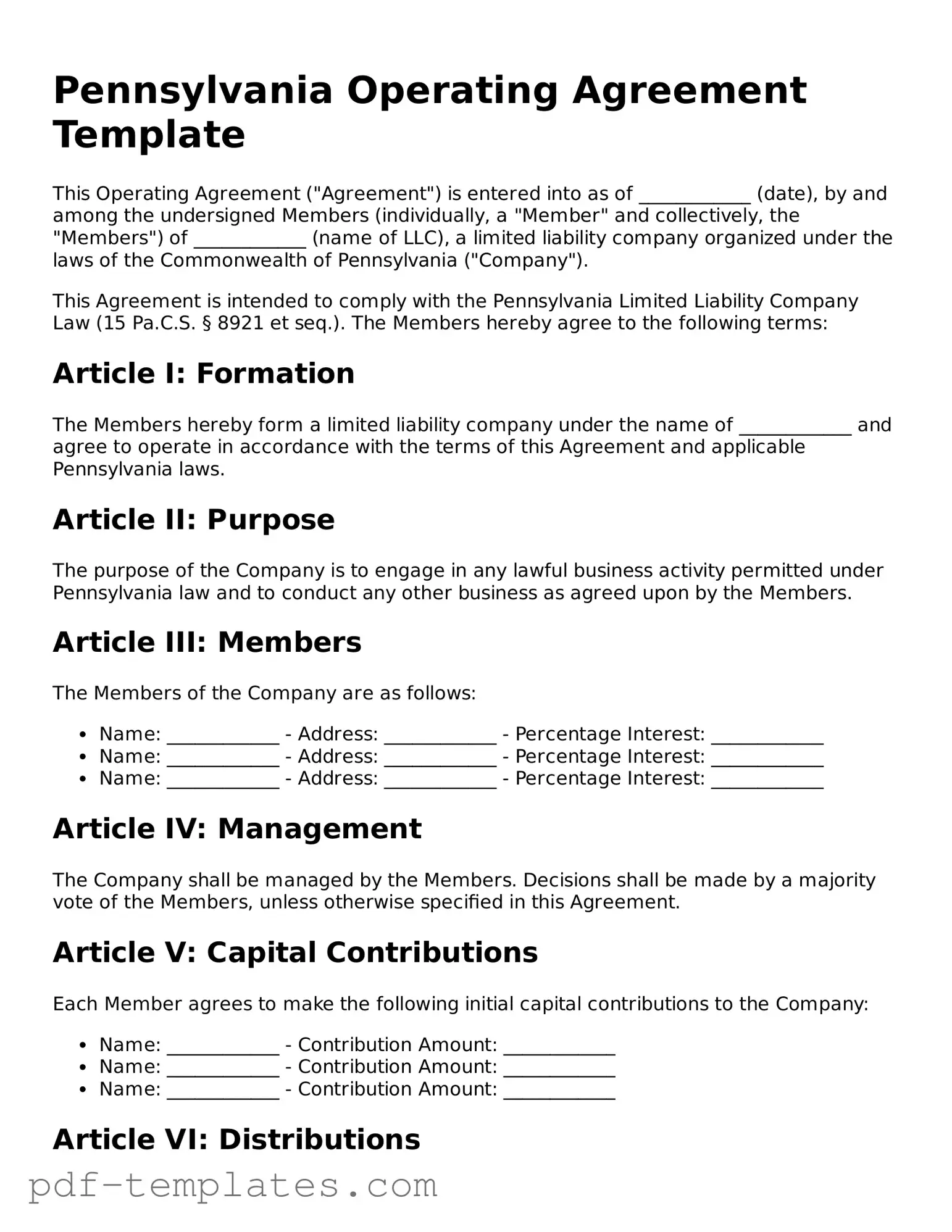

Official Operating Agreement Template for Pennsylvania State

In the realm of business formation, particularly for Limited Liability Companies (LLCs) in Pennsylvania, the Operating Agreement serves as a vital document that outlines the internal workings of the company. This agreement is not merely a formality; it establishes the framework for how the LLC will operate, delineating the roles and responsibilities of its members while also addressing key aspects such as profit distribution, decision-making processes, and procedures for adding or removing members. By clearly defining these elements, the Operating Agreement helps to prevent misunderstandings and disputes among members, fostering a collaborative environment. Moreover, it can include provisions for management structure, voting rights, and even guidelines for what happens in the event of a member's departure or the dissolution of the company. In essence, this document is a blueprint for governance, ensuring that all members are on the same page and that the LLC can navigate challenges with clarity and cohesion.

Misconceptions

Many people have misunderstandings about the Pennsylvania Operating Agreement form. These misconceptions can lead to confusion and mistakes when forming a business. Here are four common misconceptions:

- It is not necessary for all LLCs. Some believe that an Operating Agreement is optional for Limited Liability Companies (LLCs) in Pennsylvania. However, while the state does not require it, having an Operating Agreement is crucial for outlining the management structure and operational procedures of the LLC.

- It cannot be changed once created. Another misconception is that an Operating Agreement is a permanent document. In reality, members can amend the agreement as needed, provided they follow the procedures outlined within the document itself.

- It must be filed with the state. Some individuals think that the Operating Agreement must be submitted to the Pennsylvania Department of State. This is incorrect. The Operating Agreement is an internal document and does not need to be filed with the state, although it should be kept on record for reference.

- It is only for multi-member LLCs. Many assume that only LLCs with multiple members require an Operating Agreement. This is not true. Single-member LLCs also benefit from having an Operating Agreement, as it helps establish the owner’s rights and responsibilities and reinforces the business’s limited liability status.

Understanding these misconceptions can help ensure that business owners take the necessary steps to protect their interests and operate effectively within the legal framework.

Pennsylvania Operating Agreement: Usage Instruction

Completing the Pennsylvania Operating Agreement form is an important step for your business. This document outlines the management structure and operational procedures of your company. Follow these steps carefully to ensure accuracy and compliance.

- Begin by entering the name of your business as registered with the state.

- Provide the principal office address of your business. This should be a physical location, not a P.O. Box.

- List the names and addresses of all members involved in the business. Include their percentage of ownership.

- Indicate the purpose of your business. Be clear and concise about what your business will do.

- Outline the management structure. Specify whether the business will be member-managed or manager-managed.

- Detail the voting rights of members. Explain how decisions will be made and what constitutes a quorum.

- Include provisions for adding new members or removing existing ones. State any conditions that apply.

- Describe how profits and losses will be distributed among members.

- Specify the duration of the business. Indicate whether it is intended to be perpetual or for a specific term.

- Sign and date the document. Ensure all members do the same, as this confirms their agreement to the terms outlined.

Common mistakes

-

Failing to include all members' names. Every member must be listed to ensure clarity and accountability.

-

Not specifying the percentage of ownership. Clearly stating ownership percentages helps prevent disputes in the future.

-

Omitting the purpose of the business. This section defines the scope of operations and sets expectations for all members.

-

Ignoring the voting rights of members. Clearly outline how decisions will be made and what constitutes a majority.

-

Not detailing the process for adding or removing members. This information is crucial for future changes in the organization.

-

Failing to include provisions for dispute resolution. Establishing a method for resolving conflicts can save time and resources later on.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | The Pennsylvania Operating Agreement outlines the management structure and operational procedures for a limited liability company (LLC). |

| Governing Law | This agreement is governed by the Pennsylvania Limited Liability Company Law. |

| Purpose | It serves to define the rights and responsibilities of members and managers within the LLC. |

| Flexibility | Members can customize the agreement to suit their specific needs and business goals. |

| Not Mandatory | While recommended, an Operating Agreement is not legally required in Pennsylvania. |

| Member Contributions | The agreement typically details the initial contributions of each member to the LLC. |

| Profit Distribution | It outlines how profits and losses will be distributed among members. |

| Decision-Making | The Operating Agreement specifies how decisions will be made within the LLC. |

| Amendments | Members can amend the agreement as needed, following the procedures outlined within it. |

Dos and Don'ts

When filling out the Pennsylvania Operating Agreement form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of dos and don'ts that can help streamline the process.

- Do read the entire form carefully before starting.

- Do gather all necessary information, including member names and addresses.

- Do ensure that all members agree on the terms outlined in the agreement.

- Do use clear and concise language to avoid misunderstandings.

- Don't leave any sections blank unless specifically instructed.

- Don't use vague terms or ambiguous language.

- Don't forget to date and sign the document where required.

- Don't submit the form without reviewing it for errors.

Similar forms

The Pennsylvania Operating Agreement is similar to the Articles of Incorporation, which is essential for establishing a corporation. Both documents serve as foundational elements for a business entity. While the Operating Agreement outlines the internal workings and management of a limited liability company (LLC), the Articles of Incorporation detail the structure and purpose of a corporation. They both provide clarity on ownership and responsibilities, ensuring that all parties understand their roles within the organization.

Another document that shares similarities with the Operating Agreement is the Partnership Agreement. This document is crucial for partnerships, as it defines the relationship between partners, including their rights, responsibilities, and profit-sharing arrangements. Like the Operating Agreement, the Partnership Agreement aims to prevent disputes by clearly outlining expectations and operational procedures, fostering a cooperative business environment.

The Bylaws of a corporation also resemble the Operating Agreement. Bylaws govern the internal management of a corporation, detailing how meetings are conducted, how directors are elected, and how decisions are made. Both documents are vital for ensuring smooth operations and establishing protocols, helping to maintain order and transparency within the organization.

A Buy-Sell Agreement is another document that aligns with the principles found in an Operating Agreement. This agreement is particularly important for businesses with multiple owners, as it outlines the process for buying out a partner’s interest in the event of retirement, death, or other circumstances. Similar to the Operating Agreement, it aims to protect the interests of all parties involved and provides a clear framework for ownership transitions.

The Non-Disclosure Agreement (NDA) can also be compared to the Operating Agreement. While the Operating Agreement focuses on the management and operations of a business, an NDA protects sensitive information shared among members or partners. Both documents are essential for safeguarding the interests of the business and ensuring that proprietary information remains confidential, thus fostering trust among stakeholders.

Next, the Employment Agreement bears some similarities to the Operating Agreement. This document outlines the terms of employment for individuals within the company, detailing their roles, responsibilities, and compensation. Like the Operating Agreement, it helps to clarify expectations and reduce misunderstandings between the employer and employee, contributing to a more harmonious workplace.

The Membership Certificate is another document that parallels the Operating Agreement. In an LLC, this certificate represents ownership and membership rights. While the Operating Agreement governs the operational aspects of the LLC, the Membership Certificate serves as a formal acknowledgment of ownership, linking back to the terms set forth in the Operating Agreement regarding member rights and responsibilities.

In addition to the necessary documents for establishing a Pennsylvania LLC, it's essential to understand the implications of tax forms like the California Resale Certificate. This certificate, officially known as form CDTFA-230, allows businesses in California to purchase items without sales tax, provided those items are intended for resale. It serves as a crucial declaration by the buyer asserting their intent to resell, similar in significance to how an Operating Agreement governs relationships within an LLC. To explore more about relevant forms, you can visit All California Forms.

Lastly, the Resolution of the Board of Directors is akin to the Operating Agreement in that it records decisions made by the board regarding the management of the company. This document captures the formal actions taken by directors, similar to how the Operating Agreement outlines the operational framework for an LLC. Both documents ensure that decisions are documented and communicated effectively, promoting accountability within the organization.

Check out Popular Operating Agreement Forms for Different States

Create an Operating Agreement - It can stipulate the process for transferring ownership interests in the LLC.

Llc Set Up - It can include provisions for confidentiality among members.

To ensure a successful transaction, having a reliable Horse Bill of Sale form guide can be invaluable. This document not only serves to document the sale but also provides important information needed to protect both parties involved. If you're ready to proceed, you can access the form to enhance your understanding of the horse bill of sale process.

Is an Operating Agreement Required for an Llc in California - This agreement helps to formalize verbal agreements among members.