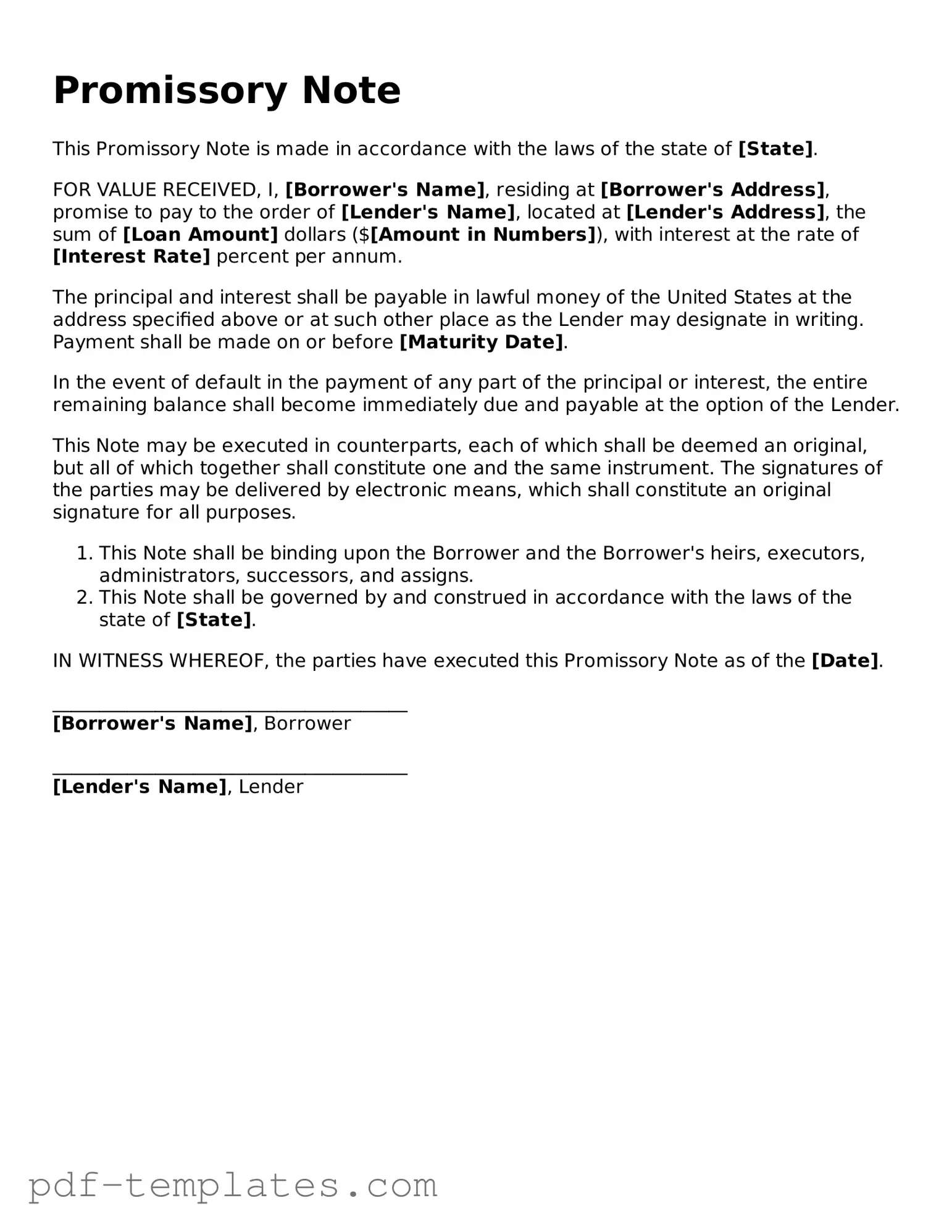

Promissory Note Document

A Promissory Note is a crucial financial document that serves as a written promise from one party to pay a specified sum of money to another party at a predetermined time or on demand. This form outlines the essential terms of the loan agreement, including the principal amount, interest rate, repayment schedule, and any penalties for late payments. It is important for both lenders and borrowers, as it provides a clear record of the obligations involved. The note can be secured or unsecured, depending on whether collateral is involved. Additionally, it may include clauses that address default and remedies, ensuring that both parties understand their rights and responsibilities. Understanding the components and implications of a Promissory Note is vital for anyone entering into a lending arrangement, as it helps protect the interests of both the lender and the borrower.

Misconceptions

Understanding the Promissory Note form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are five common misconceptions:

- All Promissory Notes are the Same: Many people believe that all promissory notes have a standard format. In reality, the terms can vary widely based on the agreement between the parties involved.

- Promissory Notes are Only for Large Loans: Some think these documents are only necessary for substantial amounts. However, they can be used for any loan amount, regardless of size.

- A Promissory Note Guarantees Payment: A common belief is that signing a promissory note ensures that the borrower will repay the loan. While it serves as a legal commitment, it does not guarantee payment if the borrower defaults.

- Notarization is Required: Many assume that a promissory note must be notarized to be valid. In most cases, notarization is not necessary, although it can add an extra layer of authenticity.

- They are Only Used in Personal Loans: Some people think promissory notes are exclusive to personal loans. In fact, they are also used in business transactions and real estate deals.

By clarifying these misconceptions, individuals can better navigate the process of creating and signing promissory notes.

Promissory Note - Customized for State

Promissory Note Document Subtypes

Promissory Note: Usage Instruction

Once you have the Promissory Note form in hand, it’s important to fill it out accurately to ensure that all parties involved understand the terms of the agreement. Follow these steps carefully to complete the form.

- Title the document: At the top of the form, clearly label it as a "Promissory Note."

- Enter the date: Write the date when the note is being created.

- Identify the borrower: Include the full name and address of the person or entity borrowing the money.

- Identify the lender: Provide the full name and address of the person or entity lending the money.

- Specify the loan amount: Clearly state the total amount of money being borrowed.

- Detail the interest rate: Indicate the interest rate that will apply to the loan, if any.

- Set the repayment terms: Outline how and when the borrower will repay the loan. Include the payment schedule (e.g., monthly, quarterly) and the final due date.

- Include late fees: If applicable, specify any penalties for late payments.

- Signatures: Ensure that both the borrower and the lender sign and date the document at the bottom.

- Witness or notarization: Depending on your state’s requirements, consider having a witness sign or getting the document notarized for added legal protection.

After completing the form, both parties should keep a copy for their records. Ensure that all terms are clear and understood before finalizing the agreement.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details, such as the full names and addresses of both the borrower and the lender. This can lead to confusion or disputes later.

-

Incorrect Loan Amount: Some people mistakenly enter the wrong loan amount. This error can cause significant issues if the borrower believes they owe a different amount than what is documented.

-

Missing Signatures: A common mistake is neglecting to sign the document. Without signatures, the note may not be legally enforceable.

-

Omitting Payment Terms: Failing to clearly outline the payment terms, including interest rates and repayment schedules, can lead to misunderstandings between parties.

-

Not Specifying Default Terms: Many overlook the importance of including what happens in case of default. This omission can complicate matters if the borrower fails to make payments.

-

Ignoring State Laws: Each state has specific laws governing promissory notes. Ignoring these can invalidate the document or lead to unforeseen legal issues.

-

Using Ambiguous Language: Vague terms can create confusion. It is essential to use clear and precise language to ensure that both parties understand their obligations.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time or on demand. |

| Parties Involved | Typically, there are two parties: the maker (who promises to pay) and the payee (who receives the payment). |

| Governing Law | In the United States, the Uniform Commercial Code (UCC) governs promissory notes, but state laws may also apply. |

| Essential Elements | A valid promissory note must include the principal amount, interest rate, payment schedule, and signatures of the parties involved. |

| Transferability | Promissory notes can be transferred or sold to another party, making them negotiable instruments. |

| Interest Rates | Interest rates on promissory notes can be fixed or variable, depending on the agreement between the parties. |

| Default Consequences | If the maker fails to pay as agreed, the payee may take legal action to recover the owed amount. |

| State-Specific Forms | Some states have specific forms or requirements for promissory notes, so it’s important to check local laws. |

Dos and Don'ts

When filling out a Promissory Note form, it’s essential to follow certain guidelines to ensure the document is valid and enforceable. Here’s a list of what to do and what to avoid:

- Do clearly state the amount borrowed.

- Do include the names and addresses of all parties involved.

- Do specify the repayment terms, including due dates.

- Do outline the interest rate, if applicable.

- Do sign and date the document in the presence of a witness or notary.

- Don't leave any fields blank; complete all required information.

- Don't use vague language; be specific and clear.

- Don't forget to keep a copy for your records.

- Don't ignore local laws that may affect the terms of the note.

Similar forms

A loan agreement is a document that outlines the terms of a loan between a borrower and a lender. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement typically includes more detailed terms and conditions, including collateral, default consequences, and other obligations of both parties. This makes it a more comprehensive document for larger loans or more complex arrangements.

A mortgage is a legal document that secures a loan for purchasing real estate. It is similar to a promissory note in that it involves a promise to repay borrowed money. However, a mortgage also gives the lender the right to take possession of the property if the borrower fails to repay the loan. This added layer of security for the lender distinguishes it from a simple promissory note.

Understanding the nuances of financial documents is crucial for effective management of business transactions. For instance, the California Resale Certificate, officially known as form CDTFA-230, allows businesses to purchase items without paying sales tax, emphasizing the importance of proper documentation. To navigate the intricacies of these forms and ensure compliance, it is essential to utilize resources like All California Forms, which aid in acquiring accurate documentation for various business needs.

A personal guarantee is a document where an individual agrees to be responsible for a debt or obligation of another party. Like a promissory note, it involves a commitment to repay money. However, a personal guarantee typically does not specify the terms of repayment. Instead, it serves as an assurance to the lender that they can seek repayment from the guarantor if the primary borrower defaults.

A business loan agreement is similar to a personal loan agreement but is tailored for business purposes. It outlines the terms of a loan made to a business entity. Like a promissory note, it includes repayment terms and interest rates. However, it may also cover additional clauses relevant to business operations, such as financial covenants and reporting requirements, making it more complex.

An IOU (I Owe You) is an informal document acknowledging a debt. It is similar to a promissory note in that it represents a promise to pay back money. However, an IOU usually lacks the formal structure and legal enforceability of a promissory note. It may not specify repayment terms or interest, making it less binding than a promissory note.

A credit agreement is a contract between a borrower and a lender that outlines the terms of a credit facility. Like a promissory note, it includes repayment obligations and interest rates. However, a credit agreement often covers a broader range of financial products, such as lines of credit or revolving credit, and includes terms regarding fees, collateral, and other conditions.

A lease agreement is a contract between a lessor and a lessee for the rental of property. While it is different in purpose, it shares similarities with a promissory note in that it involves payment for use of an asset. Lease agreements specify payment terms, duration, and responsibilities of both parties, making them more detailed than a simple promissory note.

A deed of trust is a legal document that involves three parties: the borrower, the lender, and a trustee. It secures a loan with real property, similar to a mortgage. While a promissory note outlines the borrower's promise to repay, a deed of trust provides the lender with a claim against the property should the borrower default. This makes it a more complex arrangement.

A bond is a financial instrument that represents a loan made by an investor to a borrower. Like a promissory note, it includes a promise to pay back the borrowed amount with interest. However, bonds are typically issued in larger amounts and may be traded on financial markets. They also come with specific terms regarding maturity dates and interest payments, making them more formal than a promissory note.

A settlement agreement is a document that outlines the terms of a resolution between parties, often following a dispute. It can include payment terms similar to those in a promissory note. However, a settlement agreement usually addresses broader issues, such as the resolution of claims or disputes, and may involve compromises from both parties, making it more complex.

More Documents

Employee Policy - Understand the various types of employment classifications.

To obtain the necessary documentation for employment verification, employers must utilize the USCIS I-9 form, a crucial part of the hiring process. More information can be found at https://documentonline.org/blank-uscis-i-9/, where you can access a blank version of the form to ensure compliance with federal regulations.

Private Settlement for Car Accident Pdf - Encourages a direct and honest approach to damage settlements.

U.S. Corporation Income Tax Return - Form 1120 serves as a foundation for understanding corporate financial health from a tax perspective.