Official Promissory Note Template for Pennsylvania State

In Pennsylvania, a Promissory Note serves as a crucial financial instrument that outlines the terms of a loan agreement between a borrower and a lender. This legally binding document specifies the amount of money borrowed, the interest rate applicable, and the repayment schedule. It is essential for both parties to clearly understand their obligations and rights as outlined in the note. The form typically includes important details such as the names and addresses of the parties involved, the date of the agreement, and any collateral that may secure the loan. Additionally, it may address consequences for defaulting on payments, including late fees or legal actions that could be taken by the lender. By using a Promissory Note, individuals and businesses can establish a clear record of their financial transactions, which can be beneficial for future reference or legal purposes. Understanding the components and implications of this form can empower borrowers and lenders alike, ensuring that both parties are on the same page regarding their financial commitments.

Misconceptions

Understanding the Pennsylvania Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are eight common misconceptions explained.

- 1. A Promissory Note Must Be Notarized. Many believe that notarization is required for a promissory note to be valid. In Pennsylvania, notarization is not mandatory, but it can add an extra layer of security.

- 2. All Promissory Notes Are the Same. Not all promissory notes are identical. They can vary based on terms, interest rates, and repayment schedules. Tailoring the note to fit specific needs is important.

- 3. A Verbal Agreement Is Enough. Some think a verbal agreement suffices. However, written documentation is crucial for clarity and legal protection. A written note helps avoid misunderstandings.

- 4. Only Banks Can Issue Promissory Notes. This is untrue. Individuals and businesses can create promissory notes. Anyone lending money can draft one, provided it meets legal requirements.

- 5. Interest Rates Must Be Fixed. Many assume that interest rates must be fixed. In fact, they can be fixed or variable, depending on what the parties agree upon in the note.

- 6. A Promissory Note Is the Same as a Loan Agreement. While related, they are not the same. A promissory note is a promise to repay, while a loan agreement outlines the terms of the loan in detail.

- 7. A Promissory Note Is Non-Transferable. This is incorrect. Promissory notes can often be sold or transferred to another party, unless otherwise stated in the document.

- 8. Defaulting on a Promissory Note Has No Consequences. This misconception can lead to serious issues. Defaulting can result in legal action, damage to credit scores, and potential loss of collateral if applicable.

Clearing up these misconceptions can help both lenders and borrowers navigate their financial agreements with confidence.

Pennsylvania Promissory Note: Usage Instruction

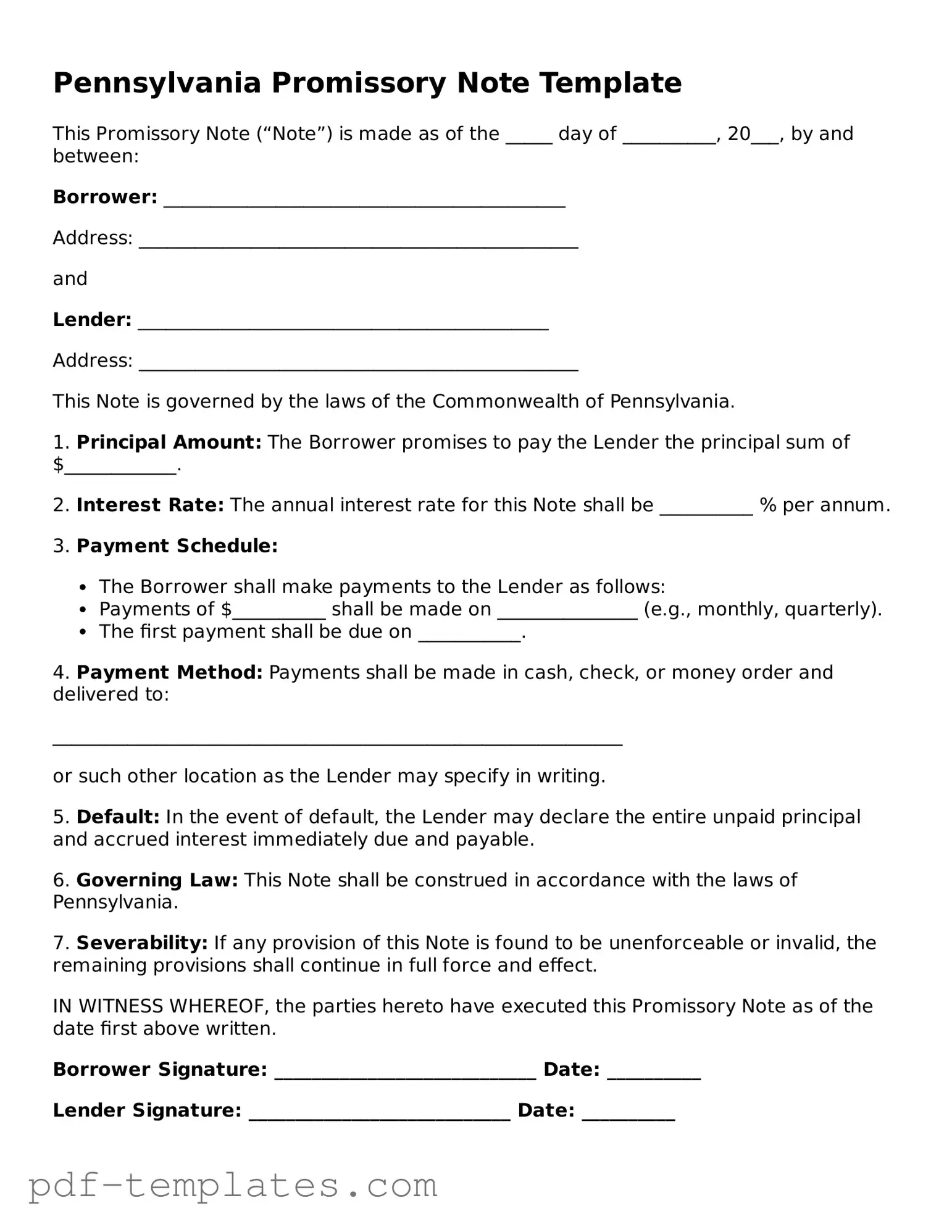

Once you have the Pennsylvania Promissory Note form ready, you will need to fill it out accurately to ensure it is legally binding. Take your time to provide the correct information in each section. Following these steps will help you complete the form properly.

- Begin by entering the date at the top of the form. Use the format month, day, year.

- In the first section, write the name and address of the borrower. This is the person or entity who will be repaying the loan.

- Next, provide the name and address of the lender. This is the individual or organization giving the loan.

- Specify the principal amount of the loan. This is the total sum of money being borrowed.

- Indicate the interest rate, if applicable. This should be expressed as a percentage.

- Fill in the repayment terms. Include details such as the frequency of payments (monthly, quarterly, etc.) and the duration of the loan.

- State any late fees or penalties for missed payments. Be clear about how these will be calculated.

- Sign and date the form. The borrower should sign, and if necessary, the lender should also sign.

- If there are any witnesses or notary requirements, ensure those are completed as well.

After filling out the form, keep a copy for your records. The signed original should be provided to the lender. Ensure that both parties understand the terms outlined in the note before proceeding with the loan agreement.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all required details. Ensure that the names, addresses, and dates are fully filled out. Missing information can lead to confusion or disputes later.

-

Incorrect Amount: Double-check the loan amount. Errors in the numerical figure or written amount can create significant issues. Both should match to avoid misunderstandings.

-

Improper Signatures: All parties involved must sign the document. Forgetting to obtain a signature from one party can render the note unenforceable. Make sure everyone involved has signed before finalizing the document.

-

Neglecting Terms: Clearly define the repayment terms, including interest rates and due dates. Vague or missing terms can lead to disputes about payment expectations. Take the time to outline all conditions thoroughly.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or bearer at a defined time. |

| Governing Law | The Pennsylvania Uniform Commercial Code (UCC) governs promissory notes, specifically under Title 13, Chapter 3103. |

| Parties Involved | The note involves two main parties: the maker (the person promising to pay) and the payee (the person receiving the payment). |

| Essential Elements | A valid promissory note must include the amount, the interest rate (if any), the payment date, and the signatures of the maker. |

| Interest Rates | Interest can be specified in the note. If not specified, the legal rate in Pennsylvania applies, which is typically set at 6% per annum. |

| Transferability | Promissory notes in Pennsylvania are generally transferable. The holder can endorse the note to another party, making it negotiable. |

| Default Consequences | If the maker defaults, the payee can take legal action to enforce the note and recover the owed amount, including interest and costs. |

| Statute of Limitations | The statute of limitations for enforcing a promissory note in Pennsylvania is four years from the date of default. |

| Form Requirements | While no specific form is mandated, the note should be clear, legible, and executed properly to ensure enforceability. |

Dos and Don'ts

When filling out the Pennsylvania Promissory Note form, it's essential to approach the task with care. Here’s a helpful list of things to do and avoid:

- Do clearly state the amount of money being borrowed.

- Do include the names and addresses of both the borrower and lender.

- Do specify the interest rate, if applicable, and the repayment terms.

- Do ensure that all parties sign and date the document.

- Do keep a copy of the signed note for your records.

- Don't leave any sections blank; fill in all required information.

- Don't use vague language; be specific about terms and conditions.

- Don't forget to check for spelling and grammatical errors.

- Don't sign the note without understanding all its terms.

- Don't rely solely on verbal agreements; everything should be in writing.

Similar forms

A Loan Agreement is a formal document that outlines the terms and conditions under which a borrower agrees to repay a loan. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement often includes additional details, such as collateral requirements and the rights of both parties in case of default. This makes it more comprehensive than a standard promissory note, which primarily focuses on the promise to repay the borrowed amount.

A Mortgage is another document that shares similarities with a promissory note. It serves as a security interest in real property, ensuring that the lender has a claim to the property if the borrower fails to repay the loan. While a promissory note signifies the borrower's promise to pay, a mortgage formalizes the lender's rights to take possession of the property under specific conditions. Both documents work together to protect the interests of the lender and outline the obligations of the borrower.

An IOU, or "I Owe You," is an informal acknowledgment of a debt. While it lacks the legal enforceability of a promissory note, it serves a similar purpose by documenting that one party owes money to another. An IOU typically includes the amount owed and may specify repayment terms, but it does not always carry the same level of detail or legal protection. Both documents signify a debt but differ in their formality and potential consequences.

A Personal Guarantee is a document that provides assurance from an individual that they will fulfill a debt obligation if the primary borrower defaults. Similar to a promissory note, it establishes a financial commitment. However, a personal guarantee often applies to business loans and requires the guarantor to use personal assets to cover the debt. This adds a layer of risk for the individual, as they may be held liable for the borrower’s obligations.

For those looking to secure a rental property, completing the necessary essential Rental Application form can streamline the process. This document ensures that landlords receive vital information regarding potential tenants, aiding in the decision-making process for suitable candidates.

A Secured Promissory Note is a variation of a standard promissory note that is backed by collateral. This means that if the borrower defaults, the lender has the right to seize the collateral to recover the owed amount. Like a traditional promissory note, it outlines the repayment terms and interest rate but adds the element of security for the lender. This document provides greater assurance for the lender compared to an unsecured promissory note.

An Unsecured Promissory Note is similar to a standard promissory note but does not involve any collateral. The borrower promises to repay the loan based solely on their creditworthiness. While both documents outline the amount owed and repayment terms, the absence of collateral in an unsecured promissory note increases the risk for the lender. This type of note often has higher interest rates to compensate for the lack of security.

A Business Loan Agreement is a document specifically designed for loans taken out by businesses. It shares similarities with a promissory note in that it outlines the terms of repayment and the interest rate. However, a business loan agreement typically includes additional clauses related to the operation of the business, such as financial covenants and reporting requirements. This makes it more complex and tailored to the needs of business borrowers.

A Lease Agreement, while primarily used for renting property, can resemble a promissory note in terms of establishing a payment obligation. It outlines the terms under which a tenant agrees to pay rent to a landlord. Similar to a promissory note, it specifies the amount due and the timing of payments. However, a lease agreement also includes rights and responsibilities related to the property, making it broader in scope than a simple promissory note.

An Assignment of Debt is a document that allows a lender to transfer the rights to collect a debt to another party. This document shares similarities with a promissory note, as it involves the same underlying obligation to repay a loan. However, an assignment of debt is focused on the transfer of rights rather than the terms of repayment. It ensures that the new lender can enforce the original terms of the promissory note, maintaining continuity in the debt obligation.

Check out Popular Promissory Note Forms for Different States

New York Promissory Note - In the event of non-payment, a Promissory Note serves as evidence in court if needed.

Virginia Promissory Note - Loan amounts can vary, and they should be clearly stated in the note.

Promissory Note Washington State - This document outlines the terms of a loan, including the amount borrowed and the repayment schedule.

Understanding the intricacies of the California Agreement Room form is crucial for both property providers and tenants, as it ensures clear communication and avoids potential disputes. For those seeking more comprehensive information, resources such as All California Forms can offer additional guidance and templates that assist in navigating the rental process effectively.

Simple Promissory Note Template California - A promissory note is a written promise to pay a specified amount of money to a designated person at a determined time.