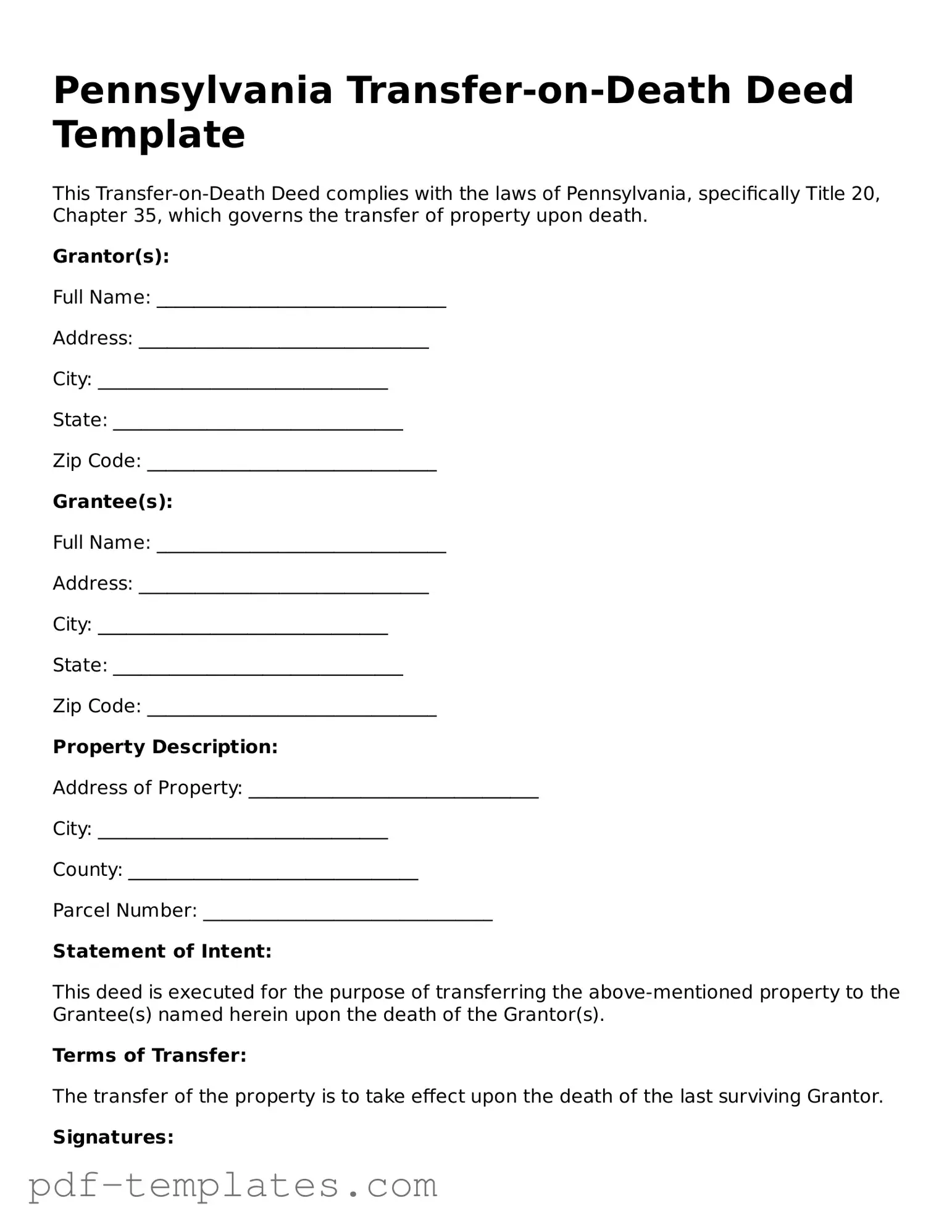

Official Transfer-on-Death Deed Template for Pennsylvania State

The Pennsylvania Transfer-on-Death Deed form is an important legal tool that allows property owners to designate beneficiaries who will automatically inherit their real estate upon their death, bypassing the often lengthy and costly probate process. This deed provides a straightforward way to transfer ownership without the need for a will, ensuring that your property goes directly to your chosen heirs. By completing this form, property owners can maintain full control of their assets during their lifetime while providing peace of mind regarding the future distribution of their property. Importantly, the form must be executed in accordance with Pennsylvania state laws, including proper notarization and recording, to ensure its validity. Understanding the nuances of this deed can help individuals make informed decisions about their estate planning, allowing them to address potential complications and safeguard their loved ones’ interests. Whether you are a first-time property owner or looking to update your estate plan, the Transfer-on-Death Deed offers a practical solution for managing property transfers in Pennsylvania.

Misconceptions

Understanding the Pennsylvania Transfer-on-Death Deed can help individuals make informed decisions about their estate planning. However, several misconceptions persist. Here are ten common misunderstandings:

- It eliminates the need for a will. Many believe that using a Transfer-on-Death Deed means they do not need a will. In reality, a will is still essential for addressing assets not covered by the deed.

- It automatically transfers all assets. Some think that the deed transfers all property owned by the individual. The deed only applies to the specific property listed and does not include other assets.

- It is irrevocable once signed. A common belief is that once the deed is executed, it cannot be changed. However, the grantor can revoke or modify the deed at any time before their death.

- It avoids estate taxes. Many assume that a Transfer-on-Death Deed allows them to bypass estate taxes. This is not true; the property may still be subject to taxes upon the grantor's death.

- It can be used for any type of property. Some people think that any property can be transferred using this deed. However, certain types of property, like jointly owned assets, may not qualify.

- It requires court approval. There is a misconception that the deed must be approved by a court. In Pennsylvania, the deed becomes effective upon the grantor's death without court involvement.

- Beneficiaries have immediate access to the property. Some believe that beneficiaries can access the property right away. In fact, they must wait until the grantor passes away and the deed is executed.

- It is only for married couples. Many think that only married couples can use this deed. In truth, any individual can designate beneficiaries, regardless of marital status.

- It is a complex legal document. Some feel intimidated by the idea of creating a Transfer-on-Death Deed. However, it is a straightforward form that can be filled out with basic information.

- It guarantees the property will be transferred smoothly. While the deed simplifies the transfer process, disputes among beneficiaries or other legal issues can still arise, complicating the transfer.

By clearing up these misconceptions, individuals can better navigate their estate planning options and make informed choices regarding their property and beneficiaries.

Pennsylvania Transfer-on-Death Deed: Usage Instruction

Once you have gathered the necessary information, you can begin filling out the Pennsylvania Transfer-on-Death Deed form. This process involves several straightforward steps to ensure that your wishes are clearly documented. Follow the instructions carefully to avoid any errors that could complicate the transfer of your property.

- Begin by downloading the Transfer-on-Death Deed form from the Pennsylvania Department of State’s website or obtain a physical copy from a local office.

- In the top section of the form, provide the name and address of the property owner (the grantor). Ensure that the information is accurate and matches public records.

- Next, identify the beneficiary or beneficiaries who will receive the property upon your passing. List their full names and addresses clearly.

- Describe the property being transferred. Include the full address and any identifying information, such as a parcel number, to ensure there is no confusion about which property is involved.

- Indicate whether you want to transfer the property to multiple beneficiaries. If so, specify how the property will be divided among them.

- Sign and date the form in the presence of a notary public. Your signature must be notarized to validate the deed.

- After notarization, make copies of the signed form for your records and for the beneficiaries.

- Finally, file the original Transfer-on-Death Deed with the appropriate county office where the property is located. This step is crucial for the deed to take effect.

Once you have completed these steps, the deed will be recorded, and your wishes regarding the transfer of the property will be documented. It's advisable to inform your beneficiaries about the deed and its implications. This transparency can help avoid confusion in the future.

Common mistakes

-

Failing to properly identify the property. It is essential to provide the correct legal description of the property being transferred. This includes the address, parcel number, and any other identifying details.

-

Not including the names of all owners. If there are multiple owners of the property, all names must be listed on the deed to avoid confusion or disputes in the future.

-

Overlooking the requirement for a witness. Pennsylvania law requires that the deed be signed in the presence of a witness. Neglecting this step can render the deed invalid.

-

Using incorrect or incomplete signatures. Each owner must sign the deed as it appears on the property title. Any discrepancies can lead to complications later.

-

Failing to record the deed. After completing the Transfer-on-Death Deed, it must be recorded with the county recorder of deeds. Not doing so may prevent the transfer from being recognized.

-

Not specifying the beneficiaries clearly. It is important to clearly identify the beneficiaries who will receive the property upon the owner’s death. Ambiguities can lead to disputes.

-

Ignoring tax implications. Some individuals may not consider the potential tax consequences of transferring property upon death. Consulting a tax professional can provide clarity.

-

Neglecting to review the deed regularly. Life circumstances change, and it’s crucial to update the deed if necessary. Failing to do so can result in unintended consequences.

PDF Features

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Pennsylvania to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by 20 Pa.C.S. § 6114. |

| Eligibility | Any individual who owns real estate in Pennsylvania can create a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can name one or more beneficiaries in the deed. |

| Revocability | The deed can be revoked or changed by the owner at any time before their death. |

| Filing Requirement | The deed must be recorded in the county where the property is located to be valid. |

| Effect on Taxes | Transfer-on-Death Deeds do not affect property taxes during the owner's lifetime. |

| Impact on Creditors | Creditors may still claim against the estate for debts after the owner's death. |

| Form Availability | The Pennsylvania Department of Revenue provides a standard form for the Transfer-on-Death Deed. |

| Legal Assistance | While not required, consulting with an attorney is recommended to ensure the deed meets all legal requirements. |

Dos and Don'ts

When filling out the Pennsylvania Transfer-on-Death Deed form, it’s essential to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things to do and avoid:

- Do clearly identify the property being transferred. Include the full legal description to avoid any confusion.

- Do provide accurate information about yourself as the grantor. Ensure your name is spelled correctly and matches official documents.

- Do include the names and details of beneficiaries. Make sure they are aware and consent to the arrangement.

- Do sign the form in the presence of a notary public. This step is crucial for the validity of the deed.

- Don't forget to check state requirements. Ensure you comply with any specific regulations in Pennsylvania.

- Don't leave blank spaces on the form. Fill in all required fields to prevent delays or rejections.

- Don't overlook the need for witnesses. Depending on the situation, having witnesses may be necessary.

- Don't submit the form without reviewing it thoroughly. Errors can lead to complications in the transfer process.

Similar forms

The Pennsylvania Transfer-on-Death Deed (TODD) is similar to a will, as both documents facilitate the transfer of property upon the death of the owner. A will outlines how a person's assets should be distributed after their passing. However, a TODD allows for the direct transfer of real estate to a designated beneficiary without going through probate, making it a more streamlined option for property transfer. While both documents serve to convey intentions regarding property, the TODD takes effect immediately upon execution, whereas a will only becomes effective after the owner's death.

Understanding the different legal documents related to property transfer, such as the General Power of Attorney, is crucial for effective estate planning. The California General Power of Attorney form allows a principal to appoint an agent to handle financial affairs, making it essential when direct management is not possible. For more comprehensive insights on legal documentation in California, you can refer to All California Forms, which provide numerous resources and forms related to managing your estate and ensuring your legal wishes are fulfilled.

Check out Popular Transfer-on-Death Deed Forms for Different States

Where Can I Get a Tod Form - A Transfer-on-Death Deed must be recorded with the appropriate local government office to be valid.

Transfer on Death Deed Washington Form - The Transfer-on-Death Deed is particularly useful for single individuals or those without a traditional estate plan.

Free Printable Transfer on Death Deed Form Florida - After the property owner passes away, the beneficiaries typically need to provide a death certificate to claim the property.

When engaging in the sale of a vessel in Florida, utilizing a Boat Bill of Sale is essential to validate the transaction and protect the interests of both parties involved. This document officially records the transfer of ownership, stipulates critical details such as the sale price and boat specifications, and is a necessary formal requirement. To streamline this process, you can refer to All Florida Forms which provide useful resources and templates for your needs.

Virginia Tod Deed - Ensuring that beneficiaries are aware of the deed can help expedite the inheritance process post-mortem.