Real Estate Purchase Agreement Document

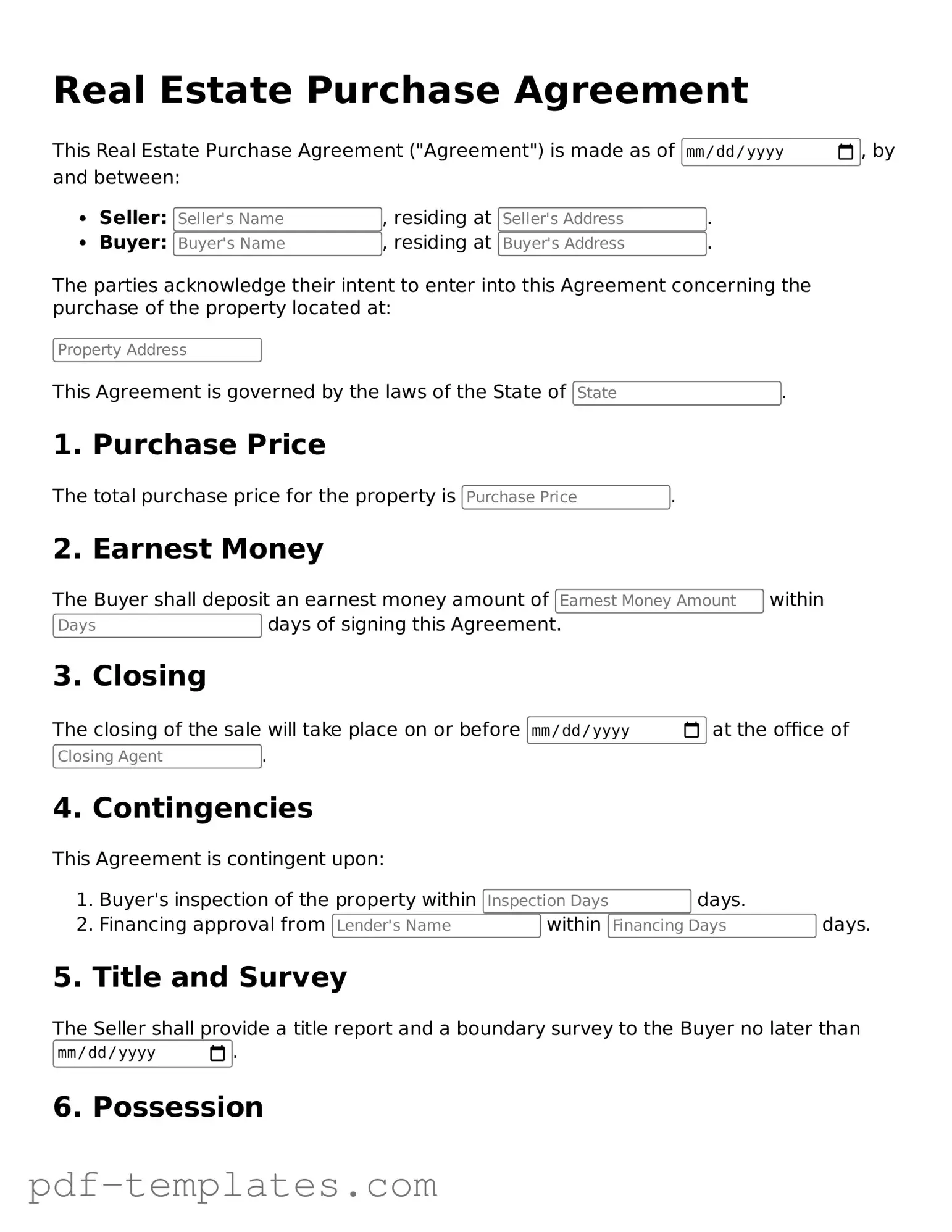

When buying or selling a property, a Real Estate Purchase Agreement form plays a crucial role in outlining the terms and conditions of the transaction. This document serves as a legally binding contract between the buyer and the seller, ensuring that both parties understand their rights and obligations. Key components of the agreement typically include the purchase price, property description, and the closing date. Additionally, it addresses contingencies, such as financing and inspections, which protect the interests of both parties. The form also outlines the responsibilities regarding repairs and maintenance, as well as any included fixtures or appliances. By clearly detailing these aspects, the Real Estate Purchase Agreement helps facilitate a smooth transaction while minimizing potential disputes. Understanding this form is essential for anyone involved in real estate, as it lays the groundwork for a successful property transfer.

Misconceptions

Understanding the Real Estate Purchase Agreement (REPA) is crucial for anyone involved in buying or selling property. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings about this important document.

- The REPA is a legally binding contract only after both parties sign it. While signatures are necessary for enforcement, the agreement may still be considered binding if there is clear intent and acceptance, even without signatures.

- All real estate transactions require a REPA. Not all property transfers necessitate a formal REPA. Some transactions may be conducted through simpler agreements or verbal contracts, depending on the circumstances.

- The REPA is the same in every state. Each state has its own laws and regulations governing real estate transactions. Therefore, the REPA may vary significantly from one state to another.

- A REPA guarantees a sale will go through. While it outlines the terms of the sale, external factors such as financing issues or inspections can still derail the process.

- Once signed, the terms of the REPA cannot be changed. Parties can negotiate modifications to the agreement before closing, as long as both sides agree to the changes in writing.

- The REPA only protects the buyer. This agreement serves to protect both parties by clearly outlining their rights and responsibilities in the transaction.

- Real estate agents are responsible for drafting the REPA. While agents often assist in preparing the agreement, it is ultimately the responsibility of the parties involved to ensure its accuracy and completeness.

- Disputes over the REPA must be resolved in court. Many disputes can be settled through negotiation or alternative dispute resolution methods, such as mediation or arbitration, rather than litigation.

- The REPA is a simple document that requires little attention. In reality, the REPA is a complex legal document that requires careful consideration and understanding of all its terms and conditions.

By addressing these misconceptions, individuals can approach the Real Estate Purchase Agreement with greater clarity and confidence.

Real Estate Purchase Agreement - Customized for State

Real Estate Purchase Agreement Document Subtypes

Real Estate Purchase Agreement: Usage Instruction

Filling out a Real Estate Purchase Agreement is an important step in the home-buying process. After completing this form, both parties will have a clear understanding of the terms of the sale. Here are the steps to guide you through the process of filling out the form.

- Gather Necessary Information: Collect details such as the names of the buyer and seller, property address, and legal descriptions.

- Fill in Buyer Information: Enter the full name and contact information of the buyer.

- Fill in Seller Information: Provide the full name and contact information of the seller.

- Property Details: Include the property address and any relevant details about the property.

- Purchase Price: Clearly state the agreed-upon purchase price for the property.

- Deposit Amount: Specify the amount of earnest money deposit the buyer will provide.

- Financing Terms: Indicate how the buyer plans to finance the purchase, whether through a mortgage or cash.

- Closing Date: Set a proposed date for closing the transaction.

- Contingencies: List any conditions that must be met for the sale to proceed, such as inspections or financing approval.

- Signatures: Ensure both the buyer and seller sign and date the agreement.

After completing these steps, review the agreement for accuracy. It’s advisable to have a real estate professional or attorney review the document before submitting it. This helps ensure that all terms are clear and that you’re protected throughout the transaction.

Common mistakes

-

Inaccurate Property Description: Failing to provide a precise description of the property can lead to confusion. Always include the full address, legal description, and any relevant details about the property boundaries.

-

Missing Buyer and Seller Information: Ensure that the names and contact information of both the buyer and seller are complete and accurate. Omitting this information can delay the transaction.

-

Incorrect Purchase Price: Double-check the agreed-upon purchase price. An error here can cause significant misunderstandings and complications during the sale.

-

Neglecting Contingencies: Not including necessary contingencies, such as financing or inspection, can leave buyers vulnerable. These clauses protect buyers and sellers in case certain conditions aren’t met.

-

Forgetting to Sign: A signed agreement is essential. Many people overlook this step, thinking their verbal agreement is sufficient. Always ensure that all parties sign the document.

-

Ignoring Deadlines: Pay attention to the timelines outlined in the agreement. Missing deadlines for inspections or financing can jeopardize the entire transaction.

-

Overlooking Disclosure Requirements: Sellers must disclose known issues with the property. Failing to do so can lead to legal troubles later on.

-

Not Reviewing the Agreement Thoroughly: Rushing through the agreement can result in missed details. Take the time to read and understand every section before signing.

-

Using Outdated Forms: Real estate laws change frequently. Using an outdated version of the purchase agreement can lead to compliance issues. Always use the most current form available.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a property sale between a buyer and a seller. |

| Key Components | This agreement typically includes the purchase price, property description, closing date, and any contingencies. |

| State-Specific Forms | Each state may have its own version of the Real Estate Purchase Agreement, governed by local real estate laws. For example, California follows the California Civil Code. |

| Importance | Having a well-drafted agreement protects both parties and helps prevent disputes during the transaction process. |

Dos and Don'ts

Filling out a Real Estate Purchase Agreement form is a crucial step in the home buying process. To ensure everything goes smoothly, here are some important dos and don'ts to consider.

- Do read the entire agreement carefully before signing. Understanding the terms is essential.

- Do provide accurate information. Double-check names, addresses, and financial details.

- Do consult with a real estate agent or attorney if you have questions. Their expertise can be invaluable.

- Do keep a copy of the signed agreement for your records. Documentation is key.

- Do be aware of deadlines. Timely responses can prevent delays in the transaction.

- Don't rush through the form. Take your time to ensure everything is correct.

- Don't leave blank spaces. Fill in all required fields to avoid confusion later.

- Don't ignore contingencies. They protect you in case certain conditions aren't met.

- Don't make assumptions about verbal agreements. Everything should be documented in writing.

- Don't forget to review the closing costs. Understand what you will be responsible for paying.

By following these guidelines, you can help ensure a smoother transaction and protect your interests in the real estate process. Take the time to do it right!

Similar forms

The Lease Agreement is similar to the Real Estate Purchase Agreement in that both documents outline the terms under which a property is used or transferred. A Lease Agreement typically defines the rental period, payment terms, and responsibilities of both the landlord and tenant. While the Purchase Agreement is focused on the sale of property, the Lease Agreement governs the temporary use of property, highlighting the differences in ownership versus tenancy.

The Option to Purchase Agreement provides a potential buyer with the right to purchase a property within a specified timeframe. This document shares similarities with the Real Estate Purchase Agreement as it outlines key terms such as the purchase price and conditions for the sale. However, the Option to Purchase Agreement does not require immediate commitment, allowing the buyer to decide later whether to proceed with the purchase.

To effectively transfer ownership, it's important to utilize a proper legal document like the Texas Trailer Bill of Sale form, which facilitates the sale process and ensures all necessary information is accurately captured.

The Seller’s Disclosure Statement is another document related to the Real Estate Purchase Agreement. It requires the seller to disclose known issues with the property, such as defects or environmental hazards. This transparency is crucial for the buyer, as it informs their decision-making process. Both documents aim to protect the interests of the parties involved, though the Disclosure Statement focuses more on the condition of the property rather than the sale terms.

The Purchase and Sale Agreement is often used interchangeably with the Real Estate Purchase Agreement. Both documents serve the same purpose: to formalize the sale of real estate. They detail the terms of the sale, including price, contingencies, and closing dates. However, the Purchase and Sale Agreement may also include additional provisions specific to the transaction, making it a more comprehensive document in some cases.

The Addendum to Purchase Agreement is a document that modifies or adds to the original Real Estate Purchase Agreement. This might include changes to the closing date, financing terms, or contingencies. While the main agreement sets the foundation for the sale, the Addendum allows for flexibility and adjustments based on negotiations or new information that arises during the buying process.

The Real Estate Listing Agreement is similar in that it involves the sale of property, but it specifically pertains to the relationship between the seller and the real estate agent. This document outlines the agent's responsibilities and the commission structure. While the Real Estate Purchase Agreement focuses on the sale itself, the Listing Agreement sets the stage for how that sale will be marketed and facilitated.

The Title Commitment is another important document that relates to real estate transactions. It outlines the condition of the title and any liens or encumbrances on the property. While the Real Estate Purchase Agreement establishes the terms of the sale, the Title Commitment ensures that the buyer receives clear ownership upon closing, protecting their investment and interests.

The Closing Disclosure is crucial for the final steps of a real estate transaction. It provides a detailed account of all costs associated with the purchase, including loan terms, closing costs, and other fees. Similar to the Real Estate Purchase Agreement, it aims to ensure transparency and clarity for both parties. However, the Closing Disclosure is specifically focused on the financial aspects of the transaction that occur at closing.

The Escrow Agreement is another document that may accompany a Real Estate Purchase Agreement. It outlines the terms under which a neutral third party holds funds or documents until the transaction is completed. This agreement is essential for ensuring that both the buyer and seller fulfill their obligations before the transfer of ownership takes place. It adds an additional layer of security to the transaction, similar to the protections offered by the Purchase Agreement.

More Documents

Dd 214 - Service members can request copies of the DD 214 be sent to specific addresses after separation.

To ensure comprehensive protection, applicants are encouraged to review the California Earthquake Authority form, which details the essential information required for earthquake insurance. This form plays a crucial role in helping residents prepare for potential seismic events and outlines coverage options tailored to their needs. For those looking for additional resources, please refer to All California Forms to facilitate the process of obtaining insurance.

USCIS Form I-864 - The I-864 can be complex; careful completion is advised.