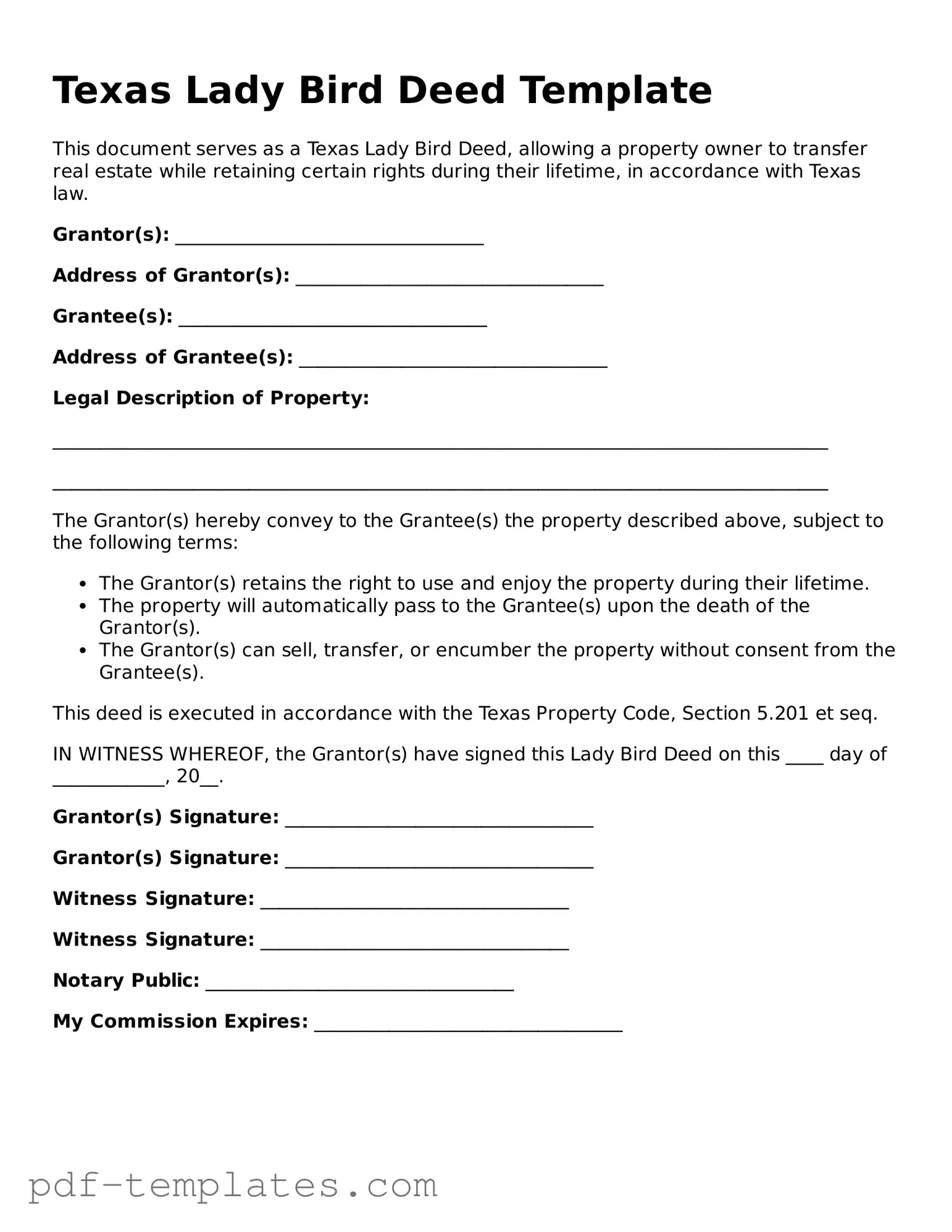

Official Lady Bird Deed Template for Texas State

The Texas Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to their beneficiaries while retaining certain rights during their lifetime. This deed provides a straightforward way to avoid probate, ensuring that the property passes directly to the designated heirs upon the owner’s death. One of the standout features of the Lady Bird Deed is that it enables the original owner to maintain control over the property, including the ability to sell, lease, or mortgage it without needing consent from the beneficiaries. This flexibility can be particularly advantageous for individuals who wish to manage their assets actively while still planning for the future. Furthermore, the Lady Bird Deed can also help protect the property from Medicaid claims, making it an appealing option for those concerned about long-term care costs. Understanding the intricacies of this deed is essential for anyone considering it as part of their estate planning strategy, as it can provide peace of mind and financial security for both the property owner and their heirs.

Misconceptions

Understanding the Texas Lady Bird Deed can help property owners make informed decisions. Here are ten common misconceptions about this legal document:

- It is only for elderly individuals. Many believe that the Lady Bird Deed is exclusively for seniors. In reality, anyone can use this deed to manage their property effectively.

- It avoids probate entirely. While the Lady Bird Deed can simplify the transfer of property, it does not completely eliminate the probate process in all cases.

- It is the same as a traditional transfer on death deed. Although similar, the Lady Bird Deed allows for more control over the property during the owner’s lifetime, unlike a standard transfer on death deed.

- It cannot be revoked. Some people think that once a Lady Bird Deed is created, it cannot be changed. In fact, the grantor can revoke or alter the deed at any time before their death.

- It is only beneficial for married couples. This deed can benefit individuals, families, and unmarried couples alike. It provides flexibility for various ownership situations.

- It automatically transfers all property rights. The Lady Bird Deed allows the grantor to retain certain rights, such as the ability to sell or mortgage the property without needing consent from the beneficiaries.

- It is a complex legal document. While it is important to understand the terms, the Lady Bird Deed is relatively straightforward compared to other legal documents.

- It is only valid in Texas. Although it is named after Lady Bird Johnson and is primarily used in Texas, similar deeds may exist in other states under different names.

- It eliminates tax implications. The Lady Bird Deed does not eliminate potential tax consequences for the beneficiaries. They may still be responsible for property taxes after the transfer.

- It guarantees the property will go to the intended beneficiaries. While the deed outlines the grantor's wishes, disputes can still arise among family members, potentially complicating the transfer.

Addressing these misconceptions can help individuals make better decisions regarding their property and estate planning.

Texas Lady Bird Deed: Usage Instruction

Filling out the Texas Lady Bird Deed form requires careful attention to detail. After completing the form, it will need to be signed and notarized before it can be filed with the county clerk's office. This ensures that the deed is legally recognized and recorded.

- Obtain a copy of the Texas Lady Bird Deed form. This can typically be found online or through a legal office.

- Fill in the names of the property owners in the designated section. Include full legal names as they appear on other documents.

- Identify the beneficiaries. List the names of those who will receive the property upon the owner's passing.

- Provide a detailed description of the property. This should include the address and any relevant legal descriptions.

- Specify any conditions or limitations regarding the transfer of the property. Be clear about what rights the beneficiaries will have.

- Sign the form in the presence of a notary public. This step is crucial for the form's validity.

- File the completed and notarized form with the county clerk's office in the county where the property is located.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to accurately describe the property being transferred. It’s essential to include the correct legal description, which can be found in the property deed. A vague or incomplete description can lead to legal complications.

-

Improper Signatures: All necessary parties must sign the Lady Bird Deed. Often, individuals forget to obtain signatures from all owners or fail to have the deed notarized. Missing signatures can invalidate the document.

-

Neglecting to Specify Conditions: Some people overlook the importance of specifying conditions or limitations on the property transfer. Without clear terms, disputes may arise later about the use or management of the property.

-

Failing to Record the Deed: After completing the form, it’s crucial to file the Lady Bird Deed with the appropriate county clerk’s office. Neglecting this step means the deed may not be recognized legally, which can lead to issues with ownership.

-

Not Understanding Tax Implications: Individuals often do not consider the potential tax consequences of transferring property through a Lady Bird Deed. It’s advisable to consult a tax professional to understand how this deed may affect property taxes and inheritance taxes.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | The Texas Lady Bird Deed is a legal document that allows property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime. |

| Governing Law | This deed is governed by Texas Property Code, specifically Section 5.201. |

| Retained Rights | Property owners can retain the right to live in and control the property during their lifetime, which is a unique feature of this deed. |

| Beneficiary Designation | Owners can designate one or more beneficiaries to receive the property upon their death, simplifying the transfer process. |

| Avoiding Probate | Using a Lady Bird Deed can help avoid probate, allowing for a more straightforward transfer of property upon the owner's death. |

| Tax Implications | The property retains its tax basis, which can provide potential tax benefits for beneficiaries, especially in terms of capital gains. |

| Revocability | The deed can be revoked or amended at any time during the property owner's lifetime, providing flexibility. |

| Eligibility | Any individual who owns real property in Texas can create a Lady Bird Deed, making it accessible for many property owners. |

Dos and Don'ts

When filling out the Texas Lady Bird Deed form, it's essential to follow certain guidelines to ensure the document is valid and effective. Here’s a list of things you should and shouldn’t do:

- Do ensure that you clearly identify the property being transferred.

- Do include the full names of all grantors and grantees.

- Do specify any conditions or limitations regarding the transfer.

- Do sign the deed in front of a notary public.

- Don't leave any sections of the form blank; complete all required fields.

- Don't use vague language; be precise in your descriptions.

Following these guidelines will help ensure that your Lady Bird Deed is properly executed and recognized under Texas law.

Similar forms

The Texas Lady Bird Deed is similar to a traditional warranty deed. Both documents serve to transfer property ownership from one party to another. However, a warranty deed provides a guarantee that the property is free of any encumbrances, while a Lady Bird Deed allows the original owner to retain certain rights, such as the right to live on the property and the ability to sell or mortgage it without the consent of the beneficiary.

Another document comparable to the Lady Bird Deed is the quitclaim deed. A quitclaim deed transfers any interest the grantor may have in the property without making any guarantees about the title. Unlike the Lady Bird Deed, which can provide a smooth transition of property upon death while retaining rights during the owner’s lifetime, a quitclaim deed offers no protection or assurances to the grantee regarding the property’s condition or title.

The life estate deed is also similar in nature. This document allows a property owner to retain the right to use and occupy the property during their lifetime, while transferring the remainder interest to another party. Like the Lady Bird Deed, a life estate deed ensures that the owner can live on the property until death, but it does not offer the same flexibility to sell or encumber the property without the consent of the remainderman.

A transfer-on-death deed is another relevant document. This deed allows the property owner to designate a beneficiary who will automatically receive the property upon the owner’s death, bypassing probate. Similar to the Lady Bird Deed, it provides a way to transfer property outside of probate, but it does not allow the original owner to retain any rights to the property during their lifetime.

Understanding the nuances of property transfer methods is essential for homeowners. For instance, complexities arise with various deeds, such as the Lady Bird Deed, which provides unique benefits compared to others like the quitclaim or warranty deed. Notably, property owners in California may also need to consider the All California Forms when dealing with liens that could affect their property rights and payment claims in the construction industry.

The revocable living trust is another document that shares similarities with the Lady Bird Deed. Both instruments facilitate the transfer of property upon death while allowing the original owner to maintain control during their lifetime. However, a revocable living trust involves a more complex legal structure and requires the property to be formally transferred into the trust, whereas a Lady Bird Deed is simpler and directly recorded with the county.

Another comparable document is the enhanced life estate deed. This deed allows the property owner to retain a life estate while also designating a beneficiary to receive the property after death. Like the Lady Bird Deed, it offers the advantage of avoiding probate. However, the enhanced life estate deed may not provide the same level of control over the property during the owner’s lifetime.

The special warranty deed is similar in that it transfers ownership of property, but it only guarantees the title against claims that arose during the time the grantor owned the property. Unlike the Lady Bird Deed, which allows for continued control and use, a special warranty deed does not provide ongoing rights to the grantor after the transfer.

The beneficiary deed, similar to the Lady Bird Deed, allows property to be transferred upon the owner’s death without going through probate. However, unlike the Lady Bird Deed, the beneficiary deed does not allow the owner to retain rights to the property during their lifetime, making it less flexible in terms of property management.

The joint tenancy deed is another document that relates to property ownership. This deed allows two or more individuals to own property together with rights of survivorship. While it facilitates the transfer of property upon the death of one owner, it does not provide the same level of control as a Lady Bird Deed, where the original owner can still manage the property during their lifetime.

Finally, the community property agreement is relevant in the context of property ownership between spouses. This agreement allows spouses to agree on how to handle property ownership and transfer upon death. While it can simplify the transfer process, it does not offer the same individual control over property as the Lady Bird Deed, which allows one owner to dictate the terms of transfer without requiring consent from a spouse.

Check out Popular Lady Bird Deed Forms for Different States

Florida Lady Bird Deed Form - Property owners appreciate the straightforward process of executing a Lady Bird Deed.

When dealing with disputes, a cease and desist letter form can be an effective tool to prompt action from the other party. In Florida, this formality is essential for outlining one's grievances clearly and is often a precursor to legal proceedings. By issuing such a letter, individuals can express their intentions and potentially avoid court altogether. For those looking to understand the specifics of this process, All Florida Forms provides a comprehensive resource that can simplify the preparation of this crucial document.