Get Tax POA dr 835 Form in PDF

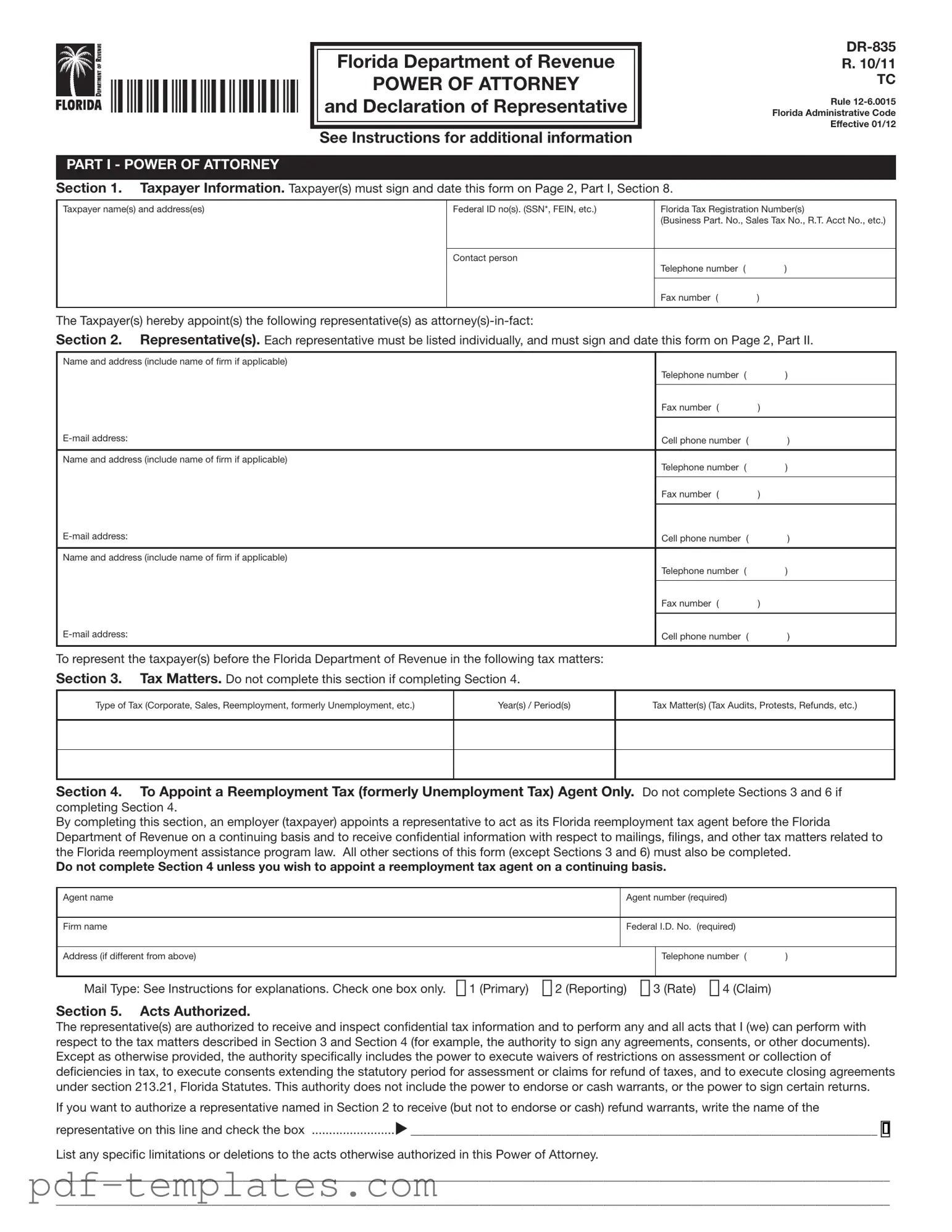

The Tax Power of Attorney (POA) DR 835 form serves as a vital tool for individuals and businesses seeking to delegate authority to a representative when dealing with tax matters. This form allows taxpayers to authorize an agent to act on their behalf in front of tax authorities, ensuring that their interests are adequately represented. By completing the DR 835, taxpayers can grant their designated representative the power to receive confidential tax information, file returns, and make decisions regarding tax liabilities. This process not only streamlines communication between the taxpayer and tax agencies but also provides peace of mind, knowing that a trusted individual is managing their tax affairs. Additionally, the form includes essential information such as the taxpayer's identification details, the scope of authority granted, and the duration of the authorization. Understanding the significance of the Tax POA DR 835 form is crucial for anyone looking to navigate the complexities of tax obligations effectively.

Misconceptions

The Tax POA DR 835 form, also known as the Power of Attorney form for tax matters, is often misunderstood. Here are nine common misconceptions about this form:

- The form is only for tax professionals. Many believe that only accountants or tax attorneys can use this form. In reality, any individual can designate someone to represent them in tax matters.

- It is only needed for audits. Some think the form is necessary only during an audit. However, it can be useful for various tax-related issues, including filing returns and negotiating with tax authorities.

- Once submitted, it cannot be revoked. There is a belief that signing the form is a permanent decision. In fact, taxpayers can revoke the Power of Attorney at any time by submitting a revocation form.

- Only one person can be designated. Many assume that the form allows for only a single representative. In truth, taxpayers can appoint multiple individuals to act on their behalf.

- The form must be filed with the IRS. Some people think that the form needs to be submitted to the IRS for it to be valid. However, it is typically kept by the taxpayer and the representative, unless specifically required by the IRS.

- It grants unlimited power. There is a misconception that signing the form gives the representative complete control over all financial matters. The authority granted can be limited to specific tax matters as defined by the taxpayer.

- It is the same as a general Power of Attorney. Many confuse the Tax POA DR 835 with a general Power of Attorney. The tax form is specifically tailored for tax-related issues, whereas a general Power of Attorney covers a broader range of financial matters.

- It is only valid for federal tax matters. Some believe that the form is applicable only for federal taxes. In fact, it can also be used for state tax matters, depending on the jurisdiction.

- Filing the form guarantees a favorable outcome. There is a common belief that submitting the form will lead to favorable tax resolutions. However, the outcome depends on the specific circumstances and actions taken by the representative.

Tax POA dr 835: Usage Instruction

After obtaining the Tax POA DR 835 form, you are ready to fill it out. This process involves providing specific information about yourself and the representative you wish to authorize. Follow these steps carefully to ensure accurate completion of the form.

- Download the form: Get the Tax POA DR 835 form from the official website or your local tax office.

- Provide your information: Fill in your name, address, and Social Security number or taxpayer identification number in the designated sections.

- Enter representative details: Include the name, address, and phone number of the person you are authorizing to act on your behalf.

- Specify the tax matters: Clearly indicate the types of tax matters the representative is authorized to handle, such as income tax or sales tax.

- Select the tax years: Indicate the specific tax years or periods for which the authority applies.

- Sign and date: Sign the form and include the date to validate your authorization.

- Submit the form: Send the completed form to the appropriate tax authority, either by mail or electronically, as specified.

Once the form is submitted, the tax authority will process your request. You will receive confirmation that your representative is authorized to act on your behalf regarding the specified tax matters. Keep a copy of the completed form for your records.

Common mistakes

-

Failing to provide all required personal information. When filling out the Tax POA DR 835 form, it is crucial to include your full name, address, and Social Security number. Missing any of this information can delay the processing of your request.

-

Not signing the form. A common oversight is forgetting to sign the form. Without a signature, the form is considered incomplete and cannot be processed.

-

Using incorrect or outdated form versions. Tax forms can change from year to year. Always ensure that you are using the most current version of the Tax POA DR 835 form to avoid complications.

-

Neglecting to specify the scope of authority. Clearly outlining what powers you are granting to your representative is essential. Vague language can lead to misunderstandings and limit the effectiveness of the authorization.

-

Not providing identification for the representative. The form requires that the person you are granting power of attorney to is properly identified. Failing to include their information can result in rejection of the form.

-

Overlooking the need for multiple signatures. If the taxpayer is a business or a joint filing situation, all necessary parties must sign the form. Missing signatures from any required individuals will invalidate the authorization.

-

Inadequate record-keeping. After submitting the form, it is wise to keep a copy for your records. This can be helpful in case any issues arise later regarding the authorization.

-

Ignoring state-specific requirements. While the Tax POA DR 835 form is a federal document, some states may have additional requirements. Failing to adhere to these can complicate matters.

File Specifics

| Fact Name | Details |

|---|---|

| Purpose | The Tax POA DR 835 form is used to grant power of attorney to an individual or organization to represent a taxpayer before the IRS. |

| Eligibility | Any individual or entity can designate a representative by completing this form, provided they have the legal capacity to do so. |

| Governing Law | This form is governed by the Internal Revenue Code, specifically sections related to taxpayer representation. |

| Submission Method | The completed form can be submitted electronically or via mail to the IRS, depending on the specific circumstances. |

| Effective Date | The power of attorney becomes effective immediately upon acceptance by the IRS, unless otherwise specified. |

| Revocation | A taxpayer can revoke the power of attorney at any time by submitting a written notice to the IRS. |

| Signature Requirement | The taxpayer must sign the form, and if applicable, the representative must also provide their signature. |

| Representation Scope | The form allows the representative to handle various tax matters, including audits, appeals, and tax returns. |

| Duration | The power of attorney remains in effect until revoked or the taxpayer passes away, unless a specific end date is provided. |

Dos and Don'ts

When filling out the Tax POA DR 835 form, it’s essential to ensure accuracy and completeness. Here’s a list of things you should and shouldn’t do to facilitate a smooth process.

- Do: Carefully read the instructions provided with the form.

- Do: Provide accurate and complete information about the taxpayer and the representative.

- Do: Sign and date the form where required.

- Do: Double-check the form for any errors before submission.

- Do: Keep a copy of the completed form for your records.

- Don’t: Leave any required fields blank; this may delay processing.

- Don’t: Use outdated versions of the form; always use the latest version available.

Following these guidelines will help ensure that your Tax POA DR 835 form is processed efficiently and without unnecessary complications.

Similar forms

The IRS Form 2848, also known as the Power of Attorney and Declaration of Representative, is similar to the Tax POA DR 835 form in that both documents authorize an individual to act on behalf of a taxpayer. The IRS Form 2848 allows the designated representative to receive confidential tax information and represent the taxpayer before the IRS. This form is often used for federal tax matters, while the Tax POA DR 835 is specific to state tax issues in certain jurisdictions. Both forms require the taxpayer's signature and the representative's information, ensuring that the authorization is clear and legally binding.

When considering the various power of attorney forms, it's essential to note that these documents are crucial in providing individuals with the ability to manage their affairs when they cannot do so themselves. Whether for medical or tax purposes, understanding the options available is key. For example, the All California Forms present a comprehensive resource for those needing guidance on medical and legal decisions, ensuring that one's preferences are honored in every situation.

Another document that shares similarities with the Tax POA DR 835 is the IRS Form 8821, which is a Tax Information Authorization form. While the Tax POA DR 835 grants authority to act on behalf of the taxpayer, Form 8821 only allows the designated person to receive tax information without the power to represent the taxpayer in dealings with the IRS. This distinction is important for those who need to share their tax details with a third party but do not require full representation. Like the Tax POA DR 835, Form 8821 requires the taxpayer's consent and specifies the tax matters involved.

The Durable Power of Attorney (DPOA) is another document that serves a similar purpose, but it extends beyond tax matters. A DPOA allows a person to make decisions on behalf of another individual in various areas, including financial and legal affairs. This document remains effective even if the principal becomes incapacitated, unlike the Tax POA DR 835, which is typically limited to specific tax-related matters. While both documents involve granting authority, the DPOA is broader in scope and can cover a wider range of decisions beyond just tax issues.

Lastly, the Limited Power of Attorney (LPOA) is akin to the Tax POA DR 835 in that it provides specific powers to an individual for a defined purpose. An LPOA allows the designated agent to perform certain actions on behalf of the principal, such as managing financial transactions or handling legal matters. This document can be tailored to limit the authority granted, similar to how the Tax POA DR 835 is limited to tax-related issues. Both documents require clear terms outlining the scope of authority and the duration of the power granted, ensuring that the principal's intentions are honored.

Other PDF Forms

Lien Release Requirements by State - Provides a formal method of notifying property owners of claims.

For those interested in understanding the legal ramifications of their choices, the Texas Do Not Resuscitate Order form is paramount. By utilizing this document, you can ensure that your healthcare preferences are duly recognized. To find more information on how to properly fill this out, visit the guide on the "Texas Do Not Resuscitate Order" and streamline your preparation process here.

Automation in Business Credit - Information submitted will be used to assess risk and terms.