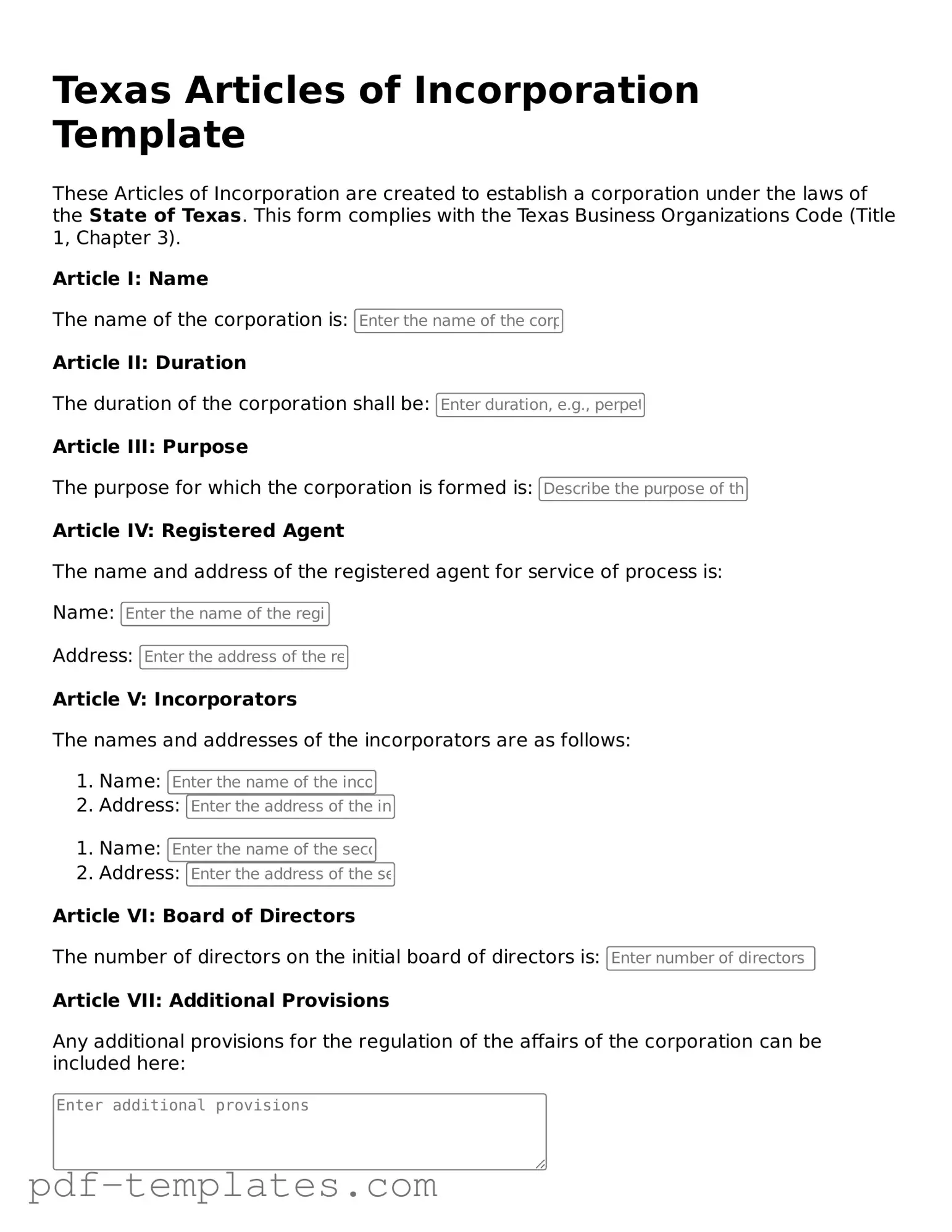

Official Articles of Incorporation Template for Texas State

Starting a business in Texas involves several important steps, one of which is filing the Articles of Incorporation. This essential document lays the groundwork for your corporation, outlining key details that define its structure and purpose. At its core, the form requires you to provide the corporation's name, which must be unique and comply with state naming rules. Additionally, you’ll need to specify the duration of the corporation, which can be perpetual or for a limited time. The Articles of Incorporation also require information about the registered agent—someone who will receive legal documents on behalf of the corporation. Furthermore, you must include the number of shares the corporation is authorized to issue, as well as the names and addresses of the initial directors. Understanding these components is crucial, as they not only comply with state regulations but also shape the future operations of your business. Filing this form is a pivotal step in transforming your entrepreneurial vision into a legally recognized entity.

Misconceptions

Many people have misconceptions about the Texas Articles of Incorporation form. Understanding the truth behind these misconceptions can help ensure a smoother incorporation process. Here are five common misconceptions:

- Misconception 1: You need a lawyer to file Articles of Incorporation.

- Misconception 2: Articles of Incorporation are the same as a business license.

- Misconception 3: You must have a physical office in Texas to incorporate.

- Misconception 4: Filing Articles of Incorporation is a one-time process.

- Misconception 5: The Articles of Incorporation form is the only document needed for incorporation.

This is not true. Individuals can prepare and file their own Articles of Incorporation without hiring a lawyer. However, seeking legal advice can be beneficial if you have specific questions or complex needs.

These are different documents. Articles of Incorporation establish your business as a corporation, while a business license allows you to operate legally in your area. Both are necessary, but they serve distinct purposes.

This is incorrect. While you need a registered agent with a physical address in Texas, you do not have to maintain a physical office in the state to incorporate.

In reality, maintaining your corporation requires ongoing compliance. You may need to file annual reports and pay franchise taxes to keep your corporation in good standing.

While the Articles of Incorporation are essential, additional documents may be required. These can include bylaws, initial resolutions, and other forms depending on your business structure and needs.

Texas Articles of Incorporation: Usage Instruction

Filling out the Texas Articles of Incorporation form is an essential step in establishing a corporation in Texas. After completing the form, you will need to submit it to the Texas Secretary of State along with the required filing fee. Ensure that all information is accurate to avoid delays in processing.

- Begin by downloading the Texas Articles of Incorporation form from the Texas Secretary of State's website.

- Provide the name of your corporation. Ensure the name complies with Texas naming requirements and is not already in use.

- Indicate the duration of your corporation. Most corporations are set up to exist perpetually, but you can specify a limited duration if desired.

- Fill in the purpose of your corporation. Clearly state the business activities your corporation will engage in.

- Enter the registered agent's name and address. This person or entity will be responsible for receiving legal documents on behalf of the corporation.

- List the initial board of directors. Include the names and addresses of the individuals who will serve on the board.

- Provide the address of the corporation's principal office. This is where the main business operations will occur.

- Sign and date the form. The incorporator must sign the Articles of Incorporation to validate the document.

- Prepare the filing fee. Check the Texas Secretary of State's website for the current fee amount.

- Submit the completed form along with the filing fee to the Texas Secretary of State by mail or online, if applicable.

Common mistakes

-

Incorrect Business Name: Many individuals fail to check if their desired business name is available. Each name must be unique and not already in use by another corporation in Texas. It is crucial to conduct a name search before submission.

-

Missing Registered Agent Information: A registered agent is required for all corporations in Texas. Some people neglect to provide the name and address of their registered agent, which can lead to delays or rejection of the application.

-

Improperly Stated Purpose: The purpose of the corporation must be clearly articulated. Vague or overly broad statements may not meet the requirements set forth by the state. It is important to be specific about the business activities.

-

Incorrect Number of Shares: When detailing the number of shares the corporation is authorized to issue, errors often occur. Ensure that the number is accurate and aligns with the corporation’s structure and future plans.

-

Failure to Sign the Document: A common oversight is neglecting to sign the Articles of Incorporation. The document must be signed by the incorporators. Without signatures, the filing will not be valid.

-

Omitting Initial Directors: The form requires the names and addresses of the initial directors. Some individuals forget to include this information, which is essential for the corporation’s governance.

-

Ignoring Filing Fees: Each submission requires a filing fee. Some applicants overlook this requirement, leading to the rejection of their application. It is vital to include the correct payment along with the form.

PDF Features

| Fact Name | Details |

|---|---|

| Purpose | The Texas Articles of Incorporation form is used to legally establish a corporation in the state of Texas. |

| Governing Law | The form is governed by the Texas Business Organizations Code. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for all corporations wishing to operate in Texas. |

| Information Needed | The form requires specific information, including the corporation's name, registered agent, and purpose. |

| Registered Agent | A registered agent must be designated, who will receive legal documents on behalf of the corporation. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation to the Texas Secretary of State. |

| Processing Time | Processing time for the Articles of Incorporation may vary, but it typically takes a few business days. |

| Amendments | Changes to the Articles of Incorporation can be made through a formal amendment process. |

| Nonprofit Option | Texas allows for the incorporation of both for-profit and nonprofit organizations using this form. |

| Public Record | Once filed, the Articles of Incorporation become part of the public record and can be accessed by anyone. |

Dos and Don'ts

When filling out the Texas Articles of Incorporation form, it is important to follow specific guidelines to ensure a smooth process. Here is a list of things you should and shouldn't do:

- Do provide accurate and complete information in all sections of the form.

- Do include the name of the corporation as it will appear in public records.

- Do specify the purpose of the corporation clearly and concisely.

- Do designate a registered agent with a physical address in Texas.

- Don't use abbreviations or informal names for the corporation.

- Don't forget to sign and date the form before submission.

- Don't leave any required fields blank, as this may delay processing.

- Don't submit the form without verifying all information for accuracy.

By adhering to these guidelines, individuals can facilitate a more efficient incorporation process in Texas.

Similar forms

The Texas Articles of Incorporation form is similar to the Certificate of Incorporation, commonly used in various states. Both documents serve as the foundational legal paperwork required to establish a corporation. They outline essential details such as the corporation's name, purpose, and the number of shares it is authorized to issue. While the terminology may differ slightly from state to state, the primary function remains the same: to officially register a corporation with the state government, thereby granting it legal recognition and the ability to conduct business.

Another document akin to the Texas Articles of Incorporation is the Bylaws. While the Articles of Incorporation provide the basic structure of the corporation, the Bylaws delve into the internal rules and procedures that govern the corporation's operations. Bylaws outline how meetings are conducted, the roles of officers, and the process for electing directors. They serve as a roadmap for the corporation’s daily functioning, ensuring that all members understand their rights and responsibilities.

In the realm of legal documentation for real estate, clarity is paramount, and the California Agreement Room form exemplifies this principle. This document is essential for ensuring that both landlords and tenants are fully aware of their respective rights and obligations when renting a room in a private home. Notably, it details crucial aspects such as rent amounts, payment schedules, and maintenance responsibilities. For a comprehensive understanding of all necessary legal documents related to real estate rentals, you can explore All California Forms to navigate the complexities of such agreements effectively.

The Operating Agreement is similar to the Articles of Incorporation but is specifically used for Limited Liability Companies (LLCs). This document outlines the management structure and operational procedures of the LLC, much like how the Articles define the framework for a corporation. It includes details such as member roles, profit distribution, and decision-making processes. Both documents aim to provide clarity and structure, but they cater to different types of business entities.

The Partnership Agreement also shares similarities with the Texas Articles of Incorporation. This document is essential for partnerships and outlines the roles, responsibilities, and profit-sharing arrangements among partners. Like the Articles of Incorporation, it serves to formalize the business relationship, ensuring that all parties are on the same page regarding their contributions and expectations. Both documents are foundational to the legal operation of their respective business structures.

In addition, the Certificate of Good Standing is another document that has a close relationship with the Articles of Incorporation. While the Articles establish a corporation, the Certificate of Good Standing confirms that the corporation is legally registered and compliant with state regulations. It serves as proof that the corporation has fulfilled its obligations, such as filing annual reports and paying taxes. This certificate can be critical when seeking financing or entering contracts, as it assures other parties of the corporation's legitimacy.

Lastly, the Statement of Information is a document that, like the Texas Articles of Incorporation, provides essential details about a corporation. This document typically includes information about the corporation's address, officers, and business activities. While the Articles of Incorporation serve as the initial registration document, the Statement of Information is often required periodically to keep the state updated on any changes. Both documents are vital for maintaining transparency and ensuring that the corporation remains in good standing with the state.

Check out Popular Articles of Incorporation Forms for Different States

Form California Llc - Defines the company's name and purpose.

To streamline your tenant selection process, our comprehensive Rental Application form provides landlords with the necessary information from applicants, ensuring you make informed decisions when renting your property. You can access this vital document by visiting our useful Rental Application resource.

Ny Department of State - Provides a legal framework for the corporation’s operations.