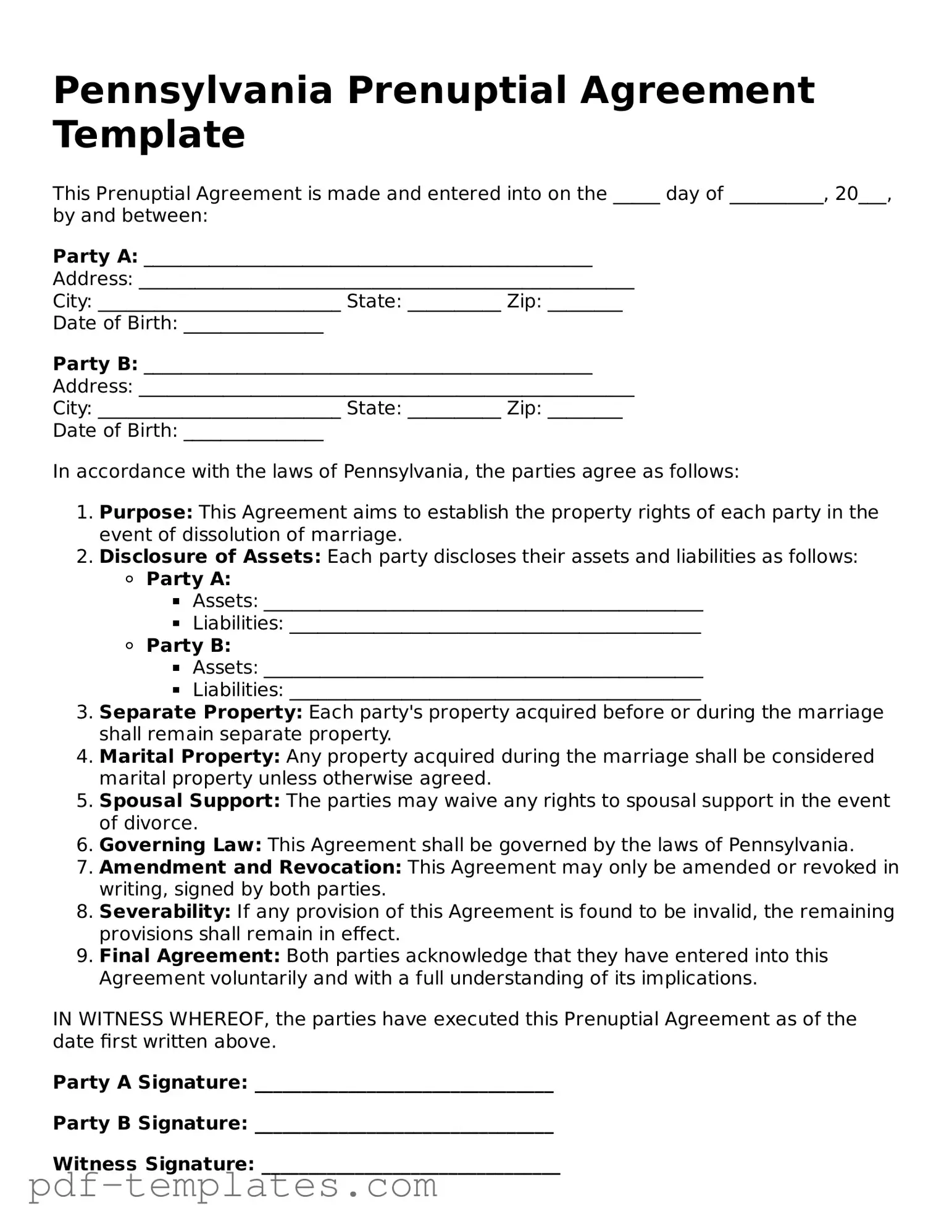

Official Prenuptial Agreement Template for Pennsylvania State

In Pennsylvania, couples considering marriage often explore the benefits of a prenuptial agreement, a legal document that outlines the distribution of assets and financial responsibilities should the marriage end. This agreement can provide clarity and security for both parties, especially when significant assets, debts, or children from previous relationships are involved. The Pennsylvania Prenuptial Agreement form typically includes essential details such as the full names of both parties, a comprehensive list of assets and debts, and any provisions regarding spousal support. Additionally, it may address how property will be divided in the event of divorce or death, ensuring that both individuals understand their rights and obligations. By taking the time to create this document, couples can foster open communication and set a foundation for a more transparent financial partnership. Understanding the key elements of the form is crucial, as it helps in crafting a fair and enforceable agreement that reflects the couple’s intentions and protects their interests.

Misconceptions

Understanding prenuptial agreements is essential for anyone considering marriage, especially in Pennsylvania. Unfortunately, several misconceptions can cloud judgment and lead to poor decision-making. Here are six common misconceptions about the Pennsylvania Prenuptial Agreement form.

- Prenuptial agreements are only for the wealthy. Many believe that only individuals with significant assets need a prenuptial agreement. In reality, these agreements can benefit anyone who wants to clarify financial responsibilities and protect personal property, regardless of income level.

- Signing a prenuptial agreement means you expect the marriage to fail. This belief can discourage couples from discussing prenuptial agreements. In fact, a prenup can foster open communication about finances and expectations, strengthening the relationship rather than signaling doubt.

- Prenuptial agreements are not legally enforceable. Some people mistakenly think that these agreements hold no legal weight. In Pennsylvania, prenuptial agreements are enforceable as long as they meet specific legal requirements, such as being in writing and signed by both parties.

- All prenuptial agreements are the same. Each prenuptial agreement can be tailored to fit the unique circumstances of the couple. It is crucial to address specific concerns and needs, which can vary widely from one couple to another.

- Once signed, a prenuptial agreement cannot be changed. This is a common misconception. Couples can modify their prenuptial agreements at any time, provided both parties agree to the changes and document them properly.

- Prenuptial agreements only cover financial matters. While finances are a primary focus, these agreements can also address other issues, such as property division and spousal support. Couples can use prenuptial agreements to outline various aspects of their relationship, promoting clarity and understanding.

Addressing these misconceptions is vital for couples considering a prenuptial agreement. By doing so, they can make informed decisions that protect their interests and foster a healthy partnership.

Pennsylvania Prenuptial Agreement: Usage Instruction

Filling out the Pennsylvania Prenuptial Agreement form is an important step for couples planning to marry. This process involves gathering information about your assets, debts, and any other relevant details that will help create a fair agreement. Follow these steps to complete the form accurately.

- Start with your personal information. Write down your full name and the full name of your partner.

- Provide your addresses. Include both your current address and your partner's current address.

- List your assets. Make a detailed inventory of all properties, bank accounts, investments, and other valuables you own.

- Document your debts. Include any loans, credit card balances, or other financial obligations that you or your partner have.

- Discuss and outline any financial arrangements. This could include how you will handle income, expenses, and any shared assets during the marriage.

- Consider future financial expectations. If you have plans for children or other significant life changes, note how these might affect your financial situation.

- Review the completed form together. Ensure both parties agree on all terms and details.

- Sign and date the form. Both you and your partner need to sign it in front of a notary public.

Once the form is filled out and signed, it’s advisable to keep copies for both partners. Having a clear understanding of each other's financial situation can help strengthen your relationship as you move forward together.

Common mistakes

-

Failure to Fully Disclose Assets: One common mistake is not providing a complete and accurate list of assets. Each party should disclose all financial information, including bank accounts, real estate, investments, and debts. Omitting information can lead to disputes later.

-

Not Seeking Legal Advice: Many individuals attempt to fill out the form without consulting an attorney. This can result in misunderstandings about legal rights and responsibilities. Legal guidance can help ensure that the agreement is enforceable and meets both parties' needs.

-

Ignoring State Laws: Each state has specific requirements regarding prenuptial agreements. Failing to adhere to Pennsylvania’s regulations can render the agreement invalid. It’s essential to understand the legal framework governing these documents.

-

Using Vague Language: Ambiguity in the language of the agreement can lead to confusion and disputes. Clear and precise terms are necessary to ensure both parties understand their rights and obligations. Avoiding vague terms can prevent potential conflicts in the future.

-

Not Updating the Agreement: Life circumstances change, and so should the prenuptial agreement. Failing to revisit and update the agreement after significant life events—such as the birth of a child or changes in financial status—can lead to complications. Regular reviews can help keep the agreement relevant.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a contract entered into by two individuals before they marry, outlining the distribution of assets and responsibilities in the event of divorce or separation. |

| Governing Law | Pennsylvania law governs prenuptial agreements, specifically under the Uniform Premarital Agreement Act (UPAA). |

| Written Requirement | In Pennsylvania, a prenuptial agreement must be in writing to be legally enforceable. |

| Voluntary Agreement | Both parties must enter into the agreement voluntarily, without any coercion or undue pressure. |

| Full Disclosure | Each party is required to provide a fair and reasonable disclosure of their financial situation, including assets and debts. |

| Modification | Parties can modify or revoke a prenuptial agreement after marriage, but such changes must also be in writing. |

| Enforceability | A prenuptial agreement may be deemed unenforceable if it is found to be unconscionable or if one party did not have adequate legal representation. |

Dos and Don'ts

When filling out the Pennsylvania Prenuptial Agreement form, it is important to approach the process with care and consideration. Below are some essential do's and don'ts to keep in mind.

- Do be honest about your financial situation. Transparency is crucial.

- Do discuss the agreement with your partner openly. Mutual understanding fosters trust.

- Do seek legal advice. An attorney can provide valuable guidance tailored to your circumstances.

- Do ensure both parties sign the agreement voluntarily. Coercion can lead to future disputes.

- Do keep a copy of the signed agreement for your records. Documentation is important.

- Don't rush the process. Take your time to consider all aspects carefully.

- Don't hide assets or debts. Full disclosure is necessary for the agreement to be valid.

- Don't ignore state laws. Familiarize yourself with Pennsylvania's requirements for prenuptial agreements.

- Don't use vague language. Clear and precise terms help prevent misunderstandings.

- Don't forget to review the agreement periodically. Life circumstances can change, and so can your needs.

Similar forms

A cohabitation agreement is a document often used by couples who live together but are not married. Like a prenuptial agreement, it outlines the rights and responsibilities of each partner regarding property, finances, and other personal matters. Both agreements aim to provide clarity and protection for individuals in a relationship, ensuring that both parties understand their obligations and rights. While a prenuptial agreement is typically executed before marriage, a cohabitation agreement can be created at any point during the relationship, making it a flexible option for couples who want to establish boundaries and expectations.

A postnuptial agreement serves a similar purpose to a prenuptial agreement but is created after the couple is already married. This document can address issues such as property division and financial responsibilities, much like a prenup. Couples may choose to create a postnuptial agreement if their circumstances change, such as a significant increase in income or the acquisition of new assets. Both agreements are designed to protect the interests of each partner, but a postnuptial agreement may also reflect the evolution of the relationship over time.

A separation agreement is another document that shares similarities with a prenuptial agreement. This document is used when a couple decides to live apart, whether temporarily or permanently. It outlines the terms of the separation, including financial arrangements, child custody, and division of property. Like a prenuptial agreement, a separation agreement aims to minimize conflict and provide clear guidelines for each party. Both documents can help couples navigate difficult transitions, ensuring that both individuals have a mutual understanding of their rights and responsibilities.

A marital settlement agreement is often used during divorce proceedings and can resemble a prenuptial agreement in that it addresses the division of assets and debts. This document is created when a couple agrees on how to handle their financial matters and other issues related to their marriage. While a prenuptial agreement is established before marriage, a marital settlement agreement is finalized during the divorce process. Both agreements serve to protect the interests of each party, but the marital settlement agreement is specifically tailored to resolve disputes that arise when a marriage ends.

To embark on your educational journey, consider the Texas Homeschool Letter of Intent form as a crucial starting point, empowering families to take control of their homeschooling experience. For more information, visit this informative guide on Homeschool Letter of Intent procedures.

A property settlement agreement is similar to a prenuptial agreement in that it focuses on the division of property and assets. This document is often used in divorce cases to outline how the couple's property will be divided. Both agreements aim to clarify ownership and responsibilities regarding assets. However, a property settlement agreement is typically executed after the couple has decided to separate, whereas a prenuptial agreement is established before marriage. Both documents can help reduce potential disputes and provide a clear understanding of each party's rights.

An estate plan can also bear resemblance to a prenuptial agreement, particularly in the context of asset protection. An estate plan includes documents such as wills and trusts that dictate how a person's assets will be distributed upon their death. While a prenuptial agreement addresses asset division during a marriage or divorce, an estate plan focuses on what happens after one party passes away. Both documents are essential for protecting individual interests and ensuring that personal wishes are honored, providing peace of mind for both partners.

Check out Popular Prenuptial Agreement Forms for Different States

Virginia Prenuptial Contract - This document brings clarity and peace of mind to the financial aspects of marriage.

Florida Prenuptial Contract - The agreement must be executed in good faith to be valid.

Texas Prenuptial Contract - This document can lead to healthier financial communication in a marriage.

Understanding the nuances of the Request for Authorization for Medical Treatment (DWC Form RFA) is essential for employees navigating the California Division of Workers’ Compensation system, as it plays a pivotal role in securing the necessary medical services following an occupational injury. To ensure all needed documentation is provided, including relevant medical reports, employees can refer to All California Forms, which assist in streamlining the authorization process mandated by Labor Code section 4610.

California Prenuptial Contract - The agreement can enhance mutual trust regarding financial commitments.