Get Stock Transfer Ledger Form in PDF

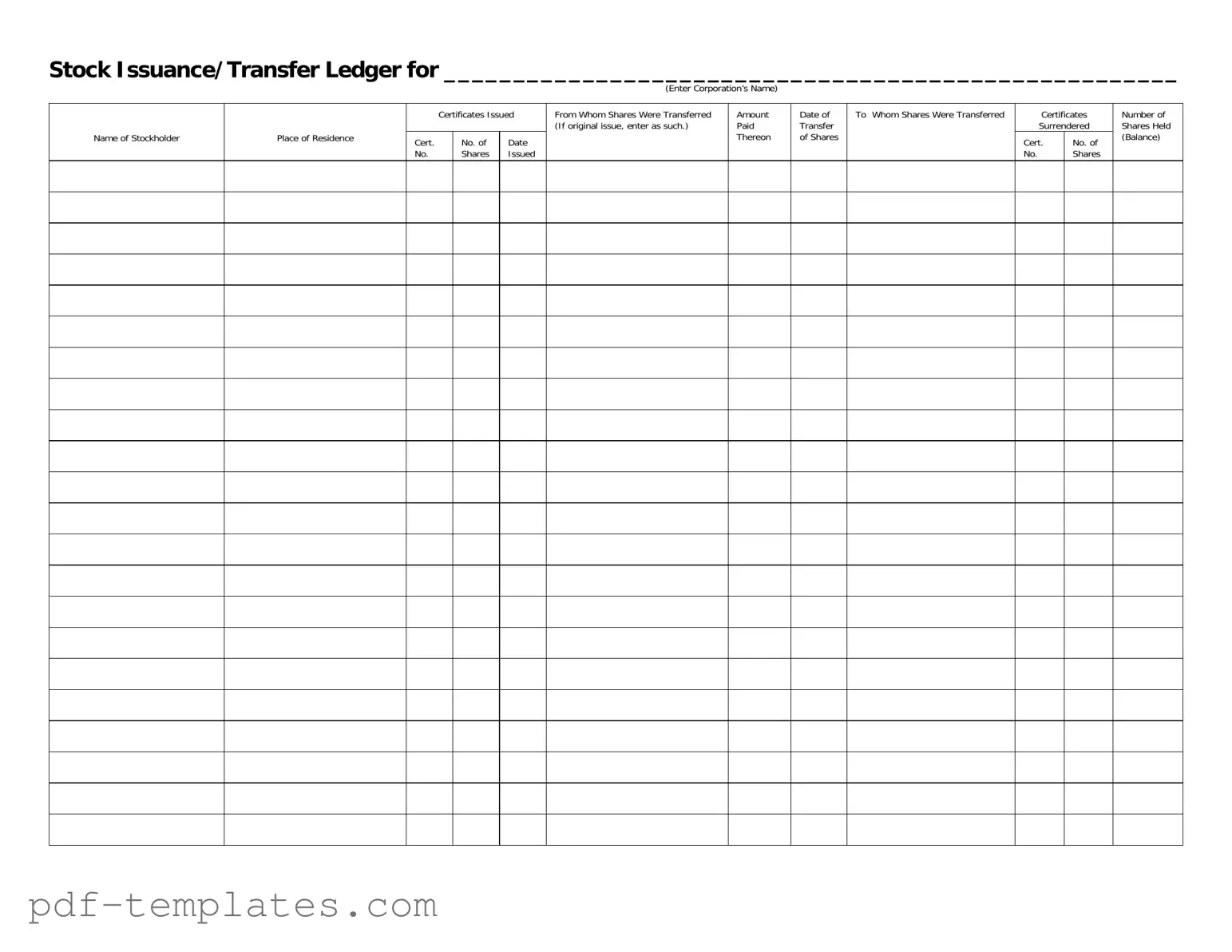

The Stock Transfer Ledger form serves as a vital record-keeping tool for corporations managing their stock issuance and transfers. This form allows for the systematic documentation of stockholder information, including the name and place of residence of each stockholder, which is essential for maintaining accurate ownership records. It captures details about certificates issued, including the certificate number, the date of issuance, and the number of shares involved. When shares are transferred, the form requires information about the transferor and transferee, ensuring that both parties are clearly identified. Additionally, it records the amount paid for the shares, the date of the transfer, and any certificates that have been surrendered. By tracking the number of shares held, the Stock Transfer Ledger helps corporations maintain a clear balance of ownership, facilitating smooth transactions and compliance with regulatory requirements. This comprehensive approach to stock management not only aids in corporate governance but also enhances transparency for all stakeholders involved.

Misconceptions

Understanding the Stock Transfer Ledger form is essential for anyone involved in corporate governance or stock management. However, several misconceptions can lead to confusion. Here are nine common misconceptions:

- The form is only necessary for large corporations. In reality, any corporation that issues stock must maintain a Stock Transfer Ledger, regardless of size.

- Only the corporate secretary can fill out the form. While the corporate secretary often manages this process, any authorized individual can complete the form.

- The Stock Transfer Ledger is the same as a stock certificate. This is incorrect. The ledger records transactions, while a stock certificate serves as proof of ownership.

- Once shares are issued, they do not need to be recorded again. This misconception overlooks the need to update the ledger with each transfer of shares.

- All information on the form is optional. In fact, certain fields, such as the name of the stockholder and the number of shares, are mandatory.

- The form only tracks the initial issuance of shares. It also records transfers between stockholders, making it a dynamic record throughout the life of the shares.

- There is no legal requirement to maintain a Stock Transfer Ledger. Many states require corporations to keep accurate records of stock transfers as part of corporate governance.

- Once the form is completed, it can be discarded. On the contrary, the ledger must be preserved for historical reference and potential audits.

- The ledger does not need to be updated if shares are transferred between family members. Every transfer, regardless of the relationship between parties, must be documented in the ledger.

By clarifying these misconceptions, individuals can better understand the importance and function of the Stock Transfer Ledger form in corporate settings.

Stock Transfer Ledger: Usage Instruction

After obtaining the Stock Transfer Ledger form, you will need to carefully fill it out with the necessary information. This process ensures that all stock transfers are accurately recorded. Follow the steps below to complete the form correctly.

- Begin by entering the corporation’s name in the designated space at the top of the form.

- In the section labeled "Name of Stockholder," write the full name of the individual or entity holding the shares.

- Next, provide the "Place of Residence" for the stockholder. This should include the city and state.

- Indicate the "Certificates Issued" by filling in the total number of certificates that have been issued to the stockholder.

- In the "Cert. No." column, enter the certificate number for each issued certificate.

- Fill in the "Date" on which the certificates were issued.

- Under "No. Shares Issued," write the number of shares that correspond to each certificate issued.

- In the section titled "From Whom Shares Were Transferred," specify the name of the person or entity transferring the shares. If this is the original issue, note that accordingly.

- Record the "Amount Paid Thereon" for the shares being transferred.

- In the "Date of Transfer of Shares" section, provide the date when the transfer took place.

- In the "To Whom Shares Were Transferred" area, indicate the name of the new stockholder receiving the shares.

- If any certificates were surrendered as part of the transfer, fill in the "Certificates Surrendered" section with the relevant details.

- For "Cert. No. of No. Shares," enter the certificate number of the surrendered shares.

- Finally, indicate the "Number of Shares Held (Balance)" to reflect the total shares remaining with the stockholder after the transfer.

Common mistakes

-

Failing to enter the corporation's name accurately. This can lead to confusion and potential legal issues regarding ownership.

-

Omitting the name of the stockholder. Each entry must clearly identify the individual or entity holding the shares.

-

Not providing a complete place of residence. This information is essential for record-keeping and communication purposes.

-

Leaving out the certificates issued section. Each transaction must include details about the shares being transferred.

-

Incorrectly filling out the certificate number. This can create discrepancies in the ledger and complicate future transfers.

-

Failing to include the date of issuance. Without this, it becomes challenging to track the history of the shares.

-

Neglecting to specify the number of shares issued. Each entry must reflect the accurate quantity being transferred.

-

Not indicating from whom the shares were transferred. This is crucial for establishing the chain of ownership.

-

Forgetting to record the amount paid for the shares. This information is vital for financial records and tax purposes.

-

Leaving out the date of transfer. Each transfer must be documented with a specific date to maintain accurate records.

-

Failing to specify to whom the shares were transferred. This ensures clarity in ownership and accountability.

-

Not documenting the certificates surrendered. This step is important for tracking the shares that have been returned.

-

Incorrectly reporting the number of shares held (balance). This can lead to confusion about ownership and rights.

File Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The Stock Transfer Ledger form tracks the issuance and transfer of stock shares within a corporation. |

| Corporation Name | The form requires the name of the corporation at the top for identification purposes. |

| Stockholder Information | Details about each stockholder, including their name and place of residence, must be recorded. |

| Certificate Details | The form includes fields for the certificate numbers and the number of shares issued. |

| Transfer Information | It captures information about the transfer of shares, including the date and parties involved. |

| Original Issue Notation | If shares are issued for the first time, the form allows for a notation indicating this status. |

| Amount Paid | The form requires the amount paid for the shares to be documented. |

| Surrendered Certificates | Information about surrendered certificates is also recorded, including their certificate numbers. |

| Balance of Shares | The form concludes with a section that shows the number of shares held by the stockholder after transfers. |

Dos and Don'ts

When filling out the Stock Transfer Ledger form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things to do and avoid during this process.

- Do enter the corporation’s name clearly at the top of the form.

- Do provide complete information for each stockholder, including their name and place of residence.

- Do accurately record the certificate numbers and the number of shares issued.

- Do indicate the date of transfer for each transaction.

- Don't leave any fields blank; all sections must be filled out to avoid delays.

- Don't use abbreviations or shorthand when entering information.

- Don't forget to document the amount paid for the shares being transferred.

- Don't neglect to indicate the certificates surrendered for the transfer.

Adhering to these guidelines will help ensure the Stock Transfer Ledger form is completed correctly and efficiently.

Similar forms

The Stock Transfer Ledger form bears similarities to the Shareholder Register. This document lists all the shareholders of a corporation, detailing their names, addresses, and the number of shares owned. Like the Stock Transfer Ledger, it tracks ownership, ensuring that the corporation maintains accurate records of who holds shares at any given time. Both documents serve the purpose of documenting changes in ownership and are crucial for maintaining transparency within the corporation.

Another document akin to the Stock Transfer Ledger is the Stock Certificate. This physical document represents ownership of a specific number of shares in a corporation. It includes details such as the shareholder's name, the number of shares, and the certificate number. While the Stock Transfer Ledger records transactions and changes in ownership, the Stock Certificate serves as proof of ownership, making both essential in the management of corporate shares.

The Corporate Bylaws also share similarities with the Stock Transfer Ledger. Bylaws outline the rules and procedures for the governance of a corporation, including how stock transfers should be handled. They establish the framework within which the Stock Transfer Ledger operates, ensuring that all transfers are conducted according to the corporation's established policies and legal requirements.

The Minutes of Shareholder Meetings are another related document. These minutes capture the decisions made during shareholder meetings, including any votes on stock transfers or issuances. Like the Stock Transfer Ledger, they help maintain a clear record of corporate actions and shareholder intentions, providing context for changes in stock ownership.

The Stock Option Agreement is similar as well. This document outlines the terms under which stock options are granted to employees or other stakeholders. While the Stock Transfer Ledger records the actual transfer of shares, the Stock Option Agreement details the rights to purchase shares, thus influencing future entries in the ledger as options are exercised and shares are transferred.

The Purchase Agreement for Shares is another document that aligns with the Stock Transfer Ledger. This agreement specifies the terms under which shares are bought and sold between parties. It includes details such as the number of shares, price, and conditions of the sale. Once the agreement is executed, the transfer of shares is recorded in the Stock Transfer Ledger, linking the two documents closely.

The Securities and Exchange Commission (SEC) Filings are also comparable. Corporations are required to submit various filings to the SEC, including reports of stock issuances and transfers. These filings provide a broader context for the data recorded in the Stock Transfer Ledger, ensuring compliance with federal regulations and offering transparency to investors and the public.

The Dividend Distribution Record can be viewed as similar as well. This document tracks the distribution of dividends to shareholders based on their ownership stakes. While the Stock Transfer Ledger focuses on ownership changes, the Dividend Distribution Record ensures that shareholders receive their rightful dividends, reflecting the financial benefits of their ownership in the corporation.

When dealing with complex financial documentation, understanding the various forms that record stock ownership is crucial. For instance, a Mechanics Lien California form is essential for contractors and suppliers asserting their rights to payment, similar to how a Shareholder Register tracks ownership in a corporation. To ensure compliance and clarity in such financial matters, referring to All California Forms can provide invaluable guidance.

Lastly, the Transfer Agent Records are comparable to the Stock Transfer Ledger. A transfer agent manages the transfer of shares and maintains accurate records of stock ownership. They work closely with the Stock Transfer Ledger to ensure that all transactions are properly recorded and that shareholders receive their stock certificates and dividends in a timely manner.

Other PDF Forms

Lift Inspection Form - Assess the cleanliness of the vehicle’s interior and exterior.

The USCIS I-864 form, also known as the Affidavit of Support, is a critical document used in family-based immigration processes. It serves as a pledge from a sponsor to financially support an immigrant, ensuring they will not become dependent on government assistance. This form is essential for those seeking permanent residency in the United States, binding the sponsor to specific financial obligations and can be accessed at https://documentonline.org/blank-uscis-i-864.

Dollar Sheet Fundraiser - Can you spare a little change for a great cause?