Get Profit And Loss Form in PDF

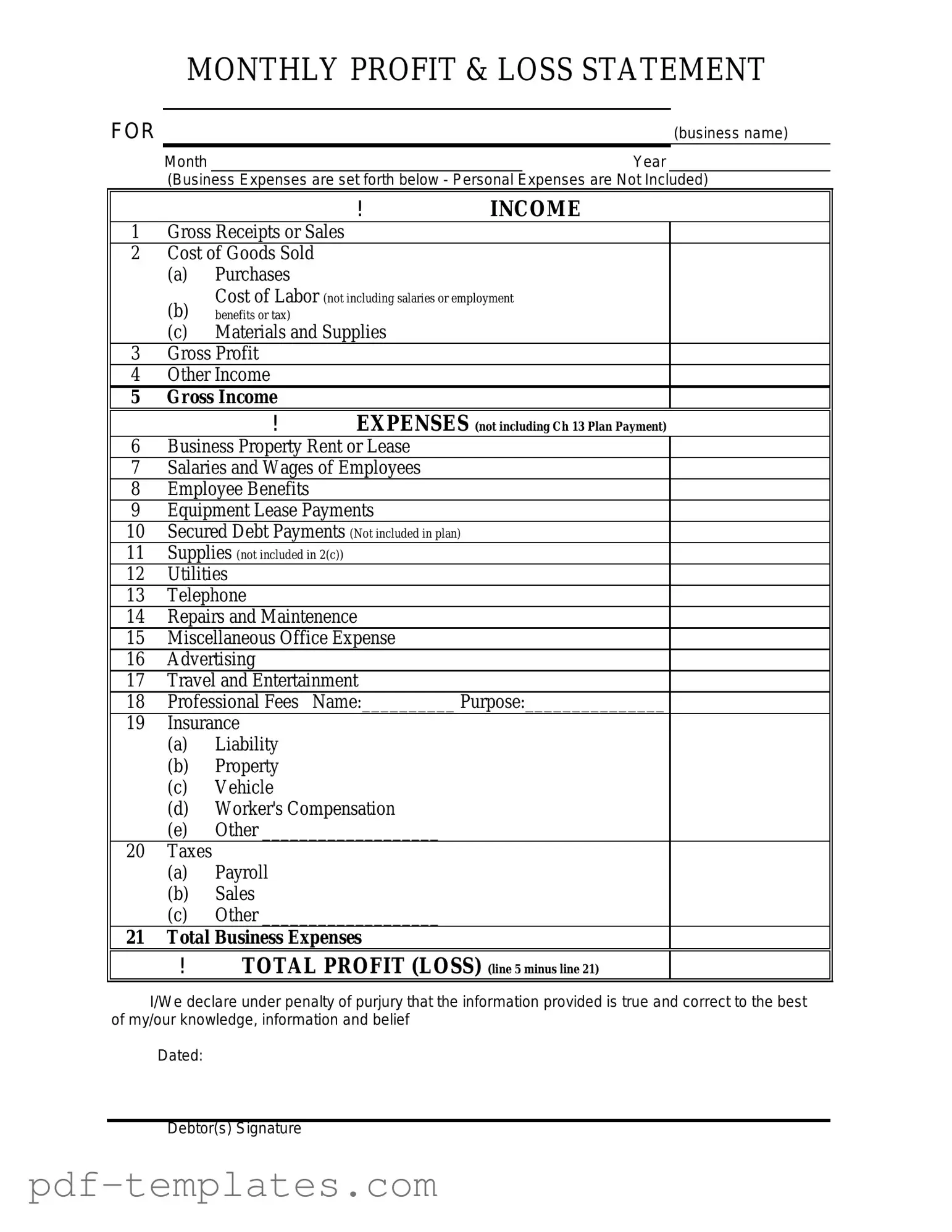

The Profit and Loss form is a crucial financial document that provides a clear snapshot of a business's financial performance over a specific period. It outlines revenues, costs, and expenses, helping business owners and stakeholders understand the profitability of the company. Typically, this form includes sections for total income, cost of goods sold, and operating expenses, which together determine the net profit or loss. By analyzing these figures, businesses can identify trends, assess operational efficiency, and make informed decisions about future investments. Additionally, the Profit and Loss form serves as an essential tool for tax reporting and financial forecasting, making it indispensable for both small businesses and larger corporations. Understanding how to read and interpret this form can empower business owners to take control of their financial health and strategize for success.

Misconceptions

Understanding the Profit and Loss (P&L) form is essential for anyone involved in business finance. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- The P&L only shows profit. Many believe the P&L form solely reflects profit. In reality, it details revenues and expenses, providing a comprehensive view of a company's financial performance.

- All expenses are deductible. Some assume that every expense listed on the P&L is fully deductible. However, certain expenses may be subject to limitations or may not be deductible at all.

- The P&L is the same as the balance sheet. There is a common belief that the P&L and the balance sheet convey the same information. In fact, the P&L summarizes performance over a period, while the balance sheet provides a snapshot of assets, liabilities, and equity at a specific point in time.

- Revenue is recognized when cash is received. Many people think that revenue is only recognized when cash changes hands. However, under the accrual basis of accounting, revenue is recognized when it is earned, regardless of when payment is received.

- Net income equals cash flow. Some individuals mistakenly equate net income with cash flow. While net income is an important measure, it does not account for all cash inflows and outflows, such as depreciation or changes in working capital.

- The P&L is only for large businesses. There is a misconception that only large corporations need a P&L form. In truth, any business, regardless of size, benefits from tracking its income and expenses through a P&L statement.

- Once completed, the P&L does not need to be revisited. Some believe that a completed P&L is final and does not require further attention. In reality, regular review and updates are crucial for accurate financial analysis and decision-making.

By addressing these misconceptions, individuals can better understand the importance and functionality of the Profit and Loss form in financial management.

Profit And Loss: Usage Instruction

Filling out the Profit and Loss form is a straightforward process that helps you track your business's financial performance over a specific period. By following these steps, you'll ensure that all necessary information is accurately recorded.

- Gather your financial documents, including income statements, receipts, and invoices for the period you are reporting.

- Start with the Revenue section. Enter the total income earned from sales or services provided.

- Next, move to the Cost of Goods Sold (COGS). List all direct costs associated with producing the goods or services sold.

- Calculate your Gross Profit by subtracting COGS from Revenue. Write this amount in the designated area.

- Now, fill out the Operating Expenses section. Include all indirect costs such as rent, utilities, and salaries.

- Determine your Net Profit or Loss by subtracting total operating expenses from Gross Profit.

- Review all entries for accuracy and completeness. Make sure that the numbers add up correctly.

- Finally, save or submit the form according to your business's reporting requirements.

Common mistakes

-

Neglecting to include all income sources: Many individuals forget to account for all streams of income. This can lead to an inaccurate representation of financial health.

-

Inaccurate expense reporting: Some people misclassify expenses or fail to report all costs. This mistake can distort profit calculations and mislead financial analysis.

-

Failing to track non-cash expenses: Items like depreciation and amortization are often overlooked. These expenses can significantly impact the overall profit picture.

-

Using estimates instead of actual figures: Relying on rough estimates rather than precise numbers can lead to errors. It's crucial to use actual data for accuracy.

-

Not reviewing prior periods: Failing to compare current data with previous periods can result in missing trends. Historical context is vital for understanding performance.

-

Ignoring seasonal fluctuations: Some businesses experience seasonal variations in income and expenses. Not accounting for these can lead to misleading conclusions about profitability.

-

Overlooking tax implications: Some individuals forget to factor in taxes when calculating net profit. This oversight can lead to an inflated view of financial success.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Profit and Loss form summarizes a business's revenues and expenses over a specific period, helping to assess financial performance. |

| Components | Key components include total revenue, cost of goods sold, gross profit, operating expenses, and net profit or loss. |

| Frequency | Businesses typically prepare this form monthly, quarterly, or annually, depending on their reporting needs. |

| State-Specific Forms | Some states may require specific Profit and Loss forms for tax purposes, governed by state tax laws. |

| Tax Implications | The information on the Profit and Loss form is crucial for determining taxable income and ensuring compliance with federal and state tax regulations. |

| Analysis Tool | This form serves as a vital tool for business owners and investors to analyze profitability and make informed decisions. |

| Record Keeping | Maintaining accurate Profit and Loss statements is essential for effective financial management and can support future business growth. |

Dos and Don'ts

When filling out a Profit and Loss form, attention to detail is crucial. Here’s a list of six essential dos and don’ts to keep in mind:

- Do ensure that all income sources are accurately reported.

- Do categorize expenses correctly to reflect your business operations.

- Do double-check your calculations for accuracy.

- Do keep supporting documents organized for reference.

- Don't omit any income, no matter how small it may seem.

- Don't forget to review the form for any inconsistencies before submission.

Similar forms

The Profit and Loss statement, often referred to as the income statement, is similar to a balance sheet in that both documents provide a snapshot of a company's financial health. While the Profit and Loss statement focuses on revenues and expenses over a specific period, the balance sheet presents assets, liabilities, and equity at a single point in time. Together, they offer a comprehensive view of a company's performance and stability, helping stakeholders make informed decisions.

The cash flow statement is another document closely related to the Profit and Loss statement. It details the inflow and outflow of cash within a company over a specific period. While the Profit and Loss statement shows profitability, the cash flow statement reveals how well a company manages its cash to fund operations and meet obligations. Understanding both documents is crucial for assessing a company's liquidity and financial viability.

A budget is similar to a Profit and Loss statement in that it outlines expected revenues and expenses for a future period. While the Profit and Loss statement reflects actual financial performance, a budget serves as a financial plan that guides decision-making. Comparing the two can help organizations identify variances and adjust their strategies accordingly.

The statement of retained earnings is akin to the Profit and Loss statement as it provides insight into how profits are utilized within a company. This document shows changes in retained earnings over a period, including net income from the Profit and Loss statement and any dividends paid out. It highlights how profits are reinvested or distributed, reflecting the company’s growth strategy.

A trial balance is another financial document that shares similarities with the Profit and Loss statement. It lists all the accounts in the general ledger and their balances at a specific time. While the Profit and Loss statement summarizes income and expenses, the trial balance ensures that the accounting equation holds true, confirming that debits equal credits. This document is crucial for preparing financial statements accurately.

The statement of comprehensive income expands on the Profit and Loss statement by including other comprehensive income items, such as unrealized gains or losses. This document provides a broader view of a company's financial performance, capturing elements that affect equity but are not included in net income. Stakeholders benefit from this additional layer of detail when assessing overall financial health.

The income tax return is also similar to the Profit and Loss statement, as it summarizes a company's income, expenses, and tax obligations for a specific period. Both documents reflect financial performance, but the tax return is used for compliance with tax laws. Understanding the relationship between these documents can help companies manage their tax liabilities effectively.

The sales report shares similarities with the Profit and Loss statement, focusing specifically on revenue generation. It details sales figures over a specific period, allowing businesses to analyze performance trends. While the Profit and Loss statement includes all revenues and expenses, the sales report narrows the focus to sales activity, providing valuable insights into revenue streams.

The financial forecast is akin to the Profit and Loss statement in that it projects future revenues and expenses based on historical data and market trends. While the Profit and Loss statement reflects past performance, the forecast helps businesses plan for the future. Comparing actual results to forecasts can inform strategic adjustments and improve financial planning.

Lastly, the management report is similar to the Profit and Loss statement in that it provides an overview of financial performance, often tailored for internal stakeholders. This document may include key performance indicators and analyses that go beyond the basic financial data found in the Profit and Loss statement. Management reports help leaders make informed decisions based on comprehensive financial insights.

Other PDF Forms

J30 Form - Includes details about surrendered certificates during transfers.

Lien Release Requirements by State - Property owners can use this waiver to confirm that they have settled all financial obligations before finalizing their project.