Single-Member Operating Agreement Document

When starting a single-member limited liability company (LLC), one of the most important documents you will encounter is the Single-Member Operating Agreement. This form serves as a foundational blueprint for your business, outlining how it will be managed and operated. It details the member's rights and responsibilities, clarifies the decision-making process, and specifies how profits and losses will be handled. While it may seem straightforward, this agreement provides essential legal protections and helps establish the LLC as a separate entity, shielding personal assets from business liabilities. By having a well-drafted operating agreement, you can prevent misunderstandings and disputes down the line. Furthermore, it can enhance your business's credibility with banks and investors, as it demonstrates a level of professionalism and planning. Understanding the key elements of this document is crucial for any single-member LLC owner looking to navigate the complexities of business management effectively.

Misconceptions

When it comes to Single-Member Operating Agreements, there are several common misconceptions that can lead to confusion. Understanding these misconceptions can help you make informed decisions about your business structure.

- It’s not necessary for single-member LLCs. Many people believe that a Single-Member Operating Agreement is optional for single-member LLCs. While it may not be legally required in every state, having one is crucial. It helps clarify your business operations and can protect your personal assets.

- It can’t be customized. Another misconception is that these agreements are one-size-fits-all documents. In reality, you can tailor your operating agreement to fit your specific needs. This customization can include outlining management structures, financial arrangements, and decision-making processes.

- It’s only for legal purposes. Some think that a Single-Member Operating Agreement serves only a legal function. However, it also serves as a practical tool for managing your business. It can help you stay organized and clarify your business goals and procedures.

- It’s too complicated to create. Many individuals shy away from drafting an operating agreement because they believe it’s too complex. In truth, creating one can be straightforward. There are templates available, and many resources can guide you through the process, making it accessible for anyone.

By addressing these misconceptions, you can better understand the importance of a Single-Member Operating Agreement and how it can benefit your business.

Single-Member Operating Agreement: Usage Instruction

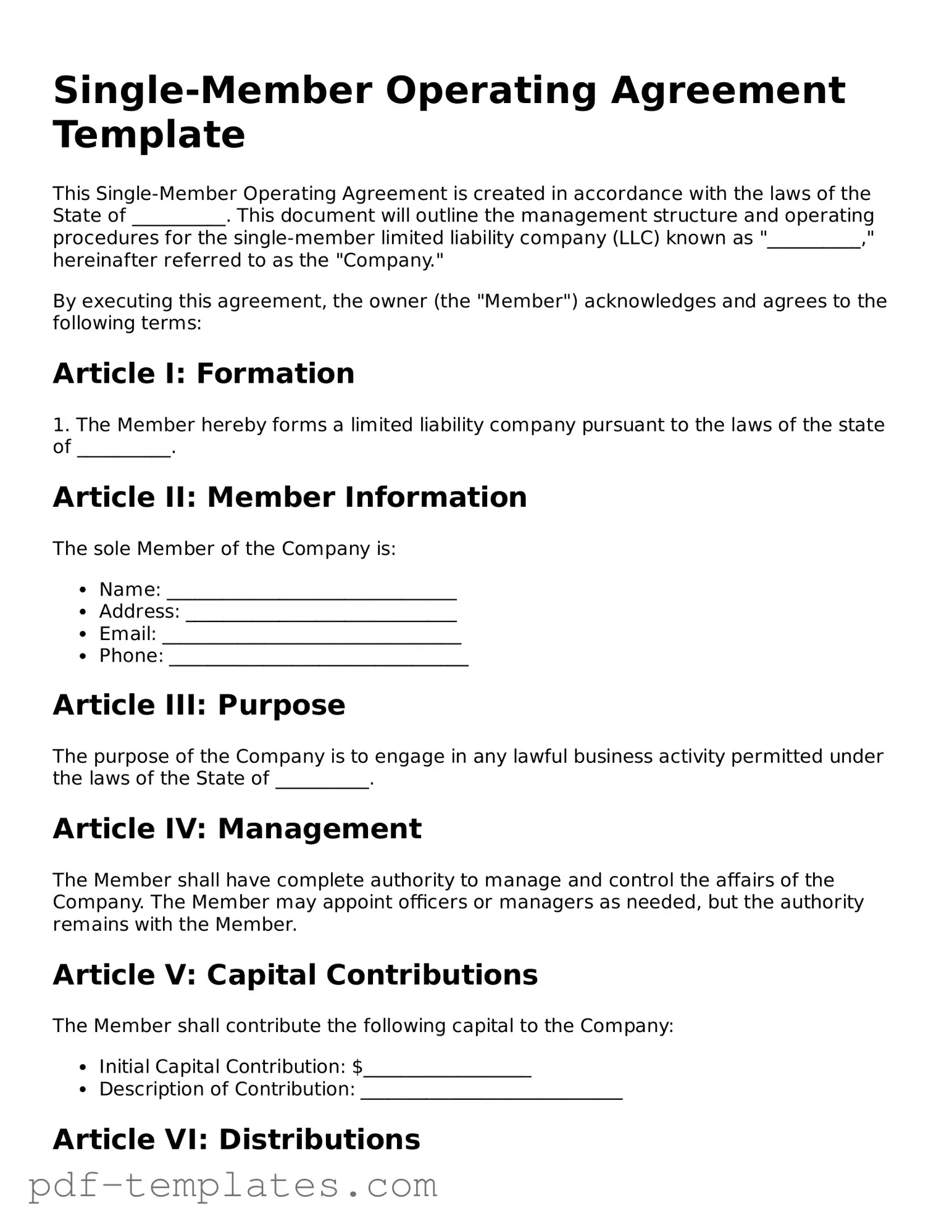

Completing the Single-Member Operating Agreement form is an important step in establishing the operational structure of a single-member limited liability company (LLC). This document outlines the management and operational procedures specific to your LLC. Follow these steps carefully to ensure accurate and complete information is provided.

- Begin by entering the name of your LLC at the top of the form. Ensure that it matches the name registered with the state.

- Provide the principal address of the LLC. This should be the primary location where the business operates.

- Fill in the name of the sole member. This is the individual who owns and manages the LLC.

- Include the date of formation of the LLC. This date should correspond with the official formation date recognized by the state.

- Outline the purpose of the LLC. Be clear and concise about the business activities the LLC will engage in.

- Indicate the management structure. Specify that the LLC is managed by the single member.

- Provide any additional provisions that may be relevant to the operation of the LLC. This could include information on profit distribution or decision-making processes.

- Sign and date the form at the bottom. The signature should be that of the sole member, confirming the agreement.

After completing the form, review all entries for accuracy. It is advisable to keep a copy for your records and to file the agreement with any necessary state authorities if required.

Common mistakes

-

Neglecting to Include Basic Information

Individuals often forget to fill in essential details such as the name of the LLC and the address of the principal place of business. This information is crucial for legal identification and communication.

-

Omitting the Purpose of the LLC

Some people fail to specify the purpose of their LLC. This section clarifies the business activities and can affect the LLC's legal standing. A vague description may lead to misunderstandings or complications in the future.

-

Ignoring the Member's Rights and Responsibilities

It is common for individuals to overlook outlining their rights and responsibilities as the sole member. Clearly defining these aspects helps in managing the business and can prevent disputes down the line.

-

Forgetting to Sign and Date the Agreement

Lastly, some individuals neglect to sign and date the operating agreement. This step is vital, as it signifies acceptance of the terms and makes the document legally binding. Without a signature, the agreement may not hold up in court.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement outlines the management and operational procedures for a single-member LLC. |

| Legal Requirement | While not always required by law, it is highly recommended for legal protection and clarity. |

| Ownership | This agreement is used by a single owner, providing a clear structure for decision-making. |

| Governing Law | The governing law varies by state. For example, in Delaware, it follows the Delaware Limited Liability Company Act. |

| Flexibility | The agreement allows the owner to customize the management structure and operational rules. |

| Liability Protection | Having an operating agreement helps protect personal assets from business liabilities. |

| Tax Treatment | A single-member LLC is typically treated as a disregarded entity for tax purposes, simplifying tax filings. |

| Dispute Resolution | The agreement can outline procedures for resolving disputes, which can save time and money. |

| Amendments | It is possible to amend the agreement as the business grows or changes, ensuring it remains relevant. |

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it's important to follow certain guidelines to ensure accuracy and completeness. Here are some key do's and don'ts to keep in mind:

- Do: Provide accurate information about your business, including the name and address.

- Do: Clearly outline the purpose of the business to avoid future confusion.

- Do: Review the completed form for any errors or omissions before submission.

- Do: Keep a copy of the signed agreement for your records.

- Don't: Leave any sections blank; incomplete forms may be rejected.

- Don't: Use vague language; clarity is key in legal documents.

- Don't: Forget to date and sign the agreement to validate it.

- Don't: Ignore state-specific requirements that may apply to your business.

Similar forms

A Single-Member Operating Agreement is similar to a Partnership Agreement in that both documents outline the structure and management of a business. While a Single-Member Operating Agreement focuses on a single owner, a Partnership Agreement details the roles, responsibilities, and profit-sharing among two or more partners. Both documents serve to clarify expectations and reduce potential disputes, ensuring that all parties understand their rights and obligations within the business framework.

Understanding the importance of these formal agreements is crucial for any business owner, particularly when considering the specific nuances of an LLC in Georgia. The significance of a well-crafted document, such as the Georgia PDF, cannot be overstated, as it provides essential clarity regarding the management and operational frameworks of a business, thereby minimizing potential disputes among members.

Another related document is the Bylaws for a corporation. Just as a Single-Member Operating Agreement governs the operations of a single-member LLC, Bylaws provide the rules and procedures for managing a corporation. Both documents establish the framework for decision-making, outlining how meetings are conducted and how the business will operate on a day-to-day basis, even though they apply to different types of business structures.

The Sole Proprietorship Agreement shares similarities with the Single-Member Operating Agreement, as both pertain to businesses owned by a single individual. While a Sole Proprietorship Agreement may not be as formal or detailed, it still serves to define the business's operations, responsibilities, and financial arrangements. Both documents aim to clarify the owner’s intentions and protect their interests, although a Sole Proprietorship does not offer the same liability protection as an LLC.

A Shareholder Agreement is another document that bears resemblance to a Single-Member Operating Agreement. While it is typically used for corporations with multiple shareholders, it serves a similar purpose by outlining the rights and responsibilities of the shareholders. Both agreements help manage the relationship between owners and provide guidelines for decision-making, although the Shareholder Agreement is more focused on the dynamics between multiple owners.

The Employment Agreement can also be compared to a Single-Member Operating Agreement. While the former outlines the terms of employment for an individual working for the business, the latter details how the business itself will be managed. Both documents are essential for setting clear expectations, whether for an employee's role or for the operations of a single-member LLC. They help prevent misunderstandings and establish a framework for accountability.

Operating Agreements for Multi-Member LLCs are similar as well. Although they apply to businesses with multiple owners, the structure and purpose align closely with those of a Single-Member Operating Agreement. Both types of agreements define the management, profit distribution, and decision-making processes within the LLC. The primary difference lies in the number of members, but the underlying principles of governance and clarity remain consistent.

Finally, a Business Plan can be likened to a Single-Member Operating Agreement in that both documents serve to outline the vision and operational strategy of a business. A Business Plan typically includes market analysis, financial projections, and marketing strategies, while the Operating Agreement focuses on the management structure and internal processes. Both are vital for guiding the business toward its goals and ensuring that the owner has a clear roadmap for success.