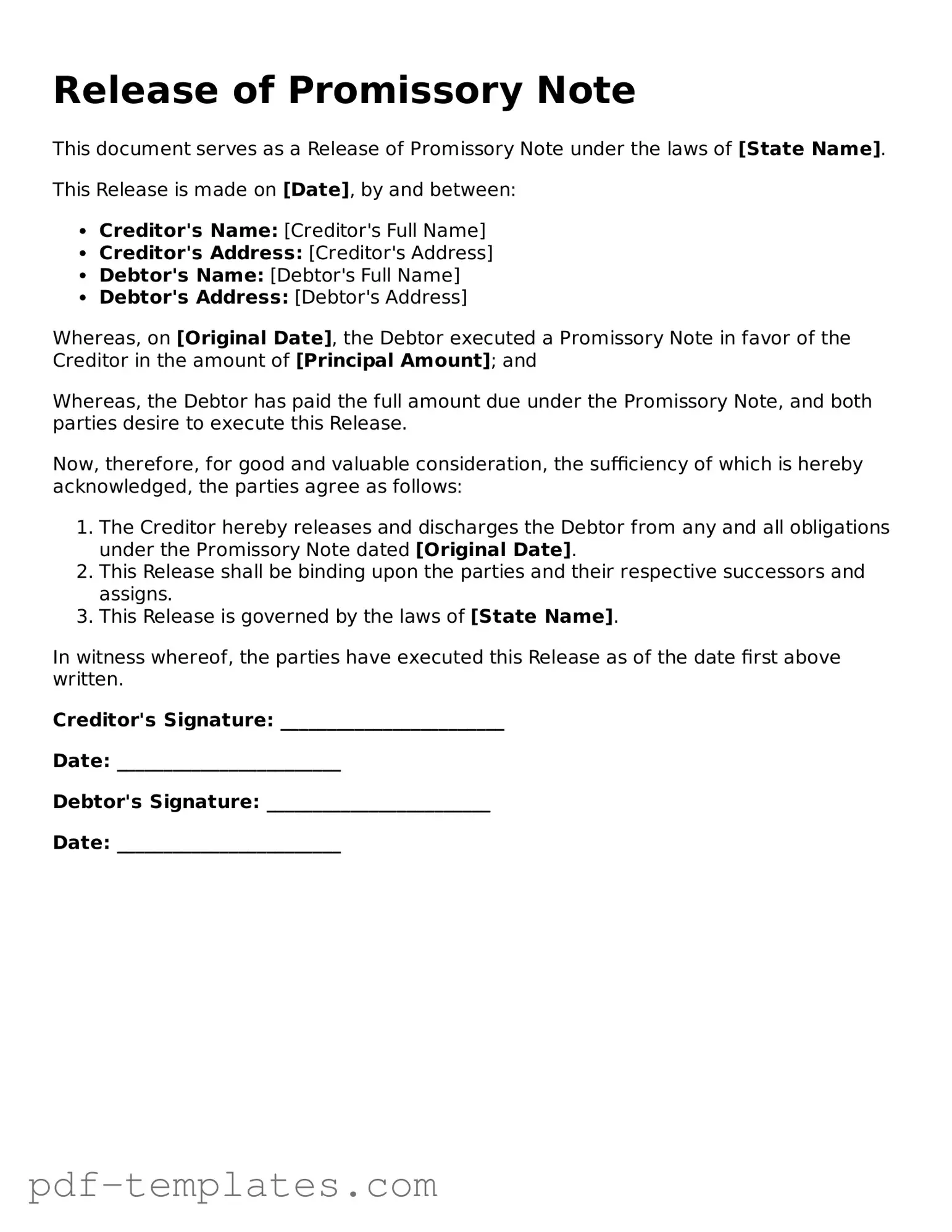

Release of Promissory Note Document

The Release of Promissory Note form is an important document used to formally acknowledge the repayment of a loan or debt represented by a promissory note. This form serves as proof that the borrower has fulfilled their obligation, allowing the lender to release any claims against the borrower. It typically includes essential information such as the names of both parties involved, the date of the release, and details about the original promissory note, including its date and amount. Additionally, the form may contain a statement confirming that the borrower has made all necessary payments and that the lender relinquishes any rights to further claims. By completing this form, both parties can ensure clarity and mutual understanding regarding the conclusion of their financial agreement. Properly executed, the Release of Promissory Note form can help prevent any future disputes related to the original debt.

Misconceptions

The Release of Promissory Note form is often misunderstood. Here are four common misconceptions surrounding this important document:

-

Misconception 1: The form is only necessary when a loan is fully paid off.

This is not entirely true. While the form is commonly used to confirm that a borrower has fulfilled their payment obligations, it can also be used in other scenarios, such as when a loan is forgiven or restructured.

-

Misconception 2: The Release of Promissory Note automatically cancels the debt.

Many believe that signing this form automatically nullifies the debt. However, the release only serves as a formal acknowledgment that the lender no longer holds the note. The underlying obligations may still exist unless explicitly stated otherwise.

-

Misconception 3: The form is not legally binding.

Some individuals think that the Release of Promissory Note is merely a formality without legal weight. In reality, once signed, it can serve as a legal document that protects both parties' interests and can be enforced in court if necessary.

-

Misconception 4: Only lenders can initiate the release.

This is a common belief, but borrowers can also request a release. If a borrower believes they have met their obligations or if there is a mutual agreement to release the note, they can initiate the process.

Release of Promissory Note: Usage Instruction

After you complete the Release of Promissory Note form, you’ll be ready to submit it to the appropriate parties. This step is crucial to ensure that everyone involved is aware of the release and can proceed accordingly.

- Begin by gathering all necessary information, including the names of the parties involved and the details of the promissory note.

- In the first section, clearly write the name of the borrower and the lender.

- Next, enter the date when the promissory note was originally signed.

- Provide the amount of the loan that was originally agreed upon in the promissory note.

- In the designated area, indicate that the promissory note is being released. You may want to include a brief statement confirming that the borrower has fulfilled their obligations.

- Both parties should then sign the form. Make sure to include the date of each signature.

- Lastly, review the completed form for any errors or missing information before submitting it to the relevant parties.

Common mistakes

-

Not Including All Necessary Information: One common mistake is failing to provide complete details. This includes missing names, addresses, or the date of the promissory note. Ensure that all parties involved are correctly identified.

-

Using Incorrect Dates: Dates play a crucial role in the validity of the document. Some individuals mistakenly write the wrong date, which can lead to confusion or disputes later on. Double-check all dates before submitting the form.

-

Not Signing the Document: A signature is essential for the release to be valid. Some people forget to sign or assume that a printed name suffices. Always include a handwritten signature from all parties involved.

-

Neglecting to Keep Copies: After filling out the form, it’s important to retain copies for personal records. Failing to do so can result in a lack of proof if any issues arise in the future. Make copies before submitting the form.

-

Overlooking Witness or Notary Requirements: Depending on the jurisdiction, some forms may require a witness or notary public to validate the release. Ignoring these requirements can render the document ineffective. Check local regulations to ensure compliance.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A Release of Promissory Note form is a legal document that signifies the cancellation of a promissory note. |

| Purpose | This form is used to formally release the borrower from the obligation to repay the loan. |

| Parties Involved | The form typically involves the lender and the borrower. |

| Governing Law | The form is governed by state-specific laws, which may vary. For example, in California, it falls under the California Civil Code. |

| Signature Requirement | Both parties must sign the form for it to be valid. |

| Date of Release | The date on which the promissory note is released must be clearly stated in the form. |

| Record Keeping | It is advisable to keep a copy of the signed form for personal records. |

| Notarization | Some states may require notarization of the form to enhance its legal standing. |

| Effect on Credit | Releasing a promissory note can positively impact the borrower’s credit score by showing the debt has been settled. |

| Availability | Release of Promissory Note forms can often be found online or obtained from legal offices. |

Dos and Don'ts

When filling out the Release of Promissory Note form, it is important to follow certain guidelines to ensure accuracy and legality. Here are seven things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Don't leave any required fields blank.

- Do provide accurate information, including names and dates.

- Don't use abbreviations or shorthand that may cause confusion.

- Do sign and date the form where indicated.

- Don't forget to keep a copy for your records.

- Do consult a legal professional if you have questions.

Similar forms

The Release of Promissory Note form is closely related to the Satisfaction of Mortgage document. Both documents serve to signify the completion of a financial obligation. In the case of a Satisfaction of Mortgage, it indicates that the borrower has fully repaid their mortgage loan, thereby releasing the lien on the property. Similarly, the Release of Promissory Note confirms that the borrower has fulfilled their obligation under the promissory note, effectively nullifying the debt. Each document provides legal proof that the respective debts have been settled, offering peace of mind to the parties involved.

The importance of these financial documents cannot be overstated, as they provide necessary clarity in transactions. For those needing to create or manage these documents, resources such as the editable template available at https://formcalifornia.com/editable-promissory-note-form/ can facilitate the process and ensure all legal requirements are met.

Another document that shares similarities with the Release of Promissory Note is the Deed of Reconveyance. This document is used in the context of a trust deed, where a borrower conveys property to a lender as security for a loan. Once the loan is paid off, the lender executes a Deed of Reconveyance, which transfers the title back to the borrower. Like the Release of Promissory Note, this document formally acknowledges that the borrower has met their financial obligations, thereby releasing them from the debt associated with the trust deed.

The Loan Payoff Statement also bears resemblance to the Release of Promissory Note. This document provides a detailed account of the outstanding balance on a loan, including any interest or fees due. Once the borrower pays off the loan, a Release of Promissory Note may be issued to confirm that the debt has been satisfied. Both documents serve as important records for borrowers, ensuring that they have fulfilled their financial commitments and can move forward without lingering obligations.

A similar document is the Certificate of Satisfaction. This document is often used in real estate transactions to confirm that a borrower has paid off their mortgage or other secured debts. Upon full payment, the lender issues a Certificate of Satisfaction, which serves to clear the borrower’s name from the debt. Much like the Release of Promissory Note, this certificate acts as a formal acknowledgment that the borrower has completed their payment obligations, thereby allowing them to proceed with future financial endeavors unencumbered.

The Termination of Lease Agreement is another document that parallels the Release of Promissory Note. While it primarily pertains to rental agreements, both documents signify the end of a financial obligation. When a lease is terminated, it indicates that the tenant has fulfilled their responsibilities under the lease, similar to how the Release of Promissory Note confirms the borrower has met their obligations. Both documents provide clarity and closure to the parties involved, ensuring that no further claims can be made regarding the respective agreements.

The Assignment of Debt is also related to the Release of Promissory Note. This document occurs when a lender transfers the right to collect a debt to another party. Once the debt is settled, a Release of Promissory Note is issued to confirm that the obligation has been fulfilled. Both documents emphasize the importance of clear communication and documentation in financial transactions, ensuring that all parties are aware of their rights and responsibilities.

The Notice of Default is another document that shares a connection with the Release of Promissory Note. While it typically indicates that a borrower has failed to meet their payment obligations, it is an important part of the overall debt process. Once a borrower rectifies the default by making payments, the Release of Promissory Note can be issued to confirm that the debt is now satisfied. Both documents highlight the importance of maintaining clear records and communication between borrowers and lenders.

The Subordination Agreement also has similarities to the Release of Promissory Note. This document is used when a lender agrees to subordinate their lien position to another lender. Once the primary debt is satisfied, the Release of Promissory Note is issued to confirm that the borrower has met their obligations. Both documents play a crucial role in establishing the hierarchy of debts and ensuring that all parties understand their rights and responsibilities in financial transactions.

Finally, the Release of Lien is akin to the Release of Promissory Note. A lien is a legal claim against property to secure payment of a debt. When the debt is paid off, the lender issues a Release of Lien to remove the claim on the property. Similarly, the Release of Promissory Note confirms that the borrower has fulfilled their obligation under the promissory note. Both documents serve to clear the borrower’s financial record, allowing them to move forward without encumbrances related to the settled debts.

Additional Types of Release of Promissory Note Templates:

Blank Promissory Note - Useful for both individual and institutional lenders to track loans.

In New York, a Promissory Note plays a vital role in formalizing loan agreements, clearly outlining the borrower's commitment to repay the loan. This legal document is essential not only for individuals borrowing money but also for businesses that require financing. To ensure you have the proper documentation, you can find useful resources, including free templates, at All New York Forms, which can help create a clear and enforceable agreement.