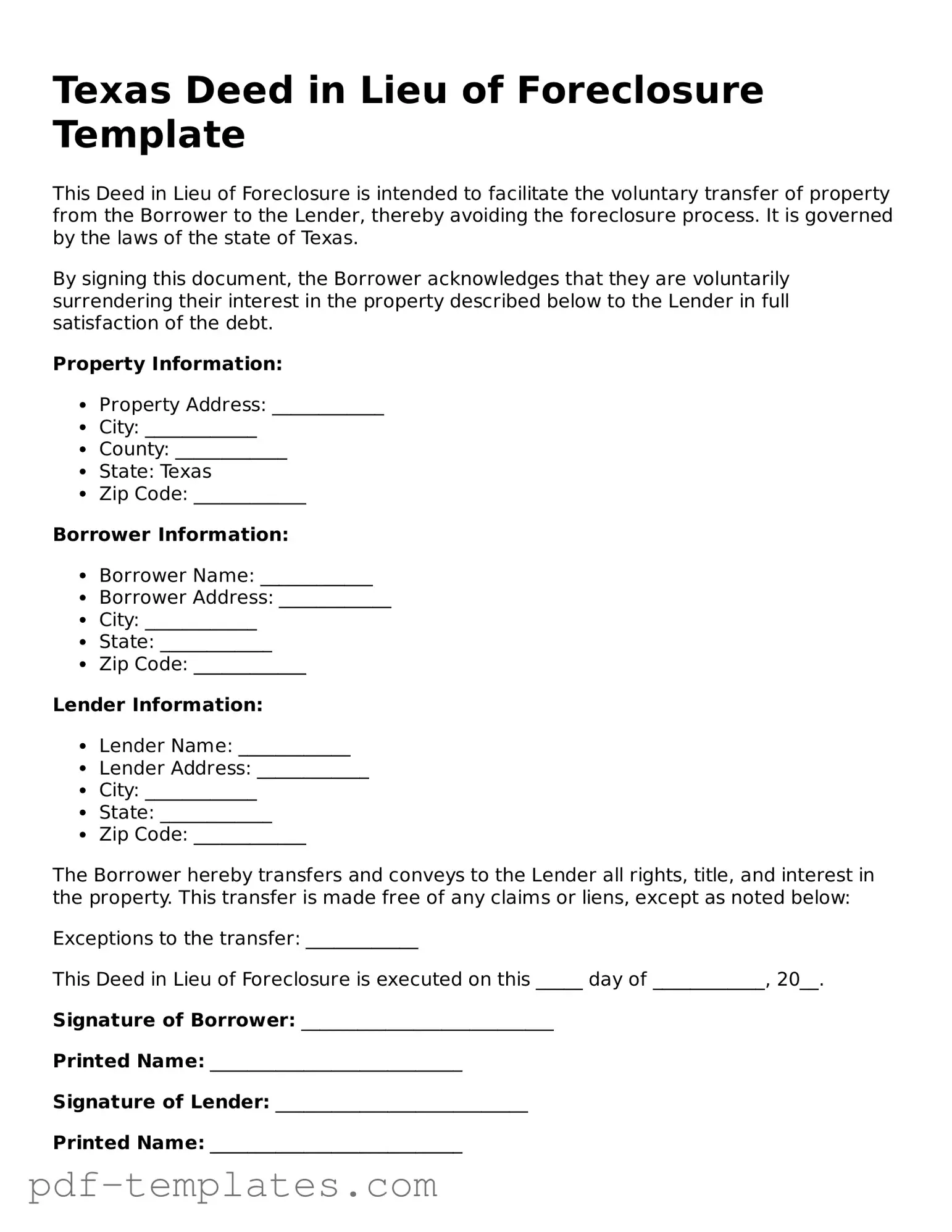

Official Deed in Lieu of Foreclosure Template for Texas State

In the state of Texas, homeowners facing financial difficulties may find themselves exploring alternatives to foreclosure, and one such option is the Deed in Lieu of Foreclosure form. This legal document allows a homeowner to voluntarily transfer ownership of their property to the lender in exchange for the cancellation of their mortgage debt. By opting for this route, homeowners can avoid the lengthy and often stressful foreclosure process. The form outlines essential details, such as the names of the parties involved, the property description, and any existing liens or encumbrances. Additionally, it may include provisions regarding the condition of the property and any agreements related to the homeowner's relocation. Understanding the nuances of this form is crucial for homeowners considering this option, as it can provide a pathway to financial relief while also protecting their credit score from the more severe impacts of foreclosure.

Misconceptions

The Texas Deed in Lieu of Foreclosure is a legal option for homeowners facing foreclosure. However, several misconceptions can cloud understanding of this process. Here are five common misunderstandings:

-

A Deed in Lieu of Foreclosure eliminates all debt.

This is not necessarily true. While the homeowner may transfer ownership of the property to the lender, any remaining debt not covered by the property value may still be owed. It's essential to clarify with the lender what debts will be satisfied through this process.

-

It will negatively impact your credit score more than foreclosure.

In many cases, a deed in lieu of foreclosure may have a less severe impact on a credit score compared to a full foreclosure. However, it still results in a negative mark, and the exact effect can vary based on individual circumstances.

-

All lenders accept a Deed in Lieu of Foreclosure.

This is a misconception. Not all lenders are willing to accept a deed in lieu as a solution. Some may prefer to proceed with foreclosure due to internal policies or financial considerations. Homeowners should always check with their lender to understand their options.

-

Homeowners can simply walk away from the property.

This is misleading. A deed in lieu of foreclosure requires the homeowner to actively participate in the process, including signing documents and potentially negotiating terms. It is not a matter of abandoning the property without consequence.

-

There are no tax implications associated with a Deed in Lieu of Foreclosure.

Homeowners may face tax consequences when transferring property through a deed in lieu. The IRS may consider the difference between the loan amount and the property's value as taxable income. Consulting a tax professional can provide clarity on potential implications.

Texas Deed in Lieu of Foreclosure: Usage Instruction

After completing the Texas Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the lender and ensuring all parties receive copies for their records. It is important to follow up with the lender to confirm receipt and discuss any further actions required.

- Obtain the Texas Deed in Lieu of Foreclosure form. You can find it on the Texas Secretary of State's website or through your lender.

- Fill in the date at the top of the form.

- Provide the name and address of the property owner(s) in the designated section.

- Enter the name and address of the lender in the appropriate fields.

- Clearly describe the property being conveyed, including the full legal description. This may be found on your property tax statement or deed.

- State the reason for the deed in lieu of foreclosure in the specified area.

- Sign and date the form in the designated signature lines. Ensure all property owners sign if there are multiple owners.

- Have the form notarized. This step is crucial for the document's validity.

- Make copies of the completed and notarized form for your records and for the lender.

- Submit the original signed and notarized form to the lender as directed.

Common mistakes

-

Failing to provide accurate property information. It is essential to include the correct legal description of the property. This includes the address, parcel number, and any relevant identifiers. Inaccuracies can lead to delays or complications in the transfer process.

-

Not understanding the implications of the deed. A Deed in Lieu of Foreclosure transfers ownership of the property to the lender. This action may impact future credit opportunities. It is crucial to fully comprehend the consequences before signing.

-

Overlooking the need for signatures. All necessary parties must sign the document for it to be valid. This includes the borrower(s) and any co-owners of the property. Missing signatures can render the deed ineffective.

-

Neglecting to seek legal advice. Consulting with a legal professional can provide clarity and guidance. Understanding the rights and responsibilities involved in the process is vital. Without proper counsel, individuals may inadvertently make decisions that are not in their best interest.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In Texas, the process is governed by the Texas Property Code, particularly sections related to real estate transactions and foreclosure. |

| Eligibility | Homeowners facing financial hardship and unable to keep up with mortgage payments may qualify for this option. |

| Benefits | This option can help homeowners avoid the lengthy and damaging process of foreclosure, preserving their credit score more effectively. |

| Process | The homeowner must negotiate with the lender and complete the necessary paperwork to finalize the deed transfer. |

| Title Transfer | By signing the deed, the homeowner transfers the title of the property directly to the lender. |

| Debt Forgiveness | In some cases, lenders may agree to forgive any remaining mortgage debt after the property transfer. |

| Impact on Credit | A Deed in Lieu of Foreclosure may have a less severe impact on credit scores compared to a foreclosure. |

| Alternatives | Homeowners can also consider options like short sales or loan modifications as alternatives to foreclosure. |

| Legal Advice | It is recommended that homeowners seek legal advice before proceeding with a Deed in Lieu of Foreclosure to understand their rights and obligations. |

Dos and Don'ts

When filling out the Texas Deed in Lieu of Foreclosure form, it's crucial to follow specific guidelines to ensure accuracy and legality. Here’s a list of things to do and avoid:

- Do ensure all parties involved in the transaction are clearly identified.

- Do provide accurate property descriptions to avoid future disputes.

- Do consult with a legal advisor if you have any questions about the process.

- Do keep copies of all documents for your records.

- Do sign the form in the presence of a notary public to validate the document.

- Don't leave any sections of the form blank; incomplete forms can lead to complications.

- Don't rush through the process; take your time to review all information.

- Don't ignore any outstanding liens or encumbrances on the property.

- Don't assume that the lender will accept the deed without proper communication.

- Don't forget to check state-specific requirements that may affect the form.

Similar forms

A Quitclaim Deed is similar to a Deed in Lieu of Foreclosure in that both documents transfer property ownership. In a Quitclaim Deed, the grantor relinquishes any claim to the property without guaranteeing clear title. This is often used between family members or in situations where the parties trust each other. Like a Deed in Lieu of Foreclosure, it can resolve disputes quickly but does not provide the same level of protection for the grantee regarding the property’s title status.

A Warranty Deed also shares similarities with a Deed in Lieu of Foreclosure, as it transfers ownership of real estate. However, a Warranty Deed comes with guarantees about the title, ensuring that the grantor has the right to sell the property and that it is free from liens or claims. While both documents facilitate property transfer, a Warranty Deed offers more security to the buyer compared to a Deed in Lieu of Foreclosure, which is often used to avoid foreclosure proceedings.

The Trader Joe's application form is a vital document for job seekers wishing to join this beloved grocery chain. It outlines necessary information about potential employees and provides an opportunity to showcase their unique skills and experience. Completing the form accurately can significantly increase the chances of landing a position at one of their stores, and you can find the application at documentonline.org/blank-trader-joe-s-application.

A Foreclosure Notice serves as a formal notification that a lender intends to foreclose on a property due to the owner's default on mortgage payments. While a Deed in Lieu of Foreclosure is a proactive measure taken by the homeowner to avoid the foreclosure process, a Foreclosure Notice indicates that the process is already underway. Both documents are related to the issue of mortgage default but represent different stages in the resolution of that issue.

A Short Sale Agreement is another document that parallels a Deed in Lieu of Foreclosure. In a Short Sale, the homeowner sells the property for less than the amount owed on the mortgage, with lender approval. Like a Deed in Lieu of Foreclosure, a Short Sale allows homeowners to avoid the negative consequences of foreclosure. However, a Short Sale typically involves a sale to a third party, while a Deed in Lieu directly transfers ownership back to the lender.

An Assignment of Mortgage is similar in that it involves the transfer of rights related to a mortgage. In this document, the original lender assigns their rights to another lender or investor. While a Deed in Lieu of Foreclosure involves the transfer of property ownership to the lender to settle a debt, an Assignment of Mortgage is more about transferring the financial interest in the mortgage itself.

A Release of Lien is another document that relates to property ownership and debt resolution. When a homeowner pays off a mortgage or settles a debt, the lender issues a Release of Lien to indicate that the lien on the property is removed. This is similar to a Deed in Lieu of Foreclosure in that both documents signify the end of a financial obligation, but a Release of Lien confirms the debt has been satisfied, while a Deed in Lieu signifies a voluntary transfer to avoid foreclosure.

A Loan Modification Agreement can also be compared to a Deed in Lieu of Foreclosure. This document alters the original terms of a mortgage to make it more manageable for the homeowner. While a Deed in Lieu of Foreclosure is a last resort option to avoid foreclosure, a Loan Modification Agreement aims to keep the homeowner in their home by adjusting payment terms. Both documents are tools for addressing mortgage difficulties but serve different purposes.

An Eviction Notice is related to the foreclosure process but serves a different function. It is issued when a tenant is being removed from a rental property due to non-payment or lease violations. While a Deed in Lieu of Foreclosure deals with property ownership and mortgage defaults, an Eviction Notice focuses on tenant rights and landlord-tenant relationships. Both documents indicate financial distress but apply to different situations.

Finally, a Bankruptcy Filing can be compared to a Deed in Lieu of Foreclosure in terms of debt resolution. When individuals face overwhelming debt, they may file for bankruptcy to seek relief. A Deed in Lieu of Foreclosure is an option for homeowners who want to avoid the foreclosure process without filing for bankruptcy. Both options aim to relieve financial burdens, but they involve different legal processes and implications for the homeowner.

Check out Popular Deed in Lieu of Foreclosure Forms for Different States

California Voluntary Property Surrender Document - This approach can often lead to less emotional distress compared to navigating a complete foreclosure process.

The importance of the California Notary Acknowledgement form cannot be overstated, as it serves to ensure the authenticity of signatures on legal documents, thereby supporting trust in the documentation process. By employing a Notary Public, individuals can receive confirmation that signers are properly identified and willingly affixed their signatures. For more details and resources regarding this form, visit https://formcalifornia.com.

The Loan Servicer Might Agree to Put the Foreclosure on Hold to Give You Some Time to Sell Your Home - A Deed in Lieu of Foreclosure transfers property ownership to the lender to avoid foreclosure.