Prenuptial Agreement Document

When two people decide to tie the knot, they often focus on the joy of their upcoming union, but it’s equally important to consider the practical aspects of their financial future together. A prenuptial agreement, commonly known as a prenup, serves as a crucial tool in this regard. This legal document outlines how assets and debts will be managed during the marriage and what will happen in the event of a divorce. It can address property division, spousal support, and even the handling of future earnings. By discussing these matters before saying “I do,” couples can foster open communication and set clear expectations, which can ultimately strengthen their relationship. Additionally, a well-crafted prenup can protect individual assets and ensure that both parties feel secure and respected. While it may seem daunting to think about potential separation before even beginning a life together, a prenup can provide peace of mind and clarity, allowing couples to focus on building their future without the worry of financial disputes lurking in the background.

Misconceptions

Prenuptial agreements often come with misunderstandings. Here are nine common misconceptions about these important legal documents:

- Prenuptial agreements are only for the wealthy. Many people believe that only those with significant assets need a prenuptial agreement. In reality, anyone can benefit from clarifying financial responsibilities and expectations before marriage.

- Prenuptial agreements are unromantic. Some view these agreements as a lack of trust or a sign of impending failure. However, discussing financial matters openly can strengthen a relationship and foster communication.

- Prenuptial agreements are only for divorce situations. While they do outline terms for separation, they can also address financial matters during the marriage, such as how to manage shared expenses or debts.

- Prenuptial agreements are difficult to enforce. When created and executed properly, these agreements are legally binding and can be enforced in court, provided they meet state requirements.

- Prenuptial agreements are set in stone. Many people think that once signed, these agreements cannot be changed. In fact, couples can modify their prenup if both parties agree to the changes.

- Prenuptial agreements are only necessary for second marriages. While they can be particularly useful in second marriages, first-time couples can also benefit from defining their financial landscape ahead of time.

- Prenuptial agreements are the same as postnuptial agreements. Although both serve to outline financial arrangements, a prenuptial agreement is signed before marriage, while a postnuptial agreement is created after the wedding.

- Prenuptial agreements are only about money. These agreements can cover a wide range of issues, including property division, debt responsibility, and even provisions for children from previous relationships.

- Prenuptial agreements are a sign of impending divorce. Many assume that discussing a prenup means a couple is planning for failure. In truth, it's a proactive step that can help ensure a fair resolution if the relationship does not last.

Understanding these misconceptions can help couples approach prenuptial agreements with clarity and confidence.

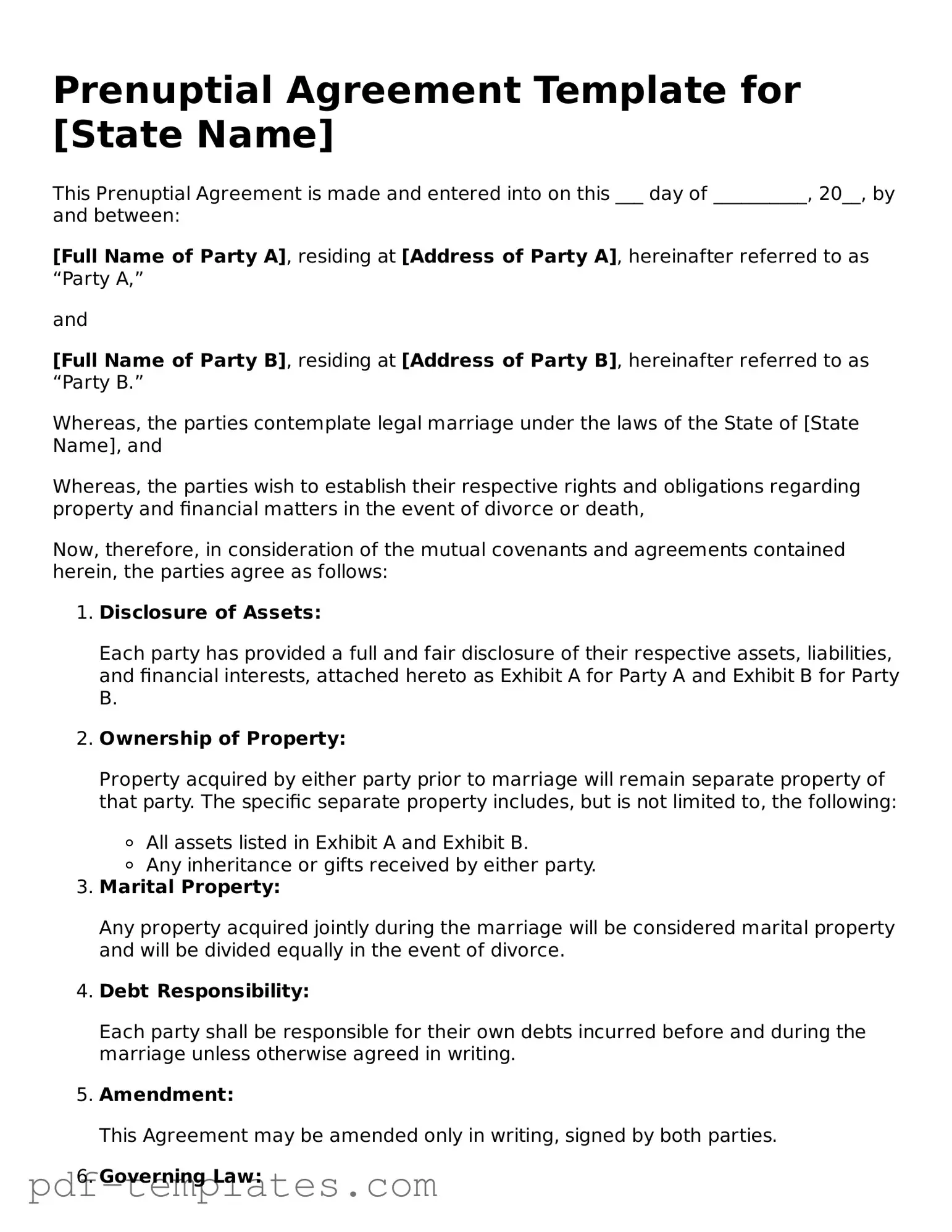

Prenuptial Agreement - Customized for State

Prenuptial Agreement: Usage Instruction

Filling out a Prenuptial Agreement form is an important step for couples considering marriage. This form allows both parties to outline their financial rights and responsibilities. The following steps will guide you through the process of completing the form accurately.

- Begin by gathering personal information. This includes full names, addresses, and contact details for both parties.

- Clearly state the date of the agreement. This should be the date you plan to sign the document.

- Detail the assets and liabilities of each person. List bank accounts, properties, investments, and debts.

- Discuss and outline how you want to handle future earnings and debts. Be specific about how these will be treated in the event of a divorce.

- Include any special provisions that you both agree on. This could involve spousal support or the division of specific assets.

- Make sure both parties sign and date the agreement. It is essential that both individuals are present during this step.

- Consider having the document notarized. This adds an extra layer of validation to the agreement.

Once you have completed these steps, you will have a signed Prenuptial Agreement. It's advisable to keep copies for both parties and consult with a legal professional to ensure everything is in order.

Common mistakes

-

Not Disclosing All Assets: One common mistake is failing to fully disclose all assets and liabilities. It is crucial for both parties to provide a complete picture of their financial situation. Omitting information can lead to disputes later on.

-

Using Ambiguous Language: Clarity is essential in a prenuptial agreement. Vague terms can create confusion and may not hold up in court. Each party should ensure that the language used is specific and easily understood.

-

Not Seeking Legal Advice: Many individuals attempt to fill out the form without consulting a lawyer. Professional guidance can help in understanding the implications of various clauses and ensure that the agreement is enforceable.

-

Rushing the Process: Taking time to carefully review and discuss the agreement is important. Hasty decisions can lead to mistakes or overlooked details that might be significant in the future.

-

Ignoring State Laws: Each state has its own laws regarding prenuptial agreements. Not being aware of these regulations can result in an agreement that is not valid. It is advisable to research or consult a legal professional familiar with local laws.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a contract between two individuals before marriage, outlining the division of assets and responsibilities in the event of divorce or separation. |

| Governing Law | In the United States, prenuptial agreements are governed by state law, which can vary significantly. Commonly, the Uniform Premarital Agreement Act (UPAA) is adopted by several states. |

| Enforceability | For a prenuptial agreement to be enforceable, it must be in writing, signed by both parties, and entered into voluntarily without coercion. |

| Full Disclosure | Both parties must provide a fair and reasonable disclosure of their financial situations. This ensures transparency and fairness in the agreement. |

| Modification | Prenuptial agreements can be modified or revoked at any time, provided that both parties agree to the changes in writing. |

| State-Specific Forms | Some states require specific forms or language to be included in prenuptial agreements. Always check local laws for requirements. |

| Legal Advice | It is advisable for both parties to seek independent legal counsel before signing a prenuptial agreement to ensure that their rights are protected. |

Dos and Don'ts

When filling out a Prenuptial Agreement form, it's essential to approach the process thoughtfully. Here are some important do's and don'ts to consider:

- Do communicate openly with your partner about your intentions and expectations.

- Do seek legal advice to ensure you understand the implications of the agreement.

- Do be honest about your financial situation, including assets and debts.

- Do keep the language clear and straightforward to avoid misunderstandings.

- Don't rush the process; take your time to discuss and negotiate terms.

- Don't hide any financial information from your partner.

- Don't assume that a Prenuptial Agreement is only for the wealthy; it can benefit anyone.

By following these guidelines, you can create a fair and effective Prenuptial Agreement that serves both partners' interests.

Similar forms

A Cohabitation Agreement is similar to a prenuptial agreement in that it establishes the rights and responsibilities of partners who live together but are not married. This document outlines how property will be divided, financial obligations, and other important matters should the relationship end. Like a prenuptial agreement, it serves to protect individual assets and clarify expectations, providing a framework for resolving disputes without resorting to litigation.

A Postnuptial Agreement is another document that shares similarities with a prenuptial agreement. This type of agreement is executed after marriage and addresses the same concerns regarding asset division and financial responsibilities. Couples may choose to create a postnuptial agreement to update their financial arrangements or address changes in circumstances, such as the birth of a child or a significant increase in income. Both agreements aim to minimize conflict and provide clarity in the event of separation or divorce.

A Will shares some characteristics with a prenuptial agreement, particularly in terms of asset distribution. A will specifies how an individual's property and assets will be distributed upon their death. Similarly, a prenuptial agreement dictates how assets will be divided in the event of divorce. Both documents require careful consideration and planning to ensure that the individual's wishes are honored and to prevent disputes among heirs or former spouses.

Understanding the importance of legal agreements in relationships can be enhanced by looking into various forms for different circumstances, including the essential All California Forms that facilitate clarity and security for individuals. Such documents, whether they pertain to medical treatment, cohabitation, or postnuptial arrangements, provide a structured way to navigate complex emotional and financial landscapes, ensuring that all parties are aware of their rights and responsibilities.

An Estate Plan can also be likened to a prenuptial agreement, as it encompasses a comprehensive strategy for managing an individual's assets during their lifetime and after death. This plan may include wills, trusts, and powers of attorney, all of which aim to clarify how assets will be handled. Just as a prenuptial agreement addresses financial matters in the context of marriage, an estate plan ensures that an individual's financial affairs are managed according to their wishes, providing peace of mind for both the individual and their loved ones.

More Documents

What Is Dnr - This order allows individuals to refuse CPR and other life-saving interventions if their heart stops beating.

To ensure a successful transfer of ownership, it’s vital to utilize the proper documentation. For more information, refer to this helpful guide: "overview of the Horse Bill of Sale". Visit the following link to access the Horse Bill of Sale form and get started with your transaction.

Cg2010 0704 - Customize the schedule to accurately reflect all involved parties for comprehensive coverage.