Promissory Note for a Car Document

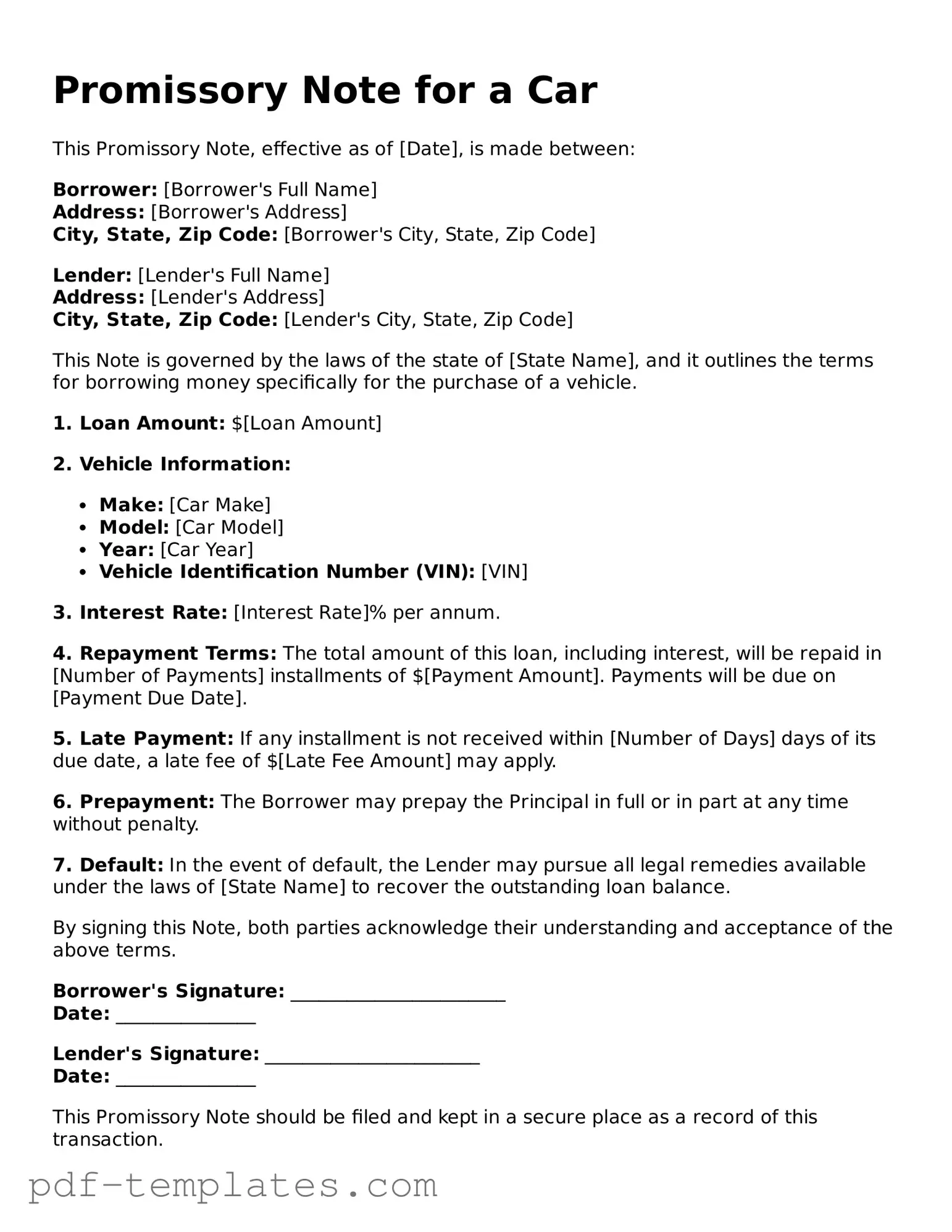

When purchasing a car through financing, a Promissory Note for a Car serves as a crucial document that outlines the terms of the loan agreement between the buyer and the lender. This form not only establishes the buyer's promise to repay the borrowed amount but also details the specific conditions of the loan, such as the interest rate, repayment schedule, and any applicable fees. It protects both parties by clearly defining the obligations and rights involved in the transaction. The note typically includes essential information like the total loan amount, the vehicle identification number (VIN), and the consequences of defaulting on the loan. By understanding the components of this form, buyers can navigate their financing options with greater confidence and ensure that their interests are safeguarded throughout the car-buying process.

Misconceptions

Understanding the Promissory Note for a Car form is essential for both buyers and sellers. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding this important document.

- It is the same as a car loan agreement. Many people believe that a promissory note is equivalent to a car loan agreement. While both documents involve borrowing money, a promissory note is a simple promise to pay, whereas a loan agreement includes detailed terms and conditions.

- It must be notarized. Some individuals think that a promissory note must be notarized to be valid. In reality, notarization is not a requirement for a promissory note, although it can add an extra layer of authenticity.

- It guarantees ownership of the car. A common misconception is that signing a promissory note grants ownership of the vehicle. Ownership is determined by the title of the car, not the promissory note.

- It is only for private sales. Many assume that promissory notes are only used in private car sales. However, they can also be utilized in transactions involving dealerships, especially when financing is arranged directly between the buyer and seller.

- It cannot be modified. Some people believe that once a promissory note is signed, its terms cannot be changed. In fact, parties can agree to modify the terms, but any changes should be documented in writing and signed by both parties.

- It is a legally binding contract. While a promissory note is a legal document, some think it is automatically enforceable in court. The enforceability may depend on the clarity of the terms and whether both parties have fulfilled their obligations.

- It does not require a repayment schedule. Lastly, some individuals believe that a promissory note does not need a repayment schedule. In reality, including a clear repayment schedule helps prevent misunderstandings and ensures that both parties are aware of the payment expectations.

By addressing these misconceptions, individuals can better navigate the process of using a Promissory Note for a Car. Understanding the true nature of this document can help foster trust and clarity between buyers and sellers.

Promissory Note for a Car: Usage Instruction

Filling out the Promissory Note for a Car form is an important step in securing your agreement for a vehicle loan. This document will outline the terms of repayment and establish the responsibilities of both the borrower and the lender. Follow these steps carefully to ensure that all necessary information is included.

- Start with the Date: Write the date on which you are completing the form at the top of the document.

- Borrower Information: Enter your full name, address, and contact information. Make sure to provide accurate details.

- Lender Information: Fill in the lender’s name and address. This could be a bank, credit union, or individual.

- Loan Amount: Clearly state the total amount being borrowed for the car purchase. This should match any prior agreements.

- Interest Rate: Specify the interest rate being charged on the loan. If it’s a fixed rate, indicate that clearly.

- Payment Schedule: Outline how often payments will be made (weekly, bi-weekly, monthly) and the due date for each payment.

- Final Payment Date: Indicate the date by which the loan must be fully repaid.

- Signature: Sign the document to indicate your agreement to the terms. If required, have a witness sign as well.

- Keep a Copy: After filling out the form, make sure to keep a copy for your records.

Once you have completed the form, review it for any errors or missing information. It’s crucial that everything is accurate before you submit or present it to the lender. This will help avoid any misunderstandings down the line.

Common mistakes

-

Incorrect Amount: One of the most common mistakes is entering the wrong loan amount. It’s crucial to ensure that the total amount borrowed matches the agreed-upon figure. Double-check any calculations to avoid confusion later.

-

Missing Signatures: Failing to sign the document can render the note invalid. All parties involved must provide their signatures. Without them, the note lacks legal enforceability.

-

Omitting Dates: Not including the date when the note is signed can lead to disputes about when the agreement became effective. Always write the date clearly to establish a timeline.

-

Vague Terms: Using unclear language regarding payment terms can create misunderstandings. Specify the payment schedule, including due dates and amounts, to ensure everyone is on the same page.

-

Ignoring Interest Rates: Not including the interest rate or miscalculating it can lead to financial strain. Clearly state the interest rate and how it will be applied to the loan balance.

-

Failure to Include Collateral: If the car serves as collateral, this must be explicitly stated. Omitting this information can complicate matters if a default occurs.

-

Neglecting to Review the Document: Skimming through the document before signing can lead to overlooked errors. Take the time to review the entire note carefully to ensure accuracy and completeness.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount for the purchase of a vehicle. |

| Parties Involved | The note typically involves two parties: the borrower (buyer) and the lender (seller or financial institution). |

| Governing Law | In the U.S., the Uniform Commercial Code (UCC) governs promissory notes, but specific state laws may also apply. |

| Payment Terms | Payment terms include the total amount financed, interest rate, payment schedule, and due dates. |

| Secured vs. Unsecured | Promissory notes for cars are usually secured, meaning the car serves as collateral for the loan. |

| Default Consequences | If the borrower defaults, the lender may repossess the vehicle to recover the owed amount. |

| State-Specific Forms | Some states may require specific forms or disclosures to be included with the promissory note. |

| Notarization | While notarization is not always required, it can provide additional legal protection for both parties. |

| Transferability | Promissory notes can often be transferred to another party, allowing for sale or assignment of the debt. |

| Legal Enforcement | A promissory note can be enforced in court if the borrower fails to meet the payment obligations. |

Dos and Don'ts

When filling out the Promissory Note for a Car form, it’s important to follow certain guidelines to ensure accuracy and clarity. Here are some things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information about the borrower and the lender.

- Do clearly state the loan amount and interest rate.

- Do include the repayment schedule and due dates.

- Don't leave any sections blank unless instructed.

- Don't use vague language; be specific about terms.

- Don't forget to sign and date the document before submitting.

Similar forms

A Loan Agreement is similar to a Promissory Note for a Car in that both documents outline the terms of a loan. They specify the amount borrowed, the interest rate, and the repayment schedule. While a Loan Agreement may include additional details such as collateral and default provisions, both documents serve the same fundamental purpose: to create a binding obligation for the borrower to repay the lender.

A Sales Contract, particularly for vehicles, shares similarities with a Promissory Note for a Car. Both documents facilitate the transfer of ownership and include essential information like the purchase price and payment terms. The Sales Contract, however, focuses more on the sale transaction itself, while the Promissory Note emphasizes the borrower's commitment to repay the loan used to finance that purchase.

An Installment Agreement also resembles a Promissory Note for a Car. This document outlines a series of payments over time, typically for a significant purchase. Both agreements detail the payment amounts, due dates, and consequences of non-payment. The key difference lies in the context; an Installment Agreement often applies to various types of purchases, while the Promissory Note specifically pertains to vehicle financing.

A Lease Agreement can be compared to a Promissory Note for a Car, especially when it comes to vehicle leasing. Both documents outline financial obligations and responsibilities. However, a Lease Agreement focuses on the terms of renting a vehicle rather than purchasing it. This includes monthly payments, lease duration, and conditions for returning the vehicle at the end of the lease term.

When engaging in vehicle-related financial transactions, it is essential to have the appropriate documentation in order, including a Florida Promissory Note, which outlines the terms of the loan. To further understand the necessary forms and ensure compliance with legal requirements, refer to All Florida Forms for comprehensive resources.

A Secured Note is another document that bears resemblance to a Promissory Note for a Car. Both are types of promissory notes, but a Secured Note is backed by collateral. In the case of a car loan, the vehicle itself often serves as collateral. This means if the borrower defaults, the lender has the right to repossess the vehicle, ensuring protection for the lender.

An Affidavit of Debt can also be likened to a Promissory Note for a Car. While an Affidavit of Debt is a sworn statement confirming the amount owed, it can serve as evidence of the debt in legal proceedings. Both documents confirm a borrower's obligation to repay a loan, but the Affidavit may be used in situations where the borrower disputes the debt or in collection actions.

Finally, a Mortgage Note is similar in structure to a Promissory Note for a Car, as both are legally binding documents that outline loan terms. A Mortgage Note is specifically used for real estate transactions, detailing the borrower's promise to repay a mortgage loan. While the subject matter differs—real estate versus vehicles—the underlying principles of loan repayment and borrower obligations remain consistent.

Additional Types of Promissory Note for a Car Templates:

Promissory Note Paid in Full Template - Official evidence that a promissory note is no longer enforceable.

When considering a loan agreement, understanding the importance of a well-crafted legal Promissory Note form is crucial. This document serves to clarify the terms of the loan, including the repayment obligations and interest rates, providing peace of mind to both the borrower and lender.