Purchase Letter of Intent Document

When considering a significant investment, such as purchasing a business or property, a Purchase Letter of Intent (LOI) serves as a crucial preliminary document. This form outlines the initial terms and conditions under which the buyer expresses interest in acquiring an asset, signaling a serious intent to move forward with negotiations. Typically, the LOI includes essential details like the purchase price, payment structure, and timelines for due diligence and closing. It often addresses contingencies that may affect the transaction, such as financing or regulatory approvals. While the LOI is generally non-binding, it establishes a framework for further discussions, ensuring both parties are aligned on key aspects before committing to a formal agreement. By providing clarity and direction, this document can help facilitate smoother negotiations and foster trust between the buyer and seller, making it an indispensable tool in the acquisition process.

Misconceptions

When dealing with a Purchase Letter of Intent (LOI), several misconceptions can lead to confusion. Understanding these misconceptions can help you navigate the process more smoothly.

- 1. A Purchase LOI is a legally binding contract. Many believe that once an LOI is signed, it creates a binding agreement. In reality, most LOIs are non-binding and serve only as a preliminary agreement outlining the terms of a potential deal.

- 2. The LOI must include every detail of the transaction. While it’s important to cover key points, the LOI is not meant to be exhaustive. It can outline major terms, with the expectation that details will be finalized in a formal contract later.

- 3. An LOI guarantees the deal will go through. Signing an LOI does not guarantee that the transaction will be completed. It simply indicates a mutual interest in pursuing the deal.

- 4. The LOI is only for buyers. This is a common misconception. Both buyers and sellers can benefit from an LOI as it helps clarify intentions and expectations on both sides.

- 5. You don’t need legal advice for an LOI. Some individuals think that because the LOI is not a formal contract, they don’t need legal counsel. However, having legal advice can ensure that your interests are protected and that the document accurately reflects your intentions.

- 6. All LOIs are the same. LOIs can vary significantly based on the nature of the transaction and the parties involved. Each LOI should be tailored to fit the specific circumstances of the deal.

- 7. An LOI is only relevant for large transactions. While LOIs are common in larger deals, they can also be useful for smaller transactions. They help establish clarity and mutual understanding, regardless of the deal size.

- 8. Once signed, the terms cannot be changed. Some believe that the terms outlined in an LOI are set in stone. In fact, the terms can be negotiated and modified before a final agreement is reached.

By addressing these misconceptions, you can approach the Purchase Letter of Intent with a clearer understanding, ultimately leading to a more successful negotiation process.

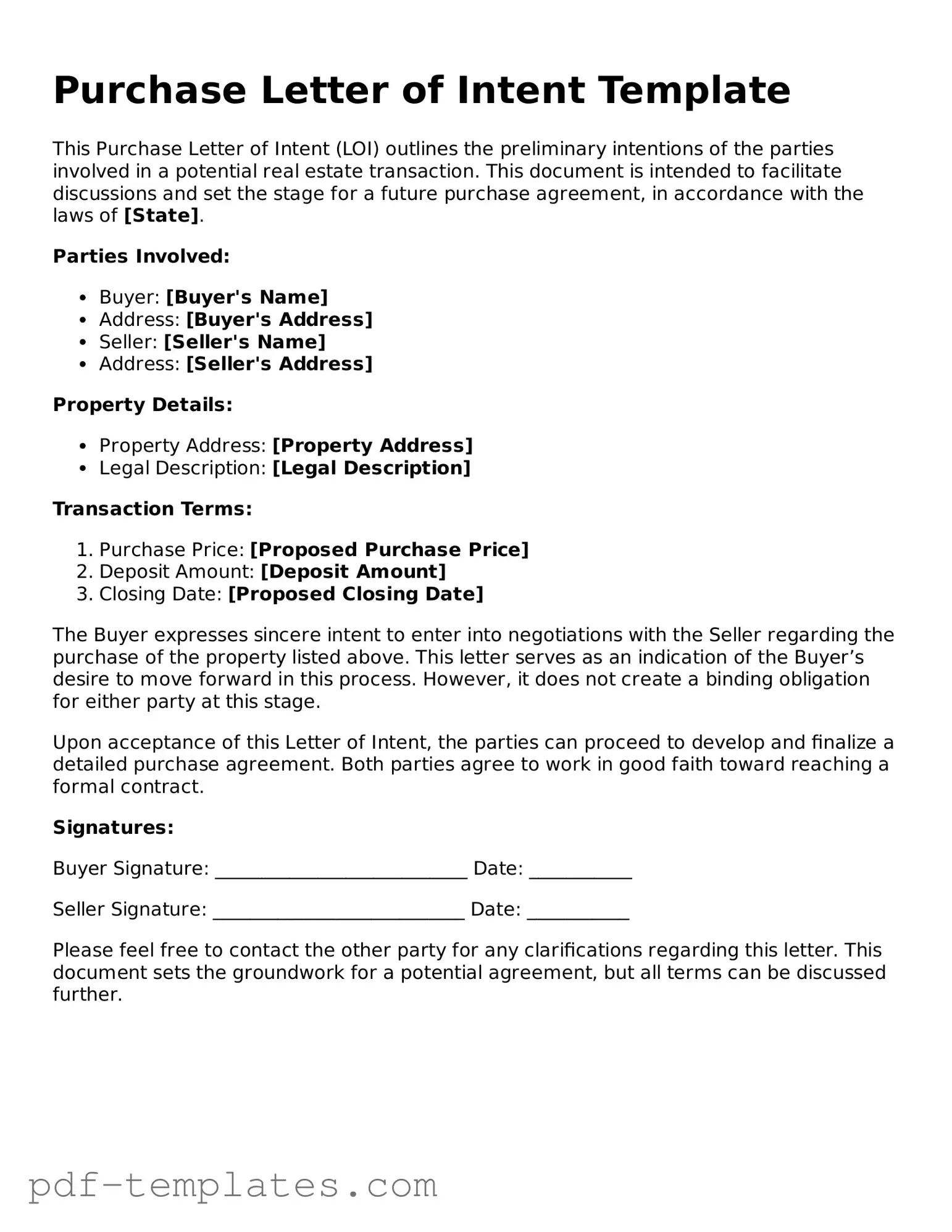

Purchase Letter of Intent: Usage Instruction

Once you have gathered the necessary information, you are ready to fill out the Purchase Letter of Intent form. Completing this form accurately is essential for outlining your intentions regarding a potential purchase. After submitting the form, you can expect further communication from the seller or their representative to discuss the next steps in the process.

- Read the Instructions: Before filling out the form, carefully read any provided instructions to ensure you understand what information is required.

- Enter Your Information: Fill in your name, address, and contact details at the top of the form. This identifies you as the buyer.

- Provide Seller Information: Include the seller's name and contact details. This helps clarify who you are negotiating with.

- Describe the Property: Clearly describe the property you intend to purchase. Include details such as the address, type of property, and any identifying information.

- Outline Purchase Terms: Specify the proposed purchase price, payment terms, and any contingencies that may apply.

- Include a Timeline: State your desired timeline for the transaction, including any deadlines for inspections or financing.

- Sign and Date: Finally, sign and date the form to indicate your agreement with the terms outlined.

Common mistakes

-

Incomplete Information: Many individuals fail to fill in all required fields. Leaving sections blank can lead to confusion and delays in the process.

-

Incorrect Details: Providing inaccurate information, such as the wrong property address or purchase price, can complicate negotiations. Double-check all entries before submission.

-

Missing Signatures: Not signing the document can render it invalid. Ensure that all parties involved sign the letter to show agreement.

-

Ignoring Deadlines: Some people overlook the importance of timelines. Failing to submit the letter within the specified timeframe can jeopardize the purchase.

-

Not Specifying Contingencies: Omitting important contingencies, like financing or inspections, can lead to misunderstandings later. Clearly outline any conditions that must be met.

-

Neglecting to Review: Rushing through the form without a thorough review often leads to mistakes. Take time to read through everything carefully before sending it off.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The Purchase Letter of Intent serves as a preliminary agreement outlining the basic terms of a potential transaction between a buyer and a seller. |

| Binding Nature | Typically, a Letter of Intent is non-binding, meaning that it expresses the intention to negotiate but does not create a legally enforceable contract. |

| State-Specific Forms | Some states may have specific forms or requirements for Letters of Intent, governed by local real estate laws and regulations. |

| Confidentiality Clause | Often, a Purchase Letter of Intent includes a confidentiality clause to protect sensitive information shared during negotiations. |

Dos and Don'ts

When filling out the Purchase Letter of Intent form, it's essential to be thorough and accurate. Here’s a list of things to do and avoid for a smooth process:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate and complete information.

- Do: Use clear and concise language.

- Do: Double-check for spelling and grammatical errors.

- Don't: Leave any required fields blank.

- Don't: Use vague or ambiguous terms.

- Don't: Rush through the form; take your time.

- Don't: Forget to sign and date the document.

Similar forms

A Purchase Agreement is a document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. Similar to a Purchase Letter of Intent, it includes essential details like the purchase price, property description, and timelines for closing the deal. However, a Purchase Agreement is typically more detailed and legally binding, while the Letter of Intent serves as a preliminary step to express interest and initiate negotiations.

In addition to the aforementioned documents, parties may also benefit from utilizing resources like the smarttemplates.net/fillable-letter-of-intent to streamline the drafting process, ensuring that key elements are addressed efficiently and accurately, thus enhancing the clarity of their preliminary agreements.

An Offer to Purchase is another document that shares similarities with a Purchase Letter of Intent. It is a formal proposal made by a buyer to a seller, indicating the buyer’s willingness to purchase a property at a specified price. Like the Purchase Letter of Intent, it sets the stage for negotiations but is often more specific regarding terms and conditions. The Offer to Purchase can lead directly to a Purchase Agreement if both parties agree.

A Memorandum of Understanding (MOU) is also akin to a Purchase Letter of Intent. An MOU outlines the general principles of a potential agreement between parties. While it may not be legally binding, it serves as a framework for future negotiations. Both documents aim to clarify intentions and expectations, helping to ensure that all parties are on the same page before moving forward.

A Term Sheet is a document that summarizes the key points of a proposed transaction, similar to a Purchase Letter of Intent. It outlines the main terms and conditions but is usually less formal. Term Sheets are often used in various business transactions, including real estate deals. They provide a concise overview, helping both parties understand the essential elements before drafting a more detailed agreement.

Additional Types of Purchase Letter of Intent Templates:

Intent to Sue Letter Template - A well-drafted Letter of Intent to Sue can help set the stage for negotiations, avoiding unnecessary court costs.

In the process of drafting an Investment Letter of Intent (LOI), it is crucial to refer to reliable resources that provide guidance on the necessary elements to include. For comprehensive information on what constitutes an effective LOI, you can visit OnlineLawDocs.com, which offers valuable insights into the structure and content of this important document.

Loi Meaning in Job - Offers both parties a chance to align on key employment terms.

Letter of Intent Purchase Business - Can establish the basis for negotiations concerning business assets.