Quitclaim Deed Document

A Quitclaim Deed is a vital legal document used in real estate transactions to transfer ownership rights from one party to another. This form is particularly useful when the grantor wishes to relinquish any claim to a property without providing warranties regarding the title's validity. Often employed in situations such as divorce settlements, inheritance transfers, or gifting property, a Quitclaim Deed can facilitate a swift and uncomplicated transfer. It is essential to understand that while this deed allows for the transfer of interest, it does not guarantee that the property is free of liens or other encumbrances. Consequently, the recipient should conduct thorough due diligence before accepting a Quitclaim Deed. Furthermore, the process typically involves signing the document in the presence of a notary public, followed by recording it with the appropriate county office to ensure public notice of the transfer. Understanding the Quitclaim Deed's implications can help individuals navigate property transactions more effectively, safeguarding their interests in the process.

Misconceptions

Understanding a Quitclaim Deed is essential for anyone involved in property transactions. However, several misconceptions often cloud the reality of this legal document. Here are five common misunderstandings:

-

A Quitclaim Deed transfers ownership completely.

This is not entirely accurate. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor has any ownership at all. If the grantor has no legal claim, the recipient receives nothing.

-

Quitclaim Deeds are only for divorces or family transfers.

While they are often used in family situations, Quitclaim Deeds can be used for various transactions, including sales, transfers to trusts, or even gifting property to friends.

-

Quitclaim Deeds are risky and should never be used.

This is an exaggeration. While they carry risks, especially regarding unknown liens or claims, they can be appropriate in certain situations, particularly when the parties know each other well.

-

A Quitclaim Deed eliminates all liability.

This misconception can lead to confusion. A Quitclaim Deed does not remove any liabilities associated with the property, such as mortgages or liens. The new owner may still be responsible for these obligations.

-

Once a Quitclaim Deed is signed, it cannot be changed.

While it is true that a signed Quitclaim Deed is generally final, it can be revoked or altered through mutual agreement of the parties involved, provided that the necessary legal steps are followed.

Clarifying these misconceptions can help individuals make informed decisions regarding property transfers and the use of Quitclaim Deeds.

Quitclaim Deed - Customized for State

Quitclaim Deed: Usage Instruction

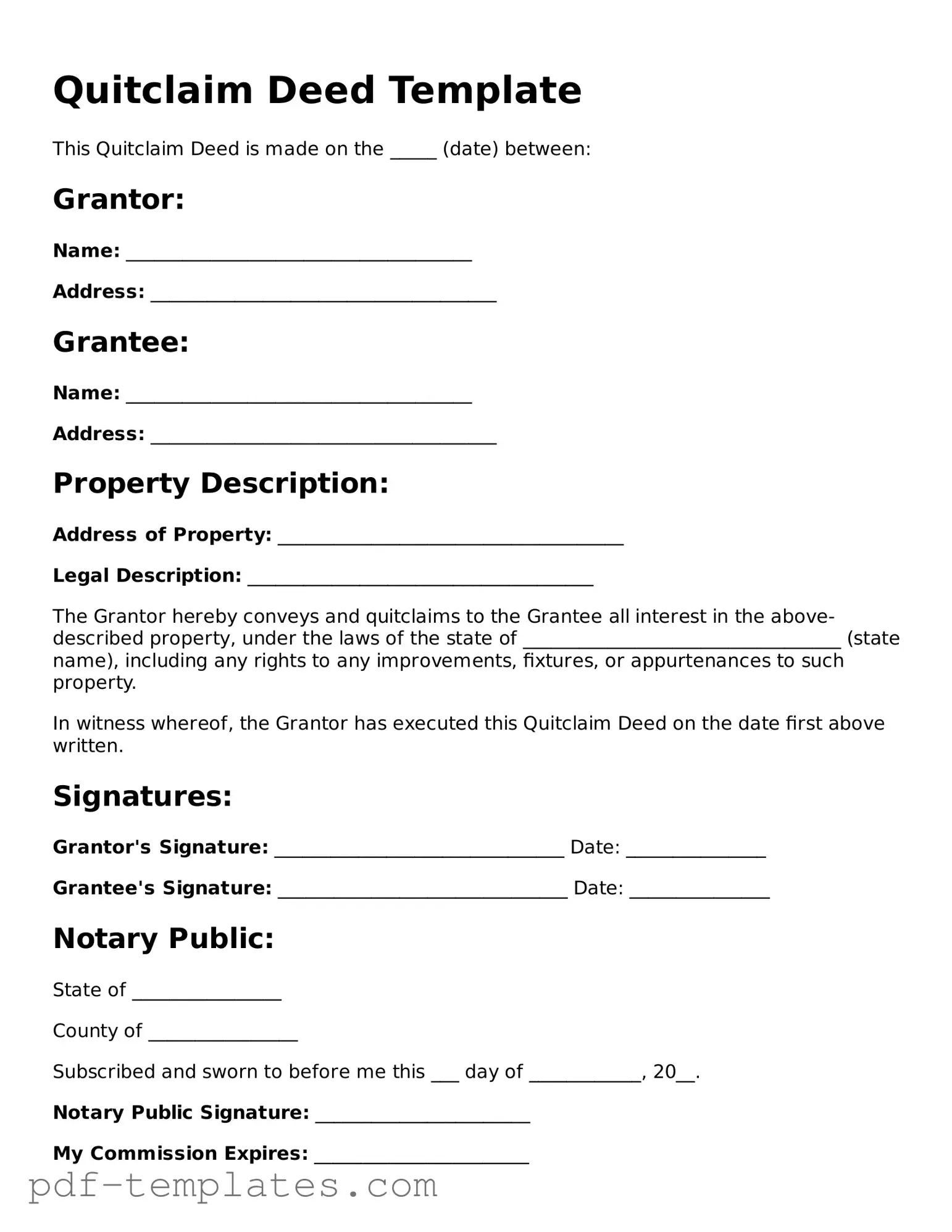

Once you have your Quitclaim Deed form ready, the next step is to fill it out accurately. This form is essential for transferring property rights, and precision is key. Follow the steps below to ensure that you complete the form correctly.

- Begin by entering the name of the current property owner, known as the grantor, in the designated space at the top of the form.

- Next, provide the name of the person receiving the property, referred to as the grantee. This should be placed directly below the grantor's name.

- Include the property address. Be sure to write the full street address, city, state, and ZIP code to avoid any confusion.

- In the next section, describe the property. This may involve listing the legal description, which can usually be found on the property’s deed or tax assessment records.

- Indicate the date of the transfer. This should be the date when the deed is being executed.

- Afterward, the grantor must sign the form. Ensure that the signature is clear and matches the name listed as the grantor.

- Have the signature notarized. A notary public must witness the signing and provide their official seal and signature.

- Finally, check that all information is accurate and complete. Any errors could delay the transfer process.

Common mistakes

-

Incorrect Names: Failing to use the full legal names of all parties involved can lead to complications. It is essential that the names match the names on the title and any other legal documents.

-

Missing Signatures: All parties must sign the Quitclaim Deed. Omitting a signature can render the document invalid, preventing the transfer of property.

-

Not Including a Legal Description: A clear and accurate legal description of the property is crucial. Vague descriptions may lead to disputes or confusion regarding the property being transferred.

-

Improper Notarization: The Quitclaim Deed must be notarized to be legally binding. Neglecting to have the document properly notarized can result in the deed being challenged.

-

Failure to Check Local Laws: Each state may have specific requirements for Quitclaim Deeds. Ignoring local regulations can lead to issues down the line.

-

Not Recording the Deed: After completion, the Quitclaim Deed should be recorded with the appropriate county office. Failing to do so can leave the property transfer unprotected against future claims.

-

Assuming It’s a Complete Transfer: A Quitclaim Deed transfers whatever interest the grantor has in the property but does not guarantee that the title is clear. Understanding this limitation is vital to avoid future legal issues.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees about the property title. |

| Usage | Commonly used in situations such as transferring property between family members, clearing up title issues, or when a property is given as a gift. |

| State-Specific Forms | Each state has its own version of the quitclaim deed form. For example, in California, the quitclaim deed is governed by California Civil Code Section 1092. |

| Limitations | Unlike other types of deeds, a quitclaim deed does not guarantee that the grantor has clear title to the property. This means the grantee assumes the risk associated with any potential title issues. |

| Recording | To ensure the transfer is legally recognized, the quitclaim deed should be recorded with the appropriate county office where the property is located. |

Dos and Don'ts

When filling out a Quitclaim Deed form, it is essential to follow certain guidelines to ensure accuracy and legality. Here are seven things to keep in mind:

- Do ensure all names are spelled correctly.

- Do include the correct legal description of the property.

- Do sign the form in front of a notary public.

- Do provide the date of the transfer.

- Don't leave any required fields blank.

- Don't use outdated or incorrect forms.

- Don't forget to check local recording requirements.

Following these steps will help ensure that your Quitclaim Deed is processed smoothly.

Similar forms

A Warranty Deed is a document that transfers ownership of property while providing a guarantee that the title is clear. Unlike a Quitclaim Deed, which offers no such warranty, a Warranty Deed assures the buyer that the seller holds a valid title and has the right to sell the property. This document is typically used in traditional real estate transactions where the buyer seeks assurance against potential claims on the property.

A Grant Deed also serves to transfer property ownership, but it includes certain warranties, similar to a Warranty Deed. The Grant Deed guarantees that the seller has not sold the property to anyone else and that the property is free from any encumbrances made by the seller. This document is often used in California and provides more protection than a Quitclaim Deed.

When navigating the complexities of business transactions, it is crucial to ensure compliance with tax regulations, particularly in California. The California Resale Certificate, officially known as form CDTFA-230, plays an essential role in allowing businesses to purchase items without incurring sales tax, provided these items are intended for resale. This certificate serves as a declaration by the buyer, assuring the seller of their intent to resell the goods. However, it is important to handle this document responsibly to avoid penalties connected with misuse. For a comprehensive overview and access to necessary forms, visit All California Forms.

A Bargain and Sale Deed transfers property without any warranties against encumbrances. It implies that the seller has the right to sell the property but does not guarantee a clear title. This type of deed is often used in foreclosure sales or tax lien sales, providing a middle ground between a Quitclaim Deed and a Warranty Deed.

A Deed of Trust is used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. Unlike a Quitclaim Deed, which merely transfers ownership, a Deed of Trust establishes a security interest in the property, allowing the lender to foreclose if the borrower defaults on the loan.

A Leasehold Deed conveys a leasehold interest in a property rather than ownership. This document outlines the terms of the lease and the rights of the lessee. While a Quitclaim Deed transfers ownership, a Leasehold Deed provides temporary rights to use and occupy the property, making it a different type of agreement altogether.

An Affidavit of Title is a sworn statement from a seller affirming their ownership of a property and the absence of liens or encumbrances. Although it does not transfer property like a Quitclaim Deed, it serves as a declaration that can accompany a deed to provide additional assurance to the buyer about the title's status.

A Bill of Sale is a document used to transfer ownership of personal property rather than real estate. While a Quitclaim Deed pertains to real property, a Bill of Sale provides a similar function for personal items, ensuring that the seller relinquishes ownership rights to the buyer.

A Power of Attorney can be used to authorize someone else to act on behalf of a property owner in real estate transactions. While it does not transfer ownership directly, it can facilitate the execution of a Quitclaim Deed or other property documents, allowing another party to sign on behalf of the owner.

A Certificate of Title is a document issued by a title company that certifies the ownership of a property and any liens against it. While it does not transfer ownership like a Quitclaim Deed, it provides important information about the property's title status, helping buyers and sellers understand any potential issues before completing a transaction.

Additional Types of Quitclaim Deed Templates:

Sample Deed in Lieu of Foreclosure - It can be a useful strategy for struggling homeowners facing financial distress.

The USCIS I-9 form is a critical document in the employment process, serving as a tool for employers to verify the identity and employment authorization of individuals hired for work in the United States. To better understand this form and its requirements, you can access a blank version of the form at documentonline.org/blank-uscis-i-9/. This knowledge helps both employers and employees navigate the hiring process more effectively, ensuring compliance with federal regulations.

Lady Bird Document - The deed remains revocable until the death of the original property owner, offering peace of mind.