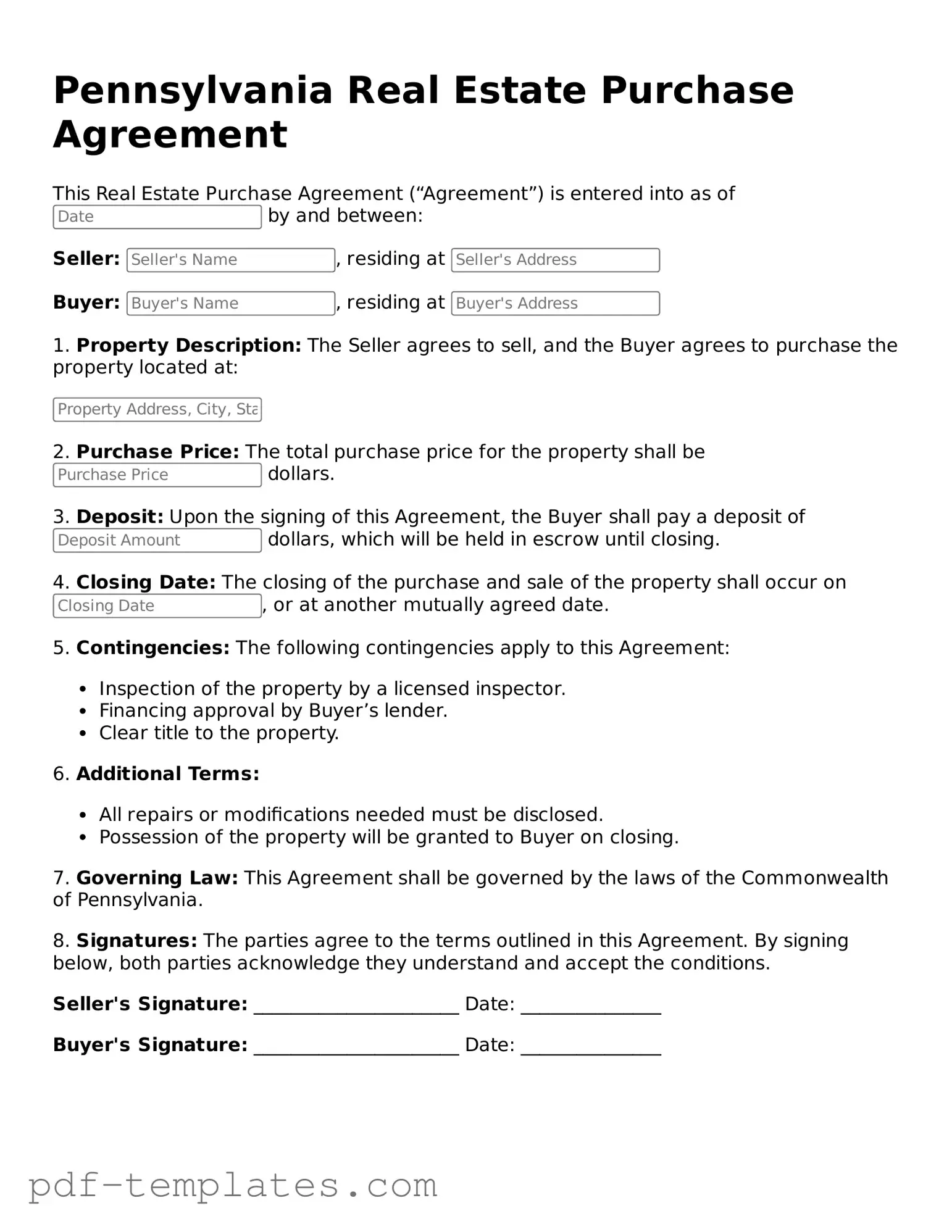

Official Real Estate Purchase Agreement Template for Pennsylvania State

The Pennsylvania Real Estate Purchase Agreement is a crucial document in the home buying process, serving as a formal contract between the buyer and seller. This agreement outlines the essential terms of the transaction, including the purchase price, financing details, and contingencies that protect both parties. It specifies the property being sold, ensuring clarity about what is included in the sale, such as fixtures and appliances. Additionally, the form addresses important timelines, such as the closing date and any deadlines for inspections or repairs. By incorporating contingencies, such as home inspections or financing approvals, the agreement provides a safety net for buyers, allowing them to back out under certain conditions. The document also includes provisions for earnest money deposits, which demonstrate the buyer's commitment to the purchase. Understanding the intricacies of this agreement is vital for both buyers and sellers, as it lays the foundation for a successful real estate transaction in Pennsylvania.

Misconceptions

When it comes to the Pennsylvania Real Estate Purchase Agreement, several misconceptions often arise. Understanding the facts can help buyers and sellers navigate the process more smoothly. Here are nine common misconceptions:

- It’s just a standard form. Many believe the agreement is a one-size-fits-all document. In reality, it should be tailored to reflect the specific terms of the transaction.

- Only real estate agents can fill it out. While agents are familiar with the form, buyers and sellers can also complete it, provided they understand the terms and conditions.

- Once signed, it cannot be changed. Parties can negotiate changes even after signing, but both must agree to any modifications.

- The agreement guarantees a sale. Signing the agreement does not guarantee the sale will go through. Contingencies can lead to cancellations.

- It only covers the price of the property. The agreement includes many details beyond price, such as closing costs, contingencies, and timelines.

- It’s unnecessary if you have an agent. Even with an agent, a buyer or seller should understand the agreement fully. It’s crucial to know what you’re signing.

- All agreements are the same across states. Each state has its own regulations and forms. The Pennsylvania agreement has specific legal requirements that differ from those in other states.

- It’s only a formality. The agreement is a legally binding contract. Ignoring its importance can lead to serious legal consequences.

- Verbal agreements are enough. In real estate transactions, verbal agreements are not legally binding. Written agreements provide clarity and protection for all parties involved.

Understanding these misconceptions can empower individuals in their real estate transactions. Being informed leads to better decision-making and smoother processes.

Pennsylvania Real Estate Purchase Agreement: Usage Instruction

Once you have the Pennsylvania Real Estate Purchase Agreement form in front of you, it’s time to get started on filling it out. This form is essential for formalizing the terms of a real estate transaction between a buyer and a seller. By following these steps, you can ensure that all necessary information is accurately provided.

- Begin by entering the date at the top of the form. This marks when the agreement is being made.

- Next, fill in the names of the buyer(s) and seller(s). Make sure to include full legal names as they appear on identification documents.

- Provide the property address. Include the street address, city, state, and zip code to ensure clarity.

- In the section for purchase price, write the agreed amount that the buyer will pay for the property.

- Specify the deposit amount. This is typically a percentage of the purchase price and shows the buyer's commitment.

- Fill in the financing details. Indicate whether the buyer will be using a mortgage, cash, or other means to finance the purchase.

- Complete the closing date section. This is when the ownership will officially transfer from the seller to the buyer.

- Include any contingencies. These are conditions that must be met for the sale to proceed, such as inspections or financing approval.

- Sign and date the agreement at the bottom. Both the buyer and seller must do this for the agreement to be valid.

After completing the form, it’s wise to review it for accuracy. Any mistakes can lead to misunderstandings or delays in the transaction. Once everything looks good, you can proceed with the next steps in your real estate process.

Common mistakes

-

Incomplete Information: One common mistake is not filling out all required sections of the form. Essential details such as the buyer's and seller's names, property address, and purchase price must be clearly stated. Omitting any of this information can lead to confusion or delays in the transaction.

-

Incorrect Property Description: Accurately describing the property is crucial. This includes not only the address but also the legal description. Errors in this section can create issues with title transfer and ownership rights.

-

Failure to Understand Contingencies: Many buyers and sellers do not fully grasp the contingencies included in the agreement. These are conditions that must be met for the sale to proceed. Misunderstanding these can result in unexpected complications or even the collapse of the deal.

-

Ignoring Deadlines: Real estate transactions often involve strict timelines. Missing deadlines for inspections, financing, or closing can jeopardize the agreement. It is important to keep track of these dates and ensure all parties are aware.

-

Not Seeking Professional Help: Some individuals try to fill out the form without consulting a real estate agent or attorney. This can lead to mistakes that might have been easily avoided with professional guidance. Engaging a knowledgeable expert can provide clarity and support throughout the process.

-

Overlooking Signatures: Finally, forgetting to sign the agreement is a frequent oversight. Both the buyer and seller must sign the document for it to be legally binding. Double-checking for signatures can prevent unnecessary delays.

PDF Features

| Fact Name | Description |

|---|---|

| Purpose | The Pennsylvania Real Estate Purchase Agreement form is used to outline the terms of a real estate transaction between a buyer and a seller. |

| Governing Laws | This agreement is governed by the laws of the Commonwealth of Pennsylvania, including the Pennsylvania Uniform Commercial Code. |

| Essential Elements | Key components include the purchase price, property description, closing date, and any contingencies that may apply. |

| Signature Requirement | Both parties must sign the agreement for it to be legally binding, ensuring mutual consent to the terms outlined. |

| Contingencies | Buyers can include contingencies for inspections, financing, and other conditions that must be met before finalizing the sale. |

Dos and Don'ts

When filling out the Pennsylvania Real Estate Purchase Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of actions to take and avoid during this process.

- Do read the entire form carefully before beginning to fill it out.

- Do provide accurate and complete information for all parties involved in the transaction.

- Do consult with a real estate agent or attorney if you have questions about any section of the form.

- Do sign and date the agreement in the appropriate places.

- Don't leave any sections blank; if a section does not apply, indicate that it is not applicable.

- Don't use white-out or other correction methods on the form; instead, cross out mistakes and initial them.

Similar forms

The Pennsylvania Real Estate Purchase Agreement is similar to the Residential Purchase Agreement used in many states. Both documents outline the terms of a home sale, including the purchase price, contingencies, and the closing date. They serve as a binding contract between the buyer and seller, ensuring that both parties understand their rights and obligations. The Residential Purchase Agreement typically includes sections for earnest money deposits and disclosures, much like its Pennsylvania counterpart, making it a crucial document in the home-buying process.

The California General Power of Attorney form is essential for individuals who need to delegate financial decision-making powers to an agent, particularly when they cannot manage their affairs personally. Understanding the implications of this document is crucial, especially when considering different legal agreements related to property, like the formcalifornia.com/ which provides clear guidelines on power of attorney usage in California.

Another document that shares similarities is the Commercial Real Estate Purchase Agreement. While the Pennsylvania Real Estate Purchase Agreement focuses primarily on residential properties, the Commercial version addresses the complexities of business transactions. Both agreements detail the purchase price and terms, but the Commercial Agreement often includes additional clauses related to zoning laws and business operations. This makes it essential for buyers and sellers in the commercial sector to understand the specific terms applicable to their transaction.

The Lease Purchase Agreement also bears resemblance to the Pennsylvania Real Estate Purchase Agreement. This document allows a buyer to lease a property with the option to purchase it later. Like the purchase agreement, it outlines the purchase price and terms but adds a layer of flexibility for buyers who may not be ready to commit immediately. Both agreements protect the interests of the parties involved, ensuring clarity in financial obligations and timelines.

The Option to Purchase Agreement is another similar document. This agreement gives a potential buyer the right, but not the obligation, to purchase a property within a specified timeframe. It shares key elements with the Pennsylvania Real Estate Purchase Agreement, such as purchase price and duration. However, the Option to Purchase Agreement is more about securing a potential future purchase, allowing buyers to evaluate the property before making a full commitment.

Finally, the Seller's Disclosure Statement can be viewed as complementary to the Pennsylvania Real Estate Purchase Agreement. While the purchase agreement outlines the terms of the sale, the Seller's Disclosure Statement provides critical information about the property's condition. It includes details about any known defects or issues, ensuring that buyers are fully informed before making a purchase. This transparency helps to build trust between the buyer and seller, fostering a smoother transaction process.

Check out Popular Real Estate Purchase Agreement Forms for Different States

Realestate Purchase Agreement - Facilitates communication between the buyer and seller throughout the process.

In Florida, the Boat Bill of Sale form is an essential requirement for buyers and sellers engaging in the purchase or sale of a vessel. This document serves to officially document the transaction, ensuring that important details, including the boat's specifications and the agreed-upon sale price, are clearly outlined. To understand more about the specifics of the form and its significance in the sales process, you can refer to All Florida Forms.

Trec License - The agreement may need to comply with state-specific real estate laws and guidelines.