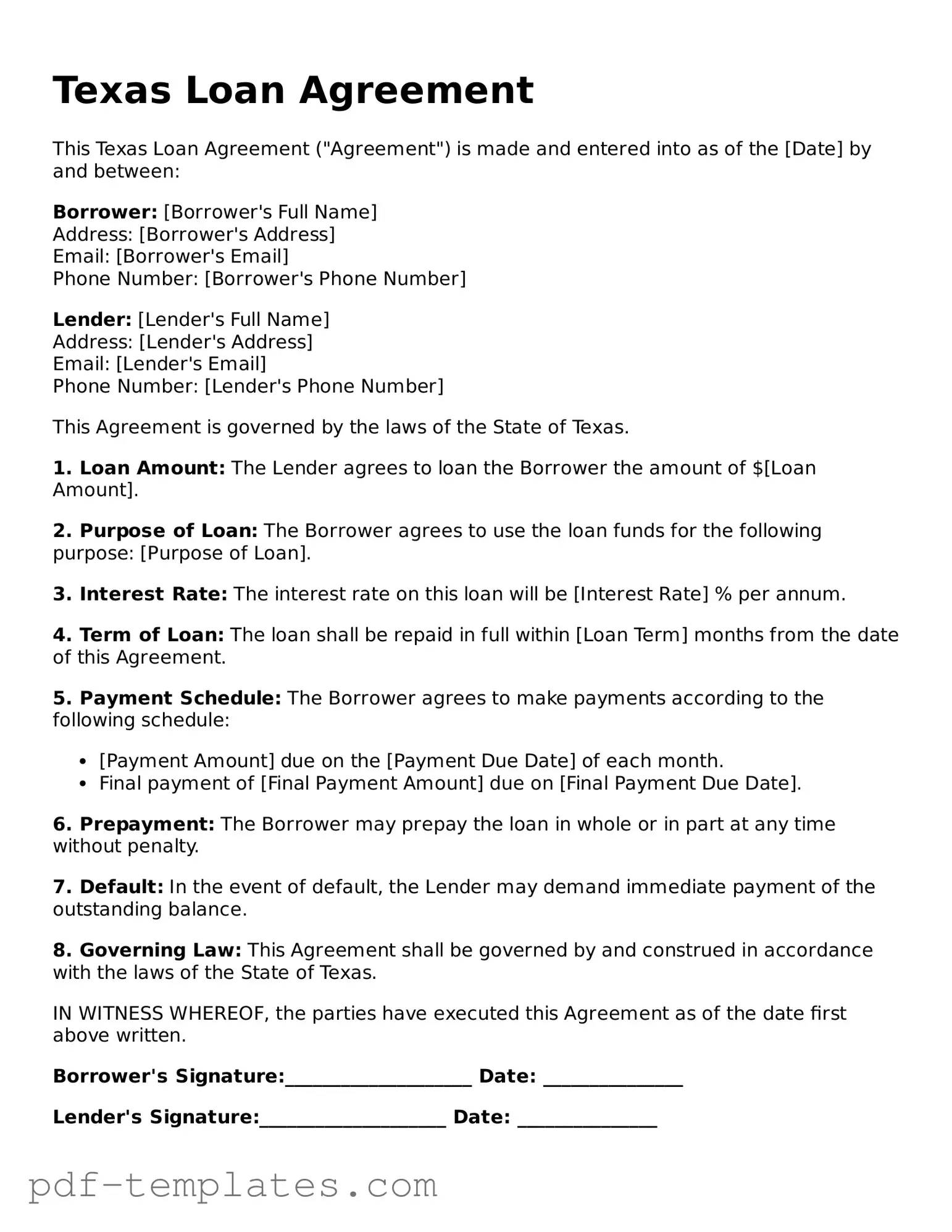

Official Loan Agreement Template for Texas State

The Texas Loan Agreement form serves as a crucial document in establishing the terms and conditions under which a loan is made between a lender and a borrower. This form outlines essential elements such as the loan amount, interest rate, repayment schedule, and any collateral involved in securing the loan. Additionally, it specifies the rights and responsibilities of both parties, ensuring clarity and reducing the potential for disputes. The agreement may also include provisions related to default, prepayment penalties, and legal remedies, which protect the interests of the lender while providing the borrower with a clear understanding of their obligations. By detailing these aspects, the Texas Loan Agreement form not only facilitates the lending process but also promotes transparency and accountability in financial transactions. Understanding this form is vital for both individuals and businesses seeking to navigate the complexities of borrowing in Texas.

Misconceptions

Understanding the Texas Loan Agreement form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion and potential issues. Here are four common misconceptions:

- The Texas Loan Agreement form is the same as a promissory note. While both documents are related to loans, they serve different purposes. A promissory note is a promise to repay the loan, whereas the Loan Agreement outlines the terms and conditions of the loan itself.

- All loan agreements must be notarized. Not all loan agreements require notarization in Texas. While notarization can provide an additional layer of security and authenticity, it is not a legal requirement for all types of loans.

- The Loan Agreement form is a one-size-fits-all document. This is not true. The Texas Loan Agreement can be customized to fit the specific needs of the parties involved. Terms such as interest rates, repayment schedules, and collateral can vary significantly.

- Once signed, the Loan Agreement cannot be changed. This misconception is misleading. Parties can amend the agreement if both sides agree to the changes. It is essential to document any amendments in writing to avoid future disputes.

Clarifying these misconceptions can help ensure that all parties involved in a loan transaction in Texas understand their rights and obligations. It is always advisable to seek professional guidance when entering into a loan agreement.

Texas Loan Agreement: Usage Instruction

Filling out the Texas Loan Agreement form is a straightforward process that requires careful attention to detail. By following the steps outlined below, you can ensure that all necessary information is accurately provided, paving the way for a smooth loan transaction.

- Begin by carefully reading the entire form to familiarize yourself with the required information.

- At the top of the form, enter the names and addresses of both the lender and the borrower. Make sure to double-check for accuracy.

- Specify the loan amount in the designated space. Ensure that this figure reflects the agreed-upon amount.

- Indicate the interest rate being applied to the loan. This should be clearly stated to avoid any confusion later.

- Fill in the repayment terms, including the duration of the loan and the payment schedule (monthly, bi-weekly, etc.).

- Provide any additional terms or conditions that may apply to the loan. This could include late fees, prepayment penalties, or other stipulations.

- Both parties should sign and date the form at the bottom. Ensure that the signatures are clear and legible.

- Make copies of the completed agreement for both the lender and borrower for their records.

Common mistakes

-

Inaccurate Personal Information: Many individuals fail to provide correct names, addresses, or Social Security numbers. This can lead to delays or issues in processing the loan.

-

Missing Signatures: A common oversight is forgetting to sign the form. Without a signature, the agreement is not valid, and the loan cannot be processed.

-

Incorrect Loan Amount: Sometimes, borrowers write down the wrong amount they wish to borrow. This can result in complications and potential rejections.

-

Failure to Read Terms: Skimming over the terms and conditions is a mistake. Understanding the interest rates and repayment schedules is crucial before signing.

-

Omitting Required Documentation: Applicants often forget to attach necessary documents like proof of income or identification. This can delay the loan approval process.

-

Not Providing Contact Information: Some people neglect to include their phone numbers or email addresses. Without this information, lenders cannot reach them for follow-ups.

-

Ignoring Co-Signer Requirements: If a co-signer is needed, borrowers might overlook this requirement. Not addressing this can lead to immediate disqualification for the loan.

PDF Features

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Loan Agreement is governed by the Texas Business and Commerce Code. |

| Parties Involved | The agreement typically involves a lender and a borrower, who may be individuals or entities. |

| Loan Amount | The form specifies the total amount being loaned, which is crucial for both parties. |

| Interest Rate | The agreement outlines the interest rate applicable to the loan, which may be fixed or variable. |

| Repayment Terms | Details regarding the repayment schedule, including frequency and duration, are included. |

| Default Conditions | The form defines what constitutes a default and the consequences for the borrower in such an event. |

Dos and Don'ts

When filling out the Texas Loan Agreement form, careful attention is necessary to ensure accuracy and compliance. Here are nine essential do's and don'ts to consider:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information in all sections.

- Do double-check all numbers, especially loan amounts and interest rates.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed form for your records.

- Don't leave any blank spaces; if a section does not apply, write "N/A."

- Don't rush through the process; take your time to ensure everything is correct.

- Don't ignore any instructions provided with the form.

- Don't submit the form without reviewing it one last time.

Similar forms

The Texas Loan Agreement form shares similarities with a Promissory Note. Both documents outline the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. A Promissory Note serves as a written promise from the borrower to repay the loan, while the Texas Loan Agreement provides a more comprehensive overview of the loan's terms, including any collateral involved and the rights of both parties. Together, they ensure clarity and accountability in the lending process.

For those navigating the complexities of property transactions, understanding the intricacies of various documentation is essential, particularly when it comes to securing financial agreements related to real estate. A Mechanics Lien California form, for instance, is instrumental for contractors and suppliers in asserting their payment claims. This legally binding document establishes a lien on a property, effectively ensuring that payment disputes are resolved before any potential sale or refinancing occurs. For more resources and legal clarity, you can refer to All California Forms which provides comprehensive guidelines and templates for such important legal forms.

Another document that resembles the Texas Loan Agreement is the Mortgage Agreement. This document is typically used in real estate transactions and details the terms under which a borrower can secure a loan using property as collateral. Like the Texas Loan Agreement, it specifies the loan amount, interest rate, and repayment terms. However, a Mortgage Agreement also includes provisions related to foreclosure, should the borrower default on the loan, emphasizing the importance of collateral in securing the loan.

A Credit Agreement is also similar to the Texas Loan Agreement. This document is often used in business lending and outlines the terms under which a lender extends credit to a borrower. Both agreements detail the loan amount, interest rate, and repayment terms. However, a Credit Agreement may also include additional clauses related to covenants, which are promises the borrower makes to maintain certain financial conditions, thus providing the lender with added security.

The Texas Loan Agreement is akin to a Loan Modification Agreement as well. This document is used when the original terms of a loan need to be changed, often due to financial hardship faced by the borrower. Both documents address the terms of repayment, but a Loan Modification Agreement specifically alters the existing agreement to make payments more manageable. This ensures that both parties can continue to meet their obligations while providing flexibility in the repayment process.

Lastly, a Personal Loan Agreement is another document similar to the Texas Loan Agreement. This type of agreement is often used for unsecured loans between individuals. It outlines the loan amount, interest rate, and repayment schedule, much like the Texas Loan Agreement. However, a Personal Loan Agreement may be less formal and typically does not involve collateral, relying instead on the trust between the parties involved. This highlights the personal nature of the transaction while still establishing clear expectations.

Check out Popular Loan Agreement Forms for Different States

Loan Agreement Template California - This agreement should be reviewed periodically to ensure compliance.

To empower your decision-making process, consider utilizing a "simplified General Power of Attorney" form, which allows you to delegate authority effectively while ensuring your legal rights are safeguarded. For more details, you can access the form by clicking here.