Official Last Will and Testament Template for Pennsylvania State

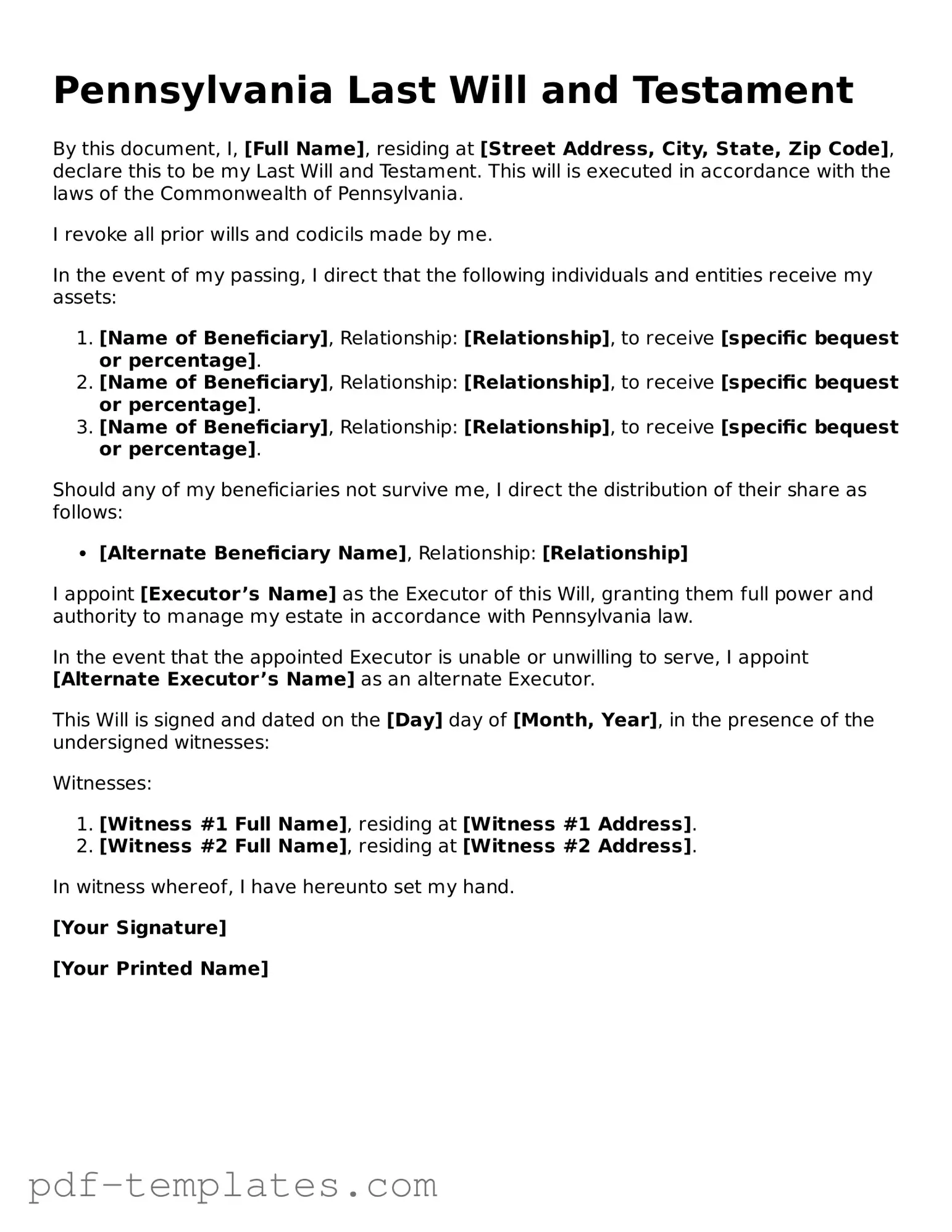

Creating a Last Will and Testament is an essential step in ensuring that your wishes are honored after your passing. In Pennsylvania, this legal document serves as a blueprint for how your assets will be distributed, who will manage your estate, and who will care for your minor children, if applicable. The form typically includes several key components, such as the identification of the testator, the appointment of an executor, and the specification of beneficiaries. Additionally, it outlines any specific bequests, which can include personal belongings or monetary gifts. The document must be signed in the presence of witnesses to be valid, reflecting the importance of formalities in the estate planning process. Understanding these elements is crucial for anyone looking to navigate the complexities of estate management in Pennsylvania, as it helps ensure that loved ones are cared for according to your wishes and that your legacy is preserved. By taking the time to craft a thorough and clear Last Will and Testament, individuals can provide peace of mind for themselves and their families during what can be a challenging time.

Misconceptions

Understanding the Pennsylvania Last Will and Testament form can be challenging. Here are some common misconceptions about this important legal document:

- A will only needs to be written once. Many people believe that once they create a will, it remains valid forever. In reality, life changes such as marriage, divorce, or the birth of a child may necessitate updates to the will.

- Only wealthy individuals need a will. Some think that wills are only for the rich. However, anyone with assets, no matter how small, can benefit from having a will to ensure their wishes are honored after death.

- Oral wills are just as valid as written ones. While some states recognize oral wills, Pennsylvania does not. A written will is essential for it to be legally binding in the state.

- All wills must be notarized. In Pennsylvania, notarization is not a requirement for a will to be valid. However, having a will notarized can help prove its authenticity if challenged.

- Wills can be created by anyone without legal help. While it is true that individuals can create their own wills, seeking legal advice can help ensure that the will meets all legal requirements and accurately reflects the person’s wishes.

- A will can control all aspects of an estate. Many people think a will can dictate everything, but certain assets like life insurance policies and retirement accounts pass outside of a will, following their own designated beneficiaries.

- Once a will is filed, it cannot be changed. Some believe that filing a will makes it permanent. In fact, a will can be changed or revoked at any time as long as the person is mentally competent.

- Only the executor can read the will. It is a common misconception that only the executor has access to the will. Beneficiaries and heirs have the right to view the will once it is probated.

Pennsylvania Last Will and Testament: Usage Instruction

Once you have obtained the Pennsylvania Last Will and Testament form, it is important to fill it out accurately to ensure your wishes are clearly stated. After completing the form, you will need to sign it in the presence of witnesses, who will also need to sign it to validate your will. Following these steps will help you prepare a legally sound document.

- Begin by entering your full name at the top of the form.

- Provide your current address, including city, state, and zip code.

- Clearly state that this document is your Last Will and Testament.

- Designate an executor by naming the person you trust to carry out your wishes. Include their full name and address.

- Outline how you want your assets distributed. Be specific about who receives what, including any personal belongings, real estate, or financial accounts.

- If you have minor children, appoint a guardian for them by naming the individual and providing their address.

- Include any specific bequests, which are gifts to individuals or organizations, and detail what each person or entity will receive.

- Review the document carefully to ensure all information is correct and complete.

- Sign the will at the designated space, ensuring that you do so in front of witnesses.

- Have at least two witnesses sign the will, confirming they saw you sign it and that you were of sound mind at the time.

Common mistakes

-

Not signing the will correctly: In Pennsylvania, a will must be signed by the testator (the person making the will) in the presence of at least two witnesses. Failing to do this can invalidate the will.

-

Forgetting to date the will: A will should always include the date it was signed. Without a date, it can be difficult to determine the most recent version if multiple wills exist.

-

Overlooking the witness requirements: Witnesses must be at least 18 years old and cannot be beneficiaries of the will. Choosing inappropriate witnesses can lead to complications during probate.

-

Failing to clearly identify beneficiaries: It is crucial to specify who will inherit what. Ambiguities can lead to disputes among heirs and delay the distribution of assets.

-

Neglecting to update the will: Life changes such as marriage, divorce, or the birth of children require updates to the will. Failing to revise the document can result in unintended distributions.

PDF Features

| Fact Name | Details |

|---|---|

| Governing Law | The Pennsylvania Last Will and Testament is governed by the Pennsylvania Probate, Estates and Fiduciaries Code, specifically 20 Pa.C.S. § 2501 et seq. |

| Age Requirement | In Pennsylvania, individuals must be at least 18 years old to create a valid Last Will and Testament. |

| Witness Requirement | The will must be signed by at least two witnesses who are present at the same time, and they must also sign the will. |

| Revocation | A will can be revoked by a subsequent will or by physically destroying the original document with the intent to revoke it. |

| Holographic Wills | Pennsylvania recognizes holographic wills, which are handwritten and signed by the testator, but they must meet specific criteria to be valid. |

| Self-Proving Wills | A self-proving will includes an affidavit signed by the testator and witnesses, making it easier to validate the will during probate. |

| Executor Appointment | The testator can appoint an executor in the will, who will be responsible for managing the estate after death. |

| Distribution of Assets | The will outlines how the testator's assets will be distributed among beneficiaries, which can include family, friends, or charities. |

Dos and Don'ts

When filling out the Pennsylvania Last Will and Testament form, it is essential to approach the process with care. Here are some important dos and don'ts to consider:

- Do ensure you are of legal age, which is 18 years or older, to create a valid will.

- Do clearly identify yourself in the document, including your full name and address.

- Do specify how you want your assets distributed after your passing.

- Do appoint an executor who will manage your estate according to your wishes.

- Don't use vague language when describing your assets or beneficiaries.

- Don't forget to sign the will in the presence of two witnesses who are not beneficiaries.

- Don't leave out important details that could lead to confusion or disputes among heirs.

Similar forms

The Pennsylvania Last Will and Testament is often compared to a Living Will. While a Last Will outlines how your assets will be distributed after your death, a Living Will focuses on your healthcare preferences when you are unable to communicate them yourself. Both documents are essential for ensuring your wishes are respected, but they serve different purposes. A Living Will guides medical professionals and loved ones in making decisions about your care, reflecting your values and desires regarding life-sustaining treatments.

Another document similar to the Last Will is the Durable Power of Attorney. This legal document allows you to designate someone to make financial and legal decisions on your behalf if you become incapacitated. Like a Last Will, it provides peace of mind, knowing that someone you trust will handle your affairs according to your wishes. However, unlike a Last Will, which takes effect after your death, a Durable Power of Attorney is effective during your lifetime, ensuring your financial matters are managed even when you cannot do so yourself.

The Revocable Living Trust is also comparable to the Last Will. This document allows you to place your assets into a trust during your lifetime, with the intention of distributing them to your beneficiaries after your death. One of the key differences is that a Revocable Living Trust can help avoid probate, the legal process of distributing assets, which can be lengthy and costly. By using a trust, you can ensure a smoother transition of your assets to your loved ones without the delays often associated with a Last Will.

For those navigating the complexities of asset management in California, understanding the various legal documents is essential. Among these, the California Resale Certificate serves a crucial role in allowing businesses to purchase items tax-free for resale. To further assist in this endeavor, resources such as All California Forms provide relevant information and documentation necessary for compliance and efficient business operations.

A Healthcare Proxy is another important document that shares similarities with a Last Will. It allows you to appoint someone to make healthcare decisions on your behalf if you are unable to do so. While a Last Will deals with asset distribution, a Healthcare Proxy ensures that your medical preferences are honored. Both documents emphasize the importance of having trusted individuals in place to advocate for your wishes, whether in financial matters or healthcare situations.

The Codicil is a document that serves as an amendment to an existing Last Will. If you need to make changes, such as adding or removing beneficiaries or altering specific bequests, a Codicil allows you to do so without creating an entirely new will. This can be a more straightforward approach to updating your wishes while maintaining the original intent of your Last Will. It’s essential to ensure that the Codicil is executed with the same formalities as the original will to be legally valid.

Finally, the Declaration of Trust is similar in that it outlines the management and distribution of assets, much like a Last Will. However, a Declaration of Trust is typically used in conjunction with a trust arrangement, detailing how the trust's assets should be handled during your lifetime and after your passing. This document can provide clarity and guidance for your trustee, ensuring that your financial legacy is managed according to your wishes, similar to how a Last Will directs the distribution of your estate.

Check out Popular Last Will and Testament Forms for Different States

Sample Will Form - A means to leave specific gifts to family, friends, or charities.

The USCIS I-9 form is a document used by employers to verify the identity and employment authorization of individuals hired for work in the United States. This form is essential for complying with federal regulations, ensuring that all employees meet the necessary criteria to work legally. For more information and resources related to the I-9 form, you can visit https://documentonline.org/blank-uscis-i-9/. Understanding the I-9 form's requirements can help both employers and employees navigate the hiring process more effectively.

Making a Will in California - Becomes a crucial legal tool once the person who created it has passed away.