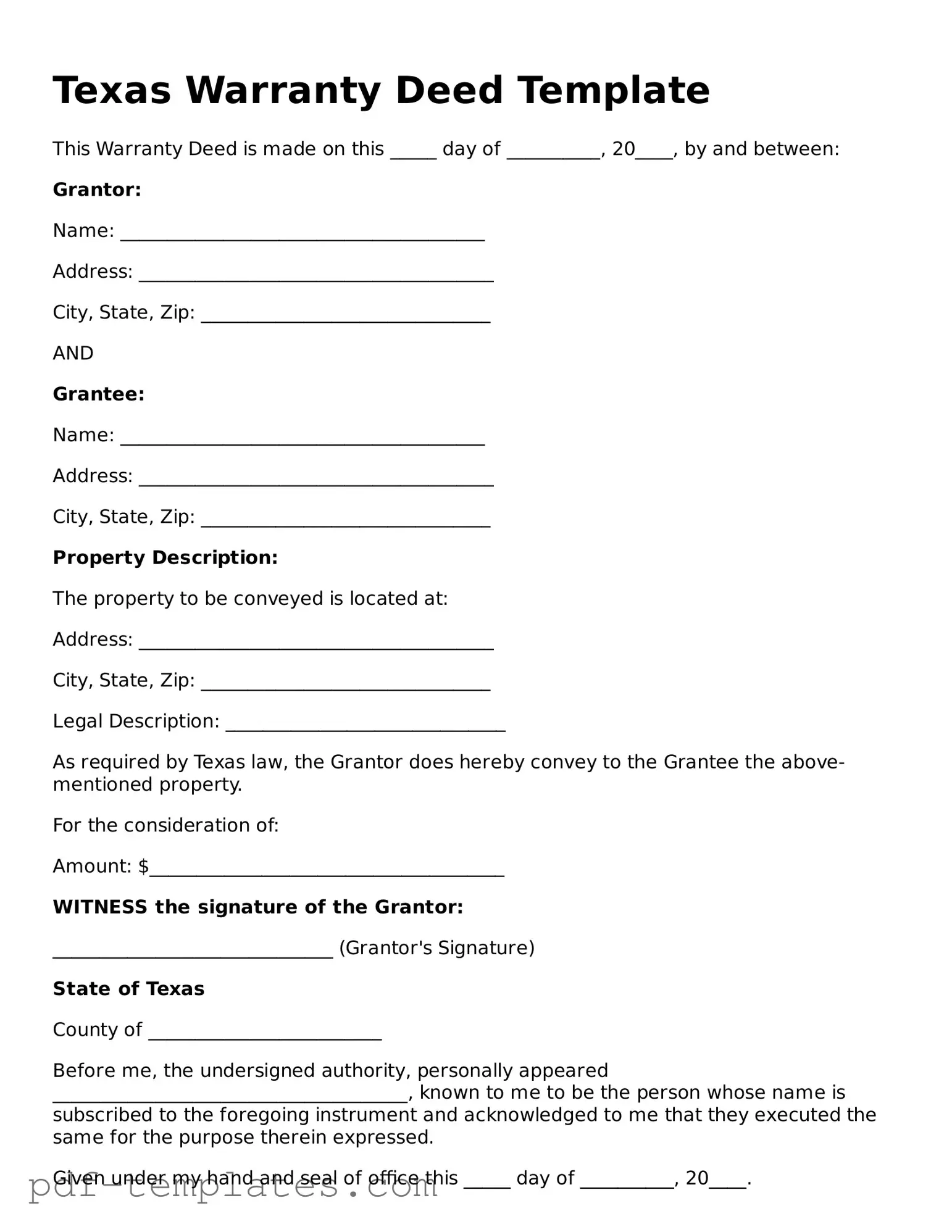

Official Deed Template for Texas State

The Texas Deed form is a crucial document in real estate transactions within the state, serving as the legal instrument that transfers property ownership from one party to another. This form includes essential details such as the names of the grantor and grantee, a description of the property being transferred, and the type of deed being utilized, whether it’s a warranty deed, quitclaim deed, or another variation. Clarity in these details is vital, as they ensure the transaction is valid and enforceable. Additionally, the form requires proper signatures and may need to be notarized to comply with Texas law. Understanding the nuances of the Texas Deed form is imperative for both buyers and sellers, as any errors or omissions can lead to complications down the line. Timely and accurate completion of this document can facilitate a smooth transfer of property and protect the rights of all parties involved.

Misconceptions

Understanding the Texas Deed form can be challenging, especially with the various misconceptions that often arise. Here are eight common misunderstandings, clarified to help you navigate the process more effectively.

-

The Texas Deed form is only for transferring ownership of residential property.

This is not true. The Texas Deed form can be used for various types of property, including commercial and agricultural land. It is a versatile document that serves multiple purposes.

-

All Texas Deed forms are the same.

In reality, there are different types of deeds, such as general warranty deeds, special warranty deeds, and quitclaim deeds. Each serves a unique function and offers different levels of protection for the buyer.

-

You do not need to notarize a Texas Deed.

This misconception can lead to legal complications. In Texas, a deed must be signed by the grantor and typically requires notarization to be valid. This step is crucial for ensuring the deed is enforceable.

-

Once a Texas Deed is filed, it cannot be changed.

While it is true that changing a deed after it has been filed can be complex, it is not impossible. Amendments can be made through a new deed or a corrective deed, depending on the circumstances.

-

A Texas Deed automatically transfers all rights to the property.

This is misleading. While a deed does transfer ownership, certain rights or encumbrances may still exist. It’s essential to review any existing liens or easements that could affect ownership.

-

You can use a Texas Deed for any type of property transaction.

This is not accurate. Certain transactions, such as those involving foreclosure or probate, may require specific forms or additional documentation beyond a standard Texas Deed.

-

Filing a Texas Deed is a quick and easy process.

While the filing itself may be straightforward, there are several steps involved, including ensuring the deed is properly drafted, signed, and notarized. Additionally, understanding local requirements can take time.

-

Once the deed is recorded, there are no further obligations.

This is a misconception. After recording the deed, the new owner may still have obligations such as property taxes, maintenance, and adherence to local zoning laws. Being aware of these responsibilities is crucial for any property owner.

By addressing these misconceptions, individuals can approach the Texas Deed process with greater confidence and clarity. Understanding the nuances of property transfer is essential for successful ownership and management.

Texas Deed: Usage Instruction

Once you have the Texas Deed form in hand, it's important to complete it accurately to ensure the transfer of property is legally binding. Follow these steps carefully to fill out the form correctly.

- Obtain the Texas Deed form: Ensure you have the correct version of the Texas Deed form. You can find it online or through your local county office.

- Identify the parties: Fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). Include their addresses for clarity.

- Describe the property: Provide a detailed description of the property being transferred. This includes the address and any legal descriptions, such as lot numbers or block numbers.

- Specify the consideration: Indicate the amount of money or other value exchanged for the property. If the transfer is a gift, you can note that as well.

- Sign the form: The grantor must sign the deed in front of a notary public. Ensure that the signature is clear and matches the name provided.

- Notarization: After signing, the notary will complete their section, verifying the identities of the signers and the date of the signing.

- Record the deed: Take the completed and notarized deed to the county clerk’s office where the property is located. There, it can be officially recorded.

After completing these steps, the deed will be recorded, and the property transfer will be legally recognized. It’s advisable to keep a copy for your records.

Common mistakes

-

Incorrect Names: One common mistake is misspelling names. Ensure that all names are spelled correctly and match the names on legal identification.

-

Wrong Property Description: Failing to provide an accurate legal description of the property can lead to issues. Always include the full legal description as found in previous deeds.

-

Omitting Signatures: All required parties must sign the deed. Missing a signature can invalidate the document.

-

Not Notarizing: In Texas, a deed must be notarized. Forgetting this step can cause problems when recording the deed.

-

Incorrect Date: Entering the wrong date can create confusion. Make sure to write the date of signing accurately.

-

Improper Formatting: Deeds must follow specific formatting rules. Using the wrong font or layout can lead to rejection by the county clerk.

-

Failure to Record: After filling out the deed, it must be recorded with the county. Neglecting this step means the deed may not be legally recognized.

-

Ignoring Transfer Taxes: Some transactions may require payment of transfer taxes. Not addressing this can lead to unexpected costs.

-

Not Seeking Legal Advice: Attempting to fill out the deed without consulting a professional can result in errors. It's wise to seek guidance if unsure.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Texas Deed form is a legal document used to transfer ownership of real estate from one party to another in Texas. |

| Types of Deeds | Common types include Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds, each serving different purposes in property transfer. |

| Governing Laws | The Texas Property Code governs the execution and validity of deeds in Texas. |

| Signing Requirements | The deed must be signed by the grantor (seller) and may require notarization to be valid. |

| Recording | To protect ownership rights, the deed should be recorded in the county where the property is located. |

| Legal Description | A complete legal description of the property must be included in the deed to clearly identify the property being transferred. |

Dos and Don'ts

Filling out a Texas Deed form is an important task that requires attention to detail. Here are some guidelines to help you navigate the process effectively.

Things You Should Do:

- Ensure that all names are spelled correctly. This prevents future legal complications.

- Include a legal description of the property. This description should be precise and clear.

- Sign the document in the presence of a notary public. This adds an extra layer of authenticity.

Things You Shouldn't Do:

- Don’t leave any sections blank. Incomplete forms can lead to delays or rejection.

- Avoid using nicknames or abbreviations for names. Use full legal names as they appear on official documents.

- Do not forget to check local regulations. Different counties may have specific requirements for deeds.

Similar forms

The Texas Deed form is similar to a Warranty Deed. A Warranty Deed provides a guarantee from the seller that they hold clear title to the property and have the right to sell it. This document protects the buyer by ensuring that there are no undisclosed claims or liens against the property. The seller is responsible for any issues that arise related to the title, making this type of deed a secure option for property transfers.

Another document akin to the Texas Deed is the Quitclaim Deed. Unlike a Warranty Deed, a Quitclaim Deed does not offer any guarantees about the title. It simply transfers whatever interest the seller has in the property, if any. This type of deed is often used between family members or in situations where the parties know each other well and trust that the title is clear.

The Special Warranty Deed is also comparable to the Texas Deed. This document provides a limited guarantee from the seller, stating that they have not caused any issues with the title during their ownership. However, it does not cover any problems that may have existed before the seller acquired the property. This type of deed is often used in commercial real estate transactions.

The Bargain and Sale Deed shares similarities with the Texas Deed as well. This document implies that the seller has the right to sell the property but does not guarantee a clear title. It is often used in foreclosure sales or tax sales, where the seller may not have full knowledge of the title’s history.

A Deed of Trust is another document that relates to the Texas Deed. While not a deed of ownership, it secures a loan by transferring title to a trustee until the borrower repays the loan. This document is commonly used in real estate transactions involving financing, ensuring that the lender has a claim to the property if the borrower defaults.

The Grant Deed is also similar to the Texas Deed. It conveys ownership of property and typically includes assurances that the seller has not transferred the property to anyone else and that the property is free from encumbrances, except those disclosed. This document provides a middle ground between a Warranty Deed and a Quitclaim Deed in terms of security for the buyer.

To secure your rights efficiently, consider utilizing the Texas General Power of Attorney form, which empowers an agent to make crucial decisions on your behalf. For further insights, refer to this comprehensive resource on the General Power of Attorney.

Finally, the Executor’s Deed is comparable to the Texas Deed in that it is used to transfer property from a deceased person's estate. This document allows the executor to sell or distribute property according to the will or state law. It often includes language that indicates the transfer is made without warranties, similar to a Quitclaim Deed.

Check out Popular Deed Forms for Different States

Who Has the Deed to My House - The Deed may include a description of the property being transferred.

Conveyance Document Deed Washington State - Allows the transferor to retain specific rights or restrictions on the property.

Deed Form New York - Some properties may have restrictive covenants, which are often detailed in the deed itself.

Understanding the intricacies of a Mechanics Lien California form is crucial for contractors and suppliers, as it serves as a vital tool to secure payments for their work. This legal document establishes a claim against the property in question, ensuring that those who have contributed to its value are compensated fairly. For more detailed information and resources, you can refer to All California Forms, which provide guidance on the necessary steps and requirements for filing a mechanics lien effectively.

Pennsylvania Deed Transfer Form - Important for mitigating issues with property title defects.