Official Employment Verification Template for Texas State

In the state of Texas, the Employment Verification form plays a crucial role in the hiring process, serving as a key document that employers utilize to confirm the employment status of current or former employees. This form typically includes essential information such as the employee's name, job title, dates of employment, and salary details. It is often requested by prospective employers, lending credibility to an applicant's work history and ensuring that they meet the qualifications for a new position. Additionally, the form can be vital for various purposes, including loan applications, background checks, and verifying eligibility for benefits. Understanding the nuances of this form is important for both employees and employers, as it helps to foster transparency and trust in the employment relationship. Proper completion and submission of the Employment Verification form can streamline the hiring process, making it easier for all parties involved to navigate the complexities of employment verification with confidence.

Misconceptions

-

Misconception 1: The Texas Employment Verification form is only required for new hires.

This is not accurate. While it is commonly associated with new employees, the form can also be used for existing employees when verifying employment status for various purposes, such as loans or housing applications.

-

Misconception 2: Employers must use a specific format for the Texas Employment Verification form.

In reality, there is no mandated format. Employers can create their own version of the form, as long as it includes the necessary information to verify employment, such as job title, dates of employment, and salary.

-

Misconception 3: The Texas Employment Verification form is a legally binding document.

This is misleading. The form serves as a verification tool rather than a legally binding contract. It confirms employment details but does not establish any legal obligations between the employer and employee.

-

Misconception 4: Employees cannot dispute the information on the Texas Employment Verification form.

This is incorrect. Employees have the right to review and contest any inaccuracies on the form. If there are discrepancies, they should address these issues with their employer to ensure the correct information is provided.

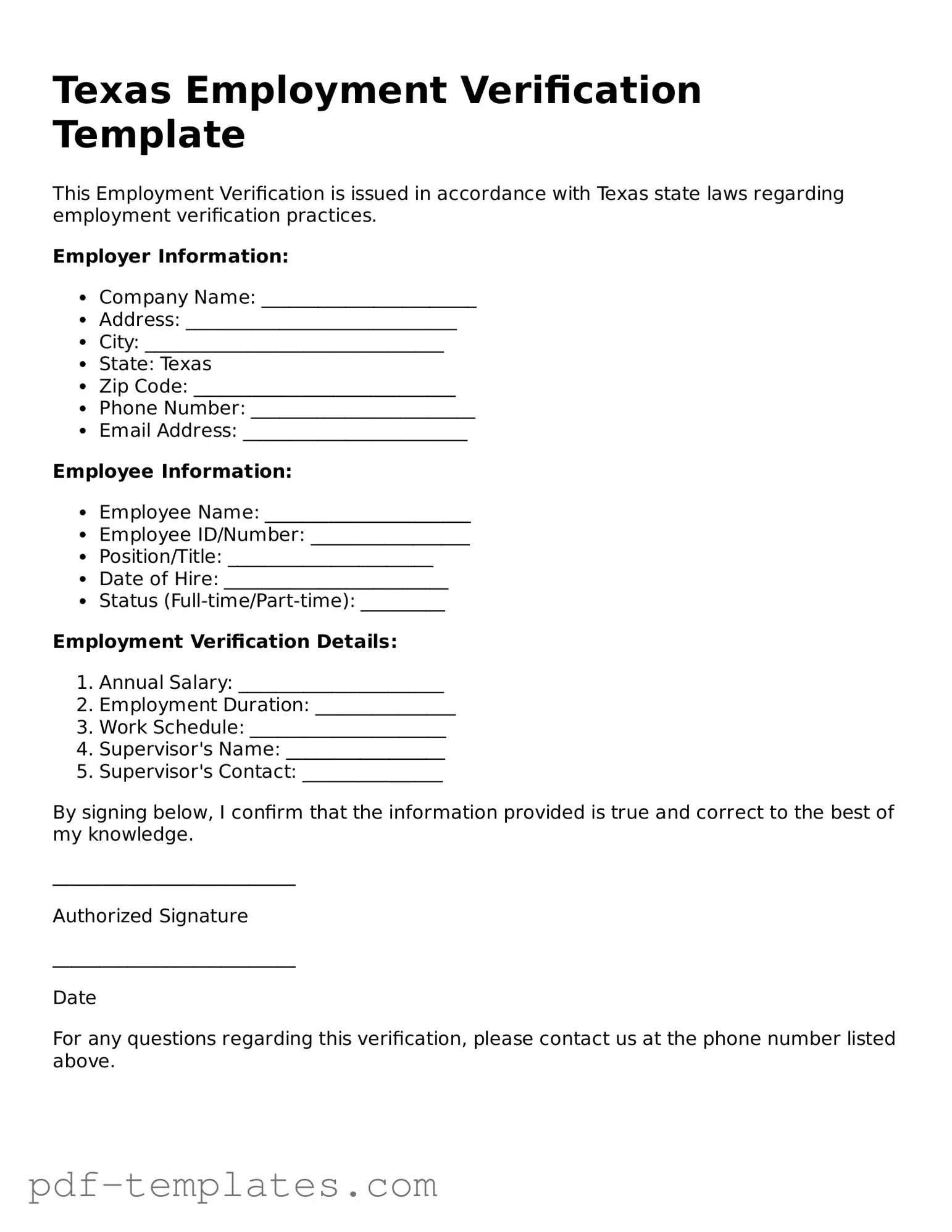

Texas Employment Verification: Usage Instruction

Once you have the Texas Employment Verification form, it's time to fill it out carefully. Follow these steps to ensure you complete the form correctly. This will help avoid any delays in processing your verification request.

- Start by entering your personal information at the top of the form. Include your full name, address, and contact number.

- Provide your Social Security number. Make sure it’s accurate to avoid any issues.

- Next, fill in your employer's details. This includes the company's name, address, and phone number.

- Indicate your job title and the dates of your employment. Be specific about your start and end dates.

- Include your salary information. If you are currently employed, provide your current salary. If not, list your last salary.

- Sign and date the form at the bottom. This confirms that the information provided is true and complete.

- Finally, review the entire form for accuracy before submitting it. Double-check all entries.

After completing the form, make sure to submit it to the appropriate department or individual as instructed. Timely submission is crucial for the verification process.

Common mistakes

-

Incomplete Information: Failing to provide all required fields can lead to delays. Ensure every section is filled out accurately.

-

Incorrect Dates: Entering the wrong employment dates is a common error. Double-check the start and end dates for accuracy.

-

Missing Signatures: Not signing the form can render it invalid. Always include the necessary signatures before submission.

-

Inaccurate Job Title: Listing an incorrect job title can cause confusion. Make sure the title reflects the actual position held.

-

Providing Outdated Contact Information: Using old phone numbers or addresses can hinder communication. Update contact details as necessary.

-

Neglecting to Review: Skipping a final review can lead to overlooked mistakes. Take a moment to read through the form before submission.

-

Using Unclear Language: Avoid vague descriptions of duties. Be specific to provide a clear understanding of job responsibilities.

-

Ignoring Instructions: Not following the guidelines provided with the form can result in rejection. Pay attention to any specific requirements.

-

Submitting Multiple Forms: Sending more than one form can create confusion. Submit only one completed form at a time.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The Texas Employment Verification form is used to confirm the employment status of an individual. |

| Governing Law | This form is governed by Texas Labor Code, Section 61.051. |

| Who Uses It | Employers and employees commonly use this form for various employment-related processes. |

| Required Information | The form typically requires details such as the employee's name, position, and dates of employment. |

| Submission | Employers must complete and submit the form upon request, often to verify employment for loans or benefits. |

| Confidentiality | Information provided in the form is generally treated as confidential and should be protected accordingly. |

| Format | The form can be submitted in both printed and electronic formats, depending on the employer's preference. |

| Signature Requirement | A signature from the employer or authorized representative is usually required to validate the form. |

| Retention Period | Employers should retain copies of the completed forms for a specified period, as outlined by state law. |

| Use in Legal Proceedings | The form may serve as evidence in legal matters concerning employment disputes or verification issues. |

Dos and Don'ts

When filling out the Texas Employment Verification form, attention to detail is crucial. Here are seven essential dos and don'ts to keep in mind.

- Do ensure all personal information is accurate, including your name and Social Security number.

- Do provide the correct dates of employment to reflect your work history accurately.

- Do review the form for completeness before submission to avoid delays.

- Do sign and date the form where required to validate your information.

- Don't leave any sections blank; if a section does not apply, indicate that clearly.

- Don't use abbreviations or shorthand that may confuse the reviewer.

- Don't submit the form without making a copy for your records.

Following these guidelines will help ensure a smooth verification process and avoid unnecessary complications.

Similar forms

The I-9 Employment Eligibility Verification form is a crucial document for employers in the United States, including Texas. Like the Texas Employment Verification form, the I-9 is used to confirm an employee's identity and eligibility to work in the U.S. Both forms require the employee to provide specific identification documents, such as a driver's license or social security card. The I-9 must be completed within three days of the employee's start date, emphasizing the importance of timely verification in both processes.

The W-4 form, or Employee's Withholding Certificate, serves a different purpose but shares similarities in its role within the employment process. While the Texas Employment Verification form focuses on confirming employment eligibility, the W-4 is used to determine the amount of federal income tax withholding from an employee's paycheck. Both forms are essential for ensuring compliance with tax laws and maintaining accurate payroll records.

The Texas Workforce Commission (TWC) New Hire Reporting form is another document that aligns with the Texas Employment Verification form. Employers must report new hires to the TWC within 20 days of their start date. This form helps to track employment for child support enforcement and other state benefits. Like the Employment Verification form, it plays a significant role in maintaining accurate employment records and ensuring compliance with state regulations.

The Form 1099-MISC is used for independent contractors and freelancers, and while it differs from the Texas Employment Verification form in terms of employment classification, both documents are essential for proper record-keeping. The 1099-MISC is issued to report payments made to non-employees, ensuring that tax obligations are met. Both forms contribute to the overall transparency of employment and financial transactions.

The Employee Handbook is not a formal legal document like the Texas Employment Verification form, but it serves as a guide for employees regarding company policies and procedures. Similar to the verification form, the Employee Handbook outlines expectations and responsibilities within the workplace. It helps to create a clear understanding of the employment relationship, promoting a positive work environment.

The Offer Letter is another document that shares a connection with the Texas Employment Verification form. When a candidate is selected for a position, an offer letter is typically issued to outline the terms of employment. This document includes details such as job title, salary, and start date. Both the offer letter and the Employment Verification form are critical in formalizing the employment relationship and ensuring that both parties are on the same page.

The Release of Information form allows employers to obtain consent from employees to share their employment history with third parties. This document is similar to the Texas Employment Verification form in that it facilitates the verification of an employee's work history and qualifications. Both forms help streamline the hiring process and ensure that accurate information is provided to potential employers or agencies.

The State Unemployment Insurance (SUI) form is another important document in the employment landscape. While it focuses on unemployment benefits, it is related to the Texas Employment Verification form in that both are concerned with employment status. Employers must report employee wages and hours worked to the state for unemployment insurance purposes. This ensures that employees have access to benefits if they become unemployed, highlighting the interconnectedness of various employment forms.

The California Transfer-on-Death Deed form is an important legal tool for individuals looking to streamline their estate planning. This document enables property owners to transfer real estate to beneficiaries without the complexities of probate, making it a practical solution for ensuring that one's property is handled according to their wishes after death. For those interested in accessing various forms necessary for such processes, you can find more information at All California Forms, which offers a range of resources to assist in navigating property transfers in California.

Lastly, the Non-Disclosure Agreement (NDA) is a document that, while primarily focused on confidentiality, shares a connection with the Texas Employment Verification form. Both documents are often part of the employment onboarding process. An NDA protects sensitive company information, while the Employment Verification form secures the legitimacy of an employee's status. Together, they help establish a secure and trustworthy working environment.

Check out Popular Employment Verification Forms for Different States

Free Employment Verification Letter - Employers can confirm employee tenure through this form.

In addition to the essential details outlined in the form, individuals can further familiarize themselves with the Texas RV Bill of Sale by visiting documentonline.org/blank-texas-rv-bill-of-sale/, which provides valuable insights and a downloadable template for ease of use during the transaction.

Employement Verification - Acts as a safeguard against fraudulent employment claims.