Official Quitclaim Deed Template for Pennsylvania State

When it comes to transferring property in Pennsylvania, understanding the Quitclaim Deed form is essential for both buyers and sellers. This legal document serves as a straightforward way to convey ownership rights from one party to another, without the guarantee of a clear title. Unlike other types of deeds, a Quitclaim Deed does not provide any warranties or assurances regarding the property’s condition or any existing liens. This means that the grantee, or the person receiving the property, takes on the risk associated with any potential issues. It is often used in situations like transferring property between family members, settling estate matters, or clearing up title discrepancies. While the process may seem simple, it is crucial to ensure that the form is filled out correctly and filed with the appropriate county office to avoid future disputes. Understanding the implications of using a Quitclaim Deed can save you time, money, and stress down the road.

Misconceptions

Understanding the Pennsylvania Quitclaim Deed can be challenging due to various misconceptions. Here are eight common misunderstandings that can help clarify its purpose and use.

- A quitclaim deed transfers ownership of property. Many believe that a quitclaim deed guarantees ownership transfer. In reality, it only conveys whatever interest the grantor has, which may not be full ownership.

- Quitclaim deeds are only for family members. While they are often used among family members, quitclaim deeds can be utilized in any situation where property interests are being transferred, regardless of the relationship.

- Quitclaim deeds are less formal than other deeds. Some think that quitclaim deeds are informal. However, they still require proper execution and recording to be legally effective.

- Using a quitclaim deed means there are no title issues. This is a common misconception. A quitclaim deed does not guarantee a clear title; it simply transfers the interest held by the grantor.

- All states have the same rules for quitclaim deeds. Each state has its own laws and regulations governing quitclaim deeds. In Pennsylvania, specific requirements must be met for the deed to be valid.

- A quitclaim deed is the best option for selling property. Many assume quitclaim deeds are ideal for sales. However, they may not provide the buyer with sufficient protection, as they do not warrant the title.

- Once a quitclaim deed is signed, it cannot be revoked. This is incorrect. While a quitclaim deed is generally irrevocable once recorded, the grantor may still have options to address the transfer through legal channels.

- Quitclaim deeds are only for real estate. Although primarily used for real estate, quitclaim deeds can also be used to transfer other types of property interests, such as vehicles or personal property.

By understanding these misconceptions, individuals can make more informed decisions when considering the use of a quitclaim deed in Pennsylvania.

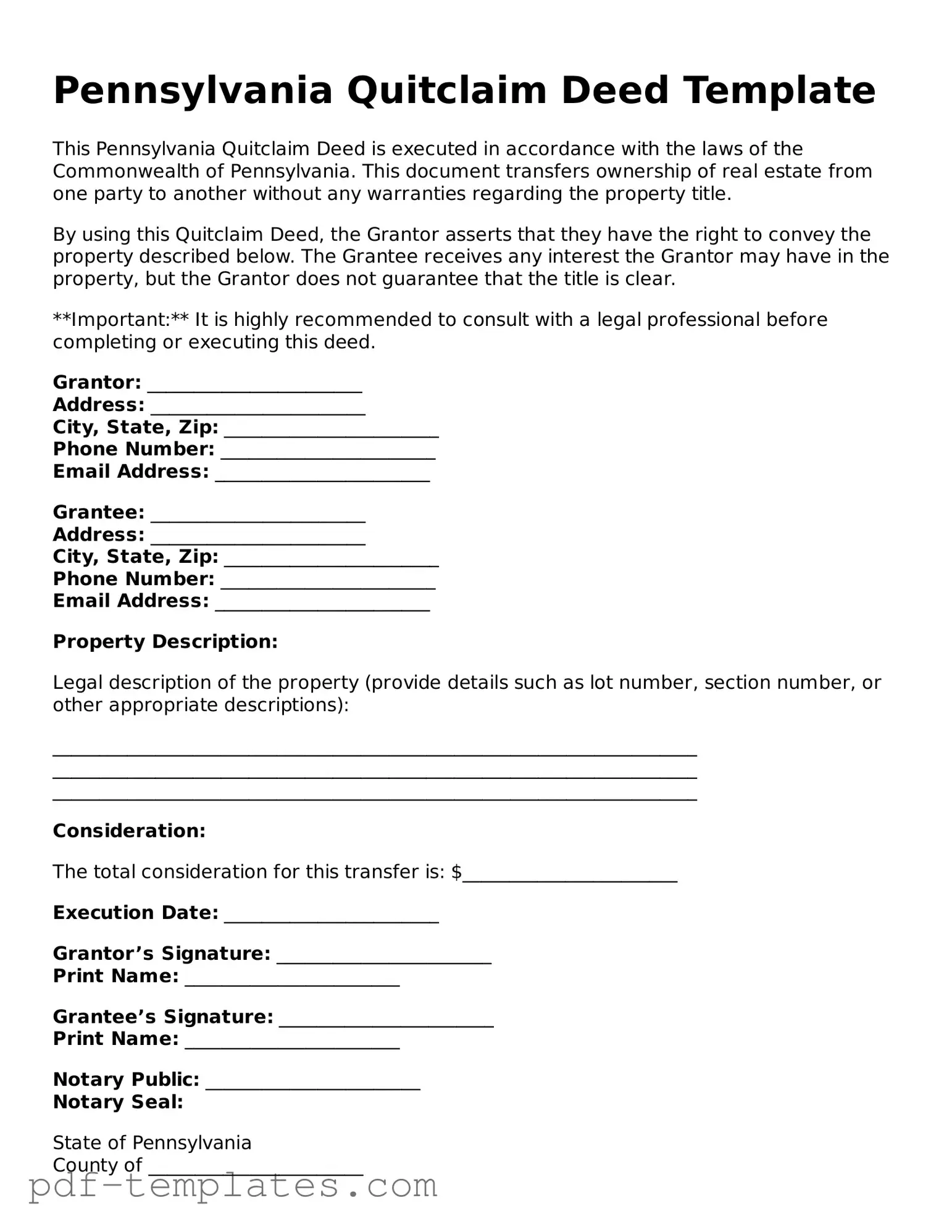

Pennsylvania Quitclaim Deed: Usage Instruction

After obtaining the Pennsylvania Quitclaim Deed form, the next step involves filling it out accurately to ensure proper transfer of property ownership. This document requires specific information about the parties involved and the property being transferred. Following the steps below will guide you through the process of completing the form correctly.

- Identify the Grantor: In the first section, write the full name of the person or entity transferring the property. Include their address as well.

- Identify the Grantee: Next, provide the full name of the person or entity receiving the property. Their address should also be included.

- Describe the Property: In this section, include a detailed description of the property. This should consist of the property’s address and any relevant legal descriptions, such as parcel numbers or lot numbers.

- State Consideration: Indicate the amount of money or value exchanged for the property. If the transfer is a gift, you may write “for love and affection” or a similar phrase.

- Signatures: The grantor must sign the form in the designated area. If there are multiple grantors, each must sign.

- Notarization: After signing, the form must be notarized. The notary will verify the identities of the signers and add their official seal.

- Submit the Form: Finally, take the completed and notarized Quitclaim Deed to the appropriate county office for recording. Be prepared to pay any associated fees.

Common mistakes

-

Incorrect Names: One common mistake is failing to use the full legal names of all parties involved. It’s crucial that names match exactly as they appear on legal documents to avoid future disputes.

-

Missing Signatures: All parties must sign the deed. Forgetting to obtain a signature from one of the owners can render the deed invalid.

-

Improper Notarization: A quitclaim deed must be notarized to be legally binding. Neglecting this step can lead to complications in the transfer process.

-

Incorrect Property Description: The property must be described accurately. Omitting details or providing vague descriptions can cause confusion and legal issues later.

-

Failure to Include Consideration: Even if the transfer is a gift, the deed should state the consideration, which is the value exchanged. Not mentioning this can create ambiguity.

-

Not Recording the Deed: After completing the deed, it must be filed with the appropriate county office. Failing to record it can lead to problems with ownership claims in the future.

-

Using Outdated Forms: Legal forms can change over time. Using an outdated version of the quitclaim deed can lead to errors and complications.

-

Ignoring Local Laws: Each county may have specific requirements for quitclaim deeds. Not adhering to these local laws can result in the deed being rejected.

-

Not Seeking Legal Advice: Many people attempt to fill out the form without understanding its implications. Consulting a legal professional can help avoid costly mistakes.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear. |

| Use | Commonly used among family members or in situations where the parties know each other. |

| Governing Law | Regulated under Pennsylvania Title 21, Chapter 35 of the Pennsylvania Consolidated Statutes. |

| Requirements | The form must be signed by the grantor and notarized to be valid. |

| Recording | To protect the new owner's rights, the deed should be recorded at the county's Recorder of Deeds office. |

| Limitations | Does not provide any warranty or guarantee regarding the property title. |

Dos and Don'ts

When filling out the Pennsylvania Quitclaim Deed form, it's important to follow certain guidelines to ensure the document is completed correctly. Here are seven things to keep in mind:

- Do provide accurate property descriptions. Include the exact address and legal description of the property.

- Don't leave any fields blank. Every section must be filled out to avoid delays.

- Do have the document signed in the presence of a notary public. This step is crucial for validation.

- Don't forget to check for any local requirements. Some counties may have additional rules.

- Do use clear and legible handwriting or type the information. Clarity prevents misunderstandings.

- Don't use abbreviations or shorthand. Always write out words fully to avoid confusion.

- Do keep a copy of the completed form for your records. This will be useful for future reference.

By following these guidelines, you can ensure that your Quitclaim Deed is properly executed and recognized in Pennsylvania.

Similar forms

The Warranty Deed is a document that guarantees the grantor holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, a warranty deed provides assurances to the buyer that they will not face claims against the property. This added layer of protection makes warranty deeds more common in real estate transactions, especially when a buyer seeks to ensure their investment is secure.

The Bargain and Sale Deed transfers property ownership without any warranties against encumbrances. Similar to a quitclaim deed, it conveys the grantor's interest in the property but does not guarantee clear title. This type of deed is often used in situations where the seller does not want to assume liability for any potential claims against the property.

The Special Warranty Deed is another variation that provides limited warranties. It guarantees that the grantor has not encumbered the property during their ownership but does not cover any issues that existed before. This document is often used in commercial real estate transactions, where the buyer may accept some risk in exchange for a lower purchase price.

The Deed of Trust is a document used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. While it serves a different purpose than a quitclaim deed, it also involves the transfer of property rights. The borrower conveys an interest in the property to the trustee as collateral for the loan, similar to how a quitclaim deed transfers interest but with specific conditions attached.

The Grant Deed is similar to a quitclaim deed in that it transfers property ownership. However, it includes certain guarantees, such as the assurance that the property has not been sold to anyone else. This makes it a more secure option for buyers compared to a quitclaim deed, which offers no guarantees about the title.

When navigating the complexities of property transactions, having the right documentation is crucial for clarity and protection. For those involved in agreements related to rental properties, understanding forms like the California Agreement Room form can provide essential guidelines. This form covers vital aspects such as rights and responsibilities for both parties. For more detailed information and resources, you may refer to All California Forms to ensure compliance and protection in your agreements.

The Life Estate Deed allows a property owner to transfer ownership while retaining the right to live in the property for the rest of their life. This document shares similarities with a quitclaim deed in that it transfers an interest in the property. However, it creates a life estate, which is a unique form of ownership that allows the original owner to retain certain rights even after the transfer.

The Transfer on Death Deed (TOD) allows property owners to designate a beneficiary to receive their property upon death. This deed is similar to a quitclaim deed in that it transfers property rights, but it does so only upon the owner's passing. The TOD deed avoids probate, providing a streamlined way for property to pass directly to the designated beneficiary.

The Affidavit of Heirship is used to establish the heirs of a deceased person. While it does not transfer property like a quitclaim deed, it is often used in conjunction with deeds to clarify ownership after someone passes away. This document can help resolve disputes over property rights and ensure that heirs receive their rightful share.

The Partition Deed is used when co-owners of a property decide to divide their interests. Similar to a quitclaim deed, it conveys ownership rights. However, it is specifically designed to formalize the separation of interests among co-owners, often resulting in the creation of distinct parcels of land for each owner.

Check out Popular Quitclaim Deed Forms for Different States

How to File a Quitclaim Deed in Texas - A Quitclaim Deed is commonly used in real estate transactions.

Florida Quit Claim Deed Rules - Quitclaim deeds may be recorded with the county clerk’s office to make the transfer part of the public record.

The Asurion F-017-08 MEN form is a crucial document used for processing specific insurance claims related to electronic devices. This form serves as a formal request for assistance, ensuring that customers receive the support they need for their devices in a timely manner. To get started, fill out the form by clicking the button below or visit https://pdftemplates.info/asurion-f-017-08-men-form/ for more information.

Free Quitclaim Deed Form California - It can facilitate the transfer of property after a death without lengthy probate processes.