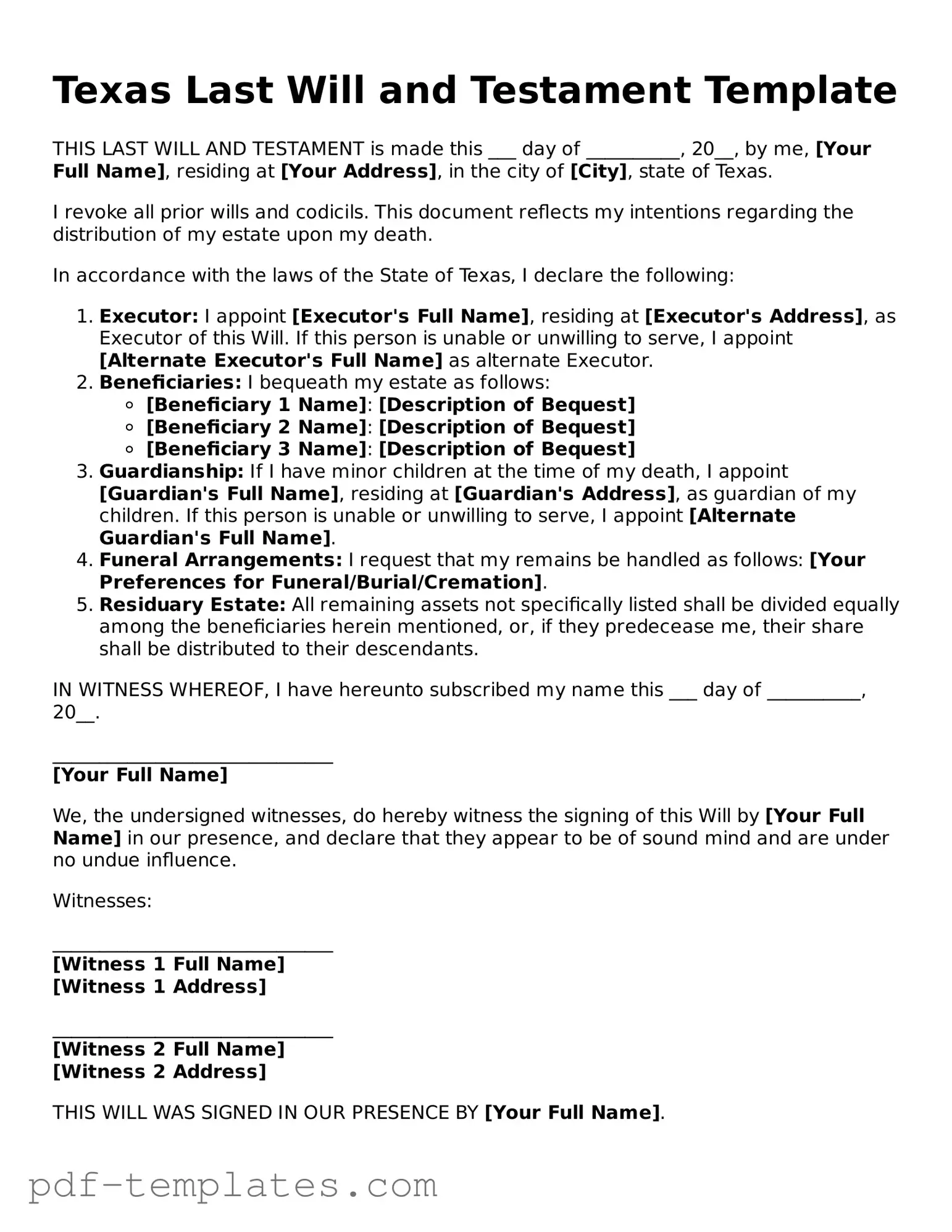

Official Last Will and Testament Template for Texas State

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Texas, this legal document serves as a comprehensive guide for distributing your assets, appointing guardians for minor children, and naming an executor to manage your estate. The Texas Last Will and Testament form is designed to be straightforward, allowing individuals to outline their final wishes clearly and effectively. Key components of this form include the identification of beneficiaries who will receive your property, specific bequests of personal items, and instructions for settling any debts. Additionally, the form allows you to specify funeral arrangements and any other personal wishes you may have. By taking the time to complete this important document, you can provide peace of mind for both yourself and your loved ones, ensuring that your intentions are carried out as you envisioned.

Misconceptions

Many people hold misconceptions about the Texas Last Will and Testament form. Understanding these misconceptions can help individuals make informed decisions regarding their estate planning. Below are ten common misconceptions:

- Anyone can write a will without legal assistance. While it is possible to write a will independently, consulting with a legal professional ensures that the will meets all state requirements and accurately reflects the individual's wishes.

- A will is only necessary for wealthy individuals. Regardless of wealth, anyone with assets, dependents, or specific wishes for their estate should consider creating a will to avoid potential disputes.

- Verbal wills are legally binding in Texas. Texas law requires a written will. Verbal statements may not hold up in court and can lead to confusion among heirs.

- All debts must be paid before a will is executed. While debts are typically settled during the probate process, not all debts need to be cleared before distributing assets to heirs.

- Wills are permanent and cannot be changed. Wills can be amended or revoked at any time, as long as the individual is mentally competent to do so.

- Only a lawyer can create a valid will. Although lawyers can provide valuable assistance, individuals can create a valid will themselves, provided it adheres to Texas law.

- Having a will avoids probate. A will must go through the probate process, which is the legal procedure for validating the will and distributing assets.

- Beneficiaries can be changed after the will is executed. Changes to beneficiaries can be made through a codicil or a new will, but it must be properly documented.

- Wills do not need witnesses. In Texas, a will must be signed by at least two witnesses who are not beneficiaries to be considered valid.

- Once a will is made, it cannot be contested. Wills can be contested in court for various reasons, including lack of capacity or undue influence at the time of signing.

Addressing these misconceptions can lead to better estate planning and ensure that individuals' wishes are honored after their passing.

Texas Last Will and Testament: Usage Instruction

Once you have the Texas Last Will and Testament form in hand, you’re ready to begin the process of filling it out. This document is essential for ensuring that your wishes regarding asset distribution are clearly articulated. The following steps will guide you through the completion of the form.

- Gather necessary information: Collect details about your assets, beneficiaries, and any specific wishes you have for distribution.

- Start with your personal information: Write your full name, address, and date of birth at the top of the form.

- Identify your beneficiaries: Clearly list the names and relationships of the individuals or organizations you wish to inherit your assets.

- Specify your executor: Choose a trustworthy person to carry out your wishes. Include their name and contact information.

- Detail asset distribution: Indicate how you want your assets divided among your beneficiaries. Be as specific as possible.

- Include guardianship provisions: If you have minor children, designate a guardian for them and provide their information.

- Review the document: Carefully check for any errors or omissions. Make sure everything is clear and accurate.

- Sign the document: Sign and date the form in the presence of at least two witnesses who are not beneficiaries.

- Store the will safely: Keep the completed document in a secure location and inform your executor where it can be found.

After completing these steps, your will is ready for use. Make sure to revisit and update it as necessary, especially after major life changes such as marriage, divorce, or the birth of a child.

Common mistakes

-

Failing to properly identify the testator. It's essential to include the full legal name and address of the person making the will.

-

Not signing the will in the presence of witnesses. Texas law requires that the will be signed in front of at least two witnesses who are not beneficiaries.

-

Using outdated forms or templates. Wills should reflect current laws and personal circumstances, so using an old form can lead to complications.

-

Overlooking the need for a self-proving affidavit. This affidavit can simplify the probate process by allowing the will to be accepted without witnesses.

-

Neglecting to name an executor. The executor is responsible for carrying out the wishes outlined in the will, so it's important to choose someone trustworthy.

-

Not being clear about asset distribution. Ambiguities can lead to disputes among heirs, so it's vital to specify who gets what.

-

Forgetting to update the will after major life changes. Events like marriage, divorce, or the birth of a child can affect how assets should be distributed.

-

Failing to keep the will in a safe but accessible location. A will should be stored where it can be easily found after the testator's passing.

PDF Features

| Fact Name | Description |

|---|---|

| Legal Requirement | In Texas, a Last Will and Testament must be in writing to be valid. |

| Age Requirement | Testators must be at least 18 years old to create a valid will in Texas. |

| Signature Requirement | The will must be signed by the testator or by someone else in their presence and at their direction. |

| Witnesses | Texas requires at least two witnesses to sign the will, who must be at least 14 years old. |

| Holographic Wills | Texas recognizes holographic wills, which are handwritten and do not require witnesses. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the existing one. |

| Probate Process | After death, the will must go through the probate process to be validated and executed. |

| Community Property | Texas is a community property state, meaning that property acquired during marriage is jointly owned. |

| Governing Law | The Texas Estates Code governs the creation and execution of wills in Texas. |

Dos and Don'ts

When filling out the Texas Last Will and Testament form, it is essential to follow specific guidelines to ensure that your will is valid and accurately reflects your wishes. Here is a list of things to do and not to do:

- Do clearly state your full name and address at the beginning of the document.

- Do name an executor who will manage your estate after your passing.

- Do specify how you want your assets distributed among your beneficiaries.

- Do sign the document in the presence of at least two witnesses.

- Do ensure that your witnesses are not beneficiaries of the will.

- Don't use ambiguous language that could lead to confusion about your intentions.

- Don't attempt to write your will without understanding Texas laws regarding wills.

- Don't forget to date the document when you sign it.

- Don't make changes to the will without following proper procedures, such as creating a codicil.

By adhering to these guidelines, you can create a clear and enforceable Last Will and Testament in Texas.

Similar forms

The Texas Last Will and Testament form shares similarities with a Living Will. A Living Will is a legal document that outlines an individual’s preferences regarding medical treatment in situations where they may be unable to communicate their wishes. While a Last Will and Testament deals primarily with the distribution of assets after death, a Living Will focuses on healthcare decisions during a person's lifetime. Both documents serve to express the individual’s wishes, ensuring that their desires are respected, whether concerning property or medical care.

Another document that resembles the Texas Last Will and Testament is the Durable Power of Attorney. This legal document allows an individual to appoint someone else to make financial or legal decisions on their behalf if they become incapacitated. Like a Last Will, the Durable Power of Attorney is concerned with personal autonomy and the management of one’s affairs. However, it is active during the individual’s lifetime, whereas a Last Will takes effect only after death.

The Texas Declaration of Guardian is also similar to a Last Will and Testament. This document allows an individual to nominate a guardian for their minor children in the event of their death or incapacity. While a Last Will distributes assets, the Declaration of Guardian focuses on the care and upbringing of children. Both documents aim to provide peace of mind by ensuring that the individual’s wishes are followed regarding their dependents.

In addition, the Texas Revocable Living Trust bears resemblance to the Last Will and Testament. A Revocable Living Trust allows an individual to place their assets into a trust during their lifetime, with the ability to modify or revoke it as needed. Like a Last Will, it facilitates the transfer of assets upon death, but it can also help avoid probate, making the process faster and more private. Both documents serve the purpose of managing and distributing assets according to the individual’s wishes.

The Affidavit of Heirship is another document that relates to the Texas Last Will and Testament. This document is often used when someone dies without a will, allowing heirs to establish their rights to inherit property. While a Last Will clearly outlines who inherits what, the Affidavit of Heirship serves as a tool to determine heirs when no will exists. Both documents aim to clarify the distribution of assets, albeit in different circumstances.

A similar document is the Codicil, which acts as an amendment to an existing Last Will and Testament. A Codicil allows individuals to make changes to their will without creating an entirely new document. This can include adding or removing beneficiaries or altering asset distribution. Both documents maintain the testator’s intentions, but a Codicil is specifically designed to update or modify the original will.

The Texas Community Property Agreement can also be compared to a Last Will and Testament. This agreement allows spouses to manage their community property in a way that simplifies the distribution of assets upon death. Similar to a Last Will, it ensures that both partners' wishes are honored regarding asset distribution. However, the Community Property Agreement is specific to married couples and focuses on property acquired during the marriage.

The Bill of Sale is another document that shares some similarities with a Last Will and Testament, particularly in the context of transferring ownership. A Bill of Sale is used to document the sale or transfer of personal property from one party to another. While a Last Will outlines the distribution of assets after death, a Bill of Sale facilitates the transfer of ownership during a person's lifetime. Both documents ensure that property rights are respected and transferred according to the owner's wishes.

Lastly, the Prenuptial Agreement can be considered similar in purpose to a Last Will and Testament. A Prenuptial Agreement outlines how assets will be divided in the event of divorce or death. While a Last Will deals with the distribution of assets after death, a Prenuptial Agreement addresses asset management and division during marriage. Both documents aim to protect individual interests and clarify the handling of property.

Check out Popular Last Will and Testament Forms for Different States

Making a Will in California - Can create certainty for beneficiaries about what they will inherit and when.

How to Create a Will in Virginia - Your will should clearly identify beneficiaries to avoid confusion during distribution.