Official Durable Power of Attorney Template for Pennsylvania State

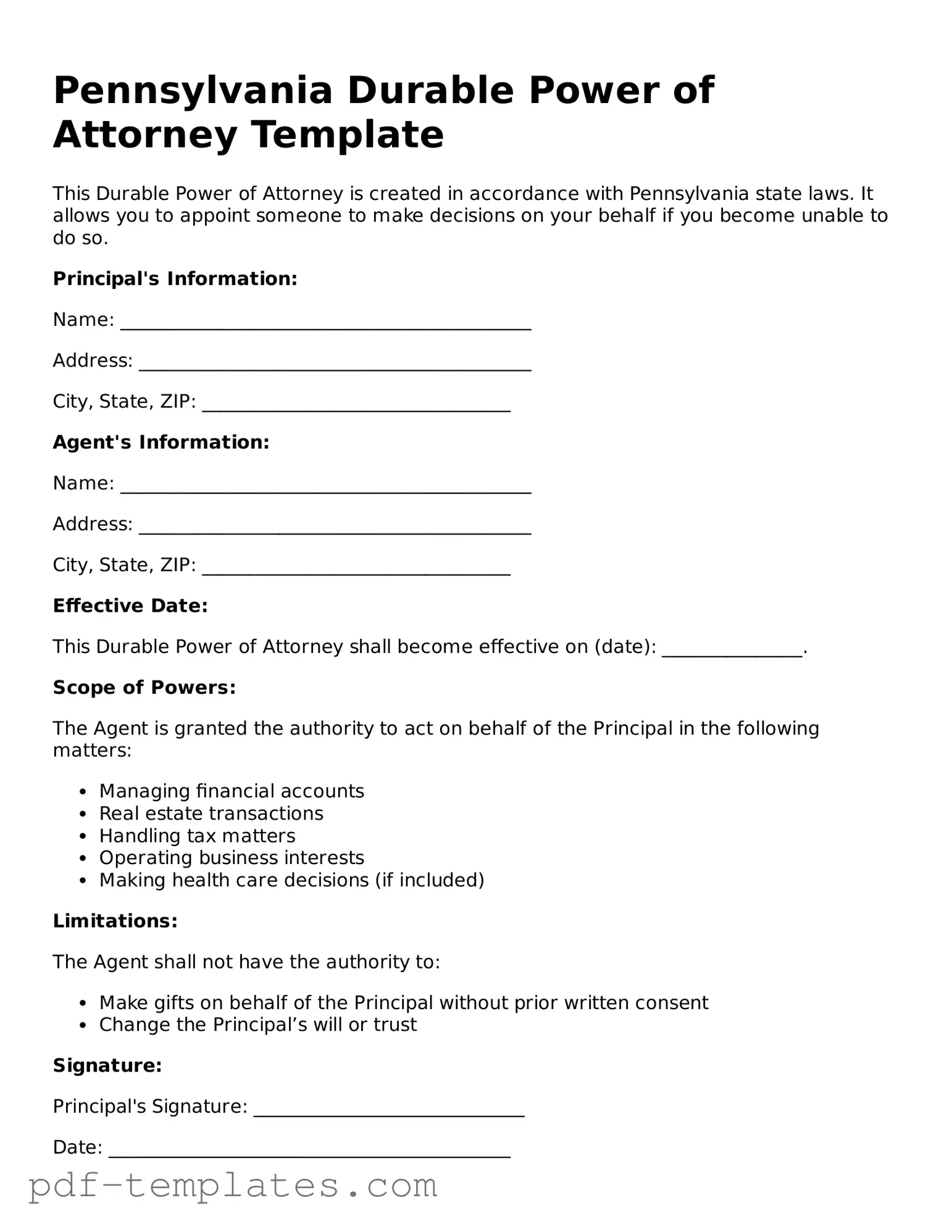

The Pennsylvania Durable Power of Attorney form is a crucial legal document that allows individuals to designate someone else to make decisions on their behalf, particularly in financial or healthcare matters. This form remains effective even if the person who created it becomes incapacitated, ensuring that their wishes are honored without interruption. It can cover a wide range of powers, from managing bank accounts and real estate transactions to making medical decisions. The principal, or the person granting authority, can specify the extent of the agent's powers, which can be broad or limited. Additionally, the form requires proper execution, including the signatures of both the principal and the agent, along with a witness or notary, to ensure its validity. Understanding the nuances of this form is essential for anyone considering their future planning in Pennsylvania.

Misconceptions

There are several misconceptions about the Pennsylvania Durable Power of Attorney form. Understanding the truth can help individuals make informed decisions. Here are four common misconceptions:

-

Misconception 1: The Durable Power of Attorney is only for financial matters.

While it is often used for financial decisions, this document can also grant authority for healthcare decisions. This means that your agent can make medical choices on your behalf if you are unable to do so.

-

Misconception 2: Once signed, the Durable Power of Attorney cannot be changed.

This is not true. You can revoke or change your Durable Power of Attorney at any time, as long as you are mentally competent. It’s important to communicate any changes to your agent and relevant institutions.

-

Misconception 3: The agent must be a lawyer or financial professional.

Your agent can be anyone you trust, such as a family member or friend. They do not need to have a legal or financial background, but they should be responsible and capable of handling your affairs.

-

Misconception 4: The Durable Power of Attorney is only effective after you become incapacitated.

This is incorrect. A Durable Power of Attorney can be effective immediately upon signing, or it can be set to take effect at a later time, such as when you become incapacitated. This flexibility allows you to choose what works best for your situation.

Being aware of these misconceptions can help ensure that you use the Durable Power of Attorney effectively and in a way that meets your needs.

Pennsylvania Durable Power of Attorney: Usage Instruction

Completing the Pennsylvania Durable Power of Attorney form is a crucial step in ensuring your financial and legal matters are managed according to your wishes. This form allows you to designate someone you trust to make decisions on your behalf. Follow these steps carefully to ensure the document is filled out correctly.

- Obtain the Form: Download the Pennsylvania Durable Power of Attorney form from a reliable source or visit a local legal office to get a hard copy.

- Read the Instructions: Familiarize yourself with the instructions included with the form. Understanding the requirements will help you fill it out accurately.

- Identify Yourself: In the designated section, write your full name, address, and any other identifying information required.

- Select Your Agent: Choose the person you want to appoint as your agent. Provide their full name, address, and relationship to you.

- Define Powers: Clearly outline the powers you wish to grant your agent. You can specify general powers or limit them to certain areas, such as financial or healthcare decisions.

- Additional Agents: If desired, name alternate agents in case your primary agent is unable or unwilling to serve.

- Sign and Date: Sign and date the form in the presence of a notary public. This step is crucial for the form’s validity.

- Distribute Copies: Make copies of the completed form for your agent, your attorney, and any relevant financial institutions or healthcare providers.

Once you have completed these steps, your Durable Power of Attorney form will be ready for use. Ensure that you keep the original document in a safe place and inform your agent where it can be found when needed.

Common mistakes

-

Not Specifying Powers Clearly: Many individuals fail to clearly outline the powers they wish to grant their agent. This can lead to confusion and disputes later on. It is essential to be specific about what decisions the agent can make, whether it’s financial, medical, or legal matters.

-

Choosing the Wrong Agent: Selecting an agent who is not trustworthy or lacks the necessary skills can be detrimental. It’s crucial to choose someone who understands your wishes and can act in your best interest. Friends or family members who are not reliable might not be the best choice.

-

Failing to Sign and Date: Some people overlook the importance of signing and dating the form. Without a signature, the document may not hold legal weight. Always ensure that the Durable Power of Attorney is signed in the presence of a notary or witnesses, as required by Pennsylvania law.

-

Ignoring the Need for Updates: Life circumstances change, and so do relationships. Failing to update the Durable Power of Attorney when significant life events occur—such as marriage, divorce, or the death of an agent—can render the document ineffective. Regular reviews are essential.

-

Not Considering Alternate Agents: Many individuals do not think about what happens if the primary agent is unavailable or unable to act. It’s wise to name alternate agents to ensure that someone can step in when needed. This foresight can prevent complications down the line.

PDF Features

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows a person (the principal) to appoint someone else (the agent) to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | The Pennsylvania Durable Power of Attorney form is governed by the Pennsylvania Consolidated Statutes, Title 20, Chapter 56. |

| Durability | This form remains effective even if the principal becomes mentally or physically incapacitated, unlike a standard power of attorney. |

| Agent's Authority | The agent can be granted broad or limited authority to act on behalf of the principal, depending on the specifics outlined in the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are still mentally competent to do so. |

| Witness Requirements | The form must be signed by the principal in the presence of two witnesses or a notary public to be valid. |

| Common Uses | This document is often used for financial decisions, healthcare decisions, or both, depending on the principal's needs. |

Dos and Don'ts

When filling out the Pennsylvania Durable Power of Attorney form, it is crucial to approach the process with care and attention. Here’s a helpful list of things to do and avoid to ensure your document is valid and effective.

- Do choose a trustworthy agent who will act in your best interest.

- Don't select someone who may have conflicting interests or motives.

- Do clearly outline the powers you wish to grant to your agent.

- Don't leave any sections blank; incomplete forms can lead to confusion.

- Do sign the document in the presence of a notary public.

- Don't forget to date the document; an undated form may not be considered valid.

- Do discuss your wishes with your agent to ensure they understand your preferences.

- Don't assume that your agent knows your wishes without a conversation.

- Do keep a copy of the signed document in a safe place.

- Don't neglect to inform your family members about the existence of the document.

By following these guidelines, you can help ensure that your Durable Power of Attorney form serves its intended purpose effectively.

Similar forms

The Pennsylvania Durable Power of Attorney (DPOA) form shares similarities with the General Power of Attorney (GPOA). Both documents allow individuals to appoint an agent to make decisions on their behalf. However, the GPOA typically becomes ineffective if the principal becomes incapacitated, while the DPOA remains in effect under such circumstances. This distinction is crucial for individuals seeking to ensure that their financial and medical decisions are managed even when they can no longer communicate their wishes.

Another document akin to the DPOA is the Healthcare Power of Attorney (HCPOA). Like the DPOA, the HCPOA designates an agent to make decisions for the principal. However, the HCPOA is specifically focused on healthcare-related decisions. This document comes into play when the principal is unable to make medical choices due to incapacitation. By using both the DPOA and HCPOA, individuals can comprehensively address both financial and medical matters.

The Living Will is another important document related to the DPOA. While the DPOA allows an agent to make decisions on behalf of the principal, the Living Will expresses the principal's wishes regarding medical treatment in situations where they cannot communicate. This document provides guidance to healthcare providers and family members about the types of life-sustaining treatments the principal does or does not want. In this way, it complements the HCPOA and ensures that personal values and preferences are respected in medical settings.

For those looking into comprehensive resource options, understanding the intricacies of various legal documents is essential, and you may find helpful information in All California Forms to navigate your needs effectively.

Lastly, the Revocable Trust bears similarities to the DPOA in that both can be used to manage assets. A Revocable Trust allows an individual to place their assets into a trust during their lifetime, with the ability to alter or revoke it as needed. Upon the individual’s incapacity, a successor trustee can step in to manage the assets without court intervention. This differs from the DPOA, where an agent is appointed to act on the principal's behalf, but both documents serve to ensure that financial matters are handled according to the principal's wishes, even during periods of incapacity.

Check out Popular Durable Power of Attorney Forms for Different States

Does a Medical Power of Attorney Need to Be Notarized in Florida - It ensures your financial affairs are handled according to your wishes.

Texas Durable Power of Attorney Free Pdf - Make informed financial decisions, guided by trusted individuals.

To facilitate your trailer sale, you can access a useful resource by utilizing the Texas trailer bill of sale template. This document simplifies the transfer process and ensures all necessary information is documented clearly.

Durable Financial Power of Attorney California - Your chosen representative can act promptly and effectively with a properly executed Durable Power of Attorney.

Types of Power of Attorney Virginia - You can revoke a Durable Power of Attorney at any time as long as you are mentally competent.