Get Sample Tax Return Transcript Form in PDF

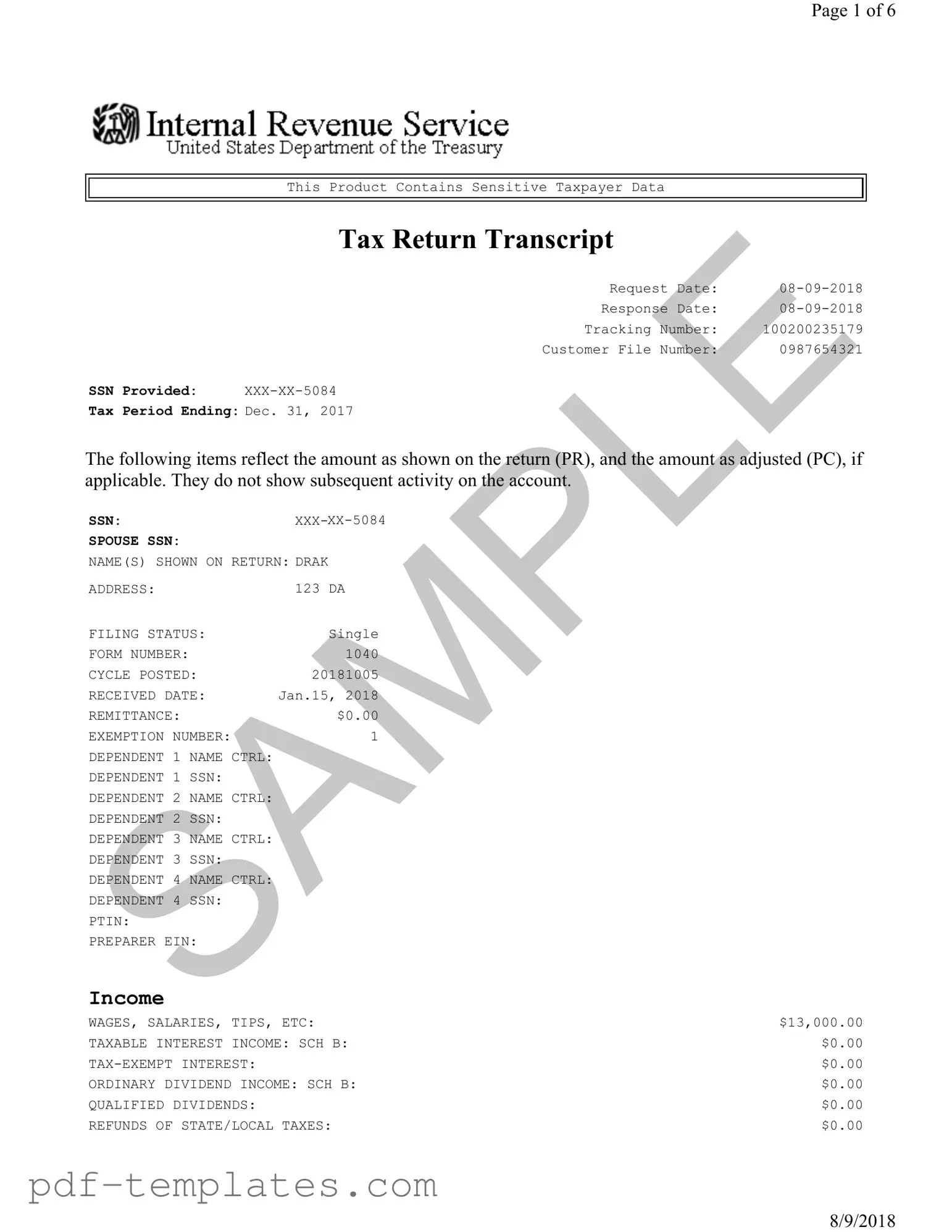

The Sample Tax Return Transcript form is an essential document for anyone navigating the complexities of their tax obligations. This form provides a snapshot of your tax return information as reported to the IRS, allowing you to verify income, deductions, and credits claimed. It includes critical details such as your Social Security Number (SSN), filing status, and income sources. For instance, you'll find breakdowns of wages, business income, and any adjustments made throughout the tax year. Additionally, the transcript outlines your total income, tax liability, and any payments made, such as federal income tax withheld. If you owe money or are due a refund, that information is also clearly indicated. Understanding this form can help you stay organized and prepared, whether you're applying for loans, seeking financial aid, or simply ensuring your records are accurate. By keeping this document on hand, you can easily access the information you need when it matters most.

Misconceptions

The Sample Tax Return Transcript form is often misunderstood. Here are some common misconceptions:

- It shows all tax-related information. Many believe this form includes every detail about a taxpayer's financial situation. In reality, it only provides a summary of the return, not subsequent account activity.

- It can be used to file taxes. Some think they can use the transcript to file their taxes. This form serves as a record of past filings, not a replacement for actual tax forms.

- It reflects current tax liabilities. There is a misconception that the transcript shows current tax obligations. Instead, it shows amounts as filed and adjusted, which may not reflect current liabilities.

- It includes personal identification details. People often think the transcript contains full Social Security Numbers (SSNs) and other personal identifiers. In fact, sensitive information is redacted for security purposes.

- It is only for individuals. Some assume this form is only applicable to individual taxpayers. Businesses and other entities can also request tax return transcripts.

- It is not necessary to request one. Some believe they can obtain all needed information from their own records. However, the IRS transcript may contain information that is not readily available to the taxpayer.

- It is always accurate. While the IRS strives for accuracy, errors can occur. Taxpayers should verify the information against their own records.

- It cannot be obtained online. Many think they must request the transcript by mail. However, taxpayers can access their transcripts online through the IRS website.

Sample Tax Return Transcript: Usage Instruction

Filling out the Sample Tax Return Transcript form requires careful attention to detail. This document is essential for verifying income and tax information. Follow the steps below to complete the form accurately.

- Start by entering the request date at the top of the form. Use the format MM-DD-YYYY.

- Fill in the response date, which should match the request date.

- Record the tracking number provided on the form.

- Input your customer file number. This is typically assigned to you.

- Provide your Social Security Number (SSN). Ensure this is accurate.

- Indicate the tax period ending date, formatted as MM-DD-YYYY.

- List your name as shown on the return and include your address.

- Specify your filing status (e.g., Single, Married Filing Jointly).

- Enter the form number (e.g., 1040) that corresponds to your tax return.

- Record the cycle posted date as indicated on the form.

- Fill in the received date in the same format as previous dates.

- Document the remittance amount, if applicable.

- Complete the exemption number section, if you have dependents.

- List any dependents you have, including their names and SSNs.

- Provide the income details such as wages, interest, and other sources as shown on the form.

- Complete the adjustments to income section, if applicable.

- Fill in the tax and credits section with the relevant amounts.

- Document any other taxes you may owe.

- Complete the payments section, indicating any taxes withheld or paid.

- Finally, note any refund or amount owed at the bottom of the form.

Common mistakes

-

Incorrect Social Security Number (SSN): One of the most common mistakes is entering the wrong SSN. Always double-check that the SSN matches the one on your Social Security card.

-

Missing or Incorrect Filing Status: Selecting the wrong filing status can lead to significant tax implications. Ensure that you choose the status that accurately reflects your situation, such as Single, Married Filing Jointly, or Head of Household.

-

Omitting Dependents: If you have dependents, failing to list them can affect your tax credits and deductions. Make sure to include all eligible dependents on your return.

-

Errors in Income Reporting: Reporting income incorrectly can lead to audits or penalties. Verify that all sources of income, such as wages, business income, and interest, are accurately reported.

-

Ignoring Adjustments to Income: Taxpayers often overlook potential adjustments, such as educator expenses or student loan interest deductions. Review all possible deductions to lower your taxable income.

-

Not Double-Checking Tax Credits: Many tax credits, like the Earned Income Credit, can significantly reduce your tax liability. Ensure you qualify for these credits and that they are correctly claimed.

-

Incorrect Bank Information for Refunds: If you expect a refund, providing incorrect bank account details can delay your payment. Always verify your account and routing numbers before submitting your return.

-

Failing to Sign and Date the Return: A common oversight is neglecting to sign and date your tax return. An unsigned return is considered incomplete and may not be processed.

-

Not Keeping Copies of Submitted Forms: After submitting your tax return, many forget to keep a copy for their records. Retaining a copy is essential for future reference and in case of audits.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Sample Tax Return Transcript form provides a summary of a taxpayer's income, deductions, and credits as reported on their tax return. |

| Tax Period | This transcript reflects information for the tax period ending on December 31, 2017. |

| Filing Status | The individual listed on the transcript is categorized as "Single," indicating their marital status during the tax year. |

| Income Summary | The total income reported is $15,500, which includes various income sources such as wages and business income. |

Dos and Don'ts

When filling out the Sample Tax Return Transcript form, consider the following guidelines:

- Double-check all personal information, including your name and Social Security Number, for accuracy.

- Ensure that all income sources are reported, including wages, business income, and any other earnings.

- Review the deductions and credits applicable to your situation to maximize potential refunds.

- Submit the form by the deadline to avoid any penalties or delays in processing.

Avoid these common mistakes:

- Do not leave any sections blank; incomplete forms can lead to processing delays.

- Do not use incorrect or outdated forms; always use the latest version available.

- Avoid guessing amounts; use precise figures from your financial records.

- Do not forget to sign and date the form before submission.

Similar forms

The IRS Form 1040 is a comprehensive document used by individuals to file their annual income tax returns. Like the Sample Tax Return Transcript, it includes detailed information about income, deductions, and credits. The Form 1040 is the primary form for reporting personal income, while the transcript summarizes key data from this form, making it easier for taxpayers to verify their tax information without needing the complete return.

The IRS Form W-2 is issued by employers to report an employee's annual wages and the taxes withheld. Similar to the Sample Tax Return Transcript, it provides crucial information about income, including wages and tips. The W-2 serves as a source document for the income reported on the tax return, and the transcript reflects these earnings in a summarized format, aiding in cross-verification of reported income.

The IRS Form 1099 is used to report various types of income received by individuals who are not employees, such as freelancers or contractors. The Sample Tax Return Transcript includes summarized income data that may originate from 1099 forms. Both documents play a role in ensuring accurate reporting of income, with the transcript providing a consolidated view of income sources reported on various 1099 forms.

The IRS Form 4868 is the application for an automatic extension of time to file a tax return. While the Sample Tax Return Transcript does not serve as an extension request, it may reflect the tax liability or refund amount that would be due after the return is filed. Both documents are linked through the tax filing process, as the extension allows taxpayers more time to prepare their returns, which will ultimately be summarized in the transcript.

The IRS Form 8862 is used to claim the Earned Income Tax Credit (EITC) after a previous denial. Similar to the Sample Tax Return Transcript, which may reflect credits claimed, Form 8862 is necessary for individuals who have previously been denied the EITC to prove eligibility for future claims. Both documents highlight the importance of accurate tax credit reporting and compliance with IRS requirements.

The IRS Form 8888 allows taxpayers to allocate their tax refund to multiple accounts or use it for specific purposes. While the Sample Tax Return Transcript shows the total refund amount, Form 8888 provides a method for distributing that refund. Both documents are essential during the refund process, with the transcript summarizing the overall tax situation and the 8888 detailing how the refund will be managed.

The IRS Schedule C is used by sole proprietors to report income and expenses from a business. The Sample Tax Return Transcript includes summarized business income, which is derived from the information reported on Schedule C. Both documents are interconnected, as the transcript provides a snapshot of the business's financial performance while the Schedule C offers a more detailed breakdown of the income and expenses involved.

The IRS Form 1040-X is the amended tax return form used to correct errors on a previously filed Form 1040. While the Sample Tax Return Transcript reflects the original return data, Form 1040-X provides a way to amend that information. Both documents are crucial in ensuring that taxpayers maintain accurate records and comply with tax regulations, with the transcript serving as a reference point for the original filing.

Other PDF Forms

Da Form 638 Fillable - The DA 638 form is used to recommend individuals for military awards.

Do 1099 Employees Get Pay Stubs - Used in record-keeping for business expenses related to contracting.

Marriage Cert - Source of information for genealogy research.