Official Gift Deed Template for Texas State

The Texas Gift Deed form serves as a vital legal document for individuals wishing to transfer property without any monetary exchange. This form outlines the specifics of the gift, including the names of the donor and the recipient, a detailed description of the property, and any conditions or restrictions associated with the transfer. It is important to note that the deed must be signed by the donor in the presence of a notary public to ensure its validity. Once executed, the gift deed should be filed with the county clerk’s office where the property is located to provide public notice of the transfer. Understanding the implications of a gift deed is crucial, as it may have tax consequences for both the donor and the recipient. Additionally, this document can help prevent future disputes regarding ownership and clarify the intent behind the property transfer. By utilizing the Texas Gift Deed form, individuals can facilitate a smooth and legally recognized transfer of property as a gift, ensuring that their wishes are honored and documented appropriately.

Misconceptions

Many people have misunderstandings about the Texas Gift Deed form. These misconceptions can lead to confusion and even legal issues. Here are six common misconceptions:

-

Gift Deeds Are Only for Family Members.

While many people use gift deeds to transfer property to family members, they can also be used for friends or charitable organizations. The key factor is the intention to make a gift, not the relationship between the parties.

-

A Gift Deed Requires Payment.

This is not true. A gift deed is meant for transferring property without any exchange of money. If money is involved, it’s likely a sale, not a gift.

-

You Don't Need to Record a Gift Deed.

While it’s not legally required, recording a gift deed is highly recommended. This helps establish clear ownership and protects against future disputes.

-

Gift Deeds Are Irrevocable.

Many believe that once a gift deed is signed, it cannot be undone. However, under certain circumstances, a gift deed can be revoked if both parties agree.

-

All Property Can Be Transferred Using a Gift Deed.

Not all types of property can be transferred with a gift deed. For example, some properties may have restrictions or require specific legal processes.

-

Gift Deeds Do Not Affect Taxes.

In reality, gifting property can have tax implications. Both the giver and receiver should consult a tax professional to understand any potential tax liabilities.

Understanding these misconceptions can help individuals navigate the process of using a Texas Gift Deed more effectively.

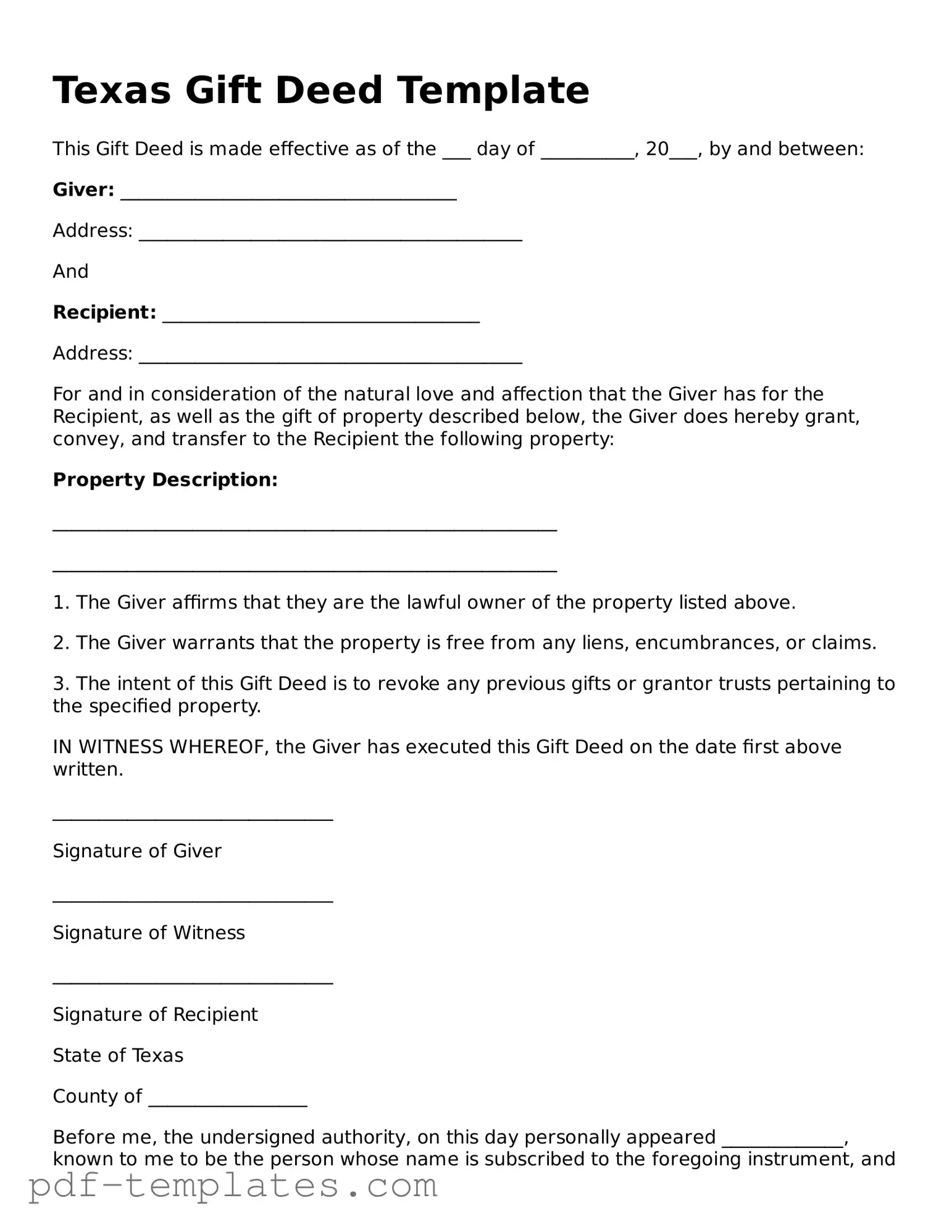

Texas Gift Deed: Usage Instruction

Once you have the Texas Gift Deed form in front of you, it’s important to proceed carefully. Completing this form accurately ensures that the transfer of property is documented correctly. After filling it out, you will need to sign the document in the presence of a notary public, which will make it legally binding.

- Begin by entering the date at the top of the form. This should be the date you are completing the deed.

- Next, provide the full name and address of the person giving the gift (the grantor). Make sure to include any middle names or initials.

- Then, fill in the name and address of the person receiving the gift (the grantee). Again, ensure all names are complete and accurate.

- In the section describing the property, include the legal description of the property being gifted. This can often be found on the property’s deed or tax records.

- Indicate the consideration, which is typically stated as “for love and affection” when it comes to a gift deed.

- Sign the document where indicated. The grantor must sign, and it’s important to do this in front of a notary public.

- After signing, the notary will complete their section. This includes affixing their seal and signature, which validates the document.

- Finally, make copies of the completed deed for your records and ensure that the grantee receives a copy as well.

Common mistakes

-

Incomplete Information: One of the most common mistakes is leaving out essential details. Ensure that all required fields are filled out, including the names of both the donor and the recipient, the property description, and the date of the gift.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can lead to confusion. It’s vital to include the full legal description of the property, which can often be found in the property’s deed.

-

Failure to Sign: A Gift Deed must be signed by the donor. Forgetting to sign the document can render it invalid. Always double-check that the signature is present before submission.

-

Not Notarizing the Document: In Texas, a Gift Deed must be notarized to be legally binding. Neglecting this step can lead to complications. Make sure to have the document notarized by a licensed notary public.

-

Ignoring State-Specific Requirements: Each state has its own rules regarding gift deeds. Failing to adhere to Texas-specific regulations can jeopardize the validity of the deed. Familiarize yourself with local laws to avoid this pitfall.

-

Not Keeping a Copy: After the Gift Deed is completed, it’s crucial to retain a copy for personal records. Not having a copy can complicate matters in the future, especially if disputes arise over the property.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by the Texas Property Code, particularly Chapter 5, which outlines the requirements for property transfers. |

| Requirements | The deed must be in writing, signed by the donor, and must include a clear description of the property being gifted. |

| Tax Implications | Gift tax may apply if the value of the property exceeds the annual exclusion limit set by the IRS, so it’s important to consult a tax professional. |

| Recording | To ensure the gift deed is legally recognized, it should be recorded in the county where the property is located. |

Dos and Don'ts

When filling out the Texas Gift Deed form, attention to detail is crucial. Here are six important dos and don'ts to keep in mind to ensure the process goes smoothly.

- Do ensure that the names of both the donor and the recipient are correctly spelled and clearly stated.

- Do provide a detailed description of the property being gifted, including its address and any relevant identifiers.

- Do have the document signed in front of a notary public to validate the transfer.

- Do check that the form is dated appropriately to reflect the date of the gift.

- Don't leave any sections blank; incomplete information can lead to delays or complications.

- Don't forget to keep a copy of the completed Gift Deed for your records.

Similar forms

The Texas Gift Deed form is similar to a Quitclaim Deed. Both documents transfer ownership of property from one party to another without any warranties. In a Quitclaim Deed, the grantor relinquishes any claim they may have to the property, but does not guarantee that they own it. This means that the recipient may not have full legal assurance of ownership. In contrast, a Gift Deed explicitly states that the property is being given as a gift, which can clarify intentions and may have tax implications.

Another document comparable to the Texas Gift Deed is the Warranty Deed. A Warranty Deed provides a higher level of protection for the grantee. It guarantees that the grantor holds clear title to the property and has the right to transfer it. Unlike a Gift Deed, which conveys property without warranties, a Warranty Deed ensures that the buyer is protected against future claims on the property. This makes it a more secure option for real estate transactions.

The Texas Gift Deed also resembles a Bargain and Sale Deed. This type of deed conveys property without warranties, similar to a Gift Deed. However, a Bargain and Sale Deed implies that the grantor has some interest in the property but does not guarantee clear title. While both documents transfer ownership, the Bargain and Sale Deed may suggest that the grantor has a vested interest, which can affect the grantee’s rights.

A Special Warranty Deed is another document similar to the Texas Gift Deed. This deed provides limited warranties, specifically covering the period during which the grantor owned the property. It protects the grantee against claims arising from the grantor's ownership but does not cover issues that may have existed prior. This contrasts with a Gift Deed, which makes no warranties at all, emphasizing the nature of the gift rather than the grantor's ownership history.

The Trader Joe's application form is a vital document for job seekers wishing to join this beloved grocery chain. It outlines necessary information about potential employees and provides an opportunity to showcase their unique skills and experience. Completing the form accurately can significantly increase the chances of landing a position at one of their stores, and interested applicants can find the form at documentonline.org/blank-trader-joe-s-application.

The Texas Gift Deed can also be compared to a Lease Agreement. While a Lease Agreement is primarily for renting property, it can sometimes include terms that allow for eventual ownership transfer. In certain cases, a lease may include a purchase option, which allows the tenant to buy the property after a specified period. However, a Gift Deed directly transfers ownership without any conditions or rental terms, making it a more straightforward conveyance of property.

A Deed of Trust is another document with similarities to the Texas Gift Deed. A Deed of Trust secures a loan with real estate as collateral. While it does not transfer ownership in the same way a Gift Deed does, it involves the transfer of an interest in property. The main difference lies in the purpose: a Gift Deed is for transferring ownership as a gift, while a Deed of Trust is used to secure a financial obligation.

Lastly, the Texas Gift Deed shares characteristics with a Power of Attorney document. A Power of Attorney grants someone the authority to act on behalf of another person in legal or financial matters, including property transactions. While not a deed itself, it can facilitate the transfer of property. However, a Gift Deed serves as a formal declaration of a gift, whereas a Power of Attorney is a tool for delegation of authority, emphasizing different aspects of property management and transfer.

Check out Popular Gift Deed Forms for Different States

Gift of Deed in Virginia - A Gift Deed allows one person to give property to another without payment.

In addition to using the California Independent Contractor Agreement form, it's essential to review All California Forms to ensure that all legal aspects and requirements are properly addressed in your contractual agreements, safeguarding both parties against potential disputes or misunderstandings.

Gift Deed California - Understanding the implications of a Gift Deed is essential for both parties involved.