Official Bill of Sale Template for Texas State

The Texas Bill of Sale form serves as a vital document in the transfer of ownership for personal property, whether it be vehicles, boats, or other tangible items. This form outlines essential details such as the buyer's and seller's names, addresses, and contact information, ensuring both parties are clearly identified. It also specifies the description of the item being sold, including make, model, year, and any relevant identification numbers, which helps prevent disputes over ownership. Additionally, the form captures the sale price and the date of the transaction, providing a clear record of the exchange. While not always legally required, having a Bill of Sale can protect both parties by documenting the terms of the sale and serving as proof of ownership. In Texas, the Bill of Sale can also be useful for tax purposes and may be required for vehicle registration. Understanding the key components of this form is essential for anyone engaging in a sale or purchase in the state, as it facilitates a smoother transaction and helps avoid potential legal issues down the line.

Misconceptions

When it comes to the Texas Bill of Sale form, several misconceptions can lead to confusion for buyers and sellers alike. Understanding these common misunderstandings can help ensure a smoother transaction process.

- It is not legally required for all transactions. Many people believe that a Bill of Sale is mandatory for every sale in Texas. While it is highly recommended for documenting the transfer of ownership, especially for vehicles and high-value items, it is not legally required for every transaction.

- It must be notarized. Another common myth is that a Bill of Sale must be notarized to be valid. In Texas, notarization is not a requirement. However, having it notarized can provide an extra layer of security and authenticity, which may be beneficial in case of disputes.

- It can only be used for vehicles. Some people think that the Bill of Sale is exclusively for vehicle transactions. In reality, this document can be used for a variety of items, including furniture, electronics, and livestock. It serves as proof of ownership transfer for any personal property.

- It does not need to include detailed information. A common misconception is that a Bill of Sale can be vague. In fact, including detailed information about the item being sold, such as its condition, serial number, and any warranties, can help avoid misunderstandings later on.

- It is only necessary for private sales. Many believe that only private sales require a Bill of Sale. However, even transactions involving dealers or businesses can benefit from this document. It provides a clear record of the transaction, which can be helpful for both parties.

By clearing up these misconceptions, individuals can navigate the process of buying and selling more effectively. A well-prepared Bill of Sale can serve as a valuable tool in any transaction.

Texas Bill of Sale: Usage Instruction

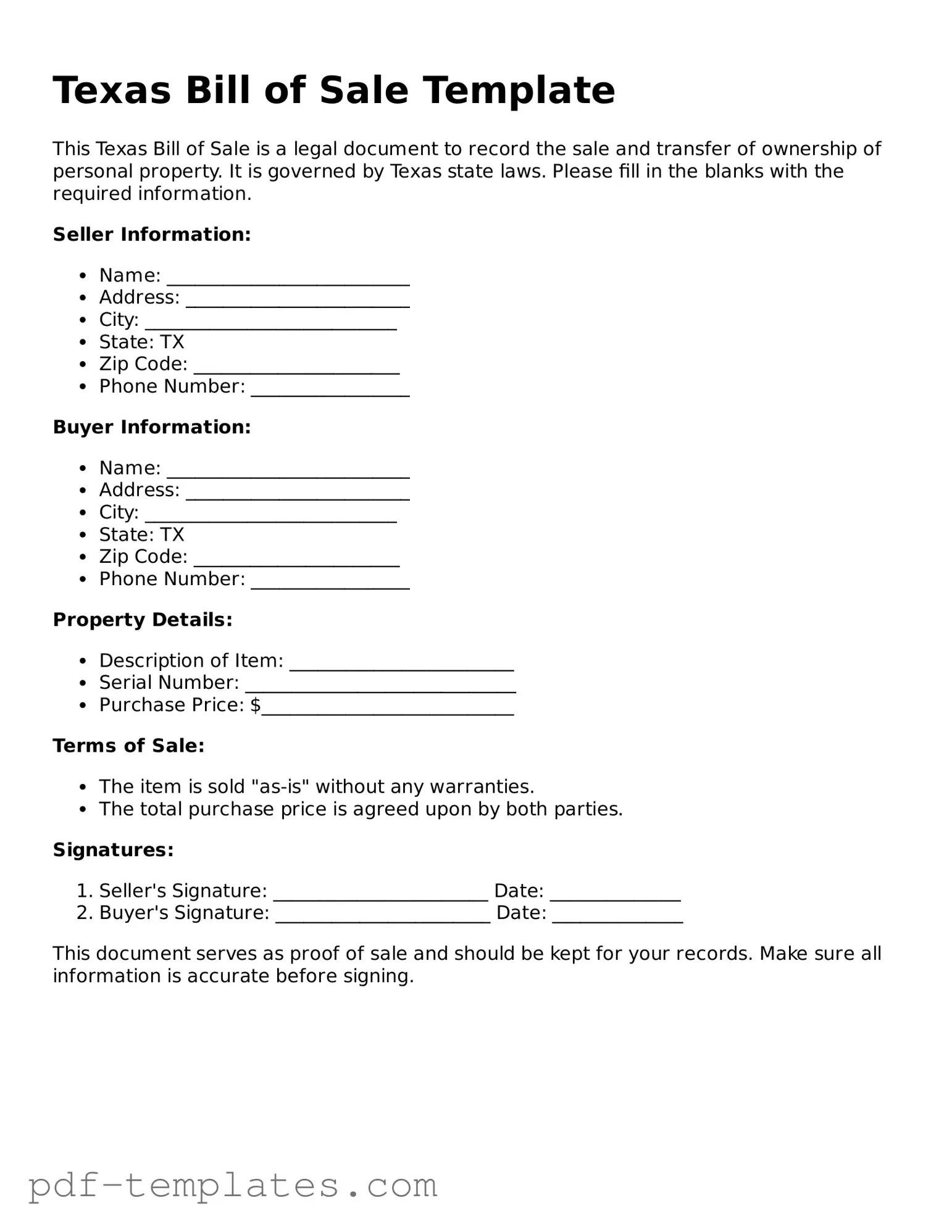

After obtaining the Texas Bill of Sale form, you will need to provide specific information to ensure the document is complete and accurate. This form is essential for the legal transfer of ownership of personal property. Follow the steps below to fill it out properly.

- Begin by entering the date of the sale at the top of the form.

- Identify the seller by writing their full name and address in the designated fields.

- Next, provide the buyer's full name and address, ensuring it matches their identification.

- Clearly describe the item being sold. Include details such as make, model, year, and any identifying numbers, like a Vehicle Identification Number (VIN) for vehicles.

- Indicate the sale price of the item. This should be a clear, numerical amount.

- If applicable, note any warranties or representations made about the item. This can include statements about its condition or functionality.

- Both the seller and buyer should sign and date the form at the bottom. This confirms their agreement to the terms outlined in the document.

Once you have completed the form, ensure that both parties retain a copy for their records. This documentation serves as proof of the transaction and can be useful for future reference.

Common mistakes

-

Incomplete Information: Individuals often fail to provide all necessary details. This includes not listing the full names and addresses of both the buyer and seller. Omitting this information can lead to confusion or disputes later on.

-

Incorrect Vehicle Identification Number (VIN): It is crucial to ensure that the VIN is accurate. Errors in this number can complicate the registration process and may lead to legal issues regarding ownership.

-

Failure to Sign: Both parties must sign the document for it to be valid. Sometimes, sellers or buyers neglect to sign the Bill of Sale, which can render the document unenforceable.

-

Not Including Sale Price: The sale price should be clearly stated. Leaving this blank or writing an ambiguous amount can create problems for tax purposes and may affect the transfer of ownership.

-

Ignoring State Requirements: Each state has specific regulations regarding Bills of Sale. People sometimes overlook these requirements, which can lead to complications during the transfer process.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Texas Bill of Sale is a legal document that transfers ownership of personal property from one party to another. |

| Governing Law | The Texas Bill of Sale is governed by the Texas Business and Commerce Code. |

| Types of Property | This form can be used for various types of personal property, including vehicles, equipment, and furniture. |

| Notarization | Notarization is not required for most Bill of Sale transactions in Texas, but it is recommended for added legal protection. |

| Buyer and Seller Information | The form must include the names and addresses of both the buyer and the seller to ensure clarity in the transaction. |

| Purchase Price | The document should clearly state the purchase price of the property being sold. |

| Condition of Property | It is advisable to describe the condition of the property being sold to avoid disputes later on. |

| As-Is Clause | Including an "as-is" clause can protect the seller from future claims regarding the condition of the property. |

| Record Keeping | Both parties should keep a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

Dos and Don'ts

When completing the Texas Bill of Sale form, it's essential to be thorough and accurate. Here’s a list of things to do and avoid to ensure a smooth transaction.

- Do: Provide accurate information about the buyer and seller, including full names and addresses.

- Do: Clearly describe the item being sold, including make, model, year, and VIN if applicable.

- Do: Include the sale price to establish the transaction amount.

- Do: Sign and date the form to validate the agreement.

- Do: Keep a copy of the Bill of Sale for your records.

- Do: Ensure both parties understand the terms of the sale before signing.

- Do: Check for any local requirements that might need to be added to the form.

- Don't: Leave any sections blank; incomplete forms can lead to issues later.

- Don't: Use vague descriptions; specificity helps prevent misunderstandings.

- Don't: Forget to notarize the document if required by local laws.

- Don't: Alter the form after it has been signed; this can invalidate the agreement.

- Don't: Rush the process; take your time to ensure everything is accurate.

- Don't: Ignore state regulations regarding the sale of certain items.

- Don't: Assume verbal agreements are sufficient; always document the sale.

Similar forms

The Texas Bill of Sale form is similar to a Vehicle Title Transfer form. Both documents serve as proof of ownership transfer for a vehicle. When you sell or buy a car, the title must be signed over to the new owner. This process ensures that the new owner has legal rights to the vehicle. Just like the Bill of Sale, the Vehicle Title Transfer form includes essential details like the buyer's and seller's information, vehicle identification number, and sale price. Both documents protect the interests of both parties involved in the transaction.

Another document that resembles the Texas Bill of Sale is the Lease Agreement. A Lease Agreement outlines the terms under which one party rents property from another. Similar to a Bill of Sale, it contains details about the parties involved, the property in question, and the terms of the agreement. Both documents are legally binding and require signatures from both parties to be enforceable. They serve to clarify the rights and responsibilities of each party, providing a clear record of the transaction.

The Warranty Deed is also akin to the Texas Bill of Sale, particularly in real estate transactions. A Warranty Deed transfers ownership of property from one person to another, guaranteeing that the seller has the right to sell the property. Similar to a Bill of Sale, it includes information about the buyer, seller, and property description. Both documents aim to provide a clear record of ownership and protect the rights of the buyer.

Lastly, the Power of Attorney form can be compared to the Texas Bill of Sale in terms of granting authority. A Power of Attorney allows one person to act on behalf of another in legal matters. While a Bill of Sale transfers ownership, a Power of Attorney enables someone to make decisions regarding that ownership. Both documents require signatures and must be executed properly to be legally valid. They ensure that the intentions of the parties are clearly documented and understood.

Check out Popular Bill of Sale Forms for Different States

How to Transfer Ownership of a Car to a Family Member in Ny - To ensure clear understanding, the language used in the Bill of Sale should be straightforward.

Washington Vehicle Bill of Sale - It can act as a deterrent against potential disputes over ownership rights.

Virginia Bill of Sale for Car - The Bill of Sale can be useful for vehicles, electronics, furniture, and other personal assets.